The Mighty Dollar – The Slayer Of All Else

The strength of the US Dollar has surprised even its most ardent fans. As the chart below shows, the USD is trading above or within 10% of its 32-year high against the JPY, GBP and the Euro. This is true against its trade weighted index DXY. This is a multidecade high territory for the dollar. Even though the dollar has shown this strength against these currencies individually, this is the first time that it is happening in a synchronised manner. In later sections we explore why this is so and also what the consequences of this strength are.

The Sources Of This Strength

Currencies are always a relative state of equilibrium between two issuing entities (countries). This equilibrium is determined by multiple parameters like interest rates, trade flows, capital flows, growth, level of indebtedness, ability to repay, political and economic risk, etc.

Of these parameters, the two primary ones are relative interest rates and the trade balance. The first determines short/medium term capital flows and the latter the current net earnings of one country vis-a-vis the other.

Interest rate differential

For these major currencies, the relative interest rate has gone into the highest zone within the range of the past twenty odd years. As the Fed has raised rates by 2.25% ytd so far and is expected to raise rates by a further 1% by year end 2022, we will see one of the sharpest and largest rate increase since Volker’s squeeze in the early 1980s. The JPY interest rate differential is reaching a high first seen in 2000. A similar story is playing out for EUR too. The Chinese rates, which have been higher than the US rates for over fifteen years (hence the differential was mostly negative), have gone down sharply in relatively terms. Now US rates are higher than Chinese rates at a level not seen since 2006. In layman terms, globally non-USD money is the cheapest it has been relative to the USD in a very long time. This creates a large incentive for investors to borrow at a cheaper rate in these currencies and invest in USD assets to get higher returns. This trade tends to strengthen the USD till other countervailing factors start kicking in. This is the first source of the USD strength.

Trade Balances Sharply Deteriorating

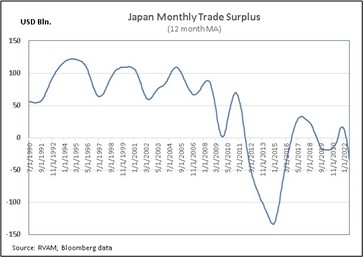

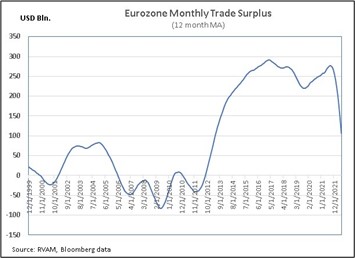

This is especially true for the Eurozone and Japan. As countries slow down after the “post-Covid” bump, global consumer demand looks weak. Combine this with the repercussions of the war in Europe and the Chinese zero-Covid policy, and consumers globally look vulnerably poised. In the longer term, with the increasing nearshoring of manufacturing, global trade has an additional structural headwind. Eurozone and Japan, which used to be structurally trade-surplus, have suddenly developed large trade deficits. This is partly also driven by the sharp increases in energy and commodity prices where countries are large importers.

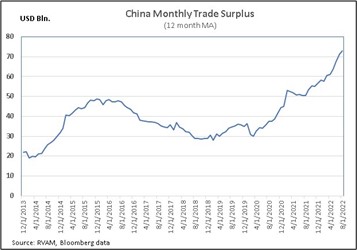

China is the only market which has come out stronger on the trade balance front through the last three years. This might slowly weaken but the numbers look strong now and partly explain the relative strength of the Chinese yuan vis-a-vis the JPY and the Euro despite the sharp move in relative interest rates. We also believe that commodity and energy exporting markets in west Asia, Australia and South America have much improved trade balances too.

Consequences And The Beginning Of Rebalancing

There are two obvious consequences of this currency move, one negative and one positive. The negative is that if this continues, there is a spiralling loss of confidence in the weakening currency which in turn could lead to a run by international investors on that country. Fortunately, Japan and the Eurozone are both net creditor countries to the rest of the world. Smaller countries with similar problems who have large international borrowings (Sri Lanka is a current example) are at risk of a full blown currency crisis.

The positives for these countries are simply a very large improvement in the relative terms of trade. Anyone from Asia now travelling to the US and then to Europe will notice how much more expensive the US seems compared to Europe. Tourists, international students, exporters all benefit from this cheapening of the currencies. Currently, as Japan is finally re-opening its borders to international tourists, the tourists are expected to rush back in large numbers.

Big Mac Burger Retail Price Comparison

An interesting way of looking at this comparative cost advantage is to look at the price of a Big Mac in each of these countries in USD. Most countries seem to rank as expected. The US is close to the top of the list preceded only by expensive countries like Switzerland and the Nordics. The Euro area is 8% cheaper and is probably 12-15% cheaper now as the below data is two months old. The other surprising ranking is Japan which ranks way down amongst emerging markets like Vietnam and the Philippines.

Other similar comparisons of prices for tourists to Japan and to the US show the stark relative cheapness of Japan:

- A room in Marriott, a 5-star hotel: USD253 in Tokyo v/s USD358 in NYC

- Theme Park ticket: USD63 in Tokyo Disneyland v/s USD118 at Disney World Orlando

- Cinema ticket: USD8.5 in Tokyo v/s USD16 in NYC

- A pint of beer: USD3.2 in Tokyo v/s USD5 in NYC

- Cappuccino: USD3 in Tokyo v/s USD4.5 in NYC

This improvement in relative competitiveness is a natural self-corrective mechanism for large currency moves. Such improvements make a country’s exports (products and services) more competitive, which in turn improves the trade flows. Also, after some time, long term capital gets attracted to cheap assets and hence portfolio flows and FDI improve. Both these are supportive. We believe the Euro and the JPY are reaching such an inflection point. Hence, one of the themes we are trying buy in our portfolio is based on this inflection.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.