While we were perusing recent financial results of various REITs and Business Trusts listed in Singapore, we couldn’t help but hark back to the period at the start of the year. It was a time when a slew of market reports hit the headlines calling for a reversal of fortunes of several REIT sectors based on the premise that ‘supply’ in many of them had or was going to peak out in 2017 and that it was going to be smoother sailing here onwards. We weren’t buying that line then and we aren’t buying it now.

Our belief has been that when there is excess supply in an industry, it takes a long time for that excess supply to be absorbed. Especially when underlying economic conditions remain feeble, as they are currently. Often the excess of the previous cycle brings with it deleterious effects – of weak pricing, market disruptors emerging and financial stresses impairing balance sheets. All of these take time and corporate actions to heal and repair. Most importantly, demand must germinate, flower and then bloom again for that excess supply to be ‘worked away’ quickly. Therefore simply marking the ‘peak supply’ point in the economic cycle based on available data as being the end of the pain period is often unreliable and premature.

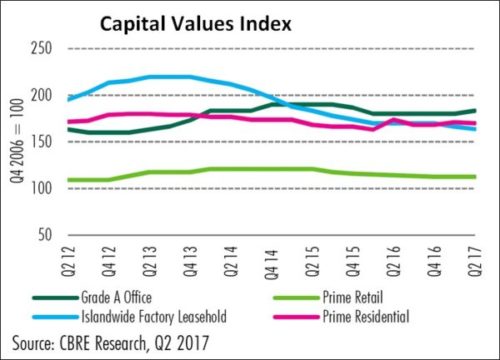

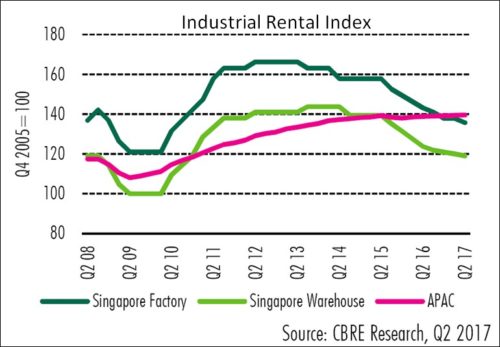

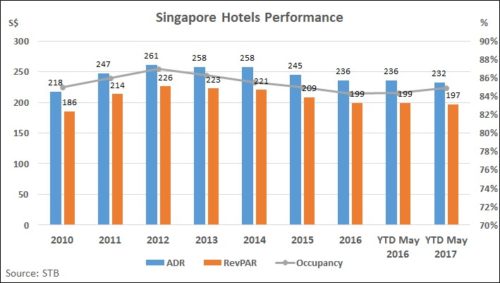

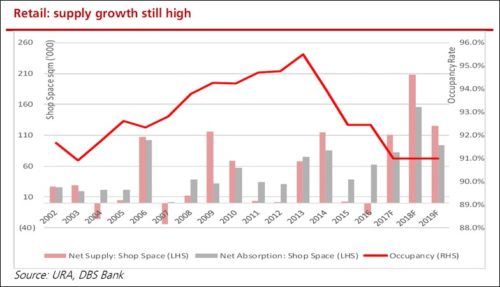

Barring a handful of sub-sectors, namely residential property and business parks, current demand conditions remain weak and supply copious. Pricing, a reflection of this, doesn’t suggest any perceptible turn upwards either. In fact, the pricing trend in sectors such as Hospitality (RevPars) and Logistics (rental reversions – psf basis) remain negative and flat at best in pockets. We have yet to see office property rentals being marked up or hear anything that suggests a trend emerging. The retail sector continues to see vacancies increase with rentals inching lower, if not falling off a cliff.

Sectors such as Logistics and Warehousing, Hotels and Office Property could see new supply peaking in 2017. When one looks at the cumulative supply built up since 2014 and current demand levels, it’s pretty obvious that prices are going to be a significant headwind for DPU and NAV growth. The best one would expect is that prices may stop declining (as they have in some areas of the island) but it would need them to start climbing surely and steadily for a few months before we get confidence that demand – supply forces are balancing out.

It will be interesting to see how investors deal with the potential disappointment of having to live with another year of weak growth equating to a further extension of declining DPUs and NAVs. Note that the FTSE Straits Times REIT Index has delivered total returns (incl dividends) of 18.8% on a ytd basis up to July 2017 vis-a-vis 17.6% for the STI Index in the same period. It must be mentioned here that the 10-year yield on the Government Bonds in Singapore have declined from 2.47% at the start of the year to 2.1% at the end of July. This contraction of yields has played a key role in driving REIT performance and masked the weak underlying trends in the REIT sub-sectors in Singapore.

We conducted an exercise to track DPU growth for their most recent financial year at 24 REITS/BTs listed in Singapore and which substantially owned Singaporean assets vis-a-vis analysts’ DPU estimates for the next financial year (CY17/FY18E) using Bloomberg data. To have a fair representation set, we excluded those which were listed in this period and had just one comparable period and also those which owned assets substantially outside Singapore.

We found that of the 24 REITs/BTs that qualified, thirteen of them i.e. ~ 54% saw DPU being cut in their recent financial year end. That number improves to eleven REITS/BTs for the next forecast financial period. Even so, ~46% of them will see a cut in DPU. Further, ten of these REITS/BTs would have been seeing DPU declines in two successive years if forecasts were true.

In sum, a peaking of supply is an unreliable indicator of a reversal of the fortunes of any sector. Over-supply of the previous cycle must be absorbed first before prices begin to reverse direction and move higher again. We don’t have sufficient evidence of this in most sectors at REITs owning Singaporean assets in sectors such as Retail, Hospitality, Logistics and Office Property. Not yet. Supply absorption could take another year, perhaps two, before we sight equilibrium. Till such time, pricing trends may remain weak, if not worsen any further. We are reminded of the quote – “Torture the data and it will confess to anything” – Ronald Coase, Economics, Nobel Prize Laureate.

Appendix

Industrial Sector

Hospitality Sector

Retail Sector

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.