Edible oils are a relatively small but important part of human diet. They are a source of dietary fats that play an essential role in the body, satisfying nutritional needs, and are necessary for the proper functioning of the brain, the nervous system as well as the endocrine system.

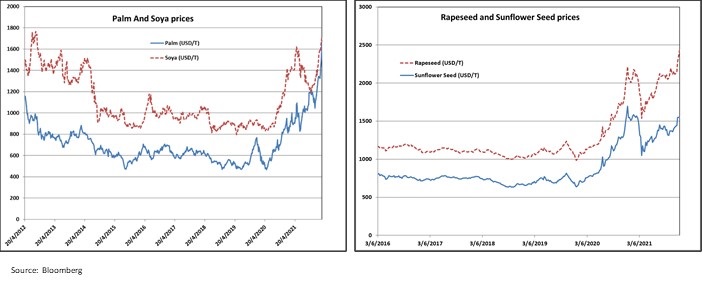

This essential commodity has seen some extraordinary price moves that have the potential to cause more human misery than the spike in the price of crude oil.

The demand for vegetable edible oil has multiple drivers. In lower income countries, it goes up with increasing wealth as diets become more fat-intensive as households become richer. A second source of demand is the replacement of oil from animal fat with vegetable edible oil as the latter is healthier. A third driver is the increasing usage of vegetables oils in cosmetics. Finally, the latest significant demand source is its increasing usage in making biodiesel to replace fossil fuel. This has meant a 4-5% annual growth in vegetable edible oil demand over the longer term. This growth rate in demand is expected to continue in the foreseeable future as we expect these drivers to remain intact.

As these demand trends have remained steady and relentless, they are not the source of shock. The real long- and short-term problems are showing up on the supply side. We will describe this in more detail later. However, we must note that the net impact has been a parabolic increase in prices across edible oils.

The Edible Oil Market

Four oils make up the bulk of the market

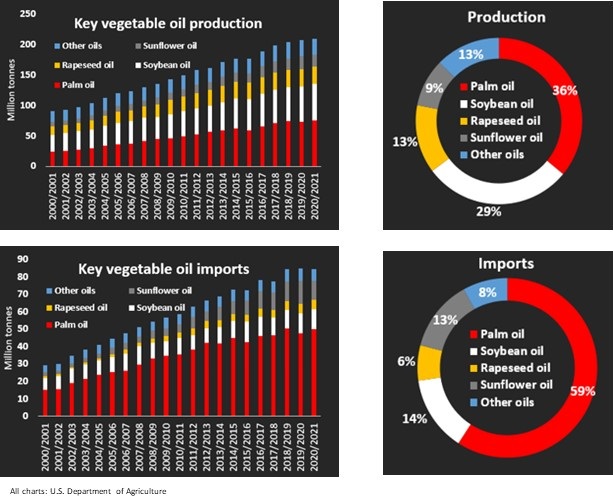

The edible oil market has grown from about 95 mln. tons in 2001 to about 220 mln. tons in 2021 – a growth of 4.3% p.a. over the past 20 years.

87% of the global edible oil production consists of Palm (36%), Soybean (29%), Rapeseed (13%) and Sunflower (9%). The rest is smaller oils like Coconut Oil, Peanut Oil, Cotton Oil, Olive oil, etc. The four oils are a narrow set of options for consumers and, as we show later, each of these is primarily produced in only a handful of countries, a situation set up to be highly vulnerable to supply shocks.

The international trade in these seeds is even more concentrated with Palm being nearly 59% of cross border trade. The four edible oils make up 92% of cross border trade in edible oils. This is important as the cross-border volume determines the global prices.

High concentration of supplier countries

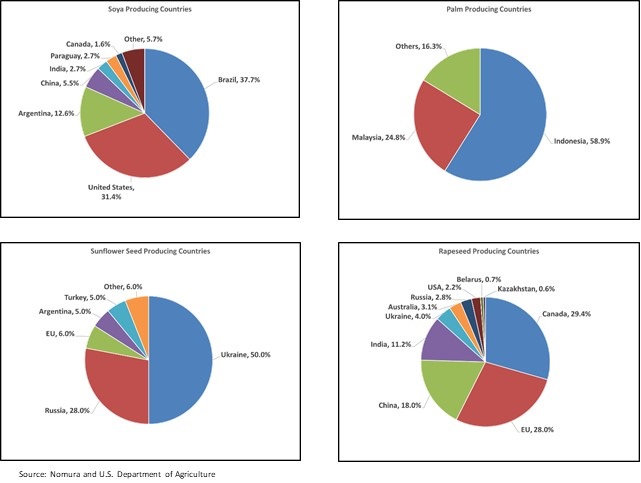

Each of these major seeds is quite concentrated in terms of the supplying countries. For Palm, the top two countries (Indonesia and Malaysia) produce 84% of total production; for Soya, the top three (Brazil, the U.S. and Argentina) make 82%; for Sunflower, the top two (Ukraine and Russia) make 78%; and for Rapeseed, the top four (Canada, the EU, China and India) make 87%. This high level of concentration creates vulnerabilities. In the last two years, medium term disruptions have happened in 3-4 large regions leading to a seemingly small but crucial supply shock that, in turn, has led to the price rise shown earlier.

The Reasons For The Supply Shock

The Structural Reasons

All structural reasons are directly or indirectly related to climate-related issues. They all come under the broad term “greenflation”.

The first is a direct cause related to climate change. There have been changes in weather patterns which have created disruption in output. This is happening on a regular enough basis for it to be now classified as structural rather than being temporary or one off. This is occurring across crops and geographies.

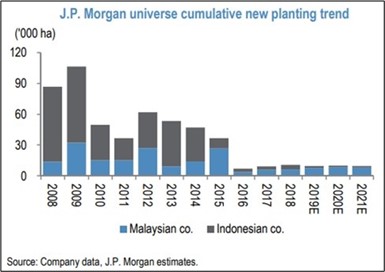

The second is cost inflation and under investment in capacity growth because of an understandable higher focus on complying with Environmental and Social issues (part of the ESG troika). For example, Indonesia had a history of increasing palm acreage by burning virgin forest and displacing existing population (sometimes by force). This became a big issue and, over the last ten years, things have slowly changed. Pressure from investors, users and governments have led to a new certification and supervision regime which has broadly made increasing acreage very difficult. Hence, the growth in acreage under palm cultivation in Indonesia and Malaysia has sharply decelerated in the past 5-6 years (as seen in the chart alongside). Also, as labour rights have come more into focus, labour costs have gone up.

These steps are good for the longer term, both at the societal level and at the company level, as these companies are forced to increase land productivity. However, in the short term, it creates supply inelasticity.

The third reason is an increasing trend of focusing on national food security by the producing nations. Brazil is currently setting minimum local sales targets for its Soya exporters. Indonesia is an important player on this front. It legislated a biodiesel blending mandate five years ago and funded this by taxing the supernormal profits of the palm exporters. The blending ratio has moved slowly from 10% to 30%, creating a strong local demand growth for Palm. It also has a minimum domestic sales target (at a lower mandated price) for the exporters. The net impact of this has been that though Indonesia’s Palm production has grown by over 33% in the last six years, its exports have grown by only about 13%.

The Short/ Medium-Term Reasons

Labour shortage: These consist of COVID-19-related issues in terms of supply chain bottlenecks. Initially it was transportation bottlenecks, but they are being gradually solved. The bigger bottleneck is labour. COVID-19 just exposed how tenuous the labour demand-supply equilibrium was in these industries. This issue is accentuated by the fact that some of the countries depend on large volumes of foreign labour. Malaysia is an example. Its palm sector employs over 450,000 people but, of this, over 350,000 (78%) are foreign workers from countries like Indonesia, India and Bangladesh. With better opportunities elsewhere and COVID-19-related issues, this supply is drying up. Even before COVID-19, Malaysia had a labour shortage in the palm sector of about 50,000 workers. This got amplified during COVID-19. Consequently, even though Malaysia’s acreage under palm cultivation has slowly grown in the past ten years, the total output is flat.

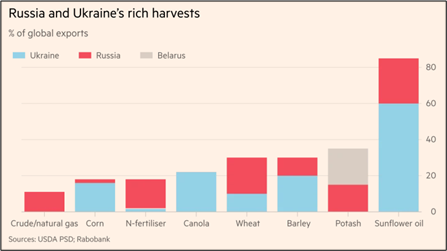

Geopolitics: This has been harshly shown up during the current Ukraine-Russia conflict. These countries dominate the sunflower seed supply and, with Belarus, have a sizable presence in the rapeseed production chain too. Also, their large presence in potash has pushed up the cost of fertilizers and hence that of the end agriproduct too. The broader interconnectivity between edible oil and grains remains. They compete in terms of what the farmers can plant. For instance, in the U.S. Soya supply is not ramping up fast enough as the incremental land is competing with corn (the prices of which have also gone up substantially). Ukraine and Russia are also large in the some of the grain export markets. The chart alongside shows the direct presence of Russia in various agri commodities, potash and energy. Even energy is connected to the agri commodity market through the biodiesel connect.

Conclusion

The price inflation in edible oils (and agri commodities overall) has short-term and long-term drivers. Even though some of the short-term reasons might fade away, the long-term structural reasons are more difficult to solve. Hence, most commodity prices will now create a new and higher trading range, even for the long term. The stocks do not fully reflect that yet. Even though the forward markets have moved up, the estimates for 2022 and beyond will need to move further up. This will create supernormal earnings and cashflow for the companies that are in the upstream agri space. Also, what is unique is there are not too many companies which directly own upstream edible oil assets except for the palm plantation stocks in Malaysia and Indonesia. We have some exposure in this space. Also, input costs will become an increasing problem for user industries in the packaged food and cosmetics space. Companies with strong market positions will slowly be able pass through some of this, but margin squeeze will be a constant refrain for the next few years. We are keeping these trends in mind while constructing our portfolio.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.