The Chinese property market has been considered by much of the world as the “canary in the coal mine” as far as the Chinese economy is concerned. They have looked at the deteriorating property sales growth this year for the overall China market and have surmised that the “canary” is dying.

The dependence of the Chinese economy on this sector is high. Whether it is the direct contribution to economic activity – the loans from the financial system to this sector, the cash generated by local governments from land sales; or derived demand for products like cement, steel, consumer durables, etc., all are large enough numbers to have an impact on the overall economy. Importantly, the secondary impact of this on consumer confidence and cash flow, and the consequent impact on overall consumption, is also significant and therefore the primary source of worry for the market.

Hence we have attempted to examine the data coming out a bit more closely.

Our view has multiple points we want to highlight:

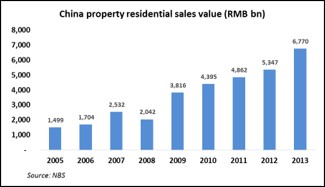

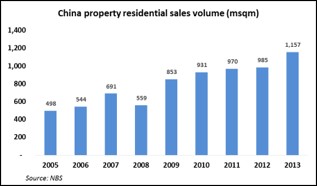

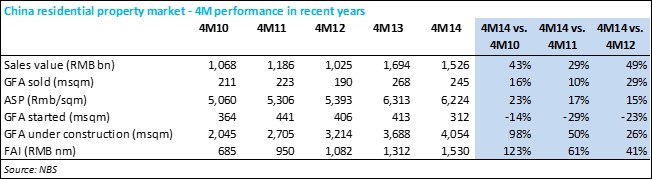

- Base effect is making sales look worse than they really are: The y-o-y slowdown of the first four months is more a base effect. China property sales had a very strong growth in 2013 which was unsustainable.

Hence the first four months nationwide sales slowdown is a bit misleading. The headline numbers for the first four months are a sales value drop of 10% and a sales volume drop of 9% over the 2013 numbers. However, growth over the first four months of 2012 is 49% in value and 29% in volume.

Already some of the May sales numbers coming from companies show a strong y-o-y growth.

- Annual property sales in China should be at a stable 1 bln sq mtrs: Annual residential property sales in China should be sustainable and flat at about 1 bln sq mtrs. If sales exceed this number dramatically in any year, they have to show negative growth in the following years. This 1 bln sq mtrs is enough to take care of replacement demand (replacing old government-owned apartments), increasing living space per capita and increasing urbanisation. We are assuming this can go on for the next 5-7 years.

Consequently this year’s sales could go back to about 1.05 bln sq mtrs.

- Fragmented market, hence listed players gaining market share: The industry is very fragmented and the listed space of property developers have only about 21% market share. Hence even in a negative growth year like 2014, they could show flat to growing sales.

Historically in years of poor demand growth the larger players (mostly the companies listed in Hong Kong) would gain market share. This would potentially lead to a more disciplined supply situation. Also, this means that the revenue growth for the listed companies could remain positive long after the market has peaked out. To prove this point – the sales growth of the listed players was up 6% in the first 4 months of 2014 (though the numbers vary a lot from company to company), even though the industry shrank by 10%.

- Mortgage rate and availability is the key lead indicator for demand: The Chinese government uses policies related to mortgage rates, mortgage availability and buying restrictions to keep the property market stable. With 70% of demand being from first time buyers, these policies matter a lot. Some of the policies which are unusually tight by global standards are:

- Down payment for second property is 70% compared to 30% for first property.

- Mortgage rates on the second property are about 10-20% higher than those on the first property.

- There are purchase restrictions based on residency rights of the city. Residents with residency rights can buy up to two properties. Residents of the city with no residency rights can buy only one property. Non-residents of the city cannot buy any properties in that city. Obviously these rules have leakages and people do find ways around them. But broadly they have suppressed demand.

We believe the government has leeway to unwind some of these rules if they want to stabilise the market; they have done so in the past.

Conclusion

Our broad point is that the property market in China is not as bad as it looks. This is especially true for the companies listed in Hong Kong which tend to be the larger and better run companies. Cash flow is tight but not disastrous. The interesting point is that the offshore bond market is more sanguine about this sector than the equity markets are. Hence though we own only bonds in this sector, the real opportunity could be in the equity space. Either way, we see value in this sector.

Also, the broad impact to the Chinese economy and other related sectors from this slowdown is more benign than assumed. The sky is not falling.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.