Like businesses, geographies and asset classes have cycles of their own. These can be protracted and end up becoming supercycles. Asia ex-Japan (AxJ) as a region/asset class has witnessed this recently. AxJ has been a serially under-performing geography for the past 11-12 years. There have been some false dawns in between where the promise of positive demographics, socio-economic changes and individual corporate excellence had failed to deliver the meaningful long term aggregate profit growth that investors have angled for.

However, there are several factors that have now turned propitious after many years, that make us sit up and take notice. The global macro set-up too looks favourable from this geography’s standpoint which suggests that this may not be another false dawn and that the 11-year ‘down-leg’ of its supercycle may have ended and a new up-leg begun. Before we get into our reasons for optimism, it is worth spending a moment to show how good an example of a supercycle AxJ has been.

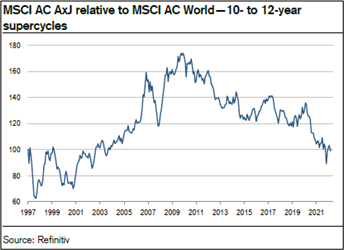

From 1998 until 2010, MSCI AxJ index handily beat global equities over a period of about eleven years (see chart alongside). However, in the next eleven years until 2022, this index has done exactly the opposite, giving up most of the outperformance of the previous up-cycle. That both cycles lasted roughly eleven years seems more than a coincidence if one believes that cycles tend to be related to each other in magnitude and time.

We now have strong reasons to believe that this supercycle may have turned up and we could be on the cusp of another extended period of relative outperformance and absolute returns for equity investors in this region. This could translate into significant wealth creation yet again for the region and its investors.

We note that AxJ has outperformed global markets by 14% since October 2022. There are only two previous periods since 2010 when the region has outperformed significantly more. The rally that we are seeing off the 2022 lows has travelled some distance to suggest that this time it is for real.

The Inflection Point

- The collapse of nominal GDP between 2011-2019, from 14% to 6% has perhaps been the biggest factor to have depressed Asia’s returns over that decade. Contrast this to nominal GDP growth in the US which remained steady between 4% and 6%, barring the exceptional period of the pandemic. This year, however, the US is expected to see a 5 percentage point decline in growth against just 2 percentage points for AxJ.

An improvement in nominal GDP favours Asian corporate revenues, whose linkages with nominal GDP are higher than those to real GDP. The collapse in nominal GDP over the past decade was also largely a function of an unsustainably high base set by China’s entry to the World Trade Organization (WTO) in the first half of the last decade. That adjustment appears to be largely complete now.

- Another factor that imparted a drag to corporate profits, ironical as it may seem, was the aggressive deleveraging of balance sheets in AxJ after the GFC (net D/E declined from 32% to 12%). Again, this was at odds with the behaviour of companies in the western world which began re-leveraging up as interest rates worked their way inexorably lower through the decade. Lower leverage, also symptomatic of lower risk appetite, in turn delivered lower growth, while US and European companies used leverage to perform share buybacks and engineered accelerated earnings per share growth for their shareholders. While we see no stark change in corporate behaviour just yet, we observe that Asian companies’ leverage being as low as it is, ought to spur the next cycle of gearing up at some point from here. Perhaps abatement of the uncertainty over global interest rates ought to pave the way for AxJ corporates to kick-start their growth strategies after a long hiatus.

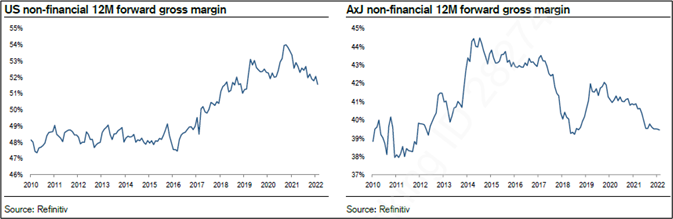

- Next, comes the impact of margins. US margins have turned lower after making a record cyclical high in 2021, whereas AxJ margins are back at decadal lows. There are several signs that margins are inflecting higher now witnessing street estimates, where six out of ten AxJ markets are forecast to deliver higher yoy margins, the notable exceptions being South Korea and Taiwan, both being global growth proxies and highly levered to technology spends.

- Connected to low gross margin levels is the low corporate profit share of GDP. This ratio in the US is close to an all-time high. In stark contrast, Asia’s is the lowest on record. Within Asia, the slowdown of China’s economy and its corporate profits has again been a huge drag overall with corporate profit/GDP declining from ~ 29% to 19% in this period.

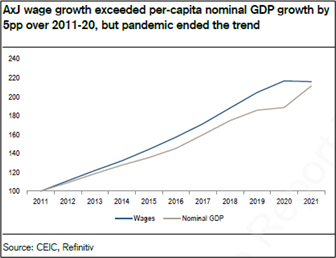

- Another headwind for AxJ and an area of difference lies in wage growth. The big minimum wage hikes of the past decade in Korea, Hong Kong, Indonesia and Thailand are behind us. In contrast to DMs, wage growth in AxJ has moderated since the pandemic since there have been no big transfers to households here. While wages outpaced GDP by 5ppts between 2011-20, the past two years’ nominal GDP has outpaced wages.

A Weak Dollar

Many economists and currency forecasters presage an imminent bear market for the US dollar soon – a decline that could run for many years. As per Credit Suisse Global Strategist, Andrew Garthwaite, the factors that would weigh on the dollar longer term include:

- overvaluation on a PPP basis;

- large US external liabilities;

- excessive holdings of dollars by central banks;

- the political impetus for some countries to reduce dollar reserves and the dollar’s use in international transactions; and

- the fact that the post-GFC dollar bull market lasted an unusually long period (eleven years).

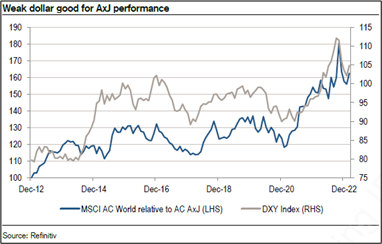

The relative performance of AxJ has a tight negative correlation with the dollar. When the dollar weakens – as is expected – AxJ tends to outperform global peers. Two other factors explain why AxJ thrives when the dollar depreciates:

- A weak dollar improves domestic liquidity. Asian central banks buy dollars to stagger the strengthening of their own currencies. The injection of local currency into financial markets resulting from dollar purchases boosts money supply and liquidity. Also, typically the dollar weakens when US rates are falling and lower US rates generally allow Asian rates to fall.

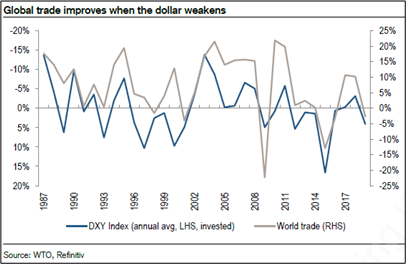

2. Garthwaite also points out that since a large proportion of international transactions are conducted in dollars, global trade moves inversely with the dollar. As the planet’s most export-dependent region, Asia benefits when the dollar falls.

A weak dollar has three broad transmissions through economies:

- Exports: Since a strong dollar is a negative for exporters, markets/stocks with higher export salience tend to be negatively correlated with the US dollar. Looking at the Exports-to-GDP ratio of AxJ markets, we see that the most export-dependent markets of South Korea, Malaysia, Taiwan and Singapore have the most negative correlations, whereas markets with low exports such as India, the Philippines and Indonesia have lower negative correlations.

- Forex reserves: Countries where forex reserves correlate negatively with the dollar are potential beneficiaries. There is an obvious connection with export dependence of such countries. Malaysia, Taiwan, Thailand and Singapore have the most negative correlations between reserves and the dollar.

- Money supply and domestic liquidity: Domestic liquidity is another important factor to keep an eye on in Asia. Singapore has highly negative correlations between M1 and the dollar while Indonesia’s correlations are low as they were previously too. However, Korea’s are now lower than before while for the Philippines they are now higher. Other factors that make a tangible impact on countries and corporate profits are country-specific such as size of capital flows, monetary policies and forex reserve accumulation account.

Taking the above into consideration, Singapore, Taiwan and Malaysia are the biggest potential winners of dollar weakness while Indonesia and India seem to be the least sensitive ones.

Asean Looks To Be A Winner

Within AxJ, Asean countries have more going for them now in addition to factors such as superior demographics and lower old age dependencies, relatively low credit to GDP ratios, higher e-commerce penetration and improving inbound FDI into manufacturing (Vietnam, Malaysia and Indonesia).

- Foreign ownership of Asean equites remains low

Although foreigners turned net buyers of Asean stocks since July 2021, foreign ownership is still low. Going into 2022, foreigners had been net sellers for five straight years.

- Strong EPS revisions, still going strong

Asean stocks’ EPS momentum remains strong almost a year since they turned up. Revisions are up 6% since March ‘22 and, relative to the region, they have outperformed since May ’22.

While the above suggests that Asean is in a good place in 2023 and beyond, there are short to medium term risks that investors must navigate.

- Political risks in Thailand, Indonesia and Malaysia: All three countries head for the polls over the next twelve months, a period which is associated with a degree of uncertainty and volatility. However, this could be a good time to be stock picking.

- Global economy troughs: This could bring growth markets back into focus and lead investors to plump for South Korea and Taiwan over Asean.

To conclude, the AxJ markets appear to have reached a significant inflection point and we may be at the start of a multi-year period of relative and absolute outperformance vis-à-vis Developed Markets. Within AxJ, Asean markets appear better placed owing to their own individual strengths and lower correlations to developed markets as against markets like Hong Kong, Taiwan and South Korea. Foreign investors have taken note of this by becoming net buyers in Asean over the last year, the first time after five years of incessantly selling down the region. Their exposure, however, remains low relative to history as well as in absolute terms.

The US dollar weakness when it arrives, would benefit the region on multiple fronts providing further impetus to the trend. Re-leveraging of corporate balance sheets is still a work-in-progress and needs monitoring, but could see an upturn once global uncertainties over inflation and interest rates abate.

On valuations, in absolute terms, AxJ is not classically cheap now given the uplift in markets but the P/E, P/B and dividend yield are still in the attractive parts of their long term ranges. The equity risk premium for both APAC and AxJ are mid-range, and the earnings yield gap (i.e. market earnings yield minus ten-year bond yields) is fairly low as well. Given the longer term inflection factors discussed above, AxJ can sustain and re-rate higher over the longer term depending on the pace of growth of corporate profits. We have made a good start in 2022, and 2023 looks set to be an improvement with some help from China coming back. Investors would do well to view AxJ with renewed focus as this could be the year where the region’s strengths vis-à-vis the developed markets are better appreciated and where rewards may follow.

Title image by https://www.freepik.com

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.