Anchoring the Investment Mosaic

Global markets are showing diverging trends in terms of both economic growth and asset prices. The US, with its strong “sugar dose” from tax cuts and a one-time fiscal boost is showing very strong GDP growth numbers and market returns. On the other hand, markets and economies in the rest of the world are showing weakness. The synchronised recovery of last year has become sharply asynchronous this year. This has been amplified with a tightening interest rate cycle and a consequently strengthening dollar. This has led to a sharp sell-off in global (ex-US) assets.

In uncertain times like these it is sometimes better to look at history and facts rather than forward conjectures and doomsday extrapolations. We look at two key facts which are stark and tell their own story:

- Asia continues to be a region of growth with strong wealth creation and our universe of companies/ countries (primarily Asia ex-Japan) have gone through multiple such cycles and generated good returns. With current per capita numbers still quite low compared to developed world standards, there continues to be head room to maintain this growth trend for the foreseeable future.

- The valuation of assets in markets in Asia is now cheap relative to history for these markets.

We will elaborate on both these issues below. From an investment perspective the key point we make is that looking ahead, the potential long-term forward return expectation looks high enough for us to slowly consider increasing our overall portfolio net exposure. We had been maintaining a cautious approach due to high valuation in some parts of the market but with that changing, we see scope to revisit our thesis. While we recognize that short-term return could be volatile, it is at times like these that we need to focus on long-term trend lines and anchor on valuation without being swayed by headline-grabbing news flow.

Wealth Creation in Asia Marches Along

The last three decades have seen tremendous growth and wealth creation in Asia as economies in the region have embraced change and delivered prosperity. This backdrop has helped companies operating in these markets to grow and deliver significant wealth to their shareholders.

While Asia today is wealthier than at any time in recent memory, when compared to developed economies in the West there is still a lot of catching up to do as per capita income of various developing Asian economies are still only a fifth to a tenth of the levels observed in developed economies in the West or their peers in Asia.

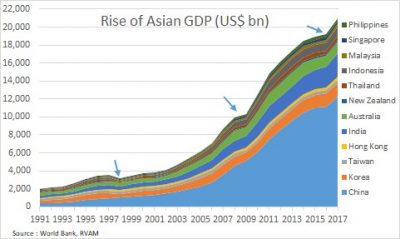

Strong growth in GDP over the long term: The chart shows the cumulative trend in Asian US$ GDP over the last 3 decades, with arrows showing periods of economic uncertainty. These episodes have been but blips in a long-term trend of rising prosperity, something a casual reader of the financial press may miss given the penchant to focus on near-term uncertainty and risk to the detriment of long term trends, which only get focus during good times.

Asia ex-Japan GDP has grown over tenfold in USD terms over the past 26 years (from USD 2 trln. to USD 21 trln.), a compounding of 9.5% p.a. This is a huge increase in economic activity. This is the underlying trend we are really playing.

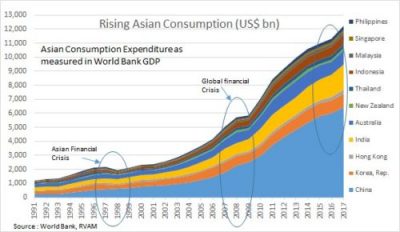

Driven strongly by consumption: With rising wealth we are seeing consumption trends in Asia continuing to rise across all economies. The region has faced significant headwinds over the past two decades – the Asian financial crisis in 1997 then the contagion from the global crisis in 2008. While these events created a lot of uncertainty at those points of time, in hindsight they were just blips in the secular trend of rising prosperity and consumption in Asian economies. As we ponder the impact of a new set of uncertainties today, it is worth reiterating the fact that the secular trend shown in the graph above is unlikely to change in the next decade as Asia catches up with the rest of the world in terms of wealth and prosperity, the underlying drivers of consumption. Consumption in Asia has grown from USD 1.2 trln. to 12.5 trln. from 1991 to 2017, a compounding of 9.4% p.a.

Markets Are Pricing in Uncertainty – Valuations Are Cheap

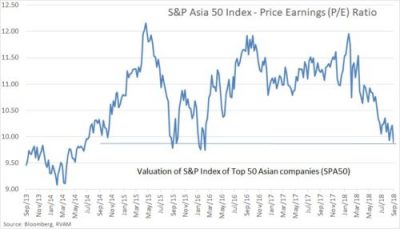

At the beginning of the year we talked about exuberance in parts of the market. As the year progressed with rising uncertainty and changing narratives, we have seen a significant market derating in Asia and, across a broad spectrum of asset classes, valuations have become reasonable. Below, we highlight two segments of the market that we operate in.

Despite stable earnings trends, Asian equity markets have trended down, pricing in uncertainty in the macro world. The chart shows valuation (P/E) of S&PA50 Index of the top 50 Asian (ex-Japan) names.

We have reached levels last seen in late 2015, a period dominated by concerns emanating from Chinese policy missteps. Astute investors will recall that investing in opportunities presented during that phase gave some of the best returns in the subsequent two years.

While aggregate valuations across equity markets are looking attractive, there are strong dispersions when we drill down into countries and sectors. US markets in aggregate look expensive when compared to other developed world markets, while in Asia valuations in India, Malaysia and Australia continue to be at the upper end of historic ranges.

On the other hand, markets like Korea, Hong Kong/ China, Taiwan, Indonesia and Singapore are at 10% of the trading range since 2010.

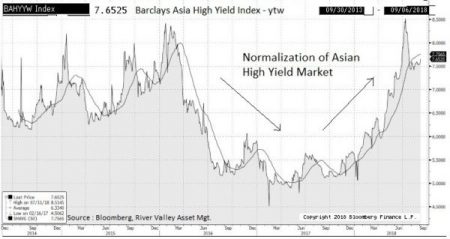

It is not just in the equity space; the Asian bond markets have also seen a correction as shown in the chart below, which plots the yield on the Barclays Asian High yield Index. We had been cautious on our bond portfolio allocations for the last year or so, given unattractive risk/return trade-offs. Now with the market yields being north of 7.5%, we are increasingly seeing opportunities to add back to our fixed income allocation.

Good Business Trading at an Attractive Price: Astra International

Each year brings with it its own challenges. This year has been no different. Next year will have its own. Stock markets’ gyrations between euphoria and despair is what creates opportunities for investors who can spot them and are patient enough to grab them. History is replete with instances of companies which have overcome challenging times and continued to grow. Asia has several of them and at every such moment in time the markets throws up enough opportunities that help investors grow their wealth.

One example of an opportunity which uncertainty brings to the table is Astra International, a Jardine group company, listed on the Jakarta Stock exchange. Astra is a quality business with a strong operating position, operating in an underpenetrated and growing market and generating a rising pool of cashflow, and is currently trading cheaply with valuation near all-time lows.

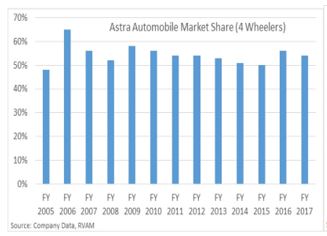

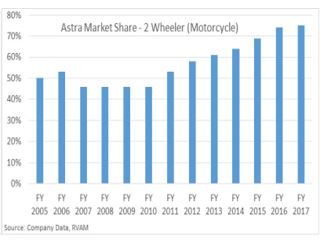

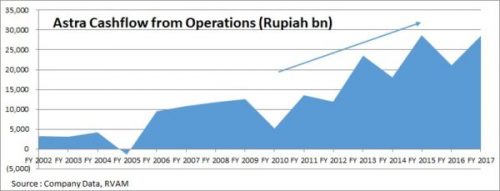

Astra International is the largest player in the automobile market in Indonesia, predominantly distributing Toyota and Daihatsu vehicles. Anybody who has travelled to Indonesia will be struck by the fact that every other vehicle on the road seems to be a Toyota. This is reflected in the strong market position that Astra has in the 4-wheeler market with a consistent market share of above 50% (chart below). In addition to selling sedans & SUV’s, Astra also has a 74% market share in 2-wheelers, distributing Honda scooters and motorcycles. It also gets involved in financing and manufacturing of these automobiles. Overall, 60-65% of its revenue comes from automobile-related activities. The remaining third of the revenue is linked to the construction and mining segment where its subsidiary United Tractors owns the distribution franchise for Komatsu, the largest player in the heavy equipment sector in the country with a 36% market share, more than twice its nearest competitor.

A dominant position in a growth business in a rising emerging market is reflected in the trend of rising cashflows from operations for Astra. Given the level of under-penetration in Indonesia, we expect this trend to continue for a long time to come.

As a large liquid stock, Astra is a good proxy for the Indonesian economy, especially the underpenetrated consumption sector which is a secular multi-year story as the country moves up the ranks to a middle-income economy. The underlying trends are secular and multi-year in nature. We have seen this play out country-by-country in Asia as economies develop, incomes rise and consumption grows to satisfy rising aspirations. Indonesia is behind China but ahead of India on various consumption parameters, but the paths being followed by each of them are similar and predictable. While trends are long term, market gyrations make stocks which benefit from these trends move in a more volatile range going from being expensive to cheap and vice-versa.

Looking at the valuation of Astra (see chart) we find one such anomaly, whereby a dominant business which is seeing cash flows grow secularly, driven by underlying trends is trading at historic low levels, providing a compelling long-term investment opportunity.

We have been looking to capitalize on this opportunity by building up positions in Astra in our investors’ portfolios.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.