Jamshed and I were in Indonesia in January attending the Nomura Indonesia conference and meeting numerous corporates. We had sixteen company meetings and a couple of macro meetings. Our broad observation is that Indonesia is at an interesting crossroads of opportunities. If it can take advantage of this opportunity, the country can raise its trend growth by 1-2 percentage points over the next ten years.

The Current Situation

Indonesia has some macro characteristics which are broadly unique to it.

- It is a fat margin economy: For a large growing economy, its competitive environment seems to be too benign. Though this statement carries the risk of over generalisation, some of the evidence is too stark to ignore. Indonesia has some industries where the margins are the fattest in the region. Industries like banking, cement and, to some extent, even consumers stand out. For example the average interest margin of the banking system is over 4%, with the larger banks having 8% margin. Most of the banks in Asia would struggle to reach even a 3% interest margin.

- It is an underinvested and under-levered economy: Indonesia has the lowest credit to GDP ratio in the region. The banks seem to have been too conservative and lent only to the highest return customers, hence the high margin but low volume of loans. This is a valuable un-fired bullet for Indonesia. As nominal interest rates come off, Indonesia has the leeway to lever up and create a virtuous investment cycle.

- It is caught in the high interest rates-high inflation cycle: Indonesia, like India, has historically been a high interest rate-high inflation economy. High interest rates tend to dissuade investments, which in turn curtails supply growth and keeps inflation high. This high inflation in turn keeps interest rates high. This negative cycle feeds on itself and many countries find it hard to break out of it.

- Dropping energy and capital costs are a huge opportunity: Indonesia (again like India), has this once-in-a-generation opportunity to break the negative cycle described above. A drop in energy prices and a drop in cost of capital has suddenly given Indonesia an opportunity to accelerate investments (and hence capacity) without worrying too much about inflation. This window of opportunity will not last for long but, if taken advantage of, can increase its trend GDP growth from the 3-5% range to a 5-7% range.

The Government Is Well Aware Of This And Hence Has A High Focus On Two Things

- Kick start an investment cycle with the aid of foreign investments initially but going forward sustained by domestic investments. There was a lot of talk about Japanese and Chinese money looking for large investment opportunities in Indonesia. Infrastructure seems to be a focus area. Also, the government is trying to stream line the regulatory requirement for large investment projects.

- Reduce the influence of vested interests: Indonesia continues to give the impression (rightly so) that a large part of the wealth is captured by a few (companies or groups of people). From the perspective of investors this is perversely not a bad situation in the short term, as long as one is co-investing with these interests. But the country pays a cost for this in terms of lower growth and a killing of the entrepreneurial “animal spirit”. The new government is trying to break this cosy situation. This will consequently create opportunities but will also increase the level of uncertainty. For us as investors, the aim is take advantage of these opportunities, while managing the uncertainty.

This Is A Growth Economy

Even without the breaking of the negative cycle of inflation and interest rates, Indonesia offers some of the best growth opportunities in Asia. There is a high level of under penetration for all kinds of businesses like automobiles, infrastructure, healthcare, modern retailing, property developers, financial services, agriculture and food products, etc. Hence growth can remain above regional averages for quite some time. The idea is to find good management and a benign competitive environment to take advantage of this.

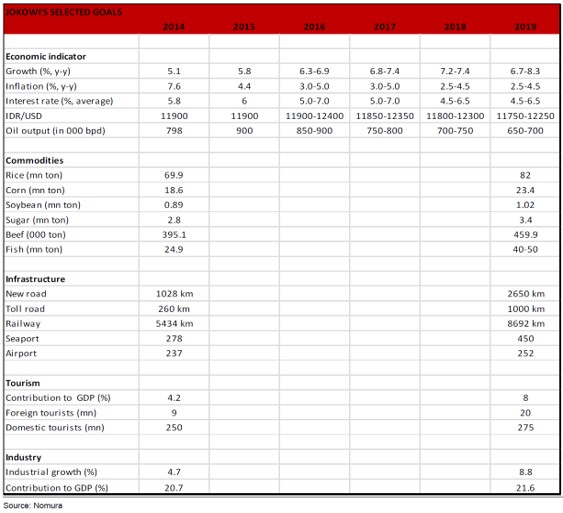

Jokowi’s medium term economic goals are:

These are ambitious goals and if achieved would create good opportunities for investors over the next five years.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.