Strong cash generation with steady growth is what we are looking for

As we prepare to launch our offshore fund (River Valley Core Compounding Fund – RVCC), it would be an opportune time to have a re-look at our world view and opportunity set. These form the core of the underlying belief on which our portfolios are constructed.

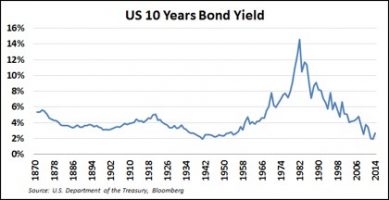

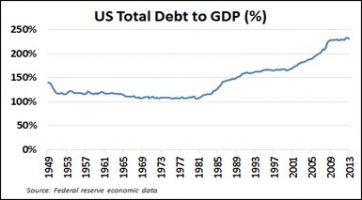

Historically low interest rates and high leverage have to reverse

In spite of the increase in interest rates over the past year, we remain at the bottom of a 30-year interest rate cycle and at the top of a leveraging cycle.

This had created a strong tailwind for high growth – unsustainable, unprecedented and probably un-replicable

This tail wind will at best become “no wind”, but the most likely scenario is that it will be a head wind.

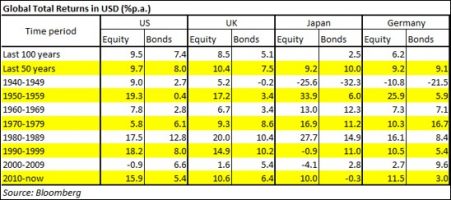

The returns in the 1960s and 1970s were low, as could be expected over a period of rising interest rates.

These returns were below long term averages and clearly below the average returns in both the equity and bond markets since the early 1980s (the peak of the interest rate cycle).

These low rates will continue in the medium term as the only corrective factor – inflation – is still benign.

With global growth being slow and inflation being low, the short term push up on rates is not too strong.

But, in the long term, this reversal of rates is here to stay.

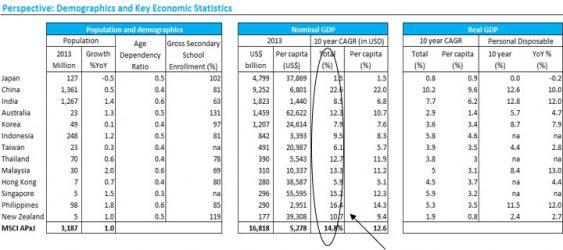

Though Asia’s growth will slow down, it will continue to remain high in absolute and relative terms

The average USD nominal growth for Asia in the past ten years has been 14.8% p.a. Even if this halves, it will still be a very large number. With operating leverage still working in favour of corporate earnings, growth could easily be in the high single digits.

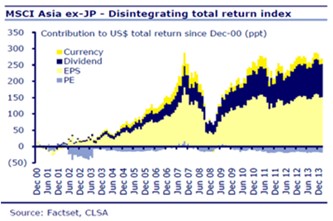

But as we explain later, this steady but lower earnings growth will be accompanied by a strong cash generation cycle, which will significantly enhance total returns.

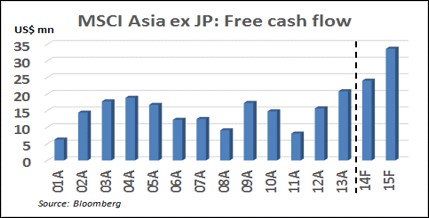

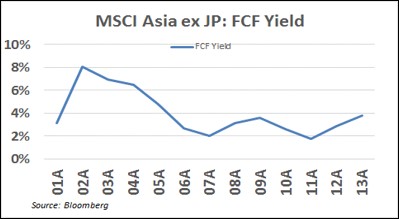

While growth slows, corporate free cash flow is improving

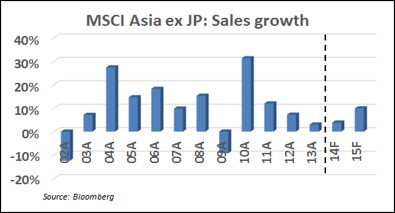

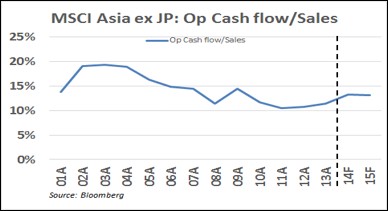

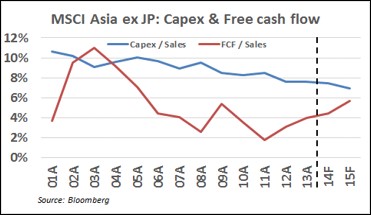

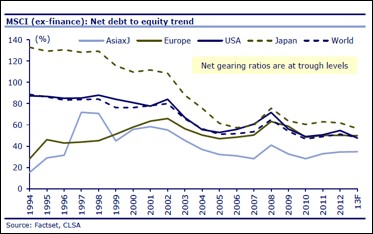

Sales growth remains positive though it is slowing down and bottoming out. Steady operating cash flow, peaking leverage and, most importantly, dropping capital expenditure are leading to a strong uptick in free cash flow.

The dropping leverage for listed Asia is incongruous with the continuous media bombardment of Asian corporate default risk rising and huge balance sheet weakness. This is probably truer outside the listed space. Anecdotally also, our research shows a large collection of small and large companies maintaining and growing their cash flow.

Improving free cash flow enhances returns in not so obvious ways

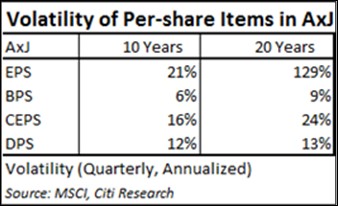

Investors tend to look at returns from stocks coming purely from EPS growth. But improvement in free cash also gives other sources of returns:

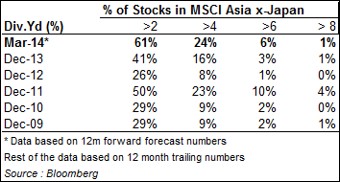

- It enhances returns through a sustainable and growing dividend stream.

- It could lead to stock buy back

- It could lead to value enhancing M&A activity

The universe of companies in Asia with significant dividend support is growing. Also, in the past, dividend has been a significant and non-volatile part of total return.

Conclusion

- The world will see slower growth going forward, as leveraging and a dropping interest rate cycle reverse.

- Through this slow down, Asia will still give solid though lower growth.

- The corporate cash flow from the Asian listed space is improving.

- Improving cash flow opens up other sources of returns for investors.

- The universe of companies in Asia with improving cash flow and dividend yield is fast growing.

- Our investment strategy hence combines elements of free cash flow and dividend, with our ongoing hunt for quality growth.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.