This month is a continuation on the point we made last month. We said that the Chinese economy is a two speed economy. The tertiary sector (which is primarily services) is growing at a healthy clip of over 10% per annum whereas the secondary sector (primarily manufacturing) is hardly growing. More importantly the service sector has now become more than 50% of GDP.

This month we have picked up two important parts of the service economy in China and would like to highlight some details about them. The first is e-commerce which we elaborate by giving more details on Alibaba the largest e-commerce company in China. And the second is Chinese tourism.

Alibaba and Chinese e-commerce

We recently attended the Morgan Stanley Asia conference in Singapore and one of the speakers was Joseph Tsai, Executive Vice President of Alibaba. As we all know, Alibaba is the largest e-commerce operator in China.

Alibaba had the “Singles Day” sale in early November. This is a special day similar to the “Black Friday” sales day in the US. Some of the statistics that were put forth in relation to this “Singles Day” in terms of the business done by Alibaba are:

- USD 14 bln of merchandise was sold in that one day, a growth of over 60% compared to the previous year. This means about 0.3% of China’s annual consumption was done through one e-commerce company on one day.

- At the peak there were 86,000 payment transactions per second, compared to 34,000 per second on the same day in 2014.

- This will require 460 mln parcels to be delivered – which would be done over the next ten days.

- 70% of the transactions were over a mobile device. This meant 95 mln mobile transactions.

- Alibaba’s Mobile Tao Bao app (for its e-commerce mall Tao Bao) is the most popular app in China.

- 16,000 international brands sold on that day. One third of the consumers bought something from an international brand.

These are humongous numbers. Some more interesting facts mentioned by Alibaba are:

- Alibaba delivers at an average 30 mln parcels a day.

- 7 mln people are working for the last mile partners who do the actual delivery.

- A typical last mile delivery failure rate is about 4-5%. But Alibaba’s systems help to reduce that to less than 1%. But this still means about 300,000 wrong deliveries a day. Hence the number has scope to be exponentially reduced from here too.

- Currently Alibaba has 380 mln paying customers. Their aim is to have a billion customers by 2025. Of this, about 700 mln will be from China and the rest form outside China.

- Their largest markets outside China are the US, Russia and Spain. They have investments in market leaders in markets like India (Snapdeal) and South East Asia.

- The company will continue to be leveraged to China’s consumption story. The current Chinese per capita consumption is about USD 3,000; the same number for the US is USD 30,000.

- Chinese consumption is growing at 10% per annum.

- The Chinese gross household holding of financial assets is about US 8 trln; the net holding of financial assets is USD 4.4 trln (with most of the debt being mortgage-related). Hence the Chinese household balance sheet is very strong (unlike the corporate balance sheet).

- China has 120 cities with over 1 mln population compared to nine in the US. Also, China has one fourth the per capita retail space of the US. Hence China can just bypass the need to build a lot of retail space as most developed countries did, by using e-commerce.

All these points give a bottom up and top down view on the potential for e-commerce in China. This is where the new GDP and new employment is going to come from.

Chinese Tourism

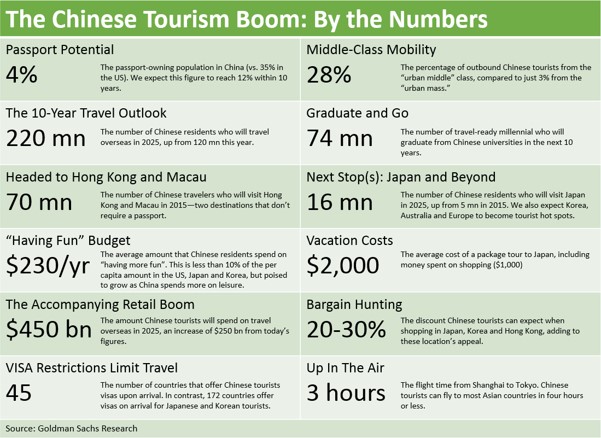

Chinese tourism has become the new strong source of demand, both domestic and international. Countries like Japan, Korea, Australia and Europe have benefitted from a big surge in Chinese tourists. Unlike 5-7 years ago when China discovered the power of owning a luxury brand to convey the message of “I have arrived”, now that same message is conveyed by showing off “experiences”. Holidays are part of this “experience” package.

Some of the tourism related points put out by a recent Goldman Sachs report are interesting:

Conclusion

We will remain focussed on the Chinese consumption/services space – it is a USD 5 trln economic entity (2.5 times India’s total GDP). We will also look for what the Chinese consumer wants to buy, especially in the services space.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.