It might seem a bit out of place to be writing about commodities as the subject of our monthly newsletter on the eve of what could be a significant turning point in the monetary policy in the United States. Yes, commodities have been the most abhorred trade now for five or more years in general. For several good reasons. One of which, the strengthening of the U.S. Dollar, happened to catalyse the price destruction along the way, substantially as a consequence of divergent monetary policies by Central Banks across the oceans of the world.

The U.S. Dollar itself has become the consensus ‘long’ trade for more than a year now. In an antipodal manner, commodities (including gold, crude oil and almost everything we consume) have become the most crowded ‘short’ trade along with possibly Global Emerging Markets in close attendance.

Today, there is not a whimper from any source that this trend might change anytime soon, although some on Wall Street have been disingenuously warning that the U.S. Dollar’s strength has reached a potential ‘inflection’ point as they call it. They fail to point out the consequence of this on commodities though.

Commodity prices have been declining for several reasons, mostly fundamental and well documented, driven by large imbalances of supply over demand. As inventories are being worked through and excess capacities closed down, this imbalance in some of them has begun to narrow. Soft commodities have a different dynamic where the weather and climate play an important role, in addition to mere demand-supply equations, making cycles shorter than hard commodities but nonetheless they too are influenced by currency fluctuations.

Since the vast majority of globally traded commodities are priced in U.S. Dollars, the direction of that currency’s movement has a bearing on the underlying commodities priced of that currency. Now, if the U.S. Federal Reserve were to indeed raise interest rates this month, the logical and well-held belief is that the U.S. Dollar will rise even further, pushing commodities down one more leg.

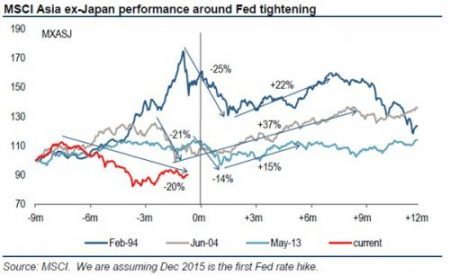

While this couldn’t be truer in theory, in practice we know that markets tend to surprise against such simplistic logic. The extent of the dollar’s strength as the U.S. Fed rate hike debate raged, warns us that the Dollar could have a period of weakness soon after the rate hike. History is not without precedent as this is exactly what happened in Feb-94 and May-13, although post the Jun-04 episode the dollar was flat for six months and rallied only thereafter. If historic actions hold true and we get a period of weakness in the U.S. Dollar, then this could lead to a sharp reversal of the huge edifice of U.S. net long positions.

It requires little to imagine what could then happen to commodity prices. This could unleash a violent counter-trend rally that a vast majority of investors of all ilks are simply ill-prepared for and certainly not positioned for. We dare say that when and if this were to occur, the force of this trade is likely to last longer and go farther than currently imagined.

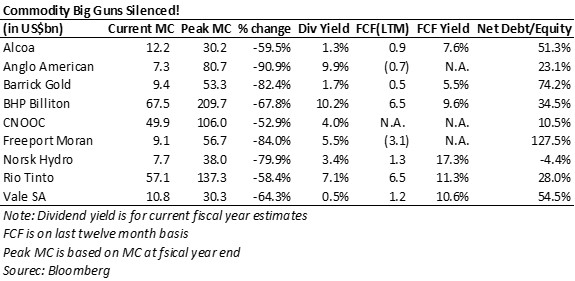

Companies in the commodities sector have seen their stock prices being ravaged and mauled beyond recognition. Often some of this has been a consequence of their own wrong-doings, over-investments at just the wrong end of the commodities curve, poor M&A actions, etc. However we note that many companies across the world have succeeded in preserving their balance sheets, continue to generate free cash flows even at current spot prices and own vast low-cost commodity assets where they have been continually cutting costs and becoming leaner and fitter. Should the demand-supply imbalance level out and turn or prices rebound owing to financial market factors, these companies will be laughing all the way to the bank. Their stock prices will soar and the people who view them with derision today will be singing a very different tune.

To see how far the commodity trade has extended, we would like to draw your attention to the table below (Commodity Big Guns Silenced!) which shows key metrics of some of the best names in commodities.

While screening for beaten- up commodity companies, we came across many an interesting case. We point out two here, both coincidentally coal miners mainly from Indonesia.

The first is an interesting mining conglomerate. A substantial part of its value emanates from a JV where it owns 46% in what is the third largest operational coal mine in Indonesia and which accounts for about one tenth of that country’s thermal coal production. The company also owns majority stakes in other coal mining companies, plus companies that conduct contract mining operations, stakes in a 660MW thermal coal power plant and an infrastructure construction business.

This company has seen its market cap erode from a peak of $2.74bn to its current value of $45mn! That is not a typo, we promise. In the same period its Enterprise Value has eroded from $2.87bn to $0.7bn today. Interestingly, even in the Sept 2015 quarter when coal prices were at their weakest, the coal mine in the JV generated an EBIDTA of $73mn in the weakest quarter yet. That is higher than the market capitalisation of the entire company. Clearly the market has sold off the stock without any consideration of the value of its underlying assets.

We have been tracking another coal miner in Indonesia, among the best run we know of, and whose market cap has been driven down to $545mn now, but which carries cash of $343mn on its balance sheet, giving it an EV of $202mn. Its EBIDTA in CY14 was $299mn while its EBIDTA for the 9m period ending Sept ’15 was $236mn. It has so far paid an interim dividend this year that implies a dividend yield of 11.3% and it could go on to pay a final dividend based on current profitability that implies a yield of 15.6%! This is when thermal coal prices are at their possible nadir! Incidentally the EV/EBIDTA for this stock works out to an illogically low 0.9x CY15E and its FCF yield is north of 30%.

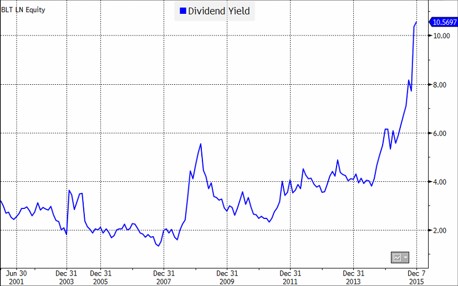

And how about BHP Billiton? It is on a dividend yield of 10% that is totally off the charts!

These examples simply illustrate how far prices have been driven down. Yes profits are declining, but companies are slashing costs like never before to generate profits and pay dividends and are preserving balance sheets yet.

In Summary

To sum up, there are three key reasons for tempering bearishness here:

- Commodity companies are now trading at multi-year lows on several parameters and yet many of them are generating sufficient cash flows to pay and possibly sustain fat dividends. Dividends and free cash flow generation could be vital fundamental supports from here.

- A medium term reversal of the U.S. Dollar strength could lead to several commodity prices shooting up without any fundamental change in the underlying demand-supply equilibrium. Stock prices could follow suit.

- Global Fund Managers’ positioning is heavily bearish on commodities as suggested by their record under-weight positions on their portfolios as per BAML research (see accompanying chart above).

The reward for being bearish on commodities from here incrementally could be meagre. In fact, we dare say that a meaningful trading opportunity to reverse that trade exists here and now. The market is poised for a key turn that could prove significant in more ways than one, heading into 2016.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.