It is rare that one finds oneself at the cusp of an inflexion point, recognizes it as one and acts on it, as it is only historic narratives which help us understand how events which we may have lived through helped change the course of life and showcase the winners and losers of the changing tides. As Mark Twain once said, “History may not repeat itself, but it rhymes”. As we ponder the events of 2020 and look towards a new dawn emerging, we draw lessons from the past and, looking at the horizon, can visualise a bright and prosperous Asia.

This year is turning out to be one which is going to keep historians busy for many years. The rollercoaster of events that we are living through and adjusting to in many a case is going to leave permanent changes, some scars, but in the process of creating deep chasms and divides, it is presenting many opportunities for the patient investor, towards which we would recommend pools of capital to align themselves.

As we and the markets ponder the changes that a new Biden presidency is likely to bring not just to the U.S. but also to the world at large, the coronavirus which emerged early in the year continues to confound its sceptics, persistently popping up just when people heave a sigh of relief. Despite its potency being similar to early prognosis, the inability of human beings to manage to live with the virus (which is likely to be around with us for a long time) is creating economic challenges which go beyond the immediate future. Amidst all this what does stand out is that Asia is doing significantly better than the rest of the world. It is about time investors in Asia took cognizance of the new emerging narrative that has the potential to overpower the U.S. narrative which has made many rich over the last decade but which may not be able to sustain its momentum, given the headwinds in the changed world.

The Asian Narrative

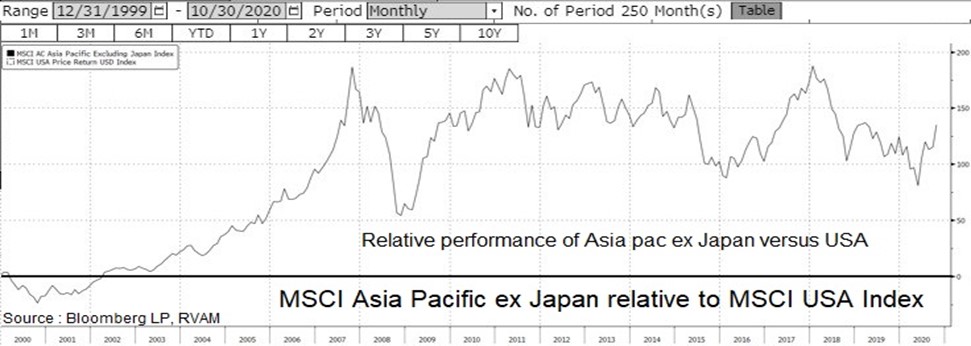

In our write up in December 2019 – Dawn of a new Decade, we looked back at the divergence in performance between the U.S. markets and Asia over the previous decade. We postulated then that after being at the crosshairs of policy uncertainty, the cyclical recovery momentum combined with fundamental improvements favour Asian equity markets. Little did we know that there was a devastating virus waiting in the wings, ready to explode onto the world stage, upsetting all calculations. As the year comes towards a close, our conviction on the underlying theme for the next decade being an Asian one just got reinforced. We think that going into 2021, this is likely to become a mainstream narrative in the marketplace.

Last month we talked about the Power of the Narrative v/s the Logic of Numbers. In Asia we are seeing the convergence of a narrative with numbers, a powerful confluence which can drive a multi-year market re-rating, reversing the nearly 35% valuation gap which has opened up with the S&P500 in the U.S. on Price to Earnings valuation. The narrative starts with the management of the COVID-19 pandemic, gets reinforced by improving economic activity and can be boosted by the powerful tailwind of global liquidity which, like water, will finds its way to places where fundamentals are strong and sound, i.e. Asia.

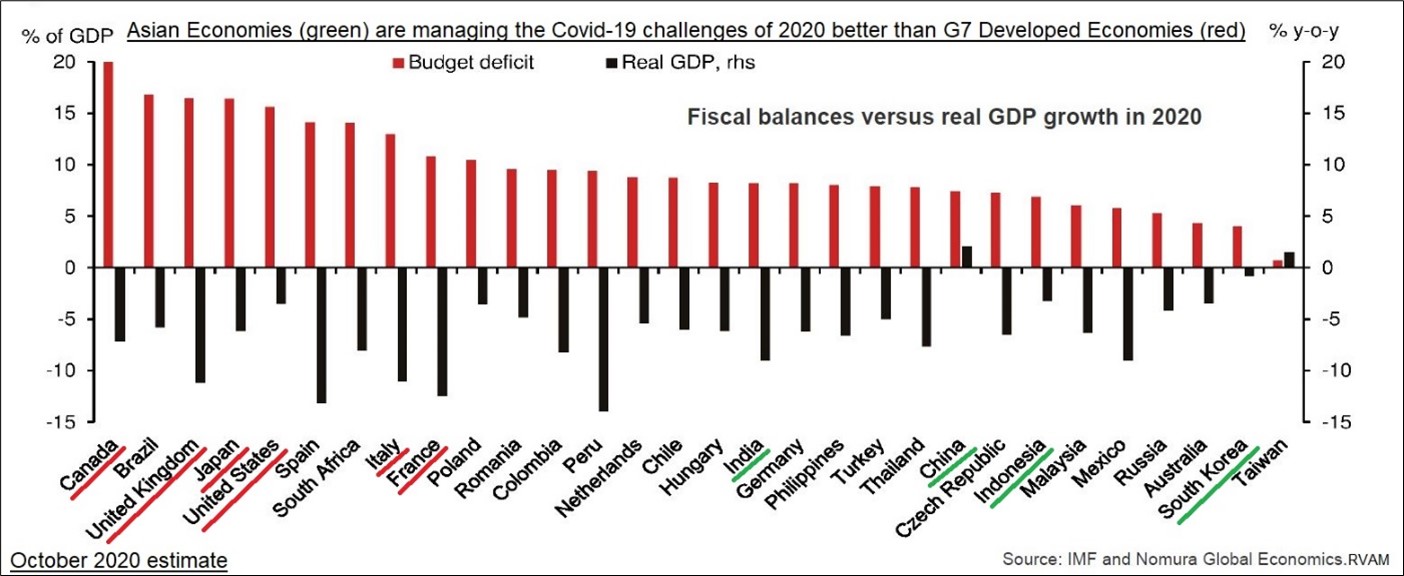

The onset of winter in the northern hemisphere is bringing with it the next wave of COVID-19 infections (the second wave in Europe, the third in the U.S.), resulting in one country after another going back into partial lockdown mode in Europe. This is putting a lid on developed market economic recovery momentum which improved in the middle of the year. The contrast with Asia cannot be starker. While the North Asian economies of China, Taiwan and South Korea continue on their path of GDP growth with negligible numbers of COVID-19 cases, even countries like India and Indonesia, with weaker institutions, seem to have achieved a semblance of balance between economic recovery and managing virus caseloads better without having to resort to wholesale shutdowns. The contrast is apparent not just in management of the pandemic (see table above) but also in the economic cost of managing the fallout.

The chart alongside shows the expected GDP growth for various economies in 2020 and the budget deficit expectations. The G7 developed market economies are bunched on the left of the chart with GDP decline in the -5% to -10% range despite running budget deficits from 10-20%. In contrast most Asian countries are bunched towards the right with GDP growth either positive or in the 0 to -5% range with deficits below 10% in most cases. Going into 2021, not only are Asian countries starting on a better footing on economic growth, but they have also achieved this without destroying government balance sheets.

We briefly touched on the potential for Asia to diverge in our May writeup – The Hare and the Tortoise, but what continues to surprise us is the persistence of the trend and the fact that some developed countries are still struggling with basics like testing (e.g. the U.K.) to get the pandemic under control. Hope now rests on vaccines which seem to be around the corner. However, the next challenge which nobody has yet figured out are the logistics and cost of delivery of these vaccines. It is to be hoped on that issue that the political change in the U.S. will bring some semblance of rationality back on the global stage with Biden promising to follow a science-based approach, a stark contrast to the chaotic tweet-driven world we have lived in for the last four years.

The Biden Boost

The market heaved a sigh of relief last week after four tumultuous years of unpredictable policy swings as it became apparent that the presidency in the U.S. would change hands from the mercurial Donald Trump to the potentially steady hands of dependable Joe Biden. The markets have rallied as the uncertainty of a contested election partially recedes. While there are many events yet to take place (e.g. outcome of Senate elections) before the impact of political change on the U.S. market becomes apparent, what is easy to prognosticate and bet on for investing is the fact that Asian economies can chug along on their own fundamental merits without being swung around by overnight policy changes in the U.S. pandering to narrow interest groups or personal whims. The U.S.-China relationship, which is key to Asia, may or may not improve dramatically, given the challenges to finding common ground on diverging ideologies. What is clear, however, is that the contours of the relationship would be predictable, both the positives and the negatives. It is fair to assume that we would no longer be dealing with ever-changing goal posts on U.S. trade and tariffs or policies on outsourcing and immigration, trying to fathom their impact on companies we invest in. These are likely to be replaced by tougher negotiations on market access and trade imbalances, which may not be all that positive for Asia but nevertheless would be forecastable and, from a market perspective, this reduces the risk premiums embedded with uncertainty.

Global Liquidity Surge

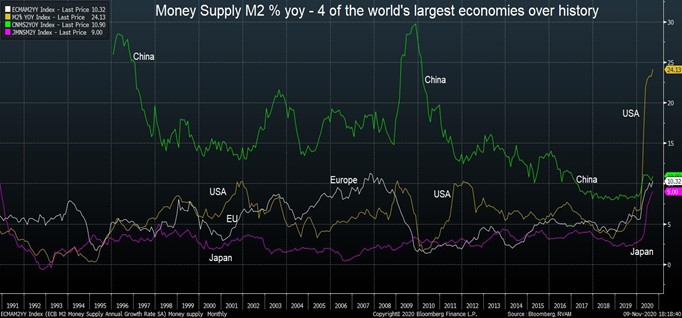

While Asia seems to be on a strong footing, we operate in an interconnected world and from that perspective it is interesting to look at the backdrop in which financial markets are currently operating. The four largest global economic blocs in the world today are the U.S. followed by the EU, then China and Japan. The chart below looks at USD money supply growth in each of these economies.

It is striking that money supply growth in China is steady while the EU, Japan and the U.S. have opened the liquidity taps. The surge we are seeing in the U.S. and Japan is unprecedented in a historical context for both economies: each is doing a 5x multiple of their historic trend lines. While this is clearly being reflected in financial market performance, over time this is likely to either find its way into the respective real economies or else we are likely to see capital heading towards Asia where growth opportunities are plentiful and more apparent.

Asian Fundamentals

The handling of the COVID-19 crisis has put countries in Asia in a better position, but that is not all. As the saying goes: “never let a good crisis go to waste”. Some of the Asian countries have used the opportunity to push through long-pending reforms which could act as a catalyst for the next round of growth. In India, we saw the government pass long-pending labour reforms and a surprise push-through of market-friendly reforms in the agriculture sector (a political hot potato). Similarly, the crisis presented Jokowi in Indonesia the excuse to finally push through the Omnibus bill which reforms tax and labour laws, cutting red tape which was acting as a constraint to investments in the country.

We expect 2021 to present the world with an emerging scenario of a two-speed global economy. Many of the developed markets, which started this crisis with already high leverage and have seen debt levels go up further, will be facing headwinds from deleveraging at the same time as governments withdraw support provided to keep income levels stable in 2020. On the other hand, Asian economies should benefit from strong underlying growth potential and the oodles of cheap capital floating around the world (courtesy global central banks) which should help propel a new growth cycle.

Lessons From History

Most investors are fascinated by the U.S. stock market and its gyrations and worry about valuations especially in the narrow sectors which have seen stellar performance such as technology. This is not the first time we have experienced this, and the current situation reminds us of the post dot.com period of 2000. The bursting of the tech bubble then was not the end of the world; It did, however, start a nearly decade-long underperformance of U.S. equities but, if you were in Asia, you had one of the most fascinating journeys with economies and markets marching in lockstep to create one of the biggest booms. Other than technology valuations, what is common with that period nearly two decades ago was the stark underperformance of value (see our September 2020 monthly – A World of Value) and the strong Asian fundamentals which were being ignored by markets infatuated by the new internet technology.

As we finished writing this piece, Pfizer just came out with the blockbuster announcement which everybody was waiting for: “the vaccine works and it is 90% effective”. And that sums up the mood for this tumultuous year: “The future is bright but be ready for the volatility of the ride”.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.