Narrative is Important in Financial Markets and in the Political Space

“The Power of a Narrative” is an interesting construct that is clearly manifesting in today’s financial markets and the political environment. It confounds the logical thinkers (who we refer to as “Numbers People”) as can be seen in the head scratching status of the conventional (value biased) investors in financial markets and the never-Trumpers in the U.S. political environment. The frustration of a hedge fund manager who has shorted Tesla is not very different from a Democratic Party supporter in the U.S. political space who has been making longer and longer lists of the reasons why the current President is undeserving of the support he gets. Both have logic on their side, numbers support what they think should happen, but the reality is often erratic or totally the opposite.

We feel this dissonance is because of the inability of these participants to understand the power of a good narrative. Numbers People and Narrative People speak different languages and often don’t understand what the other side is saying. Each side thinks it is occupying the moral high ground and believes in the worst caricature of the other side. Numbers People believe that valuations/ political leanings should be about numbers/ social logic and that narrative is a distraction that brings irrationalities into the investing/ political process. On the other hand, the Narrative People believe that investing/ political decisions are all about great stories and it is the height of hubris to try to depend on numbers/ logic/ science when the future is so uncertain. Hence the former has the fact checkers and the latter has social media manipulators.

Narrative in the Political Space

In the political space Trump’s narrative is a combination of multiple anchors including catchphrases like “drain the swamp”, “build the wall”, “there are good people on both sides”, “law and order”, “China virus”, “China has been ripping us off” and name-calling like “Sleepy Joe”, etc. Each of these terms, particularly when repeated ad nauseum, creates a very clear narrative. The important point to note is that this does not need a very strong backing of logic. A few anecdotes picked out of context are enough to solidify this narrative. For example, on “law and order” what do you think would happen if some people were to go around in a Trump rally and distribute pamphlets with a detailed analysis of the actual law and order situation across America with a special section on numbers related to the rioting during the BLM protests? At best these pamphlet distributors would get laughed off and at worst they could be physically harmed. For sure very few at the rally would read the pamphlets and probably none of the few who read them would believe the conclusion that the BLM protests have mostly been peaceful. Similarly, most people who believe Trump’s overall narrative are convinced that Trump has been tough on China, Mexico, Europe, etc. on the trade front, such that the U.S. is becoming stronger in international trade. But should we bother telling them that U.S.’s trade deficit with the world is 25% worse in 2019 compared to that in 2016 when Trump came in, and 2020 looks like a much worse year than 2019? No, because we don’t think this statistic will change the narrative these believers have created for themselves. This is the power of the narrative. On the other hand, there are similar positive narrative too – for instance, the U.S. as a country was a positive narrative for the free world for nearly all of the past century. That is also a strong narrative and still endures today (though in a weakened form).

Narrative in Financial Markets

Extrapolating this same construct to the investment world is more relevant to us. Though the investment world is not as polarised in black and white terms as the political space, the polarisation is now the most extreme it has ever been in history. The “narrative v/s numbers” world can also be broadly (though not quite accurately) defined as the “growth v/s value”, “new economy v/s old economy”, “tech v/s non-tech”, etc. In each of these cases the narrative of the first group is much stronger. On a broad basis, the market is a lot more gung-ho on the longer-term narrative of “growth”, “new economy”, “technology” companies. Historic evidence in such sectors abounds with instances of low barrier to entry, higher corporate mortality rates, much shorter corporate history, etc. But that does not deter the believers.

Tesla is the poster boy of this strong narrative world. This year Tesla’s sales will only be 1/8th of Toyota’s and profit only 1/10th. But Tesla’s market value is nearly 2x Toyota’s. Why is that? The Tesla investors can also see the current numbers. They are not fools. It is simply the difference in the narrative. Tesla’s narrative includes “changing the world”, “master disruptor”, “on the right side of the environmental movement”, “way ahead on autonomous driving”, etc. Also, they have a master narrator (like Trump) in the cult-like figure of Elon Musk, whereas few know the name of the head of Toyota. A side but very important point to make here is that Tesla’s numbers match its narrative. This is very potent and probably explains the very strong belief in the stock. We will talk more about this later.

Another example where the narrative is strong (though the numbers might not be as good) is Apple. The current enthusiastic narrative does not match the fact that in the past five years Apple’s profit is up only about 8%. Over the same time frame the stock is up three times. Clearly the narrative now is different from what it was five years ago, or else the stock would not have moved as much since the actual numbers have not moved much. This is an example of purely a narrative change driving a stock.

On the other hand, we have stocks where the narrative has clearly gone wrong. This includes all the value sectors like energy, financials, tobacco, telecom, some emerging markets, some small caps, etc. Here the short-term numbers are a mixed bag, but the long-term narrative is consistently bad. Energy companies are normally fossil fuel companies like the oil majors, coal giants in places like China, etc. These companies are down 50-60% for the year. Even though a part of this fall is explained by the current low oil prices, the bigger negative is the risks vis-à-vis the long-term price of oil. This takes a hit from the positive narrative on renewable energy, regulatory risks, etc. Like always, narratives can reverse direction and that is where potentially the opportunity is in such sectors.

Characteristics of this Narrative Power

“Narrative power” analysis is based on the recognition that the currency of a strong story is not purely truth but meaning. This is what makes a story powerful, not necessarily facts, but how the story creates a meaning in the hearts and minds of the listeners. In simple words, a powerful story is when you tell people what they already believe in – consciously or subconsciously. This explains why it is easy to tell a story which appeals to nationalism, or disruptive technology, or fear of immigrants or the potential to discover a magic drug, etc. Each of these strikes a deeper meaning in the listener. With this basic concept, let’s delineate a few characteristics of this Narrative Power.

The Power of the Anecdote: Psychological studies undeniably point to the fact that human beings respond much better to stories than to abstract numbers. Our brain is programmed to pick up anecdotal evidence, create associations and then seek out patterns. ‘Anecdotal evidence’ based thinking is as old as man, whereas the scientific method of thinking is only a few centuries old. An anecdote about Hillary Clinton’s transgression in using a private email server is enough to reinforce the view feeding the slogan “drain the swamp”. Similarly, the hoopla around every launch date of new Apple products creates a perception of a “must have product” with increasing demand. This is a lot more powerful than looking up Apple’s earnings report for the past five years and noticing that the earnings have not moved much.

The Weight of Experience: An anecdote is powerful, but an anecdote narrated by a person who himself has done something similar successfully in the past is a lot more powerful. Success in the past is viewed as a predictor of future success. For example when Trump says “I have made a lot of money and have made myself very rich” and then says “I will dramatically improve your current economic status”, it sounds a lot more believable than a career politician saying this. Similarly, if Masayoshi Son (Chairman of Softbank) says “give me USD 100 bln. for Softbank’s Vision Fund and I will make you a lot of money”, one does tend to feel comfortable given him that money. After all, he was the person who made tens of billions of dollars investing in Alibaba many years ago. Again, past success is extrapolated into future predictions of success, when in fact the corelation might be tenuous at best.

Appeals to the Emotion/ Common Sense: The best narratives have an emotional pull that drag listeners in because they can relate to that emotion. The emotions that these stories appeal to can be a mix of the negatives (greed, fear, envy, etc.) and the positives (change the world, ESG issues, reduce social negatives, etc). That’s why we see most politicians trying to tell a personal story. For instance, Biden and how he lost his young wife and child in a car accident and another child to cancer and Kamala Harris with her strong immigrant parents’ story are on this path of trying to connect emotionally.

Does Narrative Drive the Numbers or do Numbers Drive the Narrative: This is one of the core questions, and you either believe one or the other. A great example of this is again Tesla where the company’s narrative has been so compelling that the market has continuously given it money for the past ten years – Tesla has had ten equity raisings since its IPO ten years ago in 2010. Now the numbers have improved – but without the narrative of the past which lead to these equity raisings, the current business could not have been built. Here clearly the narrative was an important driver of the final numbers.

When Numbers and the Narrative Intersect

This is the part where we try to use this “Narrative v/s Numbers” construct in our investment process.

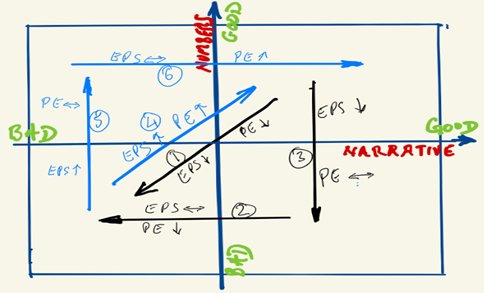

This matrix of Narrative v/s Numbers shows the four possible combinations. The more towards the right and the higher you go, the better it is, with the top right quadrant being the best scenario and the bottom left the worst. But the maximum money is made or lost not when companies stay static within a quadrant, but when they move around. The best scenario is the one marked 4 when the company moves from the bottom left quadrant to the top right. And the worst is the opposite. The rest of the movements are also described in terms of change in EPS (which represents the ‘numbers’ of the company) and PE (which represents the change in narrative of the company). Here we see that the results are more nuanced.

Source: RVAM

We as investors are always looking for companies following scenario 4. This is where the maximum money can be made.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.