Inflation or stagflation? Fed taper: when – now or later? China regulation: where does it end? Evergrande: will live or die? Cryptocurrencies: what is their future? COVID-19: ending soon or not? Vaccinations: haves and have nots. Reopening of countries: when and how much? Robinhood-ers: meme stocks and all. EVs: how fast will the market grow? ESG: love or hate it? Tesla and Musk: the zeitgeist of these times. ARK and Wood: is Noah on it or not? And now there is the metaverse.

On the night of Friday 5th November 2021, rock legend Billy Joel returned to New York’s Madison Square Garden for his 120th lifetime show at the arena at the age of seventy-two. If he could have penned and performed a follow-up to his opus “We Didn’t Start the Fire,” this would be a great time to do so.

We digress, but it has been an exasperating two years where everyone’s mind space has been overwhelmed by these catch phrases and an alphabet soup of tech jargon assaulting the senses. Not a week has passed when one or more of these have not been discussed ad nauseum, as if that were the only way to thrive in financial markets. While it might well have been the case for many, it must also be said that there is an equally large number of investors for whom it is good enough to stay informed about these and even profit from the consequences through investing, but beyond a point these various topics serve little more than to generate cacophonous distraction and divert us from the task at hand.

We have tried hard to navigate this period by “fighting this fire” and staying focussed. It has been tough going no doubt, but the journey has been full of interesting findings, discoveries and learnings. By simply de-focussing on some of these burning discussion areas, it has been possible to discover a lot out there by way of investment opportunities that has been ignored, overlooked and not worked upon well enough. In short, inefficiencies in stock pricing are in abundance, especially in Asia. This piece lays out some of our findings and how we regard such situations and stocks and bring them into the portfolio.

Value abounds in Asian stock markets today. One probable reason (and there would be others) is to do with investors’ amorous behaviour with technology/ e-commerce and related stocks over the past five years or so. It has led to a situation of virtual exclusion of several traditional sectors of the economy, which in turn has led to them being cheaper than they have traded in a decade or more. Yes, some of the blame lies with their lower rates of growth versus the younger faster-growing technology colts. Yet there is no denying that several such companies continue to command market leadership positions, operate in near moat-like businesses and whose only fault it might seem is that they have matured and hence have slower growth than in the past. But grow they still do!

On that note, let us begin our discussion on mispriced opportunities where the biggest graveyard of stocks lies in Asia and where the deepest values are to be found: China.

China’s Graveyard of Stocks: China’s graveyard of stocks has all kinds of corpses. They include large monolithic banks, telecom operators, oil and energy behemoths, port operators, insurers and power utilities among others, many of whom tend to be state-owned or provincial government-owned enterprises. There is also a swathe of privately-owned companies across a gamut of sectors ranging from consumer staples and discretionary products, capital goods, property developers, toll road operators, logistics operators and healthcare – the list is endless. Running screens in China right now will yield a copious catch of stocks like a bountiful shoal on a fishing expedition on the high seas.

It is commonplace now to run into companies trading below book value (many below 0.5x) and whose dividend yields are higher than their PE multiples. Several of these companies are bloated with cash on the balance sheets, sometime equalling 20-50% of their market capitalisations and where free cash flow yields routinely run into the low or mid-teens. This is after they have paid those generous dividends and incurred whatever capex they deem fit. This is not something that is happened due to COVID-19. It has been the case for the last few years now. Low growth may well become endemic to some of these companies now, as they are heavily geared to the Chinese economy which is slowing and could slow further.

The explanation for things to have come to such a pass is often that several SOEs have become ex-growth. This is indeed true for some of them where revenue and profit growth has slowed to a crawl and hence the lofty multiples of yore are surely history. Still, it is worth noting that growth is not yet fading or dying for most of them, given their dominant monopolistic positions in the country.

The private sector too faces headwinds often from tighter regulatory oversight, rub-off from a slowing economy and greater competitive intensity than in the past. Regardless of all this, stock prices today seem to suggest that most of these companies have existential issues or that their earnings and cash flows are likely to decline terminally and continuously and that their cost of capital is going to rise. Surely such punitive assumptions are beyond even the most bearish of cases a reasonable analyst would have made to arrive at his target price.

If one excludes the big e-commerce and tech names, the state of China’s stock market reminds us of the situation Bill Browder, CEO and co-founder of Hermitage Capital Management, found himself in back in the 1990s when investing in Russia. His fund and associated accounts were among the largest foreign portfolio investors in Russia then, growing to $4.5 billion of assets under management. The primary investment strategy of Browder was shareholder rights activism, where he took on large Russian companies such as Gazprom, and others. He describes in his book “Red Notice: A True Story of High Finance, Murder, and One Man’s Fight for Justice” how shocked he was when he found some Russian companies trading at absurdly low valuations, mostly well-below replacement cost. Local investors had given up on them as had Wall Street; given the Cold War, mistrust was at its worst.

Today, China’s stock market is getting to that point. China is friendless in the western world. A large number of investors have been forced to sell out of names like China Mobile and CNOOC by the previous Trump administration. China has not helped its cause lately either by clamping down hard on certain sectors in a manner only China can.

This has created anguish, fear and revulsion leading many more investors to throw in the towel and leave the market, perpetuating the pain and the weakness in the market further. China needs a few Bill Browders right now who have the courage and patience to scoop up the truckloads of bargains that are to be had today. China also needs to sooth frayed nerves in some manner and infuse confidence even among local investors to return to the stock markets. We hope that the mandarins in Beijing, who have known the importance of the stock market to China better than most, will not fail it.

Palm Oil and ESG: Mention palm oil stocks to anybody and ESG is the first pushback one gets. Not too long ago, the same could have been said about coal and crude oil. Both commodities have shot higher by about 4x off their lows in 2020-21. Coal and oil stocks have soared in tandem. With that, all protestations about ESG issues have fallen by the wayside.

Palm oil has risen by about 2.5x off its two-year low so far on the back of the fundamentals having turned stronger than they have been in over a decade. The adoption of biodiesel in Indonesia is rising fast and has added a new dimension to the demand dynamic in this cycle. It can prove to be a great foil to the ESG naysayers. However, investors and analysts are yet to be convinced that the structural changes that could lead to palm oil prices rising further and staying elevated are here to stay for much longer.

Within the palm oil investible universe, mostly ones listed in Malaysia, Indonesia and some in Singapore, we have Golden Agri-Resources (GAR), a palm oil company listed in Singapore which stands out. It is owned by a large Indonesian conglomerate. GAR has large palm plantations and processes palm to make oilseed-based products, including bulk and branded palm oil, oleo-chemicals and other products. GAR has reported a net profit of US$268 mn on a YTD basis versus a net loss of US$162 mn last year. But analysts are still not impressed. Their estimates continue to lag far behind, a year on since the cycle turned up. The stock remains a pariah, having not even doubled off the lows yet, despite the meteoric rise in profits so far.

GAR is unhedged and the best proxy to the upside in this sector. Its downstream branded oils business in India which is likely to IPO over the next one year is not even part of the valuations of GAR being talked about today. That company is among the top three branded edible oil companies in India and was reportedly angling for a valuation that would have made GAR’s 56% stake in it worth US$400-500mn vis-à-vis GAR’s own market cap of c.US$2.5bn today.

We see that even as certain catalysts and stimuli presented themselves, investors held on to their reservations on oil and coal only to eventually succumb. We believe it will be no different with palm oil. The key is to reach that tipping point where the evidence is overpoweringly in favour of owning the asset and the price begins to rally against you.

Palm oil is not making headlines yet. That itself is a strong message that we are far from done on this commodity’s bull market.

MAPA: Investors following and investing in Indonesian stocks may be the only ones who may be aware of a company called PT Map Aktif Adiperkasa Tbk or MAPA in short. It is Indonesia’s largest multi-brand sportswear retailer and commands a market share in excess of 60% in Indonesia. It has expanded into other ASEAN countries, but its presence is small there yet. The stock was crushed post the COVID-19 crash, but even after rallying off those deep lows, its market cap has reached a piffling US$600mn.

Today, 46% of Indonesians are between the ages of 15 and 44 (and 60% if we extend the age to 65) in a population of 273.5mn. Indonesia’s per capita GDP of over US$4,000 is high by Emerging Market standards, and is rising. In this backdrop, where adoption of sports and consumption of sporting gear is a multi-year or even decadal megatrend, MAPA’s current valuation of US$600mn does no justice to its long-term growth potential. MAPA is a small-cap stock today which surely does not deserve to remain one for too long.

Makemytrip.com (MMYT): MMYT is India’s largest Online Travel Agent (OTA). Period. Nobody comes remotely close to challenging it given its dominant share of 50-60% in air-ticketing/ hotels/ holiday packages/ bus bookings. MMYT is now majority owned by Trip.com, China’s largest OTA; both are listed on the NASDAQ. MMYT is now finally turning profitable at the EBIDTA level after many years of battling upstarts backed by PE moneybags, most of whom have given up and faded away over the last decade.

There are two megatrends at work here that we believe will override and overwhelm short-term challenges at MMYT. The first is that India’s young, upwardly mobile population is shifting the consumption slate massively and rapidly towards conspicuous items like travel, amidst rising aspirations for a better quality of life. The second megatrend is the exponential growth in technology adoption via mobile, be it payment wallets, gateways or credit cards.

These two megatrends coalesce perfectly when it comes to the desire to travel and buy travel products online, where MMYT today rules the roost. These tectonic shifts are rapidly driving people from across the country, big and small towns alike, to forsake the scruffy neighbourhood travel agent and book holidays and flights online. As a result, MMYT and OTAs in India are witnessing the kind of demand pull they have only dreamt of in the past.

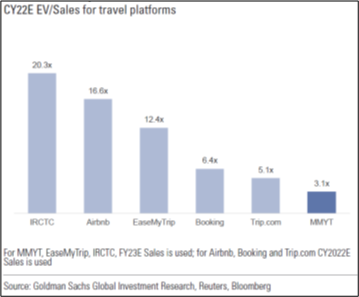

One key reason MMYT has historically traded at a valuation discount to global travel peers has been the company’s lack of profitability. We believe MMYT reaching breakeven in FY22E and steadily growing from there over the next 3-5 years could help re-rate its multiples higher. On an EV/Sales multiple basis, it is the lowest among the global travel peer universe. With an improving profit profile, we see limited reason for this valuation discount to prevail.

SingTel: SingTel masquerades as a telecom stock. While it is Singapore’s premier telco, it is way more than just that. It is more akin to an Asia Pac Telco Fund. SingTel owns 100% stakes in its Singapore operations and in Optus, the #2 operator in Australia. In addition to this, it owns stakes of between 20 and 50% in five other telcos in key Asian countries as well as a stake in domestic Singpost and NetLink Trust. But hang on. SingTel has much more going on under the hood than what most people today know or care for.

- AdTech: SingTel’s adtech play sits in its Group Digital Life (GDL) unit. GDL focuses on three key businesses – digital marketing, regional premium OTT video and advanced analytics and intelligence capabilities. GDL contains Amobee engaged in digital marketing; HOOQ which aims to be one of the largest OTT content providers in Southeast Asia, while maintaining market leadership in Indonesia; and Data Spark which provides Data Analytics. It has spent over a billion dollars since 2012 in them and seen mixed results thus far.

- It has announced the divestment of 70% of its stake in Australia Tower Network (ATN) for A$ 1,9bn in net proceeds.

- Building a regional Data Centre Platform: SingTel has an existing base of seven Data Centres with >70MW IT capacity in Singapore which generates revenues of S$250mn at an EBIDTA margin of over 60%. It wants to build on this platform to add a further 100MW in the region through joint collaborations in future for which talks with various entities are well underway.

- Trustwave is a U.S.-based cybersecurity services company which SingTel acquired in 2015 for $770mn and which is now its cyber-security arm as also that of Optus and NCS, with customers in ninety-six countries.

- NCS Group is one of Singapore’s leading IT companies, focusing significantly on government projects. As per a GS report in 2020, if NCS were to be valued then at 10X EV/EBITDA (using the lower end of the peer group) based on FY21-23E EBITDA, it alone would add c. S$700mn value to SingTel.

SingTel has put up Amobee and Trustwave for a strategic review where it could either sell them in part or whole in future to unlock value. Both these are incurring losses currently but are considered to have significant value.

SingTel’s Digital Bank: Finally, the biggest opportunity and arguably the value driver that could come into the frame soon, is SingTel winning one of two full digital bank licenses in consortium with Grab and SEA. Given the lofty valuations, similar entities are enjoying today in the region, it is anybody’s guess what this will eventually be worth in a further three years or so, once it is launched in 2022. SingTel’s stake is not yet known but it will not be surprising for it to be the senior partner in the venture.

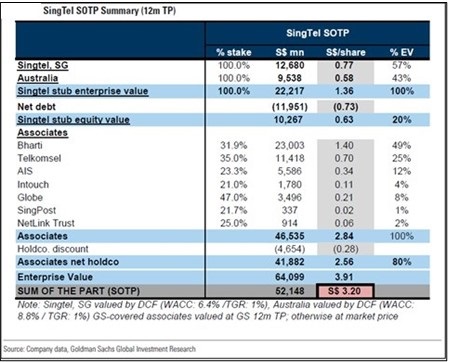

To illustrate how analysts today value SingTel, see alongside a SOTP (sum of the parts) by Goldman Sachs. Clearly, several of the smaller businesses sitting inside SingTel which have immense tangible value running into well over $1bn as well as the ATN Tower deal, adding a combined total of 5-8% to its net Holdco Value, find no mention.

On the earnings front too things are looking up over the past two quarters. The biggest upside in the future is likely to come from:

- Organic recovery of telecom revenues when global mobility and travel normalises not just in Singapore but all over Asia.

- Bharti Airtel could prove to be the crown jewel. Bharti, whose earnings were depressed owing to various regulatory issues and weak pricing in India, has seen and will see further big gains in its EBIDTA as pricing power returns in what is fundamentally now a two-player market. Analysts have been perennially under-estimating Bharti’s earnings power and continue to do so in their future estimates even now.

SingTel’s stock has finally begun to come to life with earnings improving as well as corporate value-unlocking measures coming back on the agenda of the management. Thus, the dividend, which had been pared sharply, will be restored as well. Along with the expectations of specials being paid out from the unlocking measures, it would not be too much to expect outsized gains from the stock as the discount of its holdings to its underlying value narrows in future.

Muthoot Finance: India’s largest gold loan financing company that everybody loves. How could mundane gold loans be worth writing anything about? Read further.

Muthoot derives 90% of its revenue and almost all its profits from gold loans. Muthoot runs a loan book worth US$7.2bn. Its business is designed such that the gold collateral it carries guarantees that it has no credit losses in reality. At the end of Sept.’21, Muthoot had loan assets worth Rs.547bn, against which it carried gold jewellery as collateral of 178 tonnes which is worth approximately Rs.872bn at current gold prices, i.e. ~60% LTV. Hence, barring a cataclysmic decline in the value of gold (which management surmises is ~20% in the span of a month), Muthoot will virtually never have to write-off a loan, as it can always sell the gold and recover the monies owed to it.

Muthoot’s growth and profitability has been so strong (NIMs averaging c.15% in the last 5 years), that the abundance of riches is now beginning to spill over. Embarrassingly so, to a point where the pressure on management ought to intensify in the not-too-distant future to do something about it.

Muthoot runs its business in a super-conservative fashion. Over the last few years, it has been carrying surplus cash on its balance sheet (ranging from 8-12% of total assets) claiming it ‘feels’ comfortable’ having it for a rainy day. Rainy days for Muthoot have been few and rare and have shown up for reasons related to external shocks. It enjoys the highest credit rating it can get and banks are ready to fund it, rain or shine. Yet, management persists with its policy.

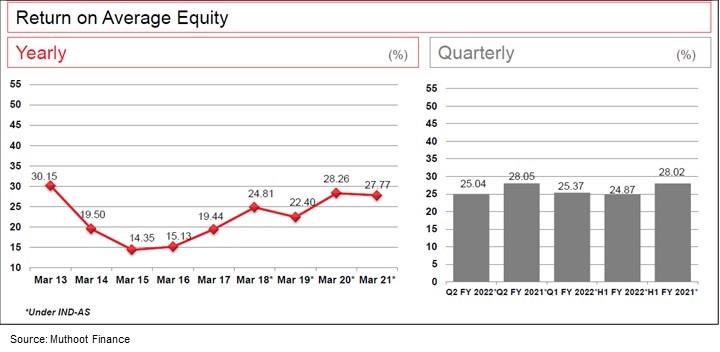

Its Capital Adequacy Ratio (CAR) is at an industry leading 27.6% of which Tier-1 Capital stands at 26.7% at the end of September 2021. Naturally, its debt gearing has declined from an already low level of 3%+ to now 2.65% and heading further lower in future. Now, despite this mountain of cash idling on the balance sheet, its headline RoE has risen to 27.8%! Its 5-yr average RoE is 24.5%. Remember, that all these are headline/ reported numbers. We cannot think of any financial company in India that throws out such profitability numbers with the consistency Muthoot has in the past five years.

At the rate at which Muthoot is growing and in the way it is running its balance sheet, a simple extrapolation of its current growth in AUM will take its CAR to 30% by natural progression in a few years at most, likely sooner. This would be twice the minimum level required by the regulator.

Now, if one were to strip out the cash, its RoE would vault well over 30% today itself. Which is to say that Muthoot has been running a ~30% RoE business for the last five years! That is a figure one does not associate with a lending business and possibly rare to find anywhere on the planet among listed companies of the size and scale of Muthoot Finance, we dare say.

Its market capitalisation is over US$9bn, so this is not a small company that we are talking about here. The family that runs the company owns 73.4% of the company. Yet the average dividend pay-out ratio over the last five years has averaged just 21%. When questioned on conference calls, the M.D. Mr George Alexander Muthoot has managed to shrug off pesky questions on increasing dividends and hoarding excess cash.

We suspect Muthoot Finance is getting to a point where its top-of-class profitability, ROE and CAR but glaringly poor dividend policy will be questioned more vociferously. Proxy advisors have thus far remained silent on this subject too, but we wonder for how long? When it happens, the virtues of Muthoot Finance’s fortress-like business and balance sheet will likely be better valued by the market relative to riskier unsecured lending models that today trade at an unjustified premium to Muthoot Finance.

We could go on and on with more examples to illustrate the myriad mispricing opportunities that lay scattered around Asian markets today. Many of the above find a home on our client portfolios today. Our pipeline of similar opportunities remains robust where we see considerable value in future.

Prospecting for solid long-term growth opportunities in Asia has seldom been more exciting, particularly now when the markets have not fully recovered post the COVID-19 pandemic shock. The normalisation of Asia’s economies and earnings is likely to happen from 2022 onwards. Asia, including China, is poised at an interesting juncture from where a new growth cycle could yet emerge.

But then, there are the myriad fiery distractions that inevitably lead investors away from the true path of value. We need to maintain our focus in the face of these.

As Billy Joel sang back in 1989….

We didn’t start the fire

It was always burning, since the world’s been turning

We didn’t start the fire

No, we didn’t light it, but we tried to fight it

Billy Joel – 1989 (Storm Front)

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.