51 Years of Growth

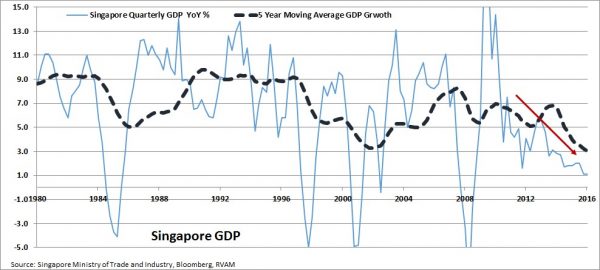

Since its independence, the Singapore economy has seen strong growth driven by gradual movement up the value chain, starting with labour intensive manufacturing, moving on to capital intensive industries, then to a service oriented economy in the 90’s. The onset of the Asian financial crisis saw the focus shift towards a knowledge based economy in the 2000’s – a global city attracting the best of talent and knowhow. Post the GFC in 2008, the focus shifted towards raising productivity and reducing the dependence on foreign labour. Consequently, over the last five years’ trend growth has slowed down markedly while costs have risen, driven by tight labour markets and high property prices. While the Government’s Future Economy Committee deliberates on the key pillars of the ‘Smart Nation’, driven by research, innovation and enterprise (report expected by end 2016), we look at the potential investment opportunities in this Little Red Dot.

Growth as a Means to an End

In its journey from a colonial backwater to a first world nation, Singapore adopted a non-consensus growth model which has not only delivered world-beating growth, but in the process has upgraded the skill set of the nation and brought it to levels seen in some of the most innovative countries, with income levels at par with the richest economies, all within one generation. With Singapore topping the lists of rich nations of the world, the focus is naturally shifting away from growth rates towards sustainability, from GDP expansion to GNI growth.

The Impact

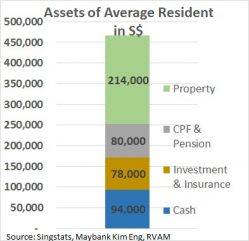

With a strong economy and growing population came rising incomes and higher affordability which drove property values higher. The attraction of capital gains has resulted in Singapore households, over time, investing S$840bn in property – more than twice the GDP – despite low yields (currently 1.6%-2.6%). But, as Singapore adjusts to a lower growth phase with modest population growth and stable but stagnant property prices, the focus should shift to higher income generating investments. This, combined with an ageing population, should drive up the attraction of yield.

The excess focus on property has resulted in housing-related costs rising to 30% of household expenditure from the low 20’s over the last decade, at the cost of other discretionary expenses. Government policies implemented over the last few years to cool the housing market should, over time, rebalance this shift.

Role of GLC’s

No discussion on Singapore is complete without reference to the role of GLC’s (Government Linked Companies) which have been keen players in the mixed economy growth model that combined pro-market efficiency elements with a high level of state involvement (through GLC’s) in priority sectors lacking private sector expertise or capital. These entities over time have come to dominate their sectors, stepping out of Singapore and building franchises in the global marketplace, delivering the Singapore brand of efficiency. The GLC’s have not only delivered on the growth objectives but also dominate the local stock markets.

The Emerging Challenges

As an export- and trade-dependent economy, with aspirations to be a knowledge driven global city, Singapore is undergoing a transformation during a period when the trend worldwide seems to be against globalization (especially in the Western world where benefits have been unevenly distributed). The Brexit vote and the polarized campaign which led to the election of Donald Trump to the presidency of the USA portend a period of uncertainty in global trade relations, presenting a headwind which the Singapore economy will have to navigate.

The Household Balance sheet

While average Singaporean households’ love affair with property is well understood, what is not that well known is the risk-averse investment mix of the average Singaporean.

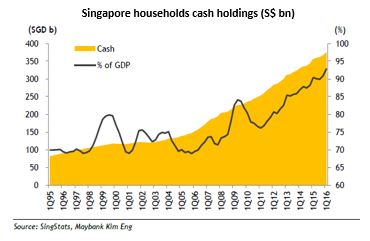

The first chart below shows the mix of average Singaporean’s assets with property being half of the asset mix. But surprisingly, cash at 20% of assets is more than the median annual income. The second chart shows the trend in household cash holdings. At 93% of GDP, the average Singaporean is currently hoarding too much cash and investing too little.

The cash pile has been rising continuously since the GFC, which perhaps implies that after getting burnt during the 2008 market meltdown, investors have become over cautious. With property generating low yields, cash not earning much and CPF generating low stable returns, the total investment income earned by the average Singaporean household is meagre. This combined with an anaemic stock market, could lead one to wrongly rationalize that the investment opportunity set available to the average Singaporean investor is mediocre.

The Marketplace

As a mature economy with stable businesses, the traditional equity benchmarks are dominated by GLCs which have grown large over time. These sector leaders are facing falling opportunities and are entering a consolidation phase. The large listed companies in Singapore (private as well as GLC’s) are facing headwinds from tight labour markets resulting in rising costs and, in the absence of growth, the need to focus on raising productivity. With strong balance sheets, some of these companies have to start looking at capital management to deliver returns to investors. The poor performance of the benchmark Straits Times Index (STI) reflects this conundrum.

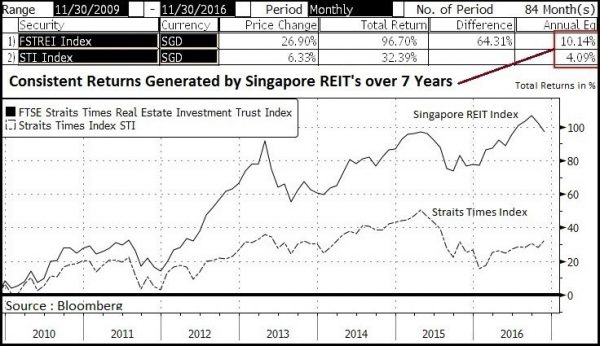

It is therefore not surprising that the Singapore markets do not excite the average investor. However, within this space we have been finding many hidden gems which have consistently delivered and increasingly fit the needs of a Singaporean investor looking for stable returns in a low growth environment: the REIT marketplace. Over the last seven years the REIT index has delivered over 10% p.a. annualized return which stands in stark contrast to the meagre 4% returns from benchmark STI index.

The REIT/Business Trust market in Singapore has gradually grown over time to encompass a globally diversified set of nearly fifty companies offering stable cashflow and consistent returns. Many people have the misconception that this space consists only of property assets. While property dominates, there are many other interesting and unique investments listed in Singapore.

REIT’s by nature own mature assetsand generate steady income passed onto investors in a tax efficient manner. Singapore has a reputation for stability, offers tax efficiency and has a pool of investors who would increasingly be looking for steady income. It is no wonder that this segment is growing and attracting interesting assets. Already we have pure plays on office buildings in Germany, United States, China, India, Australia;malls in Japan, China, Indonesia; hospitals in India, Indonesia, Malaysia; cable assets in Taiwan; and ports in China.

A unique income play we have been tracking for some time and are invested in is the owner and operator of “golf courses in Japan”.

Accordia Golf Trust (AGT SP) is a business trust listed in SGX-Singapore and owns a portfolio of stable income-generating golf courses and related assets in Japan. The company has a portfolio of eighty nine golf courses spread across Japan with 86% of them in the three largest metropolitan areas. Japan is the second largest golf market in the world after the USA. With an ageing population profile, golf is a natural recreational sport which attracts dedicated players.

The Japanese have a deep and enduring love for golf. Accordia’s courses are targeted at the middle to upper end of the market and towards experienced regular golfers. More than half of the total numberof players is over fifty years of age, 23% are in their forties and 26% are less than thirty years old. Golf is still very much a senior sport in Japan. In the next ten years post baby boomers, who number about 27 million, will be in their 50’s and 60’s and are likely to be attracted to golf. Tokyo Olympics in 2020, which has golf as one of its sports, could catalyse the take up of the game in a country which has always been in love with it.

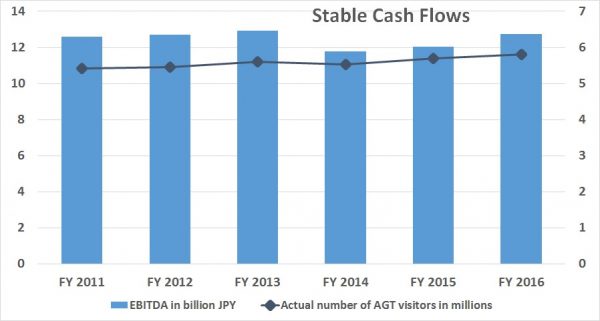

AGT generates stable cashflows, owns 76% of the land on which the golf courses are built and has an asset value of JPY 150bn. The remaining golf courses are on land leased for 10-20 years. The company has seen a steady and stable trend in visitors coming to play golf and generates consistent cashflow as seen in the chart below. The company has the ability to grow its portfolio by acquiring asset from its parent (which own forty four other courses). It is looking at acquiring 10-15 new courses at a cost of JPY 20-30bn in the near future and has the balance sheet capability to do so.

For a company with modest growth opportunity and a stable cash flow profile, the stock is trading at an inexpensive valuation, thus offering attractive yield. AGT is currently trading at 9x earnings, 7.7x EV/EBITDA, at 0.7x NAV and offers tax-free dividend yield of 9-10%.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.