The second half of 2021 is turning out to be a tough period for value biased portfolios because of a confluence of negative factors. Though we believe some of these factors are temporary and are likely good for the longer term, they have created a sharply negative short-term outcome.

Our investment construct has been one where we seek out strong businesses which are resilient, where we are conscious not to over-pay and which we intend to hold for the long term. Currently in our investment universe we see a large number of such companies where the valuations have become absurd. Companies with net cash at 20-50% of market cap, companies where dividend yields are larger than earnings multiples, companies with very strong market leadership and high ROE, trading at half of liquidation value, etc. This is a long-term investor’s goldmine. Our investment experience spanning multiple decades tells us one thing – the opportunity is the maximum when pain is the most and blood is on the streets. Today there is a lot of blood on the streets in some of our focus markets. The light at the end of the tunnel is the increasing view that global rates are moving up and the huge liquidity infusion is tapering off. This infusion has been going on (primarily in the western world) for the past ten years, but the time seems to be coming to pay up the bill for this party. The bill is in the form of sharply rising inflation and the end of easy money.

The China Reset

China, the biggest and most important market within Asia and Emerging Markets, has had the most extraordinary year in decades. The headline MSCI China index is down nearly 20% for the year (Asia ex-Japan is also down nearly 7% for the year). Much has unravelled there leading to a vicious bear market taking hold there for much of the year, but becoming particularly vicious post July. This is despite the country being least impacted by the pandemic.

This year, China’s regulators have come down like a ton of bricks on loosely regulated sectors. In their effort to put things right and in their zeal, they have over-extended their brief in some cases. This comes at a time when China’s economy was, even pre-pandemic, moving towards a lower growth rate.

China is using 2021 as the year to rectify three large structural negatives at the same time. This has created plenty of short-term uncertainty but is also creating a base for strong returns over the next 5-7 years.

These three structural resets are:

- Resetting the imbalance in the property market: This is an important sector with it contributing directly and indirectly to about 25% of the GDP. With sharp growth in the past few years in volume and price, an increase in leverage across the sector and an increase in speculative purchases, the sector was building up multiple sources of instability. The current reset through regulatory changes is potentially leading to a more stable future and giving great entry points in businesses that will survive. We feel the worst of this will play out in the next 3 months.

- Regulatory reset in the tech industry: The Chinese online tech sector has grown at a breakneck pace over the past 8-10 years. This has been in an environment of light regulatory oversight leading to a quasi-Wild West culture. Hence, a plethora of regulatory actions have been taken over the past one year (especially since the middle of this year). This includes better control over user data, sorting out the regulatory grey zone vis-a-vis the VIE structures used by Chinese ADRs listed in the U.S., reducing monopolistic practices, etc. This has again created weakening of near-term profits and increased uncertainty about the longer term, leading to a sharp drop in valuation. Stocks of companies like Alibaba could give over 50% returns even if they were to regain the lower end of their long-term valuation bands over the next 12 months. This is rational behaviour for markets which are confronting a high level of uncertainty, but this is also where the opportunity lies.

- The higher focus on social issues like, environment and inequality: This is probably the issue which will have the longest and most permanent impact. This includes actions like curtailment of fossil energy supply (though temporarily reversed because of sharp shortages), shutting down of energy inefficient capacities in base metals, cement, etc. On the inequality front it includes a push to control some social costs and reduce the burden on the middle class.

Positives building up: While the above structural re-set is happening, some strong positives are building up too

- China, through the pandemic, is showing a very strong external account balance with strong trade numbers and strong capital inflows too. Hence the Chinese Rmb is the best performing major currency in the world this year. While YTD the dollar appreciated by 9% against the Yen, 7% against the Euro and 3% against the GBP, it has depreciated by 2.3% against the Rmb. This is shows that the long-term confidence of the financial markets vis-à-vis China has remained strong.

- The government deficit has turned to surplus YTD in 2021. This is the strongest it has been since the mid-1980s. This, along with strong improvements in household and corporate savings, has taken total savings to a high of 46% of GDP, a near 2% jump over 2019. This is the opposite of what is happening in the G7 markets where overall borrowings have gone up to tide over the COVID-19 pain.

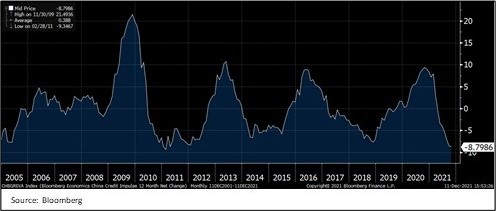

3. The Chinese liquidity cycle is turning. As seen from the credit impulse chart alongside, China has been aggressively tightening liquidity conditions for the past 12 months. The liquidity conditions are the tightest they have been in over 15 years. We expect this to reverse. Historically, this liquidity cycle has had a strong correlation with market returns. Again, this is the opposite of most markets globally. Everywhere the loosening cycle has bottomed out with some markets already having taken their first tightening steps.

4. The long-term story on China remains intact. Sometime in the second half of this decade, China will become the largest economy in the world. Even then, on a per capita basis, it will be only a third of U.S. numbers.

5. The Chinese economy is a lot more private enterprise driven than most of us recognise. This is counter to the new narrative on China giving up on private capitalism. It is a “56789 private enterprises economy”. This alludes to the fact that the private sector accounts for 50% of tax revenues, 60% of GDP, 70% of innovation and industrial upgrading, 80% of total employment and 90% of the total number of enterprises or businesses in China.

6. Valuation is very cheap. Across the board, there has been a strong sell off in Chinese stocks because of some of the above-mentioned negatives. Add to that a strong dose of geopolitical negative news, and all the “weak holders” have been shaken out.

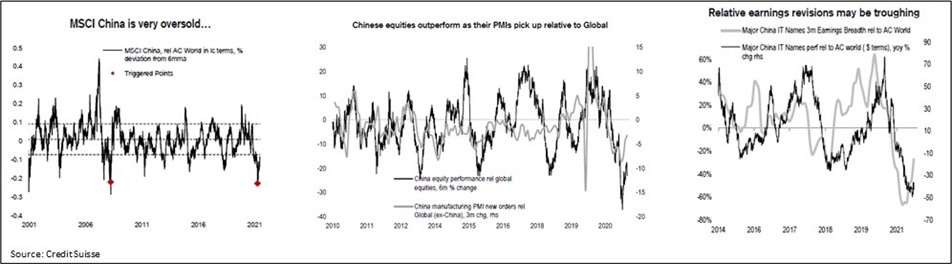

7. The short-term indicators are turning positive and the market looks very oversold.

Hence our advice to all investors is to have patience on China as it undergoes these structural corrections. In this market, patient investors are sitting on potentially outsized returns over the next few years.

The Valuation and Growth Conundrum

One clear fallout of the ultra-low cost of money has been a decimation of the conventional concept of valuation. An overwhelming majority of the market now seems valuation agnostic, where stocks are purchased on incremental improvement in performance metrics, valuation be damned. Consequently, the equity return over the past few years has been extraordinarily skewed in favour of growth – it does not matter if it is unsustainable growth, profitless growth, cash burning growth, etc. This is true in both the private space and the public space. The logic is simple: if the cost of money is cheap, I have very low cost of waiting for actual earnings and cash to show up.

Easy monetary conditions flowing from the U.S. Fed’s ultra-loose policies have led to a very different valuation dynamic taking hold and which have virtually banished fundamental accounting and traditional valuation methodology. With the reversal of the ultra-loose monetary policy, it would be interesting to see if the conventional valuation metrics make a comeback. Already, the frothiest end of markets has seen a sharp correction in the past few months.

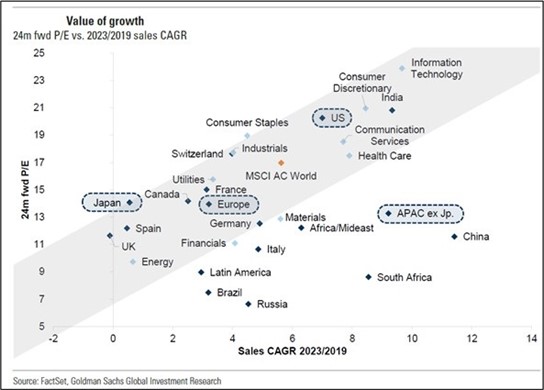

Also, slowing growth has been disproportionately punished. China is a prime example of that, where quarterly growth (for the factors mentioned above) has slowed down sharply and hence it has been disproportionately punished. As we expect growth to bottom in the next 3 months, we feel China will gain valuation tailwinds. Asean is in a similar boat, though for a different reason. As the one of the large economic blocks which has come out of COVID-19 the slowest, Asean will continue to see a re-opening re-acceleration in 2022.

The more important point is that over the slightly longer time horizon, China (and Asia) are still the best growth markets. As seen in the chart alongside, China has one of the highest expected earnings growths over the 2019-23 period and one of the lowest multiples (all Goldman Sachs data).

A good example of this is A-Living, a mid-sized property management services company owned by a mid-tier property developer in China. A-Living’s stock has been bludgeoned in the last six months like many others of its ilk to the point that today, the stock’s P/E is less than half of what it was while earnings have hardly been cut by the street through this period. Cash on the balance sheet at the end of CY21 will be ~ 40% of current market capitalisation. The forward cash generation is very strong with net cash expected to reach 70% of market cap in CY2023 and dividend yield at 5% in CY21 going to 8% by CY2023. Remember, this is not a property company; it is a property management company with steady long-term contracts, an asset-light model, good visibility on earnings over the next few years, etc. But the market will not differentiate in its current mood.

China’s stock market is replete with such stocks which have been sold off either because of acute risk aversion or because the investing style that has predominantly taken hold is to buy only stocks with positive earnings revisions in the next reporting period. Any other style or factor has been punished in the short- to medium-term.

Market Breadth Narrowing: Standing on Fewer and Fewer Legs

The other point to note here is the narrowness of returns; this is especially true of the U.S. market. The whole U.S. market has been extraordinarily propped up by just six stocks – the so called FAANGM i.e. Facebook, Amazon, Apple, Netflix, Google and Microsoft. The narrowness of the drivers of these markets is very stark. The weightage of these stocks in the S&P500 index has jumped from 7% at the end of 2012 to about 23% now. Historically, this kind of concentration has not been good for future returns. Also, over the last 7 years, the revenue growth for these stocks is over 200%, whereas the revenue growth of the rest of the 494 stocks in the S&P500 is only 28% – less than 4% per annum. A prime example of over dependence on a few stocks.

In the short term, the numbers are even starker. YTD, the NASDAQ index is up about 17%, but if you take out the top five stocks, the index is down 25%.

The broad point here is that the backward-looking obsession with the strong growth companies of the past is growing long in the tooth. The market is looking for new leadership just as returns are getting more and more concentrated only in the best of the growth stocks of the past. This is where we believe Asia including China could stand out and provide the new market leadership over the next 5-7 years.

Conclusion

The conclusion is ‘have patience.’ We have rarely seen such extreme aversion to markets/ themes as we see to China now, and historically, such times tend to beget high forward returns. In the meanwhile, the current rhetoric will all be compellingly negative and the pain will be high. Also, historic comparative returns will be so compellingly skewed in terms of the winners that the “why bother” label will be tagged on to the laggards. We believe these are all signs which are good for medium-term returns from here on.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.