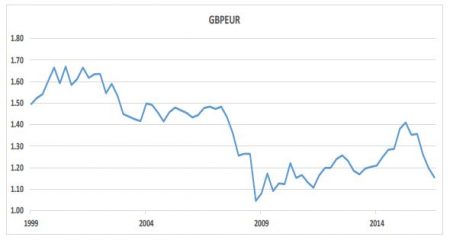

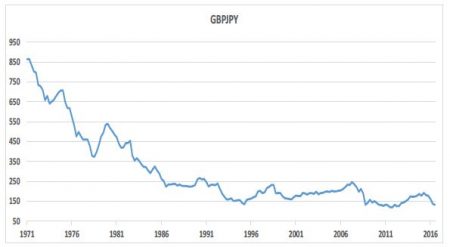

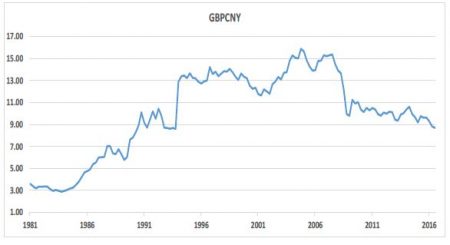

The British pound is at a multi-year low against most currencies. It is near all-time lows against the USD, JPY and the EUR. It is at a 25 year low against the CNY and has shown zero appreciation against even the INR over the past 13 years.

Why is this of interest to us? There are multiple reasons. The primary idea is that the relative competitiveness of economies is defined by multiple factors. Most of these factors are slow moving like labour productivity, capital productivity, structural flexibility and change, innovation, appetite for creative destruction, rule of law, property rights, etc. These are all factors that change very slowly and hence remain constant sources of higher or lower relative

competence. The one large factor we have left out of this list is the currency exchange rate. This is one of the biggest sources of relative competitiveness and has tended to move in large values in a relatively short period of time. For example the GBP has dropped 28% against the USD in the past 28 months and 40% in the last 9 years. These are very large moves. And these are very large doses of transfer of competiveness from a USD-cost business to a GBP-cost business. The market tends to look at a strong depreciation of any currency as a sign of relative weakness in that economy. But the really important take away from this is that this depreciation is already sowing the seeds of future relative strength in the same economy. Hence our current state of curiosity and intrigue vis-à-vis the extreme depreciation of the GBP.

The Beneficiaries

The primary beneficiaries: The obvious beneficiaries are those British businesses that are global MNCs. These tend to trade and report in GBP but have large chunks of their businesses outside the UK. Of these the best are the companies which have GBP costs but are selling products to the rest of the world (like Tata Motors). The secondary beneficiaries: This includes a swathe of companies whose benefits are not obvious at first glance. One fall out of a weaker pound is the increased competitiveness of the British services sector. This therefore leads to more students coming to the UK, more international tourist inflows, lower domestic tourist outflows, increased competitiveness of sectors like legal, healthcare, etc. This list can go on further. Here the benefits take some time to show up and some of the benefits could get negated by Brexit-related structural negatives that come up. However, it remains an interesting pool of

companies to look for buying opportunities.

The tertiary beneficiaries: These are businesses where the benefit is indirect or delayed. Some of them are initially overwhelmed by the potential negatives from Brexit. Here the positives will show up over a few years. These could include companies in the property sector, banking and finance, etc. Interestingly this set could be the source of maximum return in the long term as valuations are much lower here than in the first category. However the waiting period could be longer and initially the performance of these businesses could move down before they move up.

Conclusion

We are intrigued and excited by the current drop in the GBP. This is creating a long term opportunity to buy some good businesses at cheap prices. The obvious and direct beneficiaries are not necessarily the stocks we will invest in as the market is already pricing in the benefits of a dropping GBP into their stock prices. The really interesting opportunities could be in the secondary beneficiaries’ space and, over a period of time, in the tertiary beneficiaries’ space.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.