Over the last few weeks Investors have been grappling with trying to find clarity on an issue going viral around the world, not only debilitating human beings but also markets, spreading contagion faster than the underlying issue which is the outbreak of a new coronavirus-caused illness, COVID-19. The market impact appears to be similar to what infected individuals are going through around the world – life getting upended – and this is well before clarity emerges on the real potency and long term impact of this new pandemic. Amidst all this, a new term entered the dictionary which succinctly captures how everybody’s life has been swept away by an emerging trend that is not likely to go away soon – the “Infodemic”.

In this month’s write up, we look at not only what is happening in the investment world but also how our daily lives have been transformed by new ways of generating and consuming one of the most precious and elementary drivers of human society – information.

Social Media

We live in an age where technological innovations are rapidly changing our lives for the better. In our pockets we carry devices which give us instant access to most things in the world, with processing powers that, a couple of decades ago, would have qualified our smartphones as supercomputers. But along with its innumerable benefits, technology, instead of being the vanquisher of misinformation, has helped its mass dissemination.

The role of social media in information dissemination and news consumption came to prominence during the last U.S. presidential election in 2016, where it was observed to have a larger impact on voter preferences than information from traditional media like newspapers and television. People were turning more to sources like Twitter and Facebook for information due to ease of access and convenience. An analysis by BuzzFeed found that the top 20 fake news stories about the 2016 U.S. presidential election generated more engagement on Facebook than the top 20 best-performing election stories from 19 major media outlets.

False information is not new. Traditionally we got our news from trusted sources: journalists and media outlets that are required to follow strict editorial codes to manage their reputational risk. However, the Internet has enabled a whole new approach in publishing, sharing and consuming information and news with very little regulation or editorial oversight. Many people now get news solely from social media sites and networks and often it can be difficult to tell whether stories are credible or not. Into this vacuum steps confirmation bias – the tendency to interpret, favour and recall information in a way that confirms or strengthens one’s prior personal beliefs or hypotheses. These then tend to get liked and forwarded multiple times creating an echo chamber of fake news. Ambiguous evidence, once widely shared, grows its own tentacles and can end up becoming an accepted fact as people start believing in it.

Media is no longer passively consumed – it is created, shared, liked, commented on, attacked and defended in all sorts of different ways by hundreds of millions of people. Fake news is quite often seen as more novel than factual events, which is why people are more likely to share such misinformation. The relevance of fake news has increased in post-truth politics. For media outlets, the ability to attract viewers to their websites is necessary to generate online advertising revenue. Publishing a story with sensational content that attracts users benefits advertisers and improves ratings. This undermines serious media coverage and makes it more difficult for journalists to cover significant news stories in an unbiased manner.

Into this modern world of viral information sharing stepped the COVID-19 pandemic which has created a new challenge for health authorities globally. The wide circulation of false information led the Director-General of the World Health Organization (WHO) to make the statement: “We’re not just fighting an epidemic, we’re fighting an infodemic”. Around 2 million tweets containing conspiracy theories about the coronavirus were published over a three-week period in January and February, according to a report in the Washington Post. Many of us have ourselves received Whatsapp messages claiming cures for the virus and solutions to guard against it, some intuitive and some reinforcing our own views or beliefs which may run counter to scientific evidence, but nevertheless affecting our judgement.

The deluge of false information has set off a tide of panic about the virus among people (which in reality is seasonal, it is hoped, like other flu viruses), leading to irrational actions like storming of supermarkets in mass hysteria and creating shortages. Clearly, given the information deluge, there is fear among people which cannot be wished away and the only way to address it and overcome emotions is for authorities to keep presenting facts clearly and consistently. We at RVAM are not experts on how this new pandemic is going to pan out and leave that to rational scientists; nevertheless we believe it is worth keeping facts in perspective as they do tend to get lost in today’s world of information overdose.

Coronavirus Hysteria

The COVID-19 outbreak which began in December in Wuhan, the capital of Central China’s Hubei province, has now expanded to cover nearly every part of the globe. Faster than the spread of the virus has been the spread of misinformation, which potentially has resulted in a significant overreaction on the part of individuals as well as authorities and which, in turn, are likely to impact global economic activity. With rising uncertainty, it is logical for markets to start pricing this in by increasing global risk premiums. What is clearly known is the fact that this is not SARS (with which COVID-19 shares 80% of its DNA), but a milder version, though seemingly more contagious in its spread. A lot of worries about its fatality and impact are based on headline numbers and the rapid spread into new clusters, ignoring the significant successes achieved in places where efforts have been made to isolate and control the impact.

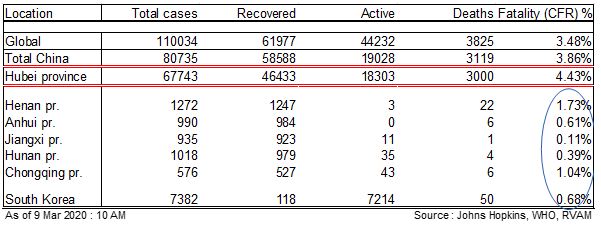

The WHO has been regularly publishing guidelines and statistics to ensure proper information dissemination. The table below shows the latest available statistics on COVID-19, which has now spread to 114 countries at the time of this writing. The WHO has observed a fatality rate of 3.4%; however, a lot of this data is drawn from the early stages of spread in a territory before proper mitigation measures were put in place. While it is true that Hubei province in China as the epicentre has seen the bulk of the cases, it is instructive to also look at the spread of the virus within China.

The table alongside enumerates the statistics on the virus outbreak as of March 9, 2020. The five provinces which ring Hubei (Henan, Anhui, Jiangxi, Hunan and Chongqing) – potentially the most at risk from contact spread – have seen very mild propagation of the virus with very high recovery rates and low fatality.

The same trend is visible when one looks at data across China for all provinces excluding Hubei. Credit needs to be given to the draconian quarantine measures put in place by the Chinese authorities to control the spread of the virus at huge economic cost.

Many observers have expressed apprehension that the measures that a command and control economy like China can adopt to control propagation, may not be feasible in free-wheeling western democracies. A look at data from South Korea, a society closer to that of Western democracies, paints a picture not dissimilar to that observed in the abovementioned five provinces of China. After seeing a spike in new cases and fatalities emerging from a rogue cluster in the city of Daegu, the country has done a wonderful job of widespread testing and implementing self-quarantine measures to bring the spread under control. As the virus spreads into newer territories, the experience in locations like South Korea, Hong Kong and Singapore gives hope that life can slowly limp back to normal as we approach the summer months and the potency of the virus potentially reduces. Social distancing seems the best way to control a virus which seems to spread by contact. While we at RVAM do not profess to be experts in this field, we believe that as investors we need to take into account the economic cost of various logical scenarios; markets, on the other hand, are starting to price in a lot of dire case scenarios, many unjustified.

Individually Rational, Collectively Irrational

The impact of COVID-19 needs to be analysed at various levels: firstly, the impact on individual consumer behaviour; secondly, the impact of actions taken by authorities; and lastly, the economic impact of disruption to trade and commerce. Over the last two months we have seen various players take preventive measures to guard against the virus, each of which may be justified in its own context, but which, from a big picture perspective, are leading to a significant freeze in global economic activity – the markets are trying to get a grip on this.

It all started with the heavy-handed clampdown put in place on internal movement within China leading into the Chinese New Year (CNY) holiday, as there were genuine fears of infection spreading across provinces during the largest human migration which takes place annually during the holiday period. As each city and province clamped down on local travel, as well as across its boundaries, many factories have been idling for more than a month now due to lack of workforce. Nearly a month and a half since CNY, migrant workers continue to struggle to make their way back from hometowns to their workplaces. Despite most provinces getting the outbreak under control, fears of a second wave resurgence of virus clusters is making authorities cautious about allowing travel within their provinces. Collectively this is prolonging the logjam of people movement within China. In 2003, at the height of SARS, traffic on the Beijing subway fell 60%yoy in May 2003 and recovered quickly back to normal in two months. Comparatively, in the month of February 2020, subway traffic in Beijing was down 90% yoy and in the first week of March is still running at -88% yoy.

It is not just within China that we are seeing a clampdown on travel. As information emerges of virus outbreaks in new countries, authorities everywhere are restricting travel from places which are considered hotspots. This is despite the WHO advisory which states, “In general, evidence shows that restricting the movement of people and goods during public health emergencies is ineffective in most situations and may divert resources from other interventions”. Clearly, most member states are reacting to public pressure and cannot be seen as taking no action when headlines scream of a new case in a particular location and the Infodemic is widespread. The action of authorities is getting exaggerated by individuals cancelling their travel programs to play safe, while many large corporations have deferred business travel as a precautionary measure. Collectively all these actions are resulting in a doomsday scenario for the travel industry, something that no industry can plan for or react coherently to.

Individuals’ actions based on rumours and on reading news on social media are creating situations that border on comical, like the invasion of supermarkets everywhere in a mass hysteria to stock up on toilet paper. It is surprising how human behaviour transcends boundaries; this is a trend that started in Hong Kong and has been replicated at different points across the world, in Singapore, Sydney, New York and innumerable other places.

Economic Impact of a Twin Shock

While COVID-19 may be less potent than the SARS virus, it could very well have an economic impact that ends up being significantly larger than that of SARS, which happened nearly two decades ago in 2003. For starters, China is now the second largest economy in the world accounting for 16% of world GDP, significantly more than the 4% level in 2003. Secondly, it is now significantly more integrated into the rest of the world both in terms of goods production as well as being one of the largest sources of tourists, resulting in significant people movement. Overseas spending by Chinese tourists accounts for 18% of global tourism now, rising exponentially from 3% in 2003. A ban on travel from China would certainly have a cascading impact on a lot of small economies which are significantly dependent on tourism revenues.

Over the last two decades we have had multiple market challenges: the Asian financial crisis, the bursting of the dotcom bubble, the Global Financial Crisis, etc. Each of these resulted in a demand shock. Coordinated fiscal and monetary policy intervention by authorities ensured a quick recovery in demand. The current episode is turning out differently. The outbreak of the coronavirus in China and the actions taken by authorities in the mainland resulted in a freeze of production and supply of manufactured goods from China which, as the factory of the world, is a critical part of the global supply chain. Till such time that the outbreak remained contained within China, this supply problem seemed transient. As global inventories started getting depleted, the expectation of activity restarting in China meant that production catch up to make up for lost output could result in a back ended recovery. However, the subsequent rapid spread of the virus around the world with kneejerk reactions in every location is resulting in concerns about an additional global demand slowdown, as consumers facing the onslaught of the Infodemic become risk averse and postpone discretionary spending, adopting a wait and watch approach.

The twin shock of a demand slowdown accompanied by supply uncertainty could potentially slow global GDP growth, a recovery from which will require different solutions from just a monetary stimulus, which markets have got used to over the recent past. To the existing uncertainty we just added a potent oil market dislocation as Saudi Arabia and Russia decided to part ways and go for an all-out market share war in a slow demand period.

Rational Anchor in an Irrational Market

In the face of multiple uncertainties, the market is going through a volatile phase as risk premiums rise and investors price in lack of near term visibility. February is a good case in point. Given that headwinds from the COVID-19 virus resulted in a near full shutdown of activity in China, taking bets away from the country till clarity emerges was the most logical action. But markets have their own ways. The farther you were from China the more you got hit in the month. The chart below shows US$ returns achieved from various markets over the month and the only market which delivered a positive return was China.

The next few months are likely to be uncertain as markets remain volatile while investors find their footing. Humans have an innate inability to understand very large or very small numbers. “The virus multiplies exponentially!!!! Oil supply will shoot up while demand craters!” All superlative statements with no insight on scale or a desire to calibrate. This always results in overreaction and rising volatility driving market risk premiums. We do this on the upside and we will inevitably do so on the downside. This is why the investment process becomes so much more psychological than purely mathematical. As far as a business is concerned, this does not change the long term value anchor of a business – its cashflow generating ability. But with rising risk premiums, the way the cash flows are valued becomes volatile. However, investors need to ride through the short term gyration in risk premiums.

Our experience is that dislocations like these, driven by unexpected short term events, leave behind a wealth of “investment opportunities of a lifetime”. When fear overtakes rationality, the market leaves greed behind and we witness indiscriminate selling, providing valuable opportunities to build up long term positions in well-run companies that are rarely available at cheap prices. The key to capturing these opportunities is to be patient and disciplined with enough liquidity available to pick up ideas as and when they present themselves.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.