Conventional academic logic dictates that the dividend policy of a company should not matter as the money belongs to the shareholders anyway, whether or not it is paid out as dividend. This is true in theory and all else being equal. But the real world is neither “in theory” nor “all else being equal”.

High dividend paying companies/ stocks tend to have a few important characteristics. They also give out hidden information which the market finds useful.

The few important characteristics of high dividend paying companies are:

- A strong normalised free cash flow (FCF) that supports the dividend: This is a necessary condition over the medium term, though the market might tolerate a lower FCF for a year or two. No one will give credit to a company that pays dividend from borrowed money.

- Sustainable and non-volatile operating cash flow that supports this free cash flow: A high dividend paid by a volatile deep cyclical business is less valuable, than one being paid by a steady business.

- Lower stock volatility: A stated dividend policy attracts “low velocity, income driven” investors. This reduces the stock volatility of the company and the attached risk perception.

- Reduced dependence on the price discovery mechanism of the market: Dividend is that part of the total return of the stock which is driven purely by the company and not by the stock market. Hence it reduces the exposure to the price discovery mechanism of the market. This creates a damping effect on the total return from a stock and reduces its volatility.

- Capital discipline being imposed on the management: This is especially true in an environment where growth is structurally slowing down compared to the past and hence higher risk is taken to maintain the growth of the past. Exactly the kind of environment we foresee in the coming decade.

The increased information a cash dividend gives is:

- Cash is real, hence the company is real: This statement is not as facetious as it sounds. Especially in markets like Asia where management history is short and corporate governance is still being tested, actual cash flow coming into the hands of investors puts a reality check on the earnings and balance sheet.

- It gives an insight into the long term confidence of the management: Sticking to a steady or steadily growing dividend policy tends to be an important point for most managements. They tend to use dividends as a signalling device to show their long term view on their business to the market.

In addition to the above, dividend tax is a lesser problem in Asia. In Asia the tax disadvantage of dividend over capital gains is reduced as tax on dividend and withholding tax on dividend are both lower than in the developed world.

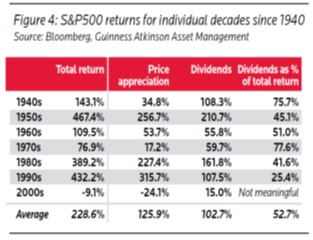

Dividend contribution to total return has been high over the years

Dividend contribution to total return of the S&P500 has been over 50% for the past decades. It has gone up to as high as 78% in periods of low total return. Earnings growth contributes the rest of the total return. P/E is a negligible contributor to total return in the long term (but contributes most of the return in the short term and is the source of most of the volatility).

As can be seen from the chart on the right above, dividend is a significant contributor to total returns. The contribution of P/E is negligible.

Dividend is less volatile than Earnings

Also, during market downturns, dividend per share tends to be a lot more resilient compared to EPS. This creates the “damping” effect on total returns mentioned earlier.

As seen in the table on the right, the peak-to-trough drop in DPU for the S&P500 during various downturns has only been 8% on average, whereas the earnings drop has been 42% on average.

Increasing universe of dividend and free cash flow focused stocks in Asia

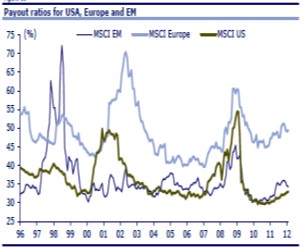

Asia in particular, and the emerging markets (EM) in general, was always a growth-focused story.

This was not the place where investors went if they wanted safer lower growth.

This, at the margin, has become less true. Asia continues to be the best place to find growth stories but now it comes with an added layer of strong free cash generation and dividend pay-out.

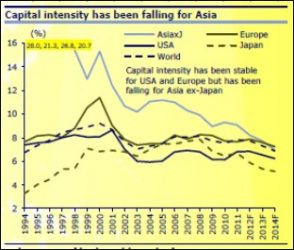

Dropping debt burden and capital expenditure are leading to strong cash generation by most Asian and EM stocks. This in the past few years has dramatically increased the pool of such dividend paying companies.

This could lead to a higher pay-out ratio going forward as pay-out ratios are still low.

The current dividend yield is still at the higher end of the historic range (except during the Asian crisis and the 2008 crisis time). This is in spite of interest rates being at multi-decade lows.

In summary

Given these positive points about the dividend strategy, RVAM has a higher than normal focus on cash generation and distribution. We do believe that growth is important but we think the market tends to overpay for pure growth and underpays for the lower risk associated with a cash flow based strategy.

Hence most of the companies we buy are strong cash generators with good visibility and earnings growth (though a bit lower than the market expected growth).

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.