The Angels of Today

In these times of extreme love for certain kinds of businesses, it would be quite appropriate to recall the stories of past fallen angels. History is replete with stories of so-called “built to last” companies which were swept up in the hysteria for a group of companies or businesses, but created a lot of angst as investors over time realised that they are not exactly built to last.

The current times clearly reflect an extreme form of love for some of the large tech companies of the world: Apple, Google, Amazon, Facebook, Tencent, Alibaba, etc. This passionate love affair stretches across geographies and also across market capitalisation. For sure, some of these companies are built to last, but not necessarily all. Also, questions remain on share price performance in the medium term even if the companies continue to show solid financial performance. As they say, there is a difference between a good stock and a good company.

We define “fallen angels” as companies which have gone through a period of being well-loved and whose long term business sustenance was not under question. These are the kind of stocks one would erroneously include in the list of “stocks to buy-and-forget for your kids”. These are companies which have subsequently had a permanent loss in the value of the business. Hence the term “fallen angels”.

Why do Angels Fall?

The cause for this permanent drop in value can be roughly categorised under four headings:

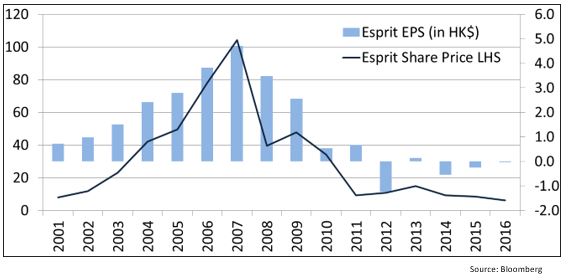

- Companies with ‘faddish” products with finite life cycles: These are normally consumer brands where the product fails to continually evolve and loses its uniqueness value. Examples of such companies are: Esprit, Billabong, Crocs, Belle, etc. Here, the typical story starts with a small well-run company that has a “cool” product and an entrepreneurial management. The product is well liked and the company starts to expand geographically. The honeymoon period then begins and could last 5-7 years before the business starts to collapse under its own weight. The product becomes jaded, the company’s high profitability creates a barrier to “creative destruction”, management becomes complacent and the stock becomes expensive. After that it is all downhill as the initial growth hiccups are mistakenly considered to be temporary. Then the company morphs from a growth to a value stock. Some companies stabilise at this level, but many turn out to be value traps. The negative narrative moves from “slower growth” to “negative growth”. And then they are forgotten by the markets. We show here the deterioration in one such company (Esprit) in terms of both earnings and stock price.

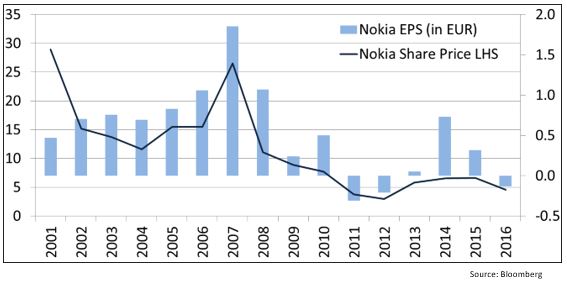

- Companies with product obsolescence and generational change: These tend to be mostly in the tech and consumer electronics space. The examples here include: Nokia, Blackberry, Nortel, GoPro, Kodak, etc. Here the consumer suddenly has an alternative product with better features or the product features are captured by some other more versatile product. The existing company is unable or unwilling to make this change and gets left behind. Here, we use the example of Nokia – one of the biggest fallen angles of our times.

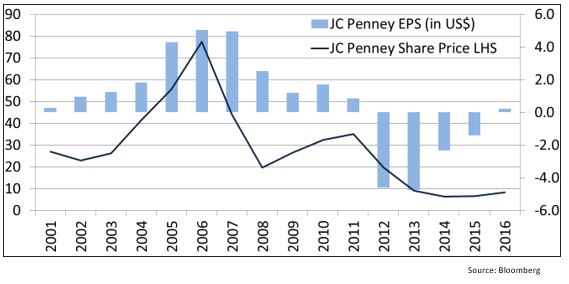

- Companies where there is a structural change in the business environment and their product is not required: The oft-quoted example of this is the best typewriter manufacturer in a world which is moving towards computers. History is replete with such examples. In the current environment, these are potentially all businesses being arbitraged out by technology-intensive competitors with much higher value propositions. The “Amazonization” of multiple sectors like department stores, food services, bookshops, music distribution, food retailing, travel, etc. is a growing list. Old fashioned entertainment and advertising companies are being structurally weakened by the Googles and the Facebooks of the world. Some examples of companies in this space are: JC Penney, Circuit City, Tower Records, Courts (in Singapore), Media Prima (in Malaysia), TVB (in HK), etc. Here, we illustrate the example of JC Penney.

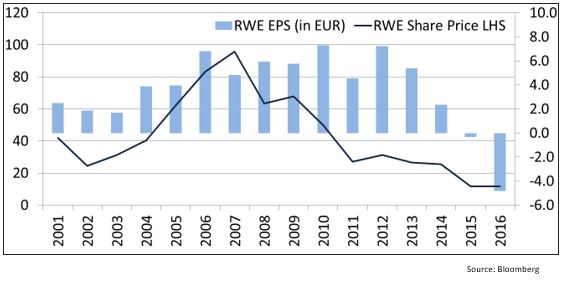

- Companies which are hit by adverse regulatory changes: These tend to be in the utility space, where a long term steady business is suddenly shaken up because of a directional change in the regulatory outlook. Prime examples here are the thermal power generators in Europe (and the rest of the world) who were hit by a slew of policies which favour renewable energy. Though some of these utilities morph into companies with a large renewable capacity, they are never the same in terms of profitability. Also, power distributors are increasingly being threatened by the concept of distributed power generation (i.e. roof-top solar capacities). These could lead to a permanent loss of value for the companies. The example we give here is of RWE, a German power utility.

Ways in which our current angels could trip, if not fall

The point we are making here is that some of the most solid companies can become fallen angels. The current angels (who, as of now look invincible) can be threatened in various ways:

- Anti-monopolistic measures. Google and Facebook capture over 75% of the internet advertising traffic. Amazon by itself has over 3% of total retail sales and about 21% of total online sales (in the US). More importantly Amazon represents over 20% of US retail sales growth. Though Amazon does not use this powerful position to get monopolistic profits (in fact it is systematically cutting away the profitability of business after business), what stops it from becoming the new version of the “vampire squid” of the coming decades? Remember the last time this term was used was for Goldman Sachs post the 2008 crisis as the epitome of the big bad bank? And we all know what has happened to the financial sector in terms of regulatory burden since 2008.

- Hit on employment leading to increased socio-political risk. The deep pockets of these companies are wiping out large swathes of small businesses (which tend to be a large source of base level employment). In 2017, Amazon is expected to increase the number of robots it employs from 45,000 to 120,000. These are robots doing typical labour-intensive tasks like sorting, stacking and transportation in a warehouse. This is happening in a year where overall retail sector employment in the US is expected to grow by only 24,000 jobs. This is great for Amazon and its shareholders but creates a huge gap in terms of lower level employment generation. Once we go down this chain of thought, add the topic of AI, robotics, income disparity, etc. and it is very easy to imagine social and political issues overwhelming the Amazon story.

- Sudden change in business design. Remember, Facebook is finally just a company which earns the bulk of its money through advertisement and is in the business of providing social connectivity to a gigantic network of people, companies and other such entities. It gives us a service today which we did not even know we needed about fifteen years ago. Hence the ability to predict the longevity of this service that Facebook provides has to be questioned. Will other players be able to do the same, will the industry turn in a totally different direction which Facebook, because of its gigantic size, will not able to take? Similarly, will the shopping malls of today be able to make a comeback with a much lower cost structure? The online shopping experience is still a frustrating and incomplete experience. How often have we bought clothes and shoes online and been disappointed by what was delivered? Why did Amazon buy Whole Foods, a bricks and mortar retailer, if brick and mortar assets were going out of fashion?

These are all the unknowns our current “Angels” have to deal with. They do make a strong case of dealing with these unknowns and coming out stronger. But there is a finite chance that some of them could turn into the “fallen angels” we have seen in the past. This is the thought we would like to leave you with.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.