Through the US stock market euphoria of the past two years and the crescendo of US growth being stronger than the rest of the world, the data set that we look at keeps emphasising one broad point – underlying US growth remains anaemic and there is no indication of any significant acceleration.

The few broad points that are worth highlighting are:

- GDP: US real GDP growth has struggled to break out of the 2-2.5% range. This is in spite of long rates being much below expectations and unemployment numbers going back to 2004 levels.

- Employment: Though headline employment has improved there is poor wage and consumption growth.

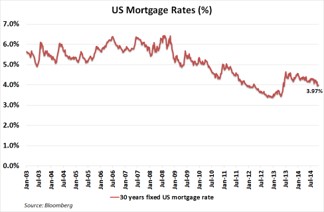

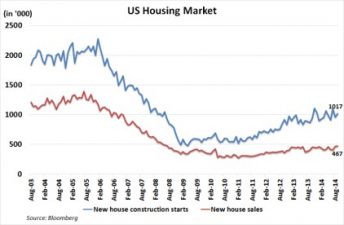

- Housing: Mortgage rates have come off since the peak of July 2013, but housing affordability has continued to drift down.

- Inflation: Remains low

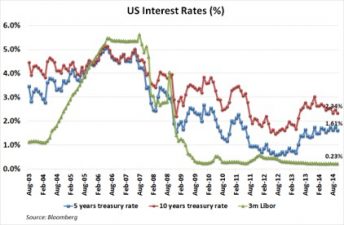

- Interest rates: As a result, interest rates have surprised on the downside and will struggle to go up.

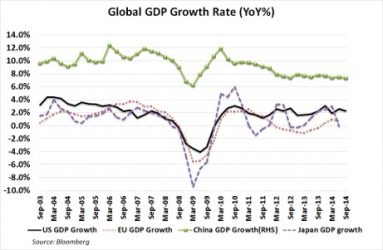

Global Growth Continues to Struggle

Growth in China, Europe and Japan has been trending down in the last few quarters. The US just looks better because it has managed to hold on to its 2-2.5% growth rate and is not decelerating.

With the strong USD appreciation of the past few months, the US could see export head winds which could be the next dampener on growth. These currency moves are just shifting the value from one geography to another without actually growing the pie – for that you need actual productivity improvement.

Also the drop in oil prices, though good for consumers, is bad for employment in the US. With energy being one of the largest source of employment growth in the US, a slowdown in energy capex is not good news on that front.

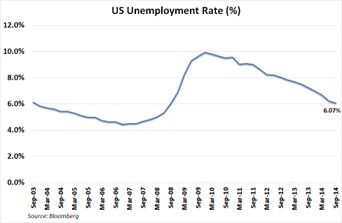

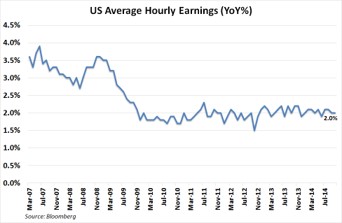

It is “Wageless” Employment Growth

This is the big conundrum. The market (and the Fed) had equated reduction in unemployment to wage growth, which in turn was expected to boost consumption and GDP growth. Hence the linkage between employment and interest rate increase. But this logic has broken down.

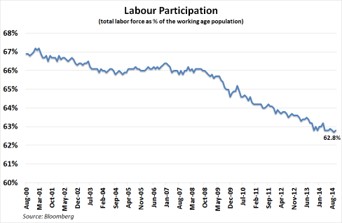

A drop in the headline unemployment numbers is, firstly, not representative of the underlying level of unemployment as the labour participation rate has been reducing.

Also, the equally surprising part has been the poor wage growth. Adjusted for inflation it has barely managed to remain in positive territory. This partly explains the poor consumption growth.

An unintended consequence of the low rate environment and low wage growth has been an increase in the US metrics of social inequality. The middle class is being hollowed out as its jobs are either being offshored or automated. This has a positive effect on corporate costs and margins but a negative impact on wage growth.

The Housing Market Has Reached a Low Level of Equilibrium

Though US 30yr mortgage rates have slowly drifted down over the past sixteen months, housing affordability has been decreasing as house prices have moved up.

Hence housing sales and construction have been flat lining since early last year.

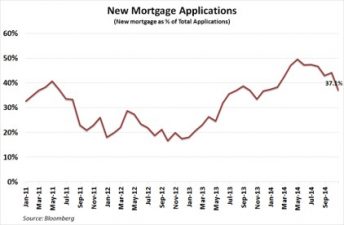

Also, new mortgage applications have become a decreasing proportion of total mortgages. This is because of flattening housing sales and an acceleration in refinancing as the mortgage rates have come down. This refinancing has helped prop up consumption but this is a finite process.

Inflation – Remains Low

Inflation is the canary in the coal mine. Once inflation starts increasing, the current equilibrium will be disturbed. But given the global growth deficit, this does not look likely in the near term. Japan and Europe are fighting deflation and EM is seeing slowing inflationary trends.

Consequently Interest Rates Remain Muted

The biggest surprise vis-à-vis expectations at the beginning of the year has been the drop in long rates for US treasuries. This is in spite of QE being unwound to zero. The primary culprit is again global growth being poorer than expected.

Conclusion

The conclusion of this macro review is just to reiterate our macro view of Low Growth and Low Interest Rates. This is the underlying thesis on which our portfolio construction process works. We do understand that there could be quarterly volatility around this view but our medium term view remains the same.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.