China is slowing down. Everyone knows that and everyone is worried about that. Our recent trip to China gave us enough of evidence about that. But very often when we talk about “China slowing down” we mean the manufacturing part of China – what economists classify as the “secondary industry”. This is manufacturing related to exports, commodities, heavy and light goods, consumer goods, electricity production, etc. – but all manufacturing.

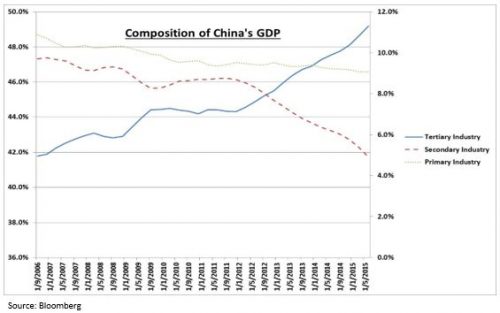

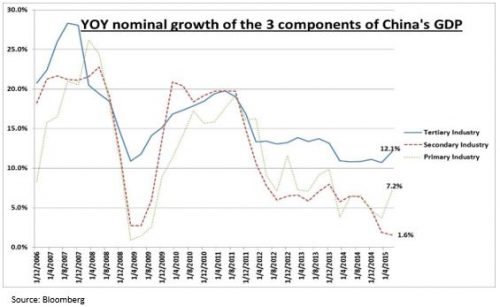

On the other hand another China has been steadily growing and has become half of the Chinese nominal GDP in Q2 2015. This is the services part of China – what economists refer to as the “tertiary industries”. This includes healthcare, education, logistics, tourism, entertainment, financial services, transportation, e-commerce, retail, etc. This, as a whole, is still showing a healthy nominal growth of over 12%. And it has now become 50% of GDP from about 44% three years ago. These figures are remarkable in terms of both the sharp increase in share and the steadiness of growth through the so-called China slowdown. In Q2 2015, therefore, tertiary industries contributed to 6% of the 7% nominal growth in the Chinese GDP. This is a full 82%. The other take away from this is that the secondary industry component of GDP is already at 1.6% growth (this includes a huge price deflation in the past one year); for it to contribute less, it will have to go into negative territory.

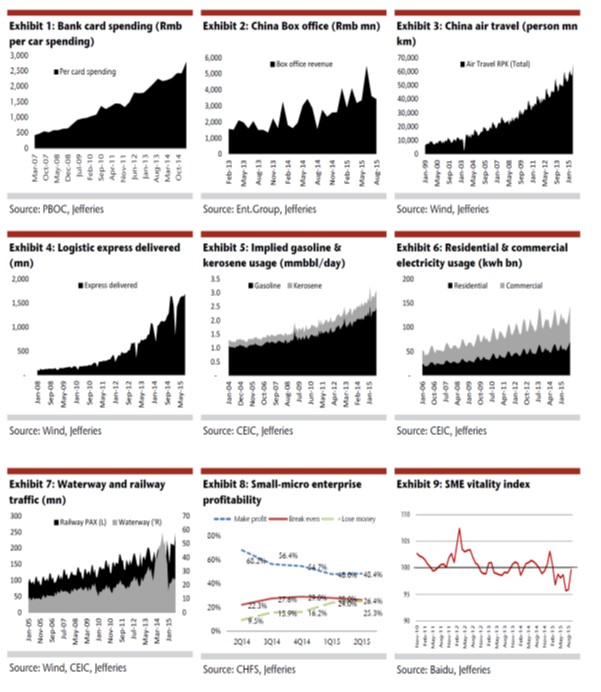

To give some of examples of growth in the tertiary industry and also to prove that the non-industrial demand remains steady we have attached a few charts below from a recent Jefferies report.

Conclusion

Yes we agree that China has problems of high leverage, reducing capital productivity, oversupply in the manufacturing sector, etc. But remember that it is still only a USD 7,000 per capita GDP. Hence it has the ability to grow out of it. Half of China’s GDP (which by itself is three times India’s size) is doing just fine.

Our aim is to continue to find local and global companies that benefit from this.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.