As we close an eventful 2018, fear and uncertainty seem to rule markets, leaving in their wake attractive opportunities for investors to pick and choose. Crystal ball gazers are finding it hard to come up with a cogent narrative for the times ahead as a plethora of unknowns from trade wars to Brexit to slowdown worries present the proverbial Sword of Damocles hanging over many investment decisions. In an environment like this we go back to our core Investment philosophy and look for cashflows that are predictable, with visible cash return to investors and trading at an attractive price. We find many such ideas but some have outlook uncertainty embedded in the price, others have become prisoners of policy uncertainty, but then we find a company that is trading attractively mainly because most investors have not heard of its name.

Cromwell European REIT (CERT), listed in Singapore just about a year back, is one such name. The company is an owner of developed market properties across a diversified group of European countries, delivering a stable and growing pool of cashflows most of which flow into the hands of investors, thus providing high visibility to returns. We seem to be in an environment where market the should reward such stability and predictability but, given that most investors are not aware of its existence, we are getting the stock at a valuation which provides significant downside protection with reasonable likelihood of capital appreciation as market awareness develops. For a company with a market capitalization north of a billion Singapore dollars with potential for double digit returns, we think this is a stock waiting to be discovered by the yield-chasing Singapore market.

The First Diversified European Asset REIT Listed in Singapore

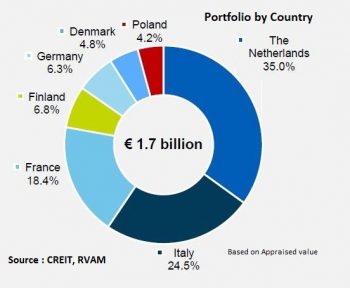

CERT, listed in November 2017, is the first diversified pan-European real estate trust in Singapore. It is externally managed by Cromwell Property Group and has a mandate to invest in income-generating office, light industrial/ logistics and retail properties in Europe. The sponsor, Cromwell Property Group, is listed in Australia and has a 35% stake. CERT has a portfolio of ninety eight properties in seven European countries with a total appraised value of over EUR 1.78bn.

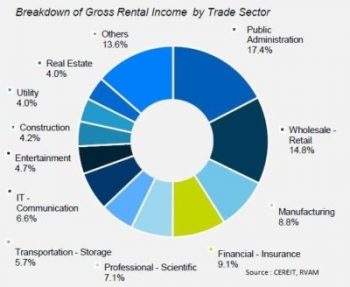

The properties are spread across Denmark, France, Germany, the Netherlands, Italy, Finland and Poland and were acquired from either third-party vendors or funds managed by the sponsor group on behalf of third-party investors. The spread of properties across geographies and end user groups makes CERT one of the most diversified income-generating assets listed in the Singapore REIT market. The top ten client groups account for only 36% of income and CERT has exposure to a good mix of public and private sector clients, and across industrial, retail and service sectors. The charts below highlight the exposure of CERT’s property assets.

CERT’s portfolio comprises a total lettable floor area of 13.86 mn square feet with an occupancy rate of 88.7% with weighted average lease expiry (WALE) of 4.9 years. There are two key positive differentiating factors when one compares CERT with local Singapore property trusts: (a) most of its assets come with inflation-linked reversions; and (b) 90.4% of the properties are sitting on freehold land (many Singapore REIT’s have shorter duration leasehold assets).

Favourable Growth Prospects

The Eurozone has made a good recovery since the days of the GFC and forecasts are for 1.9% GDP growth in 2018 and 1.7% in 2019. CERT’s portfolio latches onto two sectors where the medium-term outlook is strong. 57% of its portfolio is made up of office assets and another third is in logistics, both geared towards the improving economy in the region. The chart below shows the trend in vacancy rates in both the segments. As vacancy moves into the low single digit level after years at double digits, rental reversions are starting to move up across various markets. This is increasingly attracting capital to European property assets.

With office assets in the Netherlands and also Italy, CERT is well- positioned to benefit from growing demand as labour conditions improve and businesses search for an alternative base to the UK. Rents are accelerating and supply is tight as supply pipeline is limited. The light industrial/ logistics space is seeing take-up due to growth in manufacturing output and trade across Europe.

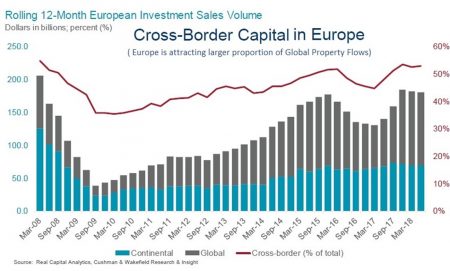

The improvement in the fundamental position along with reasonable valuation of assets is attracting global capital to European property assets. In Asia we are used to global capital coming in hunting for returns. The property sector in Europe is turning into one such global hunt, and for investors in Asia, Cromwell provides a liquid way of accessing this opportunity. The chart alongside from Cushman & Wakefield highlights this trend of capital flows into European property assets.

Good Visibility for CERT

We think there is good visibility into CERT’s distribution cash flow, with income stability anchored by a staggered portfolio expiry profile and long tenant leases with a WALE of nearly five years. The average property asset yield is 5.7% with reversion yields on recently acquired properties estimated around 7.4%, giving good visibility on the upside as and when leases come up for renewal. With an average occupancy of 88.7%, a tightening market could see rising utilization levels. Consequently, there are two potential sources of upside to the existing cashflow stream – reversions and higher utilization. More than a third of headline rents are coming up for renewal over the next four years. With a gearing of 36.8%, CERT has a further €72m that can be channelled to acquisitions without raising additional capital. We think that maturing close-ended funds within Cromwell Property’s pan-European funds platform provide visibility for asset injections. The sponsor currently manages around €3.9bn AUM in Europe across various asset classes.

Group Strategy and Execution Track Record

CERT is part of the Cromwell group which has been listed in Australia since 2006 and has over 15-year track record managing property assets in Europe through a portfolio of specialized funds. ARA Asset Management (a highly respected asset manager in Asia and part of the Cheung Kong Group of HK) recently took a 20% stake in Cromwell group of Australia thereby upgrading the pedigree of CERT. The group has a 200-member team in Europe spread across twenty offices in thirteen countries managing about €3.9bn of assets across 260 properties. CERT has the first right of refusal on buying these assets, thereby providing strong visibility to undertake DPU enhancing acquisitions. The company recently did a rights issue to finance its first big transaction since listing – acquisition of three portfolios containing twenty three properties. These are a mix of logistics and office properties chiefly across France, Italy, the Netherlands and, for the first time, Finland and Poland. A rights issue in a weak market in an undiscovered stock has brought the price to levels where the stock is providing a once-in-a-lifetime entry opportunity. CERT, like several other REITs listed in Singapore, is going through a process of discovery. Such REITs remain uncovered by institutional and retail brokers till they reach a certain size and once they cross $1bn threshold in market capitalization, they suddenly attract a large following. CERT post rights will go across this threshold.

CERT has an Attractive Yield

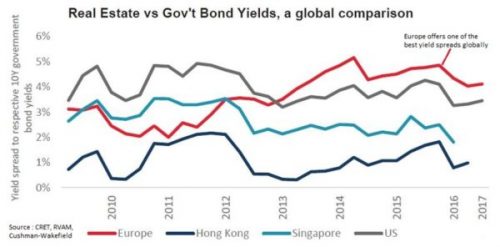

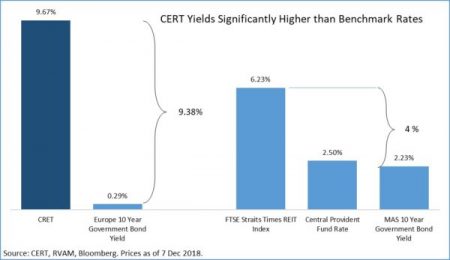

While considering the attractiveness of the yield of any asset, one has to compare it with an appropriate risk-adjusted benchmark. For CERT we look first at the underlying European asset yields and then at the relative position within the Singapore market where it is listed. As a Euro-denominated asset, the first relevant comparison is with its home market government risk free return.

The chart on the right compares real estate yields globally with their relevant local government bond yields. What is interesting is that European assets are offering one of the best yield pick ups over their respective risk-free rates. This is followed by assets in the US, though on a relative basis over the last few years we have seen price discovery of US real estate assets compressing their yield spreads, leaving European real estate as a stand out asset class. In comparison, risk adjusted spreads on Singapore real estate are not that attractive.

After establishing the attractiveness of the European real estate asset class, in the chart on the left we compare the yield spreads observed in the Singapore market. The average Singapore REIT is trading at a 4% spread over Singapore government 10-year bond yields. Conversely, when we look at CERT, at an estimated 9.7% dividend yield it is trading at a 9.4% spread over benchmark European government paper. Even assuming that rates in Europe are artificially low and would go up over the next few years, the yield spreads will continue to look very attractive.

There is thus significant scope for capital gains in CERT as the market starts to compress this extraordinarily high yield. For an investor in Asia, a Euro asset adds an extra layer of complexity in terms of currency exposure but with spread over local rates so high, one can easily hedge out the Euro exposure in an yield enhancing transaction and get a juicy US$ or S$ net yield.

CERT’s Valuation

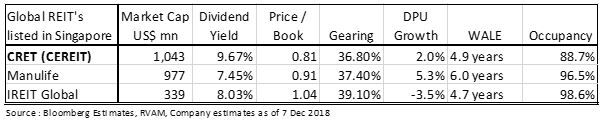

CERT has one of the highest one-year forward distribution yields of ~9.7% as per very conservative proforma numbers from the rights issue documents. We believe the inexpensive valuation is partly due to its unique portfolio composition. The geographical proposition is unfamiliar in the SREIT universe with CERT being one of only two European asset REIT’s listed in Singapore.

In addition, most investors think that CERT’s portfolio is overly diversified but to us that provides strong diversification and risk mitigation for a long duration income generating asset. The table above compares the valuation of CERT with its global peer group listed in Singapore. The closest in size is Manulife, but it owns US assets. IREIT is European (German assets) but is small in size. However, both of them are trading at a 20% plus premium to CERT despite the latter being larger and more diversified with potential for higher upside from improving utilization.

Enhancing Returns Through Hedging

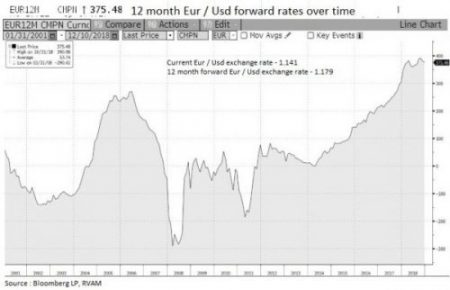

CERT is quoted in Euro and the underlying dividends are paid in Euro. This naturally brings exchange rate risk to the forefront in investors’ decision making process. We are, however, currently in an environment where forward hedging of Euro is very attractive (a function of US-Europe rate differentials).

The chart shows the long-term trend in EUR/USD forward rates. By hedging one’s exposure to CERT in the forward market, it is easy to enhance the 12-month USD return achieved from CERT dividends by 330bps, thereby taking the total USD return to 13.0% (at the cost of giving up upside if the Euro strengthens, but being protected from downside risk if it weakens).

Similarly using EUR/SGD forwards, hedging can give a total 12 month return of 11.9% in Singapore dollars.

Key Risks

The biggest risk to the story comes from the geographic exposure of CERT. Political uncertainty which keeps roiling the Eurozone on and off could have an impact on property prices across Europe despite tightening of the physical market. The second risk comes from a rise in interest rates in Europe, which at some point over the next two years have to move up from the artificially depressed levels seen over the last five years. We think the yield spread embedded in CERT provides adequate protection against the latter risk. Operationally, CERT’s interest rates are locked substantially until 2020 when the first large refinancing comes up. Its weighted average debt maturity is 3.6 years, very similar to the profile seen in other Singapore REIT’s.

Summary

In summary, CERT as a collection of properties in stable European jurisdictions provides a predictable stream of cashflows that could grow over time and as a Singapore REIT, channels that into the hands of investors as dividends in a tax efficient manner. With growing size, this is a REIT that is waiting to be discovered. As street knowledge and coverage improves, we think the excessive valuation discount would disappear, potentially providing investors capital gains in addition to the attractive cash return from the juicy dividend yield.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.