Donald Trump took office as the President of the United States of America on January 20, 2017. By the time he gets through his four-year term, he may well become one of the most controversial U.S. presidents of all time. And a month into the year, as investors, we are trying to fathom the direction of risk premiums as the existing order of business is called into question around the world.

Every President enjoys a “honeymoon” period of 100 days when hope and optimism reign. In Trump’s case, this honeymoon is proving to be one filled with drama, high expectations and big promises. His relationship with the media has been traumatic and tempestuous. The U.S. media is unlikely to turn its focus away from Trump easily and will do its utmost to prod and beleaguer him, even embarrass him for every misstep, every lapse and bloomer. It will hold him to every word and action. For financial markets which have invested so much in his post campaign utterances, the ride looks like a roller coaster.

Trump’s presidential campaign promises have been reiterated by him and his advisors in this period strongly enough for the world to believe that they were not just election rhetoric and that his administration means to carry them out. Trump has made Immigration, Global Trade, Tax changes (border tax/ income and corporate tax cuts) and U.S. Infrastructure the four key pillars of his presidency.

The world is now waking up to an American president who wants to run a marathon fast, from day one. With a narrow agenda, the American people and the media are latching on to every word he utters (or tweets) with vehemence. Thus far, Trump has come out firing a few random shots in the air and across the border down south, a few harmless ones across the Pond and yonder in the direction of China and Russia. He has torn up Obamacare (mostly) and the Trans-Pacific Partnership and threatened to shred and rewrite some others. His first shots fired across the bow on immigration ended up unnerving a section of immigrants living in the country and in the process got himself into a run-in with the judiciary.

However he has yet to spell out the contours of his Immigration Bill, his tax reforms, the fiscal spending on infrastructure, trade issues with China, Japan, Europe and of course how to build the wall on the southern border. He hardly has a foreign policy yet. Soon the financial markets and the world will want him to elucidate each of the four emblematic cornerstones of his presidential campaign and actions on them that he vowed to accomplish during his first 100 days.

The financial markets have read much into Trump-speak. His intentions and their consequences are obviously inflationary in nature. When one considers that the world has only recently come back from the brink of a deflationary scare, the new-found inflation paradigm has reversed the rationale for many of the trades of the past few years.

Trump-speak has sent the U.S. 10yr bond yields slicing past 2.5%, the Dollar Index knocking back the 100 mark with consummate ease and commodities like copper rallying on the reckoning of economic reflation, to name just three instances.

The narrative in the New Year reads like the complete antithesis of what was being said and accepted as the norm just a few months ago. Equity and bond markets have accordingly begun to unwind the trades of the past and price the new narrative in.

Trump is about three weeks into his presidency at the time of writing, with approximately eleven more to go before his ‘honeymoon’ period ends. Such is the level of expectation that the market will hardly give him a day beyond his first hundred when he must at the least spell out the details of his policy intents. Trump must place before the world clear legislations and a road map on critical issues such as fiscal spending on infrastructure, corporate tax cuts and capital repatriation, immigration and global trade with the likes of China and Mexico. This is the bare minimum that is expected.

The Trump Trade

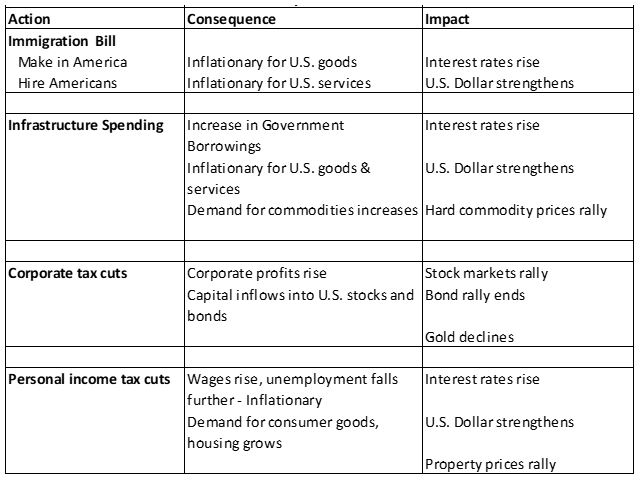

The four areas of policies and their likely impact on the economy and on market variables are presented in the table below.

Should he fail to act on more than one or all of these, the financial markets will lose confidence and conviction in the reflationary notion and the trades firmly in place today could come unstuck pretty quickly. The narrative could swing around yet again come May as his 100-day dalliance ends. Complacency rules the roost today and such turns are not expected, as gauged from market sentiment indicators such as the VIX or Put-Call ratios. Despite the apparent high decibel debates going on, this air of market calm is a bit unnerving as challenges rear their head.

The Trump Challenges

While this positive narrative is being played out, the market has relegated to the background structural challenges which have shackled the U.S. for some time now.

Going back to economics 101, output (Y) is a function of consumption (C) plus investment (I) plus government spending (G) less trade imbalance (imports M less exports X).

Y = C + I + G – (M – X)

While Trump has rightly focussed on correcting the significant trade imbalance and boosting investment activity, the moves in interest rates and currency could quickly sow the seeds of doubt. The U.S. economy is still very consumption-driven and rising interest rates could quickly force the over-leveraged consumer to temper his enthusiasm. Also, a strong dollar has a negative effect on trade balance improvement of the U.S. (which imports more than it exports).

“America First” trade and immigration policies may ironically end up hurting corporate America first before the trickle-down benefits of a stronger U.S. economy percolate to corporate earnings. More than half of U.S. market earnings are derived from sources outside the U.S. Secondly, the biggest beneficiaries of the last few decades of globalization have been U.S. listed corporates as they have been able to attract the best of global talent to work for them in developing innovative products and services, sourcing goods from the cheapest possible location and thereby capturing the maximum value in the chain. Such “America first” policies – a Wall of America – could put the robustness of corporate earnings in the U.S. to the test.

As we ruminate over the imponderables, stock markets around the world continue to rally, expecting Trump to make good on his promises soon, in spite of knowing that there could be some nasty consequences to bear in the long run because of them. How long the stock market continues to climb this proverbial “Wall of Worry” is not difficult to guess – Trump’s 100 days will run out soon.

Till then the narrative continues to play out, the year rolls along and we all expect Trump and his administration (in the next eleven weeks and counting) to put their plans forth, the dollar to keep dallying with strength and U.S. 10-year yields to hold their heads above 2%. The Fed will likely do what it is expected to do – raise rates at least twice if not more times.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.