The COVID-19 pandemic is in its final throes and lockdowns are now receding from our memories quickly. People are out and about, partying, tippling and travelling with a vengeance. It’s back to the times when folks like us, who live and breathe stocks, meet other stock market types over beers and prognostications most weekends at a neighbourhood bar. If one was in Mumbai, India, a typical conversation ice breaker would be “Kya lagta hai?”, which simply translates to, “So, what do you think/ feel?” – a reference to the direction of the market. The banter quickly moves on to individual stocks, one or two usually. Once a few gulps have been downed and the senses well lubricated, cadences shift higher and conversations become more animated.

Discussions like these, whether they are in Mumbai, Singapore, London or New York, have a familiar ring and path to them. The hottest stocks of the times get discussed and debated. This repeats itself ad nauseum, at a cocktail party one gets invited to or when one bumps into one’s neighbour walking the dog or an acquaintance in the gym or in the elevator in the office building. One goes back home and turns on the TV to catch the financial news, and the talking heads are more than likely weighing in on the same names one chattered about recently. What is it that gets so many people excited enough to incessantly discuss a certain set of stocks out of the thousands that are traded on the exchanges every day?

These are what, in stock market lingo, we call stocks that have “a story”. Such stocks unwittingly become the “storied stocks” of their times. A storied stock is simply one of those companies one knows about well (or at least thinks one does!) because it is always in the news. These stocks are often, but not always, new and innovative companies which usually remain in the public eye and discourses. The media plays its part in discussing every trivial piece of information about them as this never fail to get the listeners’ attention.

Some of the storied stocks of our times need no introduction: the famous FAANG (Facebook, Amazon, Apple, Netflix and Google’s parent Alphabet), Tesla, Microsoft, Uber, NVidia, Palantir, Shopify, Peloton, Zoom, Uber, Snap, Coinbase, Teladoc, Crispr and others – the list is indeed very long. All these stocks are fast-evolving companies whose successes and new path-breaking innovations not only contribute to the real advancement of the human race and betterment of our day-to-day lives but also make for great “stories” in the stock market. The frequency of their innovations keeps investors in thrall and provides longevity to their “stories” and their popularity in the market.

How And When Do Storied Stocks Get Created?

Storied stock before and after IPOs: The life of a storied stock begins much before it comes to the stock market. Such companies already tend to be well known for their products or services ahead of their debuting on the stock market. Companies such as SEA (Shopee), Grab, Zomato, Uber, Snap, LinkedIn, Zoom and Peloton were all well known to investors before they IPOed in the last two or three years.

Storied stock IPOs tend to happen late in the economic cycle or when the major stock market trend has matured. What most investors miss is that when storied stocks finally IPO, it is usually the time when the original founders of the business are selling, along with private equity funds who got in early and on the cheap and wish to be rewarded for the risks they undertook.

In the last few years of the bull market in the U.S., the storied stocks have generally emerged from the fields of technology and biotechnology due to the sheer allure and grip that these have had on the minds of even the most novice investors. In other words, people see a new business model they fall in love with and have some positive personal experience with, perhaps using the product or service. They somehow believe it will turn out to be a great success and hence a winning investment.

- It is not surprising then that a profusion of storied stocks is commonplace and flourishes during bull markets.

- The industry sector that generates the most storied stocks depends on the dominant investment theme prevailing at that time.

- In the most recent bull market it has been technology and biotech, by far the most storied of industry groups.

- They transition from being great stories pre-listing to becoming the quintessential storied stocks post their IPOs.

The Problems Of Being “Storied”

Unprofitable now, but how long will they stay that way? Many of these companies can’t afford to sustain their current business models as the cash they possess today (raised through IPOs) will eventually burn out. As the stock market trashes their stock prices, somewhere down the road this will limit their ability to raise fresh capital in the changing paradigm of high inflation and rising interest rates. These businesses will need to pivot their business models dramatically, pare costs and find a way to grow and earn their bacon and demonstrate that the business has a durability and is sustainable in the long term to be value accretive to their shareholders.

Serviceability of debt: In the ultra-easy monetary environment of the last few years, several such companies benefitted from cheap funds and ratcheted up funding through debt markets once they were listed. However, now that the tide has decisively turned for the worse, it remains to be seen how many will receive funding from Wall Street when these debt instruments come up for repayment and refinancing in the future, at a time when such companies are far from generating any economic profit.

Why Do Most Storied Stocks End Up Being Poor Investments?

History has proved time and again that storied IPOs have flattered for a while after listing until the reality of their volatile businesses begins to hit investors. Once the bear market comes along, as the night follows the day, several such highly-vaunted IPOs end up losing substantial market value and becoming poor investments, running up huge losses for investors who hang on to them on their way down. For these stocks to recover from the throes of the bear market becomes akin to climbing the Matterhorn, and few, if any, manage to do so when the market begins to re-inflate in the next cycle.

Besides the fact that they usually get created towards the end of the economic cycle or a major bull market, there are other tell-tale signs and occurrences that contribute to their poor performance as investments several years post their listing.

- Gross over-valuation: The market valuations of storied stocks inflate rapidly in the bull market and soon exceed their fundamental value, not just by a bit but by a lot. Given the popular view, stock prices continue to remain bid up for much longer than seems sane. Usually, the degree of over-valuation reaches such an extreme that even though most investors are in agreement about their over-valuations, none wants to sell-out; the momentum becomes so strong that it is an entrapment from which few can break free. It is this extreme degree of valuation that sets them up for the inevitable, inexorable, painfully-long decline in value once the market has peaked.

- Short-sellers move in: While a typical storied stock has a huge fan following and investor base, its rapid rise leads to its valuations becoming ever richer. This begins to attract short-sellers who are sceptical about the company’s long-term prospects and who short the stock and lead to an above-average build-up of short interest. This then tends to lead to significant price volatility.

- Risk of further dilutions and debt: Post an IPO, it is usually stock options and stock awards that keep the current executives tied to the company. However, this results in the number of shares outstanding continually growing each year. This is not good for the interests of long-term shareholders because their ownership in the company also gets diluted with every passing year. For example, Uber went public in May 2019 with 1.1 billion shares outstanding. By December 2021, this number had grown to 1.9 billion shares. That is a 72% dilution in less than three years since its listing with little to show by way of a profit.

- Victims of rising risk premia: Storied stocks which benefitted from the ultra-easy financial conditions and low risk premia accorded to valuations have suddenly found themselves like deer caught in the headlights. As the interest rate cycle turns higher and the risk premia on stocks in general rise, companies with zero or little cash flows tend to be the ones that are most penalised. Valuation metrics that worked thus far (Price/Sales, PEG ratios, etc.) begin to be questioned. In the previous Tech boom of 1999-2000, metrics such as eyeballs captured, subscriber numbers and growth, clicks/hits per day/month and the sort ruled the day. All until the boom eventually went bust in 2000 and the Dot.com bubble unravelled.

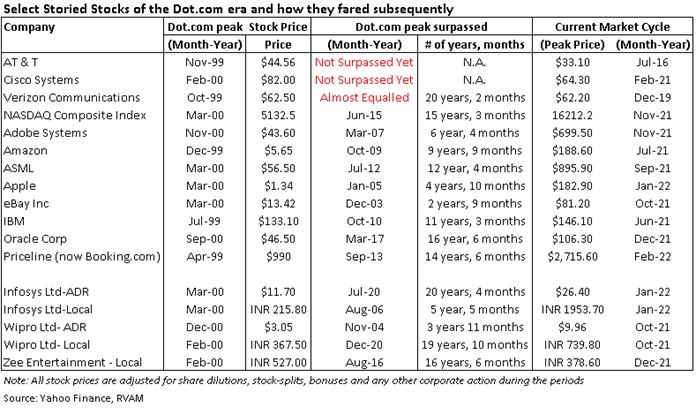

In the U.S. itself, names like CISCO, Verizon and AT&T have not recaptured their Dot.com peaks even twenty-two years later! The table below makes it amply evident that no matter how storied the stock may have been or loved back then, the weight of over-valuation is simply too much to bear and for too long a time in most cases. It illustrates how difficult it is for such storied stocks to come back and in fact go past their previous price peaks. Even the Nasdaq Composite index took fifteen long years to get past the Dot.com peak, such was the magnitude of the bubble and mispricing back then.

Several Dot.com era show-stoppers like AOL, Nortel, Enron, Global Crossing, Yahoo, Time Warner, Nokia, Palm, Blackberry and several others no longer exist in the way they did and, if some do, then they have been merged, acquired or have morphed into entirely new businesses. However, out of the scores of companies that bit the dust or perished, there were a few that not just survived, but came back bigger and stronger – some of which are now the flag-bearers of their industry groups and global leaders. Names such as Amazon, Apple, Adobe and Booking.com (then Priceline) have gone way past their 2000 peaks, while others like Cisco Systems, AT&T and Verizon continue to survive but have morphed and changed with the times and have even found a way to succeed again. The rest – and there are scores of names – have permanently destroyed massive shareholder value since.

Why Is It So Important To Be Profitable?

The creation and life cycle of storied stocks serve a purpose not just to students of history and those who have invested in the markets for long periods of time, but to all the new investors who invest in them along the way. Companies and businesses ultimately derive their value from the cash-flows they generate for their shareholders in the long term across market cycles and different economic environments. They capture shifts in interest rates, inflation and external factors along the way.

Such stocks’ long term value destruction is a stark reminder that the stock market can only price assets for a limited period of time on new-fangled standards and metrics which have a weak basis and which challenge the conventional laws of accounting as the world knows them. Pricing businesses on sales growth multiples or eyeballs and clicks or some ephemeral notion, with utter disregard for the need to make profits and generate cash, has severe limitations and a finite life. Price action in history proves this across geographies and markets.

The history of stock markets in the world has proved time and again that the standard and acceptable methods of valuing businesses haven’t changed fundamentally even though accounting standards have been modified and refined to adapt to new businesses and business practices arising from advances mainly in technology and its use. The Dot.com bubble, the GFC boom and bust and the QE-fuelled-cum-technology-led bull market of the past decade have only served to highlight and remind us yet again that it never pays to stray too far off the beaten path when it comes to playing by the rules of investing. The stock markets are the ultimate arbiters of justice and serve to value asset prices appropriately eventually, as they should be. That wavering of faith can happen only at one’s own peril.

The stories behind storied stocks after all haven’t proved to be like fairy tales which always had happily-ever-after endings. One hopes they leave lessons that the next generation of investors will learn from to become better investors.

Annexure: Three Kinds Of Storied Stocks

- There are three kinds of storied-stocks. The first kind is when an existing company with a history of strong business performance catches the fancy of the market because of certain strategic shifts in its products or services or certain pivots it makes in its model that the market believes would accelerate that growth and hence gets super-excited about it. Apple is a good example of this.

Once Apple’s services business built scale and became a big driver of its profits and cash flows, the market began looking at it in a new light. The stock traded at ~$22 back in mid-2016, at which time it was mostly viewed as a company that made nifty cell phones, tablets and some accessories, all of which were enmeshed in its own ecosystem of hardware and software in the form of music, entertainment and more. Apple’s stock rallied inexorably since, to hit its peak at $182 in December 2021, a nearly 9-fold rise in five and half years! Through this period, Apple continued to drive innovation with its iPhones and sundry products and capture the imagination and wallets of its faithful band of consumers and investors. But it was the services business growth and profit share that propelled and truly re-rated the stock.

- The second type is one where the business is a disruptor, a new technology or service that the market laps up but where it isn’t bothered too much about when the profits might arrive, confident that they would soon enough. Such a stock tends to get valued on metrics like user/ subscriber growth. Netflix has been that kind of stock, an early beneficiary of market benevolence.

Netflix brought streaming video content into homes and fundamentally changed the way we entertained ourselves through differentiated and original content that it produced across languages and genres. Netflix’s appeal thus spanned the globe within a matter of a few years. Consumers lapped up its subscriptions and investors believed that its ability to disrupt traditional linear television and the cord-cutting that followed would lead it to the path of riches. The stock’s rally was for all to see. But recently Netflix run into subscriber growth issues, ARPUs have begun to struggle and it has had to reset its growth algorithm in quick time delivering a below-the-belt blow to investors of one of the most storied stocks of our times. Ironically, this comes just at a time when the company has begun to turn a profit and generate cash flows. It is perhaps reminiscent of some stocks like Amazon, Adobe and a few more that found themselves in a similar situation post the Dot.com bubble and who eventually found a way to grow out of those depths of despair. Will Netflix pivot its model quickly enough and reposition itself for growth?

- The third type are those companies which just can’t seem to get rid of the red ink on their income statements. Often even the company doesn’t have a good idea when the business will turn a profit or at what scale. Several start-up kinds of companies, smallish in size with high technology intensity, require continuous investments in people, R&D and marketing. While some are, in all fairness, reducing their losses, they still remain unprofitable. Their stock prices have been the darlings of the market until early this year when things have begun to change somewhat unexpectedly for this bunch. Think Uber, Beyond Meat, Airbnb, Palantir, the list is a pretty long one here.

Uber’s CEO had the temerity to tell the street soon after the IPO that he didn’t see Uber reporting a profit for a long time. That didn’t stop investors from staying invested and the stock even rallied three-fold post the COVID-19 market lows. Uber has succeeded in doubling its income since 2017, but its operating loss is pretty much similar to what it was back then (just shy of $4bn). The stock rallied off the COVID-19 lows in the 20s all the way to $60 only to be back in the low 20s now. How will Uber change tack from here and will a new model surface that places profit above all else?

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.