The current strength of the USD and the strong performance of the US equity market would have us believe that the US economy is doing very well. This view has also driven the consistent belief that interest rate increases are just around the corner. Hence it is important for us, every once in a while, to have a dispassionate look at what the macro charts show us.

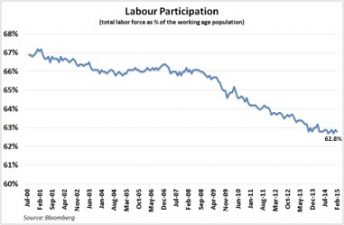

Unfortunately, the macro factors we see show that at best the US seems to have settled into a low level equilibrium. The only factor which seems to have clearly improved is the headline unemployment rate. Even this has been accompanied by poor wage growth and historic low labour participation rate. If we were to combine these with the consistently low inflation number, it is clear that the benefits of low unemployment have not translated into higher economic activity.

US GDP Growth – Always new reasons why it does not turn out to be as good as expected

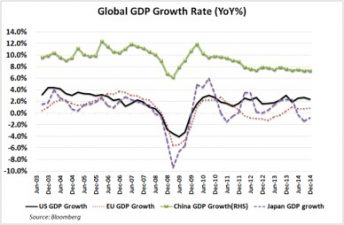

The US GDP growth numbers have struggled to break out of the 2.X% handle. Various reasons have been quoted every quarter for sluggish numbers – weather, inventory, currency, etc. The only positive is that these numbers have remained flat while the rest of world’s growth numbers have been pushed down.

Compared to twelve months ago, the current GDP growth numbers are lower for Japan, Europe and China – but for the US they have remained more or less the same. Going forward we could see a rebound in both Europe and Japan, simply based on a lower base effect. This is the first reason why a Fed rate increase that is significant or sustained is unlikely.

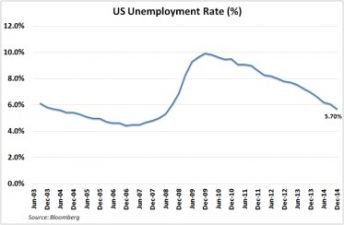

The improvement in labour statistics is hollow

The implied positive from an improvement in unemployment is that wages will improve and consumption would get a boost. With nearly three fourths of the US GDP coming from consumption, this should be a big positive.

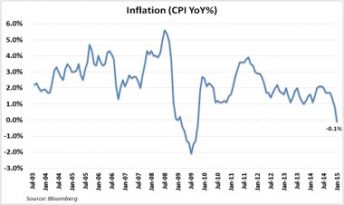

Also, this should lead to an increase in inflation numbers – always a positive for an over-leveraged economy flirting with deflation. But unfortunately the improvement in unployment has led to an increase in neither wages nor inflation.

There are multiple reasons being given for this disconnect. One possible explanation is that the job creation has primarily been in the lower paying retail and hospitality industry. The statistic we have mentioned in the past is the record low labour participation. Since before the 2008 crisis, labour participation has dropped from 66% to 62.8%. Which means that nearly 3.2% of working age population has permanently dropped out of the labour force.

Hence our conclusion that till wage growth gets some traction and core inflation starts moving up, the GDP growth will remain sluggish. This is another reason to believe that Fed rates will struggle to move up in any significant way.

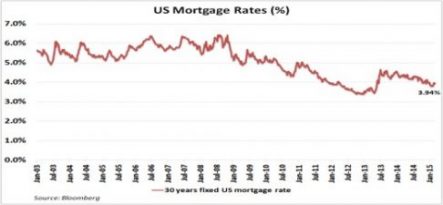

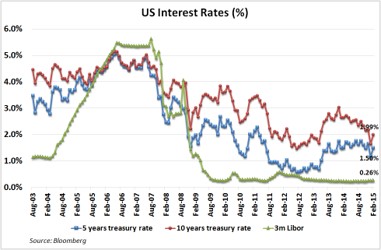

The Housing Sector has found a low level of equilibrium

Housing is one of the larger sources of economic activity and employment in the US. This sector seems to have settled at a level of activity which is about half of the pre-2008 days.

This is in spite of mortgage rates near historic lows and affordability about 50% higher than the 2008 low. Again we suspect that as consumers unwind debt built up over thirty years, the housing recovery is going to be anaemic at best.

This is the final reason we believe that the Fed rate increase is going to be small and slow.

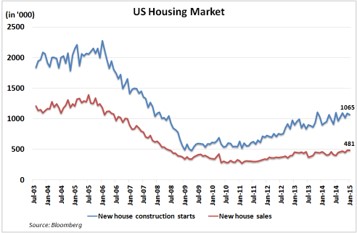

Interest rates – Weren’t the 10 year UST rates supposed to be 3.5% by now?

Even as recently as a year ago, the expectations were that US 10 year rates would be near 3.5% by Q2 2015. We are nowhere near that. Other than the reasons mentioned above, factors like the strong USD, poor non-US growth, etc. are going to further delay this move

The bigger picture remains that the balance sheets of most global economies are very over stretched. This is a balance sheet recession and that takes a long time to repair. Ask the Japanese.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.