After experiencing strong returns in 1Q with markets recovering from their December slump, we headed to Hong Kong for the Credit Suisse Asian Conference to gather insights and gauge which way the wind is blowing. In this month’s write-up we summarize our gleanings from many packed sessions stretching from macro-economic views to discussions on contemporary political topics, China navel-gazing as well as interesting titbits on the impact of emerging trends in AI, 5G technology and more.

It is rare that one gets treated to views of three contemporary U.S. Fed governors in succession. When such an opportunity presented itself at the conference, it left behind enough insights to mull and form a backdrop for our investment mosaic. We seem to be headed back to an era of lower growth and lower rates but with hopefully lower volatility as policy makers seem to have a better grip on the financial system. In this era of lower global growth, the stark contrast between western economies and Asia seems to be widening further. The issues and concerns being debated in the West are around managing challenges of inequality in an era of low productivity, while Asian debates centre around opportunities presented by a growing middle class and how emerging technologies are being used by companies to deliver services using new business models.

Interest Rates Are Stagnating

A year ago, in the midst of optimism on growth, central banks around the world were sounding hawkish, telegraphing a prolonged phase of rate increases as the focus was on normalization. This made us take a relook at our central view of lower-for-longer, but a year down the road, we are back to debating the trend which has been the dominant narrative of the last decade – how low can the rates really go? After a year of unusual hawkishness, we entered 2019 with the U.S. Federal Reserve subtly changing stance and signalling a pause and, as we read between the lines, potentially a cut, if data continues to deteriorate. What caused this rapid about-turn in global views? Firstly, it was the realization that growth acceleration seen emanating from the U.S. was not sustainable, as the effect of one-off drivers (like tax cuts, deregulation) started wearing off rapidly as these were not followed up by any structural measures. Added to this was the rising uncertainty around the world brought about by the mercurial Trump presidency that is questioning the efficacy of current WTO rules without presenting an alternative architecture. Thirdly and most importantly, despite the monetary stimulus of the past decade inflation continues to be low and stubborn.

Growth Is Trending Lower

In our November 2017 newsletter, writing about improving global growth outlook, we cautioned investors about the unsustainability of expectations as long term drivers underpinning the trend were still weak. Listening to the Fed at the Hong Kong conference, we were struck by how bearish U.S. policymakers were on long term U.S. growth expectations. From a level above 2%, the Fed now thinks that long term GDP growth rate for the U.S. is around 1.75% due to stubbornly low productivity and labour market issues.

We have used this chart in previous newsletters to highlight how growth in the U.S. and Europe has been trending lower due to structural reasons, while Asia continues to maintain a significant growth rate differential. The Fed’s U.S. growth expectations clearly indicate that the recent bump-up in growth is being seen as temporary and we would be heading back to the lower-for-longer trend in growth. From a near term perspective, we seem to be decelerating fast from a 3% growth rate in the U.S. to a 1%+ level which is likely to have spill-over effects onto the rest of the world over the course of 2019.

While the downward mean reversion of U.S. growth is not a surprise, what is of concern is the fact that it is happening at a time when the rest of the world is struggling with its own challenges. Both China and Europe seem to be facing a domestic industrial slowdown brought about by rising uncertainty about trade prospects with the U.S. To us the big insight was that European businesses have stopped investing as the consensus over there was that President Trump would turn towards Europe with his tariff wars once he has finished with a China trade “Deal”.

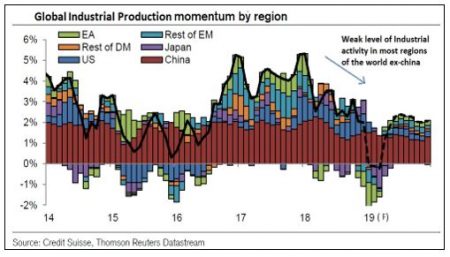

We can clearly see that in the falling momentum of industrial activity across the world (see the chart below showing monthly industrial production YOY growth). 4Q 2018 saw the weakest global IP reading in history, without a U.S. recession.

In Asia, we are well aware of the slowdown in China in the second half of 2018 brought about by tightening of domestic credit during a period of rising U.S.-China trade war rhetoric. But, looking at the chart above, it seems as if China was what held up global activity in the period, i.e. IP growth seems to have disappeared from the rest of the world.

Risks Are Morphing Into Uncertainty

One of our observations while attending a week full of presentations was the fact that the risks facing the investment world continue to remain the same (Brexit, U.S.-China relationship, Euro growth) but each of them seems to be heading nowhere in terms of clarity of outcome. When faced with conundrums it is sometimes useful to open a dictionary and get one’s head around what certain terminology means and that is exactly what we did. We looked up the difference between Risk and Uncertainty. This is what we gathered – “In Risk, you can predict the possibility of a future outcome while in Uncertainty you cannot predict the possibility of a future outcome. Risk can be managed while uncertainty is uncontrollable.”

And therein lies the challenge for investors in 2019. As we head into a period where solutions are being worked out for intractable problems, the best course of action would be to run a disciplined portfolio, ever aware of the risk from volatility, and for us to head back to our core philosophy – focus on visible cashflow and predictable growth.

U.S.-China Trade Wars

Turning our focus to Asia, for investors the biggest source of anxiety as well as optimism over the last year has been the ever-morphing contours of the U.S.-China trade negotiations. Consensus is slowly veering round to the view that we are most likely to get a deal in the near future, however watered down it be, as both Presidents Xi and Trump want to do one. But listening to experts debating the merits of various issues in the Hong Kong conference, we were struck by the vast gap between the two sides (U.S. and China) not just in terms of approach but also in terms of objectives. China wants to contain damage from U.S. trade policy while the Americans want to use the opportunity to change China. In terms of approach, Beijing is focussing on incrementalism while the policy makers in Washington want transformation of their relationship with China and how it opens up to the world. Given the chasm between the two, we see this issue becoming a thorn that will keep rearing its head and rattling markets well after the ink on the deal dries off.

China And Its Consumption Stimulus

Asian markets have rallied this year from beaten-down levels as optimism on growth bottoming out in China set in. We got more insights into how policy makers are managing the structural transformation taking place in China. Wizened by past experience of policy misfires, authorities clearly seem to want to continue deleveraging initiatives, but at the same time there is an attempt to ensure that credit flows back into the economy, especially to areas where there is a dearth, for instance private sector SME. To offset the property sector slowdown, there is an attempt to accelerate new infrastructure investments, some of which were on hold. But the biggest initiative announced is the “Rmb 2 trillion stimulus plan” which, unlike the one rolled out at the depths of the Global Financial Crisis in 2009, is now focussed on providing tax cuts and rebates to ensure that more money flows into the pockets of the consumers and boosts activity. This broadly fits with China’s macro-economic objective of rebalancing growth away from investment-driven over-capacity industries towards services and consumption.

From an investment perspective, in the near term, a return of confidence as fears of U.S. tariffs recede, at the same time as more money making its way into Chinese pockets, should result in a recovery of domestic demand momentum in China. But unlike in past cycles, lack of investment acceleration means that the impact on the rest of the world from a China recovery will be muted in this cycle. Talking to an Australian commodity mining company at the Hong Kong conference reinforced this view for us. They are seeing industrial profits in China getting squeezed but at the same time demand for their exports remain buoyant, with prices being traded off against volume.

Property in China is seeing a slowdown as saturation seems to be setting in but, as is always the case with China, there are positive and negative trends within that. Lower tier cities are facing a stalling of demand while areas in the periphery of the two new economic engines – “Greater Bay Area” and “Yangtze River Delta” – driven by the proliferation of new economy job creation are seeing a recovery in investment property demand. Given this outlook, we would have a cautious stance on a segment of the offshore bond market in Asia – Chinese property – where we are seeing a proliferation of bonds offering ever higher yields (from players having large tier three/four land banks).

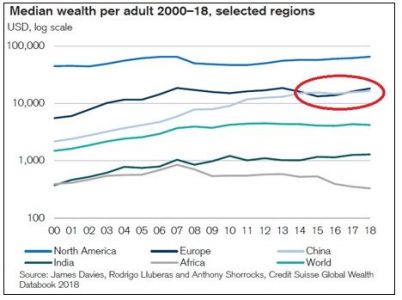

Sitting in a growth region with millions of people continually being pulled up the prosperity curve, people sometimes tend to miss inflexion points. We know that wealth creation in emerging markets, especially China, has been strong over the last two decades, but what caught our attention was a chart which showcased the fact that median wealth per adult in China is now in line with Europe. No wonder profits made by global luxury brands are now higher in Asia than in western regions.

But will this continue to be the case? We got insights on this from another presentation which highlighted the fact that after many years the popularity of foreign brands is falling for the first time and consumers in China increasingly prefer well-known local brands in many categories. Well why not? The best mobile phones in the marketplace currently seem to be mainly China brands (Huawei, Xiaomi, Oppo) and not just Samsung/ Apple.

New Paradigms

Conferences are not just about getting insights on the economy, looking for investment ideas and validating portfolio holdings; they sometimes give a glimpse of the exciting stuff the future holds. And we were exposed to a plethora of paradigms which may change the way we know the world.

Artificial Intelligence (AI) is one such area where China is buzzing with activity (from government to state owned enterprises to private start-ups). This is not a new trend but technology seems to have reached a stage of maturity where real world impact is visible. AI-based facial recognition accuracy is now at a stage where with 95% accuracy more than 1 billion data points of stored facial data can be searched within one second. That, combined with the rollout of 5G-mobile technology and instant mobile speed, is going to change the way all of us live. It is no longer about solving developed world challenges like finding autonomous driving solutions for the US$ 700bn U.S.-trucking industry which is facing a shortage of 200,000 drivers, but also about last mile Asian transport challenges. The innovations in AI are taking place in Asia, trying to improve the lives of Asian consumers. The U.S. with its Silicon Valley has about 12% of the global AI workforce, but entities in China employ 8.7% of globally qualified AI talent and not far behind is India hosting about 8.4% of global AI talent.

The other trend which has people with greying hairs completely flummoxed is the rising popularity of watching eSports (screens where live electronic games are played and stadiums full of spectators just watching and sometimes participating). Today there are an estimated 380m gamers who watch eSports and a majority of them are in Asia. No wonder eSports are going to be a medal sport in the next Asian games and potentially a new demonstration sport in the 2024 Olympic Games. That is obviously attracting the eyeballs of advertisers and sponsors; this is one of the fastest growing segments with current revenue of $266mn, which represents a mere 0.4% of the $65bn global sport-related sponsorship spending.

Where To Invest?

Asia always throws up new and interesting trends but we need to keep in mind the broad macro-environment under which we are investing, which increasingly seems to be reverting to one of low growth with low interest rates. Our return expectation needs to be tempered by this backdrop. A low rate environment always runs the risk of inflating a bubble (showing up as abnormal returns) but when the cost of capital is tending towards zero there is only so much excess return that can be generated by the financial market on that capital. Our job as investors is to keep an equally vigilant eye on return of capital as much as on return on capital, at the same time hunting for opportunities emerging due to growing Asian economies.

As we wrote in our monthly last month (Predictability Pays. Distraction Deceives), visibility and predictability are key traits for navigating environments like these.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.