Our Portfolio Adjustments after the US Presidential Election

When Donald Trump pulled off his famous Presidential win back in November 2016, we felt like many others did too – that the world had just moved under our feet. The narrative changed overnight. It was all pre-Trump and post-Trump from then on. We could not find too much fault with that line of thinking, except that the conclusions arrived at seemed a bit over-simplified. As if the world had it all figured out.

The first thoughts were that this is all going to be inflationary, tighten long bond yields and the dollar was going to run hard and fast. Sure enough the US 10-yr and the US dollar were off to the races immediately post November 9, 2016.

So we huddled in our meeting room one morning soon after the election with our portfolio in hand. Till then, we had held on to our beliefs about the way we saw the world economy play out over the next five or more years. You could call it what you want – a slow burn or slower-for-longer or muddle-through. Now Trump was threatening to put a blowtorch under the pot.

We had to decide if this was the point where we had to change tack, adjust the sails to catch the wind and chart a new course. The ship needed steady hands and clear minds to steer away from the welter of emotion that swelled around us in the markets then. After an in depth discussion, we chose to merely adjust the sails, so to speak. Thus, we chose to largely retain the strategy and character of the portfolio that embodied our investment philosophy.

We added some growth-oriented stocks and pared some bonds whose prices left literally no upside to hope for. The most important decision we made was to keep our REIT holdings unchanged. We have been investors in Singapore REITs and business trusts (with business exposures all over the world) from inception and these form an integral part of the ‘yield’ basket of stocks in our portfolio. We knew that REITs, akin to infinite duration bonds as they are, would be most susceptible to changes in long bond yields. If bond yields broke above a certain level, the tide would turn and the REITS would be under pressure, especially if their individual growth outlook did not improve with rising rates.

Our assessment of the situation told us that even though the US Fed was going to hike interest rates, it would be at a slower pace than what the markets were expecting. And when that transpired, bond yields and the US dollar would, after their short period in the sun, retrace and stay becalmed. Also, we were not in the camp that felt that the US economy would grow wings overnight and soar. Our modest view was and remains that the US economy was cruising along nicely at a slow but steady pace. It did not yet have enough strength to get itself into higher gear which would then trigger a series of rate hikes from the Feb and lead us to make a large shift in our portfolio strategy.

Our Reassessment after Labour Day (May 1, 2017)

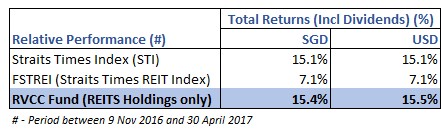

Post the Labour Day weekend as we took stock of the portfolio, we had reason to feel warmly satisfied about the way we had handled the aftermath of November 9, 2016. We compared the performance of RVCC Fund’s REIT holdings alone versus the Straits Times Index (STI) and the FTSE Straits Times REIT Index (FSTREI) between November 9, 2016 and April 30, 2017 in Singapore dollars and U.S. dollars. We took into account capital appreciation during the period and all dividends received during this period for the Fund and also took into account the total returns including dividends for the indices.

RVCC Fund’s REIT portfolio comprising five stocks grew 15.5% during this period versus 7.1% for the SG REITs index and 15.1% for the broader benchmark STI index in US dollar terms.

The humble REITs, which most active investors think lack the oomph to deliver large-sized returns, have surprised many so far this year. The narrative at Raffles Place goes like this: supply is peaking in several parts of the Singapore economy, be it high-grade office space, retail malls, hotels or industrial space. Therefore, as the economy recovers, asset prices and rental yields will follow suit over time. The fact that the three or four year period of declining values and yields was ending was sufficient reason for investors to turn positive and lift REIT prices off their floors and rather strongly so. The second argument in favour of SG REITS is that if the domestic and global economy recovers (even slowly), growth at SG REITS will follow and take DPUs higher.

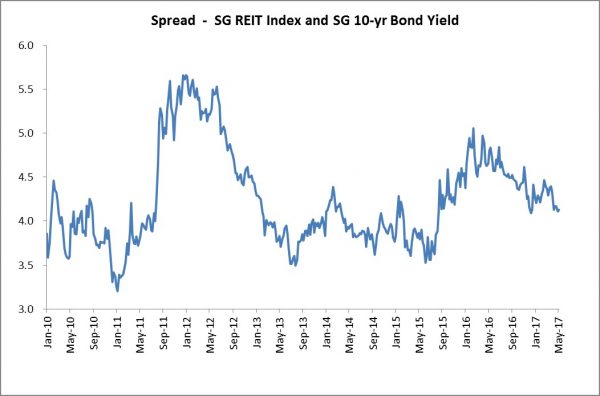

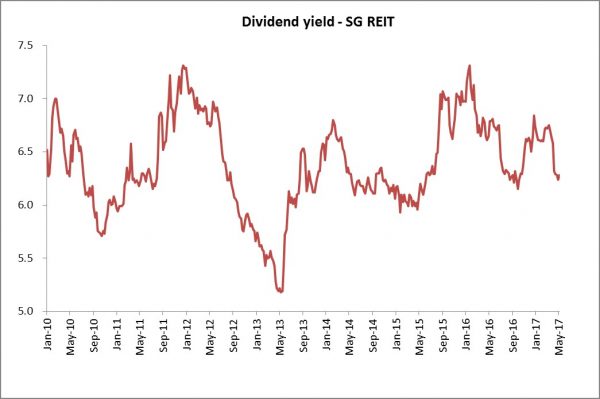

As we stand in May 2017, we see that the average yield on REITs has reverted back to its long term average and its spread against the benchmark Singapore 10yr bond yield has also narrowed to an average level of a bit over 4% (see chart below). We are still some way away from the extremes where the spread had narrowed to 3.5% twice (2013 and 2015). For that spread to recur, we may need a further contraction of bond yields or for REIT dividends to rise strongly. Both events could trigger off another leg of the rally in REITs. Much will need to happen globally and in Singapore before that occurs.

Our review has confirmed our assessment that often seemingly significant geo-political and socio-economic events transpire, but they need not force investors to turn their investment strategies 180 degrees. Also that a balanced portfolio populated with good quality assets can withstand volatile periods without having to resort to esoteric forms of hedging, short-term forced actions and/or altering the basic risk parameters of its construction.

So far, it is playing as per the script at River Valley Asset. But this could change at short notice given the mercurial leadership in the White House and the omnipresent geo-political risks elsewhere in the world. We are listening and as always trying to read the tea leaves.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.