This has been one of the conundrums of 2014 – the falling risk free rates. The US has cut its QE from USD 85 bln p.m. to USD 25 bln p.m. now. Global GDP growth was supposed to have bottomed out, EM risk perception was better in January 2014 than at the worst times in August-September 2013.

The conundrum – falling risk free rates

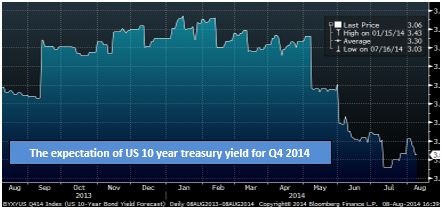

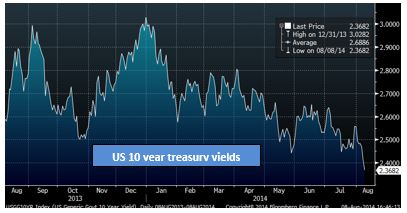

The US 10 year yield expectation for Q4 2014 has had a roller coaster ride over the past 12 months, moving from below 2.8% in May 2013 to a high of 3.4% in January 2014 to about 3.06% now. With current 10 year yields at below 2.4%, even this 3.06% number looks too high.

The dropping 10 year yields are important but the more important number is the expected long term stable 10 year rates. The Fed in its last report reduced that number from 4% to 3.75%. The Fed has historically been on the optimistic side of expectation on growth and inflation and hence our view is that this number is most likely going to be lower, in the 3.5% range. Also, we are going to hit this number later than the market expects.

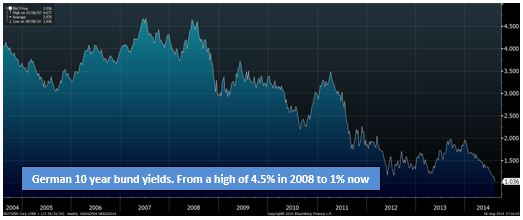

Similarly the German government bond yields are hitting historic lows. 2 year yields went below zero for the second time in two years and 10 year yields are at about 1%. What kind of investor is willing to hold assets with a 1% p.a. nominal return for the next ten years and a negative return over the next two years? Clearly someone who is very negative on the world.

Why are the rates down?

There are multiple theories:

- Poor US GDP growth (weather related!)

- Very slow growth in Europe and Japan

- Russia

- Iraq

- China

- The whole of EM

- China aggressively buying treasuries

- Etc.

All of these are probably true in varying degrees. But our suspicion is that the real reason is more long term and structural.

It is simply that the developed world, because of its excessive debt build up and no structural change, is now unable to match the growth rates of the past. For strong growth you either need a strong engine (productivity improvement) or a turbo charger (increased leverage). The west has run out of both.

The EMs have also leveraged up quickly in the past few years but their debt levels are much below that of the developed world. More importantly they have more levers of structural change which could lead to productivity improvement. But the EMs are having to deal with a host of social and political issues, which create a different kind of risk.

Conclusion

We feel that rates are going to remain lower for longer. Though the short term possibility is of an increase in risk spreads and a possible bottom in risk free rates, the upside to rates is not too high. Hence we remain confident vis-à-vis our focus on steady cash yielding businesses.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.