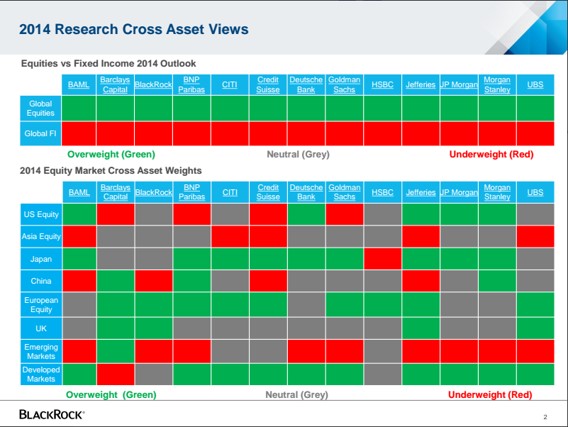

In this time of large macro-driven market movements it is interesting to look at what the consensus is thinking. One of the learnings over our investment history is to always be suspicious of extreme forms of consensus in the markets. The table above from Blackrock shows some interesting extreme consensus views. Views have been obtained from thirteen sell side houses on ten broad investment baskets. A few very strong consensus views come through.

On the negative front:

- Everyone is negative on fixed income (i.e. they all expect interest rates to move up). This is a very strong consensus. Given the history of these extreme consensus views, this means that there is a strong probability that it is wrong. We do agree that in the long term rates have to go up as they are at the bottom of a 30-year down cycle. However, in the next twelve months we think the markets could be surprised by how little interest rates move up. There are various reasons why rates could remain flat or go down. These could include: more uncertainty in emerging markets, US growth losing steam as the effects of higher rates and continuing deleveraging dampen growth, EU develops new weak links like France, etc. In short, it might not be a bad idea to tactically have a few slightly longer duration bonds in the portfolio. Also, this gives us more comfort with our core philosophy of holding steady yield equities.

- Most are negative on Emerging Markets. Nine of the thirteen houses are negative EM and only one is positive. The rest are neutral. In our view, EM is going through a growth and interest rate reset as liquidity dries up and US rates move up. But if the first consensus view is wrong (on interest rates), these head winds will dissipate by the end of the year. Also, these tougher times will, we hope, lead to a few structural steps to create long term growth drivers. Finally, the very low valuation in these markets means that a large amount of bad news is already expected – hence the potential to surprise on the upside is high.

On the consensus positives:

- Equity is a consensus buy: again, this has been tested in the last one month.

- Europe is a consensus positive: Nine out of thirteen houses are positive on European equity and the rest are neutral. No negatives. Again this is after a very strong equity performance in the last twelve months. Europe needs earnings growth. It also needs structural growth drivers. The cyclical rebound from the extreme bottom of 2012 is already expected.

- Japan is a consensus buy too: Only one house is negative, nine are positive and the rest are neutral. Again the currency advantage is losing steam as the base effect of that starts tapering off. The expected structural reforms have not kicked in.

The mixed bags:

- The US: Strangely the US is a mixed bag with the market equally dived between the bears and the bulls. Our assumption is that most of the bears are negative on valuation and expectation and not the fundamental call. This is where the surprise could be. But it does create an incentive to look at this market more closely.

- China: This is the perennial source of divide views. The bulls’ view is valuations are very cheap and the current slowdown is a one-time structural downward reset of growth hence it will not break the system. The bears think that this reset will break the system. The jury is still out. Our view remains that the system will morph but not break.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.