Sawadee ka! The gentle cadence of that mellifluous welcome everywhere you go in Thailand has more meaning to it than a cursory acknowledgment would do justice. Thailand’s welcoming embrace once you land at any one of its gateway airports is an immediate reminder to a foreigner that this country wants him to be there, wants him to visit as often as possible and hopes that he spends not just his time but enough money to partake fully in all the splendour, culture and hospitality it has to offer.

We were enthralled yet again when we arrived for a conference in the heart of Bangkok’s Sukhumvit district at the end of August, where the who’s-who of Thailand’s corporate sector had gathered for a conference over three days.

As the meetings rolled past it became apparent that the Thais deal with economic challenges with a degree of equanimity and composure that others could do well to learn from. For someone from India the difference is stark. There were no shrill wails of hapless fretting or cries for help. No remonstrative finger pointing to pin blame or any government bashing as is the wont in some countries.

Yes, Thailand has had its share of problems and challenges, many of which are no different from that of the rest of Asia or the world – slowing growth, weak domestic consumption, a fortified currency (in its case particularly true), are just some of the headline-grabbing challenges Thailand’s mandarins are grappling with today.

As a backdrop, Thailand’s GDP growth has been decelerating from 1Q18 when it peaked at 5%. The current quarter will hence be the sixth consecutive quarter of lower growth rate. Growth estimates have been declining throughout and still are, with most believing that the estimates of the Bank of Thailand (BoT) will be breached to downside.

The BoT has been cutting interest rates through this period and they are at levels from which further cuts are proving to have little effect in stimulating growth. Ytd loan growth for the big banks is up an anaemic 1.2%. This comes at a time when successive rate cuts by the BoT have left banks no room to cut retail deposit rates any further even as their loans keep repricing lower, thus squeezing margins.

On the other hand, it is business as usual for the non-bank finance companies (NBFCs) and retail lenders/ credit card issuers. Auto loans, personal loans and credit card companies are seeing better loan growth traction as consumer demand sustains itself. Over time these NBFCs have done a good job of maintaining asset quality while maintaining double-digit loan growth in these segments.

The Baht. Bah!

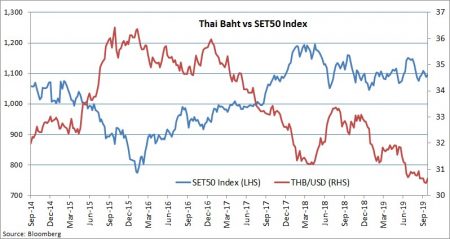

Thailand’s better relative growth, low inflation, current account and balance sheet strength meant that it began to suffer over the past two years from the embarrassment of riches. Result: persistent strengthening of the Thai Baht. One of the biggest banes for Thailand’s corporates has been the strength of their currency. The BoT has made its exasperation fairly obvious as its efforts to stem the Baht’s strength have met with little success. With a current account surplus of 5.6-5.7% of GDP, it is unlikely that the Baht strength will reverse soon.

Market consensus is that the Baht has room for further strength as a ‘safe haven’ currency should the U.S.-China trade talks fail. A wag remarked at lunch that the Baht is fast becoming the ‘reserve currency of ASEAN’! The headache for the BoT is unlikely to go away anytime soon and, given the data, another rate cut by the end of the year is now becoming a foregone conclusion.

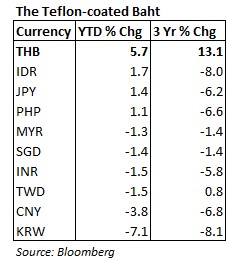

The Thai baht has been the runaway success among Asian currencies this year – surging by 5.7% while the U.S.-China trade war has punished peers all around the region. There are two reasons why it may rise even more.

The Thai currency has proven to be the perfect Asian hedge against global trade frictions. It has withstood the last three spikes in U.S.-China trade tensions and has been unmoved by the sharp yuan moves among eight other Asian currencies. Such strong sentiment could be reinforced further.

Another stiff test approaches when the outcome of the October U.S.-China trade talks will be known. It won’t surprise many if the currency makes another show of strength if those talks were to fail again and precipitate further harsh words and deeds from both countries.

The Thai Baht’s strength hasn’t been a recent phenomenon (see table on the right). The Baht’s strength vis-à-vis any Asian currency versus the U.S. Dollar has been off the charts in 2019 as well as over the last three years. The angst of the BoT and the corporate sector is justified in the face of such readings. It is also the case that when one evaluates Thai companies’ revenue and profit growth in this period, adjustments for the currency strength would make a material difference between reported and adjusted growth rates.

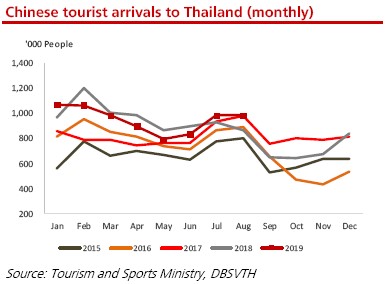

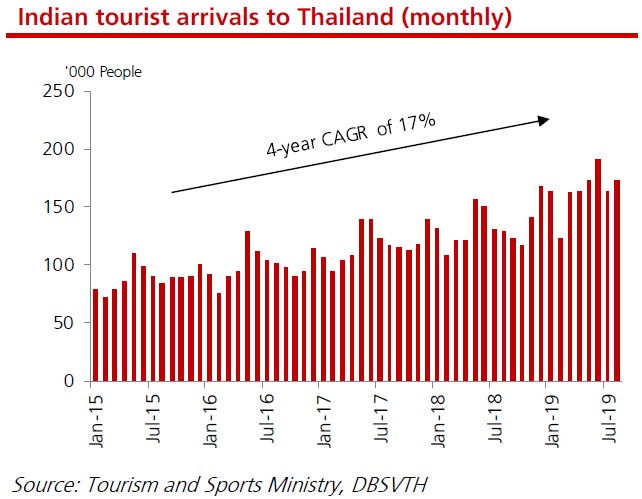

The Baht’s strength has been hurting Thailand’s exporters and tourist-oriented industries directly. Hoteliers are uneasy as tourist arrivals have slowed down, although not as alarmingly yet. The good news is that the government has been quick to give the sector a hand by relaxing visa rules for several countries including India. Indians have been the fastest growing group of tourists to Thailand this year. Chinese tourist numbers, after hitting an air-pocket, are now recovering despite the weakening Renminbi.

A leading hotel company we met remains unfazed by what it believes is a cyclical bump as it continues to chart its own growth path regardless. It plans to grow its room strength across Thailand, Maldives and the Middle East by more than 75% over the next 3-5 years mostly through an asset-light strategy. Its food and restaurant business expansion plans have also not been constrained by the weak economy even though their growth rates have slowed down.

Infrastructure – Real Progress Around the Corner

Talk about infrastructure and we find many corporates holding out in hope. Thailand’s long charted mega infrastructure roll-out has been in-waiting for some years now with slow progress so far. With the elections behind us, there is renewed hope that several large road and rail projects will now be flagged off in dead earnest.

The Eastern Economic Corridor (EEC) Office expects to make significant headway on the three-airport high-speed rail and Map Ta Phut port in the next few months. Concession awards for the U-Tapao airport and Laem Chabang port could take place by end-2019 or early-2020. The office is keen to get infra-related concession awards out of the way to shift focus to the more critical task of attracting investment into the EEC. It is expected that over 60% of EEC’s targeted U.S.$50bn investment over the next five years will come from non-infra investment in high-tech industries, smart cities and tourism-related infrastructure. Breaking ground on these infrastructure projects could provide a foundation to attract investment.

Concession awards to expand Bangkok’s rail network are also on the horizon. The Mass Transit Authority of Thailand (MRTA) expects the terms of reference for the Orange Line to be ready by November 2019 and to finalise the concession winner by August 2020. Work packages for the South Purple Line could be open for bids in 1Q20 and construction could start in 4Q20, based on MRTA guidance. In Phuket, studies on its light-rail project have been ongoing since 2Q19 and the MRTA expects approval by May 2020. This is likely to trigger off loan growth, boost employment and lift sentiment. Corporate banks in particular were more sanguine that this was likely to happen soon and that corporate credit growth from 2020 would see a marked improvement.

An infrastructure company talked of continuing expansion in its raw water, waste-water treatment and industrial water business at the industrial estates as also make further growth in investments in Vietnam and in its power business.

The CMLV – Thailand’s Own Backyard Playground

Thailand sees itself expanding its presence and influence in the CMLV sub-region (Cambodia, Myanmar, Laos and Vietnam) where it has deep historic connections and knows how to do business. We wrote about the CMLV opportunity in our July monthly “ASEAN: 20 years On From The Financial Crisis”. Companies exposed to these economies see this region as an extension of Thailand. These economies are at a very young stage of development (where Thailand was 20-25 years ago) and growing rapidly. Barring the usual execution and forex risks that are germane, Thai corporates we met seemed confident that they were on a strong wicket in the CMLV region for the next ten years.

The mood at the domestic/ regional plays was optimistic, stemming from their own growth which has been moderately good and their future plans within Thailand and the CMLV region. For example, a large cement company was seeing the Thai demand-supply imbalance evening out gradually and profitability rising since last year. As the new infra projects get kick-started, cement prices in Thailand are likely to improve further as years of excess supply begins to thin out.

We met one of the region’s large branded pharmaceuticals and supplements companies which also has one of the region’s largest third-party distribution business for pharmaceuticals and consumer products, chiefly in Myanmar and Vietnam. It had its growth plans charted and funded for the next three to four years. The management’s confidence stemmed from the fact that their markets of CMLV, Thailand and Malaysia and a smaller exposure to sub-Saharan Africa where they operate, have a long runaway for growth and are under-penetrated. Their superior management, well-funded balance sheet and strong product portfolio gives them the edge to succeed in the long term. Having doubled their business in the last five years, they believed they could double the business again in the next five.

The Trade War Casualties

Finally, we met a few of the potential casualties of the U.S.-China trade fight, exposed to global growth through electronics, auto parts or petroleum products. The common refrain was that the global growth slowdown from auto to petroleum products to consumer electronics was impacting them badly. Thailand’s auto sector is mainly export-oriented. With a strong Baht and weak global auto sales, this sector is unlikely to grow out of its state of funk.

Electronics manufacturing companies have a huge headache with tariff wars as they face disruption in their business. They are grappling hard to switch as much production as possible from China back to Thailand, to cut costs and to hang on to clients. They admit that it is impossible to shutter Chinese plants just yet as they have no offset for that production volume elsewhere. Yet none are willing to make wholesale changes in their business models just yet and are holding out for an end to the U.S.-China trade spat. These companies have hunkered down for the moment and are willing to see this out, even if it means that their profits take a hit for a year or two.

Oil refiners are saddled with both the refining and petrochemical cycles being down in unison due to large capacity builds in the sectors coming on-stream this year and next. Weakening global demand and a strong Baht have simply compounded their woes.

Summing It All Up

The point of all this is that despite the gloom and doom that gets trotted out to us by the media on a daily basis, the growth plans of several Thai companies in several sectors remain on track, with some modulation in pace, regardless of the short-term challenges. The CMLV region’s growth opportunities are vast and though the market is small right now, it would become meaningful enough in the next few years for companies that drop roots early and become dominant over time. The strength of the Baht isn’t a recent phenomenon and companies are now taking it in their stride and learning to live with it. It should have made the corporate sector more focussed on costs and made them leaner and better for it eventually.

When we sit back and take a hard look at Thailand, we see a mixed picture from an investment standpoint. While there are obvious losers, such stocks have been beaten down to valuations that are plumbing historic lows.

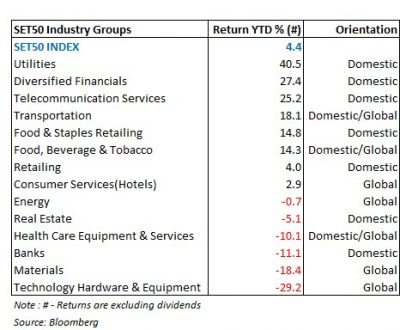

Domestic plays such as telecoms, REITs, consumer staples, select non-bank financials and mid-caps levered to the domestic and CMLV region have all done rather well this year in terms of stock price.

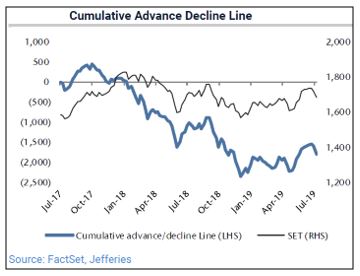

While market breadth in Thailand has been deteriorating for some time, the number of stocks still trading above the 260day moving average is actually rising suggesting that investors have been selective and have moved money into safe haven stocks.

Take a look at the table on the left showing how different sectors within the SET50 Index have performed.

Of the 50 stocks in the SET50 Benchmark, 29 had positive returns and 21 negative. Yet this has only been enough to deliver a mere 4.4% returns (ex-dividends) on a ytd basis. The broader SET Index which has 500 stocks had 298 stocks up and 202 down. That more stocks are trading higher than lower tells us that stock-picking has been the key. Thailand hasn’t been a macro trade this year in the true sense.

Energy, materials and surprisingly hospitals have been hit by the macro-economic headwinds but domestic consumption plays like food & staples retailing, REITS, telecoms, etc. have all withstood them. Banks have been hit badly but domestic non-bank financials are the second strongest performers this year. Interest rate cuts clearly impacted both set of companies very differently.

The opportunity then lies in monitoring the macro situation closely from here on. Companies least impacted by the currency and its side-effects or levered to the infrastructure impetus by the government in future are likely to standout as their growth delivery continues. In an economy which is caught in a disinflationary funk and where the cost of capital is only declining, Thailand cannot be such a bad place after all to be finding bottom-up companies for whom business is running as usual.

So, as we wound our way back to the airport making mental notes of our visit, there was the unmistaken feeling that regardless of the levels of the Baht and interest rates and the trajectory of GDP growth, the Thai stock market has had plenty of stocks which would have brought smiles to investors’ faces. We believe there could more to smile about in the future.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.