Habit: an acquired behaviour pattern regularly followed until it has become almost involuntary. It is also said that old habits die hard. In India we have several habits that are ages old and which seldom die. Handling and dealing with ‘black money’ is one of them.

In India, ‘black money’ refers to funds earned on the black market on which income and other taxes have not been paid. Everybody at some stage in their lives has had to deal with it, either being forced to receive it or paying some of it onward for goods received or services rendered. And Indians have been accustomed to doing this for decades now, with the practice now ingrained in business and culture seamlessly and invisibly. Accepting and giving black money is almost a way of life for scores of people and businesses, many of which are built, survive and thrive on its existence.

Now in one fell swoop, the Prime Minister of India Mr. Narendra Modi, on November 8, 2016 announced that he was going to make a break with the past. He declared his government’s order that from the following day notes of Rs. 500 and Rs. 1,000 would no longer be legal tender and that they would be replaced with new notes over the course of the next few months.

Black money purveyors have used these denominations as the prime notes in their mode of payment. Counterfeiting also thrived in these denominations for this reason. The Indian black money economy itself existed in almost every industry, small and large, rural and urban. It existed along with the regular economy leading it to be euphemistically called the ‘parallel economy’.

Back in 2014, an Indian Government study found that this black economy was nearly 75% of GDP. More recently Ambit Capital Research said that this number was closer to 20% of GDP, which still makes it larger than the GDPs of Thailand and Argentina. Whichever estimate is true, it is massive enough to have a very tangible impact on the real economy and on the lives of millions of Indians.

After Mr Modi’s announcement, everybody will immediately have to trade in their old Rs. 500 and Rs. 1,000 notes for new ones. Thus anybody with these notes will be unable to conduct any transactions unless they go through the banking system. This will render large sections of India’s vast manufacturing, trading and even some service sectors incapacitated from functioning without perforce transacting legally and having to pay their due taxes. Businesses will have to mend their ways in a dramatic fashion almost overnight, some of them even facing existential issues.

The second constituency that will feel the earth shake under their feet are the political classes and the bureaucracy. These, along with their unholy nexus with businesses, have been a huge breeding ground for black money. Elections have long been financed, fought and won with the power of black money. This is not bombast we assure you, but a distasteful truth in many parts of the country for many years now. This entire constituency will now become blunted and lame very soon. In future, elections will surely be fought very differently than they were in the past, giving them greater legitimacy and politicians the imperative to deliver on their promises. People too will have to get used to voting without inducements from wily politicians.

Finally, the underworld and terror organisations that lurk in the shadows, almost completely trading in the black economy for arms, services and to finance their operations, will now be disarmed without a shot being fired. Perhaps not permanently, but clearly their modus operandi will be severely impacted and impaired.

The common outcome for all three constituents – business, politicians and criminals – is that their existing trove of black money will overnight turn into the proverbial toilet paper unless they bring it into the banking system, which is tantamount to turning themselves in. This will not only bare their identities but also incur the wrath of the long arm of the law through penalties and even jail.

For the government and for the country, this single act will have a salubrious effect in ways we can only imagine in the economy, the lives of people and businesses. We list a few obvious ones here:

- Higher GDP growth as the black economy coalesces with the regular economy

- Higher tax collections from reporting of direct and indirect taxes in future

- Higher savings especially financial savings

- A huge increase in liquidity in the banking system

When you tie this with the introduction of GST in India from 2017 onwards and juxtapose the benefits of the replacement of currency notes, we realise that the double dose of this strong medicine will likely lead to a substantial eradication of the black economy in the next few years. This will be no small feat and the impact far reaching and substantive.

Clearly, the stock market will figure these things out sooner than later. In the short term, dislocations of demand and supply in pockets of the economy are inevitable and will impact several industries. It will also impact the smooth flow of money transactions. However all this is likely to be transient and the economy will adjust to the new paradigm quickly.

In the long term what India needed was a way to structurally lower the cost of capital. Given its complex fiscal system, deep-rooted inflationary pressures and socio-political compulsions, this was going to be a multi-year effort for any government with the will to act. These twin actions over time ought to be disinflationary, fiscally highly productive and contribute meaningfully towards achieving that goal. The benefits of that in the long term are obvious and bear no further elucidation.

Mr. Modi simply reaffirmed the faith (if any sceptics needed such reaffirmation) that India’s reform process is alive and kicking.

Size of Cash

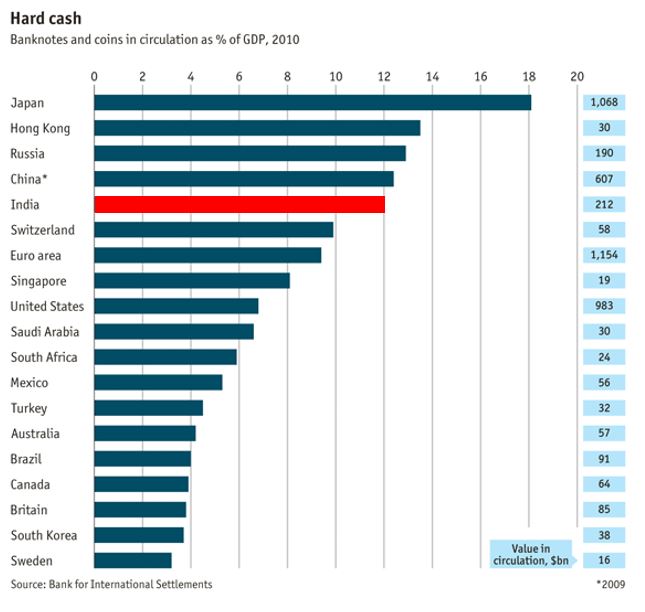

The Reserve Bank of India and commercial banks annually incur around $3.5bn in currency operations costs each year. The scale of this burden is unique to India considering that it is among the most cash-intensive economies in the world with a cash-to-GDP ratio of 12%, almost four times as much as other emerging markets such as Brazil (3.93%), Mexico (5.3%) and South Africa (3.73%) and even higher than the U.S. and Switzerland. Clearly, the drive towards a more cashless society in India will get a big fillip from the move to demonetize high value denomination notes, an upshot we have not read much about so far.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.