The race to vaccinate substantial parts of their populations is well and truly on among countries in Asia. Country after country has announced large deals to acquire vaccines over the coming months and expressed a strong desire to provide jabs to cover substantial parts of their population and achieve herd immunity at the earliest. Amidst this, there are a few countries which have their hands fuller than others. They are busy trying to tame their ‘second wave’ of the pandemic as the vaccines arrive on their shores. It is a race which has no real winner but in which everybody hopes to be a worthy and early finisher. The consolation prize, the ‘Finisher’s Shirt’, would be good enough for now, just to get their economies back on the rails.

What is keeping money managers like us busy these days is not picking the winner of this race. It is more about picking the winners among companies in these countries which may come through, perhaps even stronger, out of the pandemic. It is also about finding bargains at a time when uncertainty about ‘third waves’ remains, when vaccine supplies are ramping but not fast enough yet and finally with the piquant problem of certain populations and sections of people in some countries resisting taking their jabs altogether. It is not surprising then that the stock markets in Asia are diffident and treading water.

Currently, the country that offers some of the best recovery and growth-thereafter plays to us is Indonesia. Indonesia has been serially under-achieving Emerging Markets, growing below potential for many years now, frustrating investors and observers. Its stock market has not gone far for five years now, through a period where its currency has bucked around like Bronco Billy. Any screen run at any time in this period on the country’s stocks would have thrown up a plethora of deeply under-valued companies. Sadly, much of that under-valuation has remained in place and arguably gotten worse through the pandemic. Its stock market has lacked the depth in retail investor flows and support that other markets, like India and Thailand, possess in abundance. This makes stock-picking a thankless and frustrating task. The good news is that some of that is changing, at the least on the retail participation front, where local Indonesians have been quick to embrace online brokers and begun to participate in the stock market in droves in the past two years.

But before we get into the nitty-gritties of picking stocks, it is worth looking at where Indonesia is in relation to its own targets to vaccinate itself out of the pandemic. Therein lies the answer to how quickly its corporate earnings will bounce back to normalcy and begin to grow again.

Setback To Reopening And Recovery

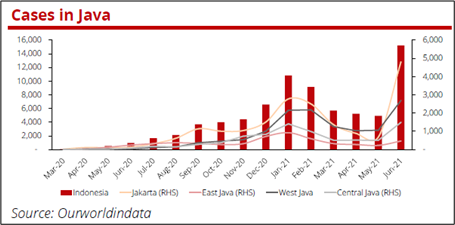

The onset of the second wave of the pandemic post the Lebaran holidays in May has meant that authorities have had to bring back lockdowns in different parts of Indonesia. The government has again tightened restrictions on activities under the ‘PPKM Emergency’ regulation for the Java-Bali area in the 3-20 July period. Three most notable differences from the previous regulation are 1) 100%/50% WFH for non-essential/essential sectors (previously 50-75%/100% WFO); 2) shopping malls are now closed; and 3) no dine-in allowed for restaurants. There is also stricter enforcement with the closing of several main roads, which has helped to improve overall traffic conditions in Jakarta as compared to the past few weeks.

At the beginning of the year, the government and consensus expected a 5% GDP growth in 2021 with reopening to happen in the second half of the year. Now that is being revised down towards the 4% mark, and corporate earnings are being pared back to factor in the impact. Individual stocks have backed up since the March 2021 highs, yet the market as a whole has been remarkably resilient and trended sideways since.

Daily Cases Rise But The Government Has Acted Quickly

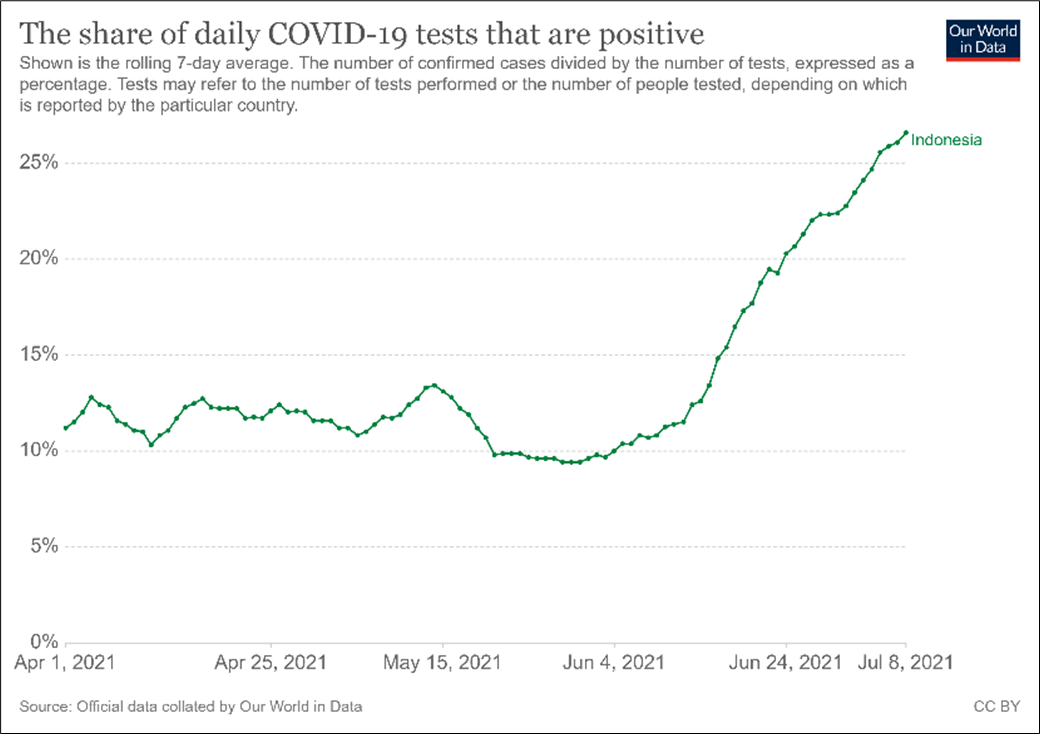

Indonesia’s daily COVID-19 case numbers continued to increase significantly in the past two weeks, reaching ~ 34,000 cases (all-time high) as of 7th July. This meant that active cases now reached 343,000, or double that of two weeks ago. While the number of daily tests (PCR + antigen) have been accelerating and reached an average of 110,000 tests in the past seven days (two weeks ago it was 71,000), the positivity rate has steadily increased to ~26% (two weeks ago was 19%).

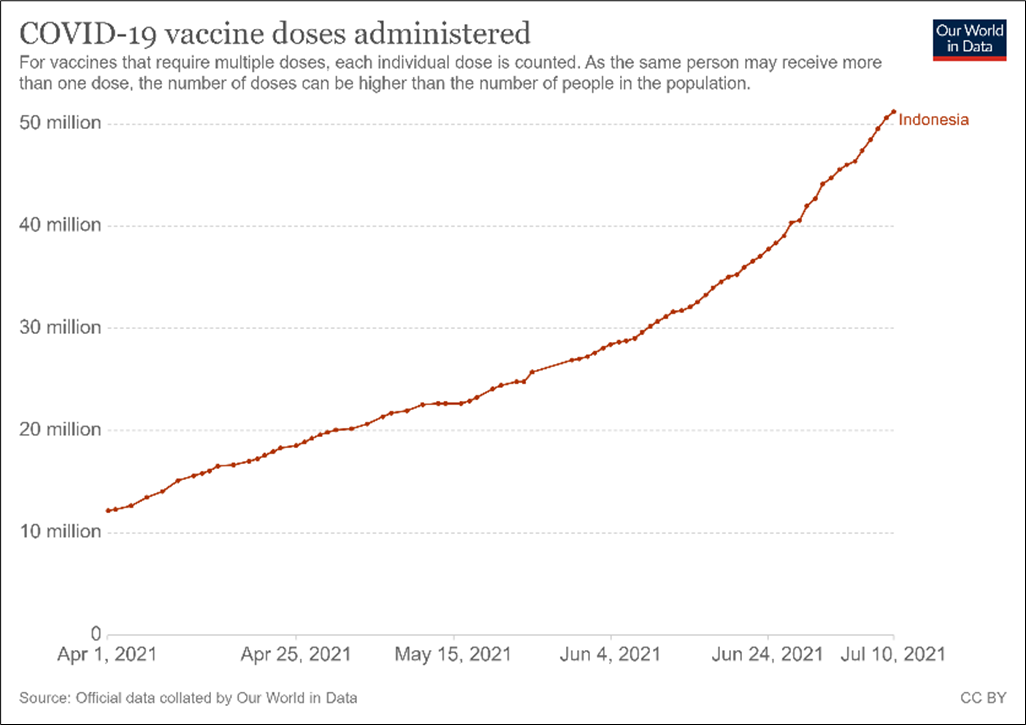

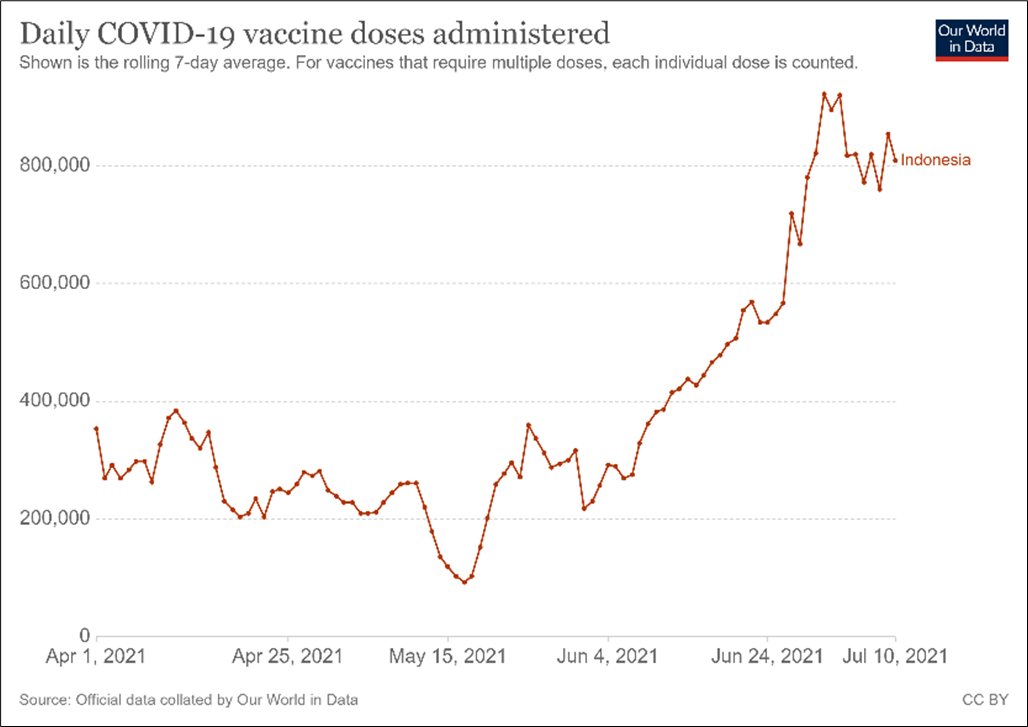

On a more positive note, the latest vaccination statistics show that ~24% of its 200mn targeted population have taken the first dose, and the daily vaccination rate is just shy of the government’s target of 1mn, up from less than 400,000 in mid-June. In the future, the government intends to increase the number of daily vaccinations to 2mn by next month and reach 3mn by 4Q21 to reach 100% of the targeted population (c.200mn out of 270mn) vaccinated.

Where Indonesia has scored well is on its vaccine procurement strategy. The Ministry of Health has been using a strategy to diversify the vaccine suppliers and schedule the arrivals of the vaccines. This is expected to minimize the risk of vaccine supply hiccups for the public. Another strategy has been to produce the vaccines domestically. The government has been configuring the production facilities of Bio Farma, an Indonesian pharmaceutical SOE, to be able to produce the Sinovac vaccine under a licensing arrangement. Private sector corporates, under the coordination of association, Kadin, have proposed to the government their willingness to procure and administer vaccines for their employees, which has been agreed by the government so long as the vaccines are supplied free-of-cost.

Well-Directed Supportive Government Actions

The government, on its part, has taken a few key measures which it is hoped will catalyse a recovery in demand once confidence returns post the vaccination drive.

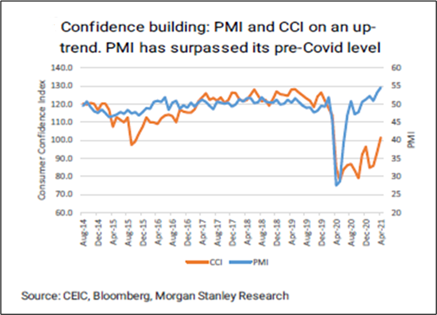

The PMI continues to improve, up 3.3pt YTD to 54.6 at Apr-21, in tandem with the consumer confidence index (CCI) rising to 101.5 at the same time, up from the recent low of 84.9 in Jan-21.

We think the confidence of corporates and the public is an important driver of the pace of economic recovery, following the fiscal and monetary stimuli that have been provided by the government and central bank since 2020.

Low Banking System LDRs: Post the stimuli, the bottleneck for the recovery appears to lie in the level of public confidence. The stockpiling of idle funds in the banking system is reflected in the system LDR falling to 81% in April 2021 from 94% in December 2019. A lack of public confidence could lead to-

- Low public spending with the public preferring to keep their money in bank accounts; and

- Low credit demand with businesses having little interest in borrowing either for investment or working capital.

Temporary tax cuts on autos: The Ministry of Finance has previously relaxed taxes for autos- temporary discount on luxury tax. This was expected to spur Indonesians to buy more cars and automobiles, which could boost consumer credit and offer job support to this large industry segment.

Temporary VAT cut on houses and apartments: The government lowered VAT on purchases of new houses and apartments (from currently 10%) to 0% for properties priced below Rp2 bn and to 5% for properties priced between Rp2 bn and Rp5 bn. The tax break is applicable for six months starting from 1 March to 31 August 2021. The property has to be physically handed over during the tax incentive period, hence it is only applicable for those that are already built or going to be completed in the next six months. The tax break is provided for maximum one purchase per person and the property cannot be sold in the next twelve months.

PKH, a key support often under-appreciated: While many programs around the world struggled to deploy emergency aid to the right beneficiaries, Indonesia’s main G2P (government-to-persons) programs were uniquely positioned to respond swiftly. In April 2020, the government announced it was directing an additional IDR 110 trillion (over US$7 billion) towards social safety net programming, and the Ministry of Social Affairs (MoSA) announced that the conditional cash transfer, Program Keluarga Harapan (PKH), would disburse an additional IDR 8.3 trillion (about US$558 million) and make the following changes:

- Increase annual disbursement by 25% per beneficiary,

- Shift the disbursement frequency from quarterly to monthly disbursements, and

- Expand the program from 9.2 million to 10 million beneficiaries.

MoSA was prepared to shift PKH’s disbursement cadence, payment amount and scale in the span of a month in large part because PKH beneficiaries were already receiving G2P payments directly to their bank accounts.

Lifting The ‘Wet Blanket’

The second wave has been a ‘wet blanket’ on what was looking like an incipient recovery germinating in the first quarter of the year. Clearly, since June, things have pulled back and it appears that the third quarter may well be a sub-par one. Past experiences of new cases eventually flattening and being ‘tamed’ in other countries like India, the U.K., Singapore and even lately China’s Guangdong province shows that Indonesia too is expected to see a plateauing somewhere by the end of July. Combined with the rapid rise in vaccination numbers, this could potentially mean that the authorities might begin to ease back on the lockdown measures as we have seen elsewhere. This sequence of actions has made an impact on the behaviour of the stock markets elsewhere.

Recent history of this sequence of events in the developed countries and in Singapore indicate that the market bottoms ahead or around the peaking of cases and begins to rally as investors’ confidence returns and the re-opening trade comes into play.

What Could Drive The Next Consumption Revival?

Our readings throw up some interesting findings about Indonesia. Firstly, the three main income drivers for the low and middle class (which are the main drivers for consumption growth in Indonesia) are:

- Yearly minimum wage increase,

- Key commodity prices (coconut, CPO, rubber, cocoa, coffee and coal) and

- Government subsidies (conditional cash transfer or PKH and food subsidies or BPNT).

In order to understand what drives consumption in Indonesia, we first look at the source of income for the population. About 40% of Indonesians (those working in manufacturing and wholesale/retail trade, restaurants and hotels) are directly impacted by changes to the minimum wage, while an additional ~30% are farmers. Hence, the yearly increase in minimum wage and movement in agricultural prices are the most important factors that impact the income and hence the spending behaviour of these consumers. Another important factor is government’s subsidies, of which the PKH (conditional cash transfer) is the most crucial one. The government, which had been increasing allocations through the past decade, is now relooking at using these funds more efficiently and directing them at targeted areas and income groups in the economy with the objective of poverty alleviation and indirectly hoping this money would spur consumption of basic goods and services.

Further, agriculture, forestry and fishing contribute ~ 14% of GDP while mining adds another 6.5% of GDP adding up to ~ 20% or a fifth of the GDP directly impacted by commodity prices. When you juxtapose that a third of the population works in these sectors, the impact in the economy from these sectors is indeed substantial when the going is not good, as has been the case in the past few years.

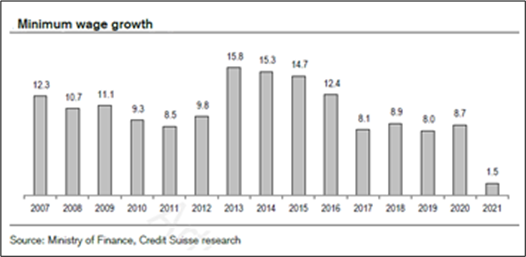

The factors that explain the low growth over the past few years are connected to the above: lower nominal wage growth (see chart), lower farmers’ income (from lower soft commodity prices and/or lower produce), weak mineral prices leading to lower mining incomes and profitability. This was further exacerbated by cost pressure from fuel prices and electricity tariff hikes. Minimum wage increase since 2017 was significantly lower than that in the previous years and has stayed weak, while electricity prices for ~19mn households (users of 900 VA power limit) were hiked by ~120% post the removal of electricity subsidies.

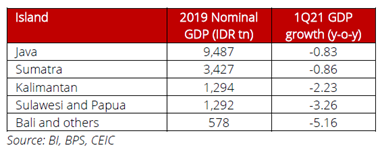

The Importance Of Jakarta And Java

Another point to note is that Java and Bali account for 62% of Indonesia’s GDP. The largest urban centres of Jakarta, Surabaya, Bandung and Yogyakarta are all on the island of Java and contribute in large measure to the economy and hence any impact to them through the pandemic has had a disproportionate overall impact on economic activity in the country. Bali, in particular, will be heavily affected since it relies on both domestic and overseas tourism.

It stands to reason that when the lockdown measures ease, the recovery will be just as sharp, as the regions most impacted are also the largest drivers of GDP and growth in the economy.

The Commodity Cycle Has Turned

The biggest and least highlighted factor about Indonesia’s potential recovery is the big turnaround in the prices of agricultural and hard commodities. Indonesia is the largest producer of palm kernel, palm oil, copra, and the second largest producer of natural rubber, a top five producer of coffee, coal and nickel, among other commodities. The fact that all these commodities have seen a massive boom in prices in 2020-21 will have a big positive impact on the economy once the drag from the pandemic induced slowdown recedes in 2022.

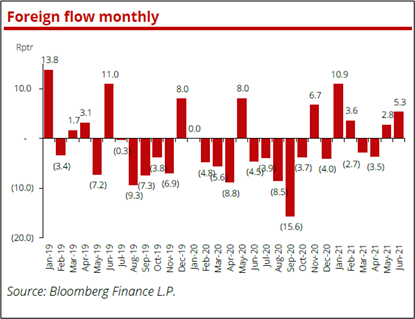

It would not be hard to imagine that the recent stability in the Rupiah is attributable to this, in spite of the recurrent selling by foreign investors in the stock market through the year.

The Stars Are Aligning, Finally

We believe that the stars are finally aligning for Indonesian stocks to make a strong comeback, most likely sometime in the next few months as the country begins to get control of the pandemic with new cases beginning to drop away and vaccination pace and numbers rising sharply on the other hand. As far as earnings are concerned, there are several companies which will pull through 2021 with minimal damage and could well be set-up to grow strongly into 2022.

There has been some technical overhang arising from the reconstitution of the benchmark JCI Index moving to a market-cap weighted formula. This has been well-flagged and we believe the impact of it is already being seen in the behaviour of stocks that could likely lose out. Also, the inclusion of some of the digital banking stocks and tech IPOs lined up in the months ahead will give a more technological flavour to the index, which has so far lacked any such exposure.

So, going back to the race for the consolation prizes, it does appear that Indonesia is clocking stronger times, running harder and building a head of steam here, that could culminate in its stock market having a strong run sooner than later.

As we conclude this piece, the voice of Glenn Frey, the founding member of the evergreen band the Eagles, wafts through my living room. It could not be playing at a more apt time to describe the race for the vaccine in ASEAN…

The heat is on, on the street

Inside your head, on every beat

And the beat’s so loud, deep inside

The pressure’s high, just to stay alive

‘Cause the heat is on

Appendix: India’s Market Bottoming v/s New Cases. Will Indonesia Follow The Same Path?

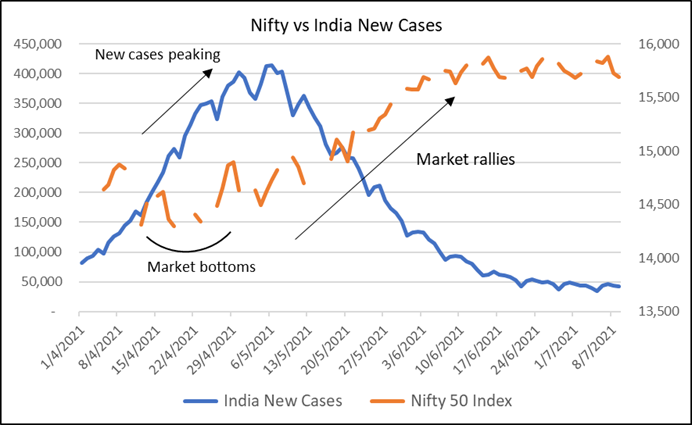

We alluded earlier to how other countries’ stock markets have followed a pattern of trading – bottoming just ahead of new COVID-19-cases peaking and topping off, and then rallying forth as the case count declines, vaccinations increase and lockdowns begin to ease off, and economic activity begins to normalise gently.

From the charts below we draw parallels with what transpired in India a few months ago.

In India, new cases peaked in the first week of May 2021. However, one can see that the Nifty 50 Index was bottoming in the last two weeks of April, even as the new case numbers were raging higher (chart on right). The index has since rallied strongly by over 10%.

Source: RVAM

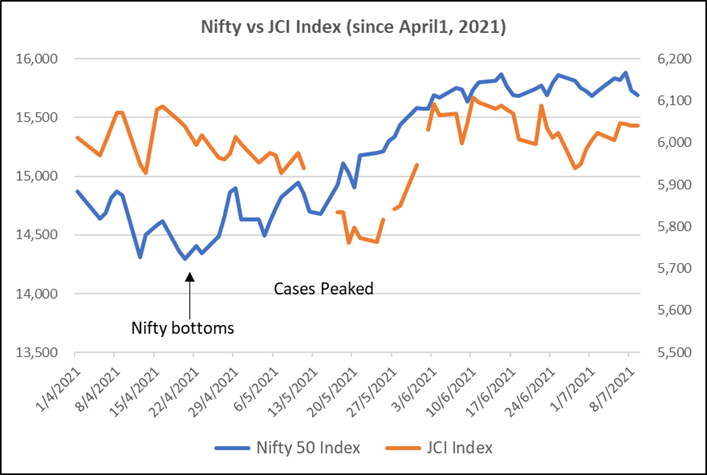

Source: RVAM

If one plots the path of the JCI now versus the Nifty, there is no bottoming pattern evident yet, but it is seen that the index is trading in a narrow range, which could eventually lead to a rally taking hold in this area, once the new case number is seen to be topping off (chart on the left).

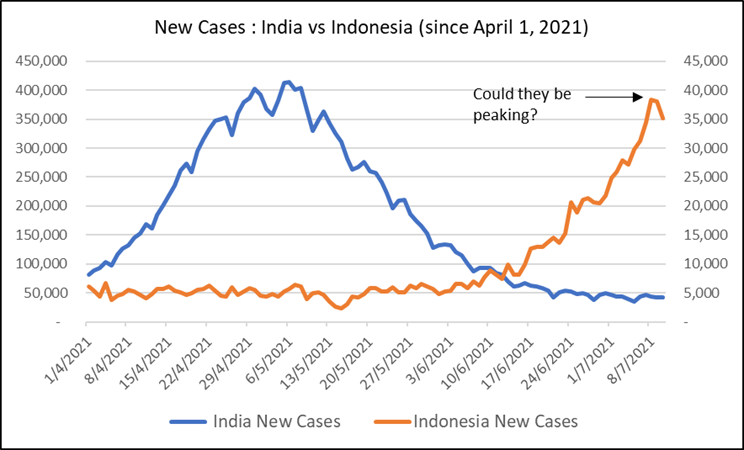

From the chart on the right, we can see a small rounding of new cases in Indonesia over the past week. We need evidence of a few more days to believe that the new cases have indeed topped off. When seen together with the rapidly rising rates of vaccination, there is room to be optimistic that once the market senses that we may be past the peak, it could begin to gather strength, all else being equal. Indonesia’s JCI Index and its constituents bear close monitoring over the next few weeks, for potential cues of a bottoming of the market.

Source: RVAM

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.