The fizzing sound of gas leaving an inflated balloon has been getting louder across financial markets in the past six months. The party is coming to an inglorious end as a generation of investors learns, for the first time, that large portfolio drawdowns can happen even in a seemingly strong economy. This confirms the theory that the U.S. markets’ strong returns in the past twelve years was largely propped up by a huge and increasing dose of liquidity. All other positives finally seemed to lead to this one primary support. And now this support is reversing. Hence the sharp selloff being witnessed in the growth and frothier parts of the market.

The Sell Off Across Various Inflated Asset Classes

Readers who are not fully focused on financial markets might have missed out on the extent of the selloff that has happened in large swathes of the so-called ‘higher growth/ higher risk’ part of the investment world. The headline indices (though down a lot) do not reflect this. A few examples of this are:

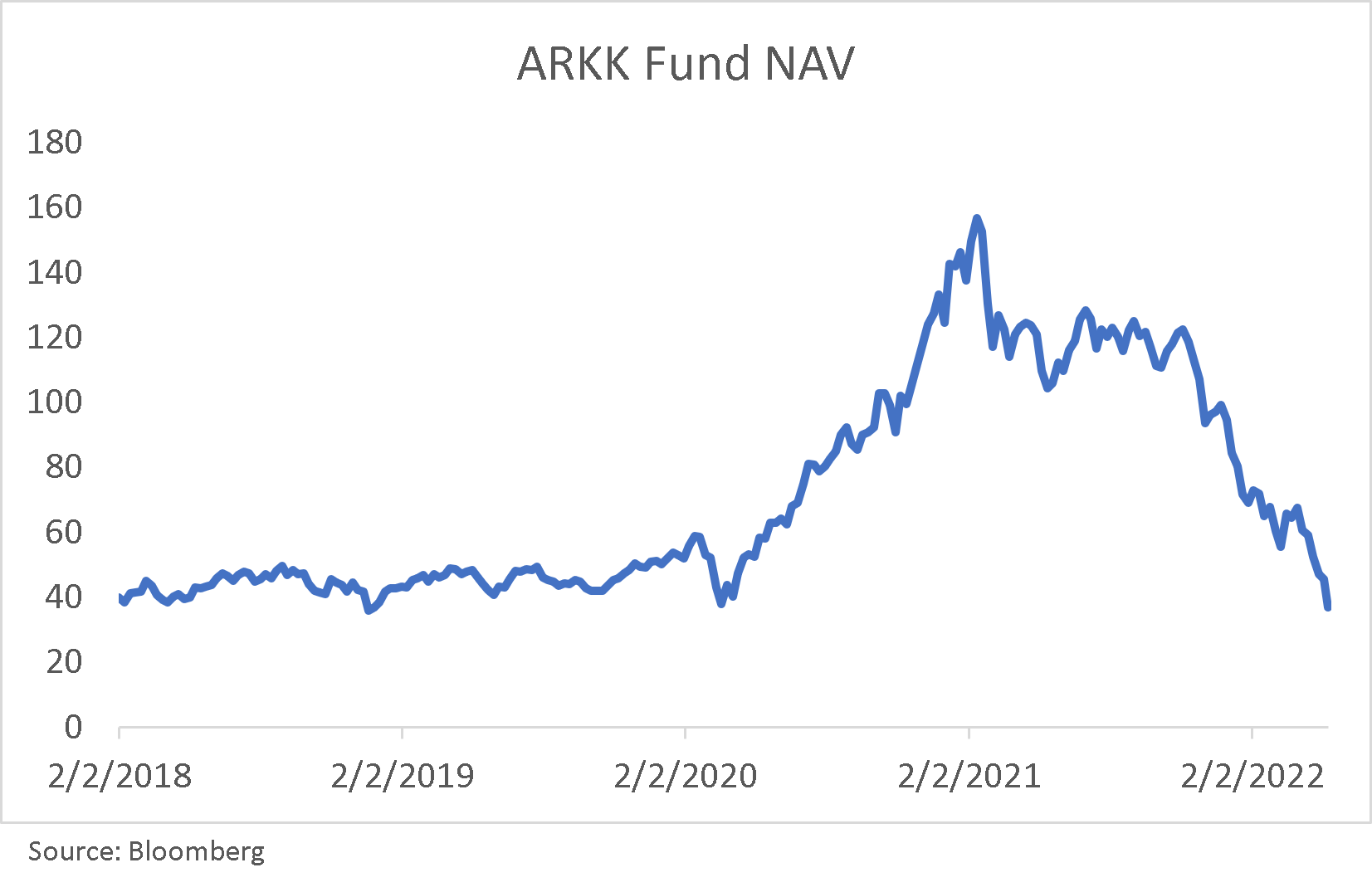

1. ARKK Fund (identified with its well-known manager Cathie Wood):

This was the poster child of thematic investing space (also defined as innovation stocks, profitless growth stocks, disruption stocks, etc). Our view on Cathie and her team is constructive in terms of how they look at their companies and we are impressed by their level of transparency. But investment also includes buying companies that are finally profitable and buying them at the right price. Here, the metrics being used became so unconventional and out of line with common sense that the risk of a large sell down became high. The NAV went up from about 40 in January 2018 to above 140 in early 2021 and is now in the mid-30s. As the bulk of the money came into the fund at an NAV over 65, the average ARKK shareholder has lost about 40-50%. Clearly, the story told is enticing but the numbers never added up. This did not matter till the party was on but became a disaster when the party ended.

ARKK’s investee companies include names like Tesla, Teledoc, Zoom, Roku, Coinbase, Block, Twilio, Unity Software, etc. All these companies are disruptors and have an exciting story. But the best money is often made by the “boring” stories. Most of these companies are not profitable and have business designs which are still evolving and are themselves easily disruptable.

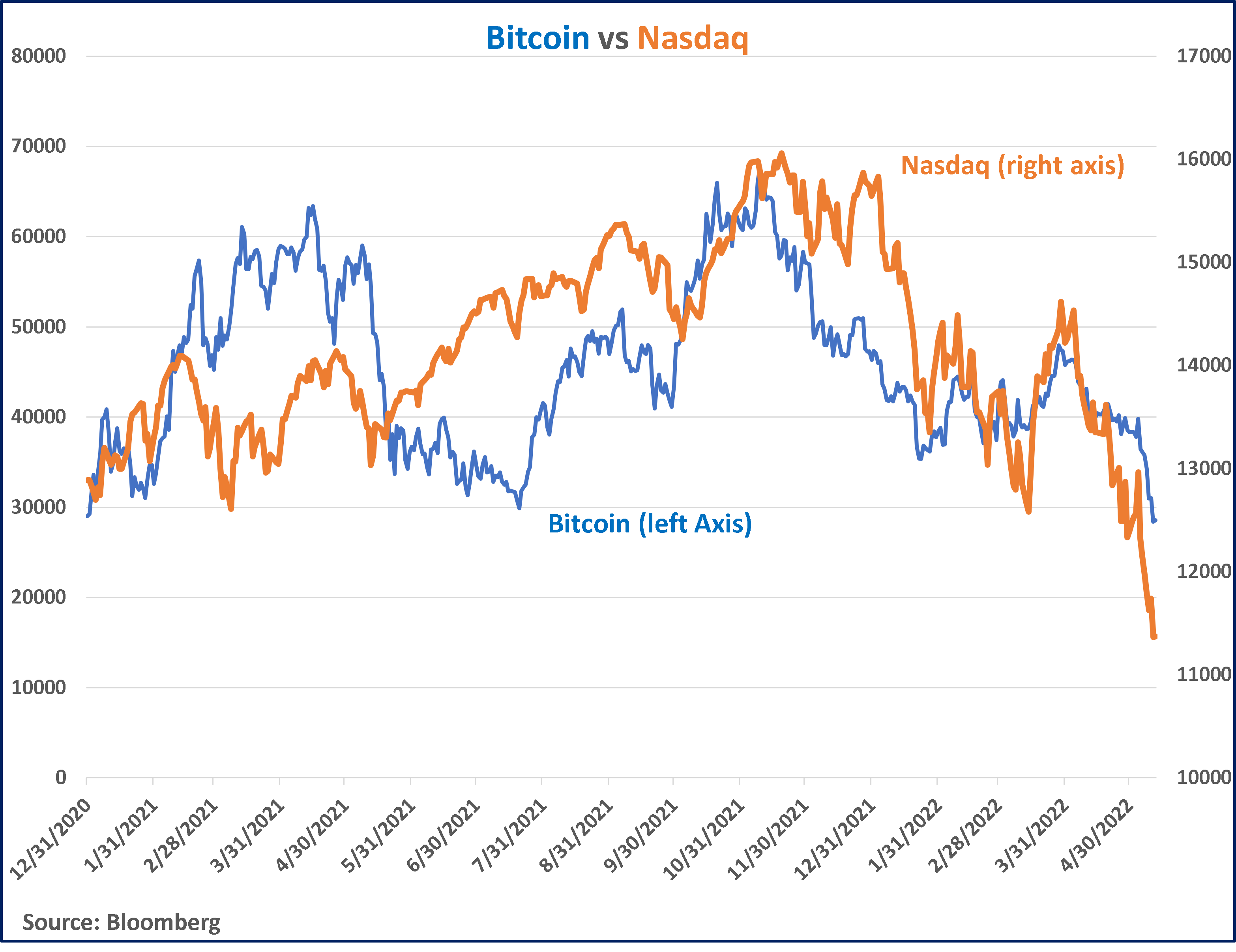

2. The Crypto space:

This is the universe which is also referred to as the “Defi” space i.e. Decentralised Finance. This is the financial world which offers financial instruments, without relying on intermediaries such as brokerages, exchanges or banks, by using smart contracts on a blockchain. This is a great concept and based on a (so far) tamper-proof and reliable technology. But once we get past that part of the story, the rest becomes hazy. The biggest grey area is the ability to value these assets. These assets, which are often compared to gold as a store of value, are too volatile to be considered as a reliable place to store your wealth or a place where one can create value. The best known of these is Bitcoin which has had a torrid twelve months and is down about 60% from the peak. Other names like Ethereum, Dogecoin, Shiba Inu, Solana, etc have lost a lot more. And as these prices go down, the systemic risks are much higher than the last time this universe had a similar drawdown, as a lot more money is now invested in these. The point here is that this was also a direct beneficiary of the loose money policy and the run up in speculative assets. In the past eighteen months the Nasdaq index and Bitcoin prices have tracked each other closely (though Bitcoin is a lot more volatile).

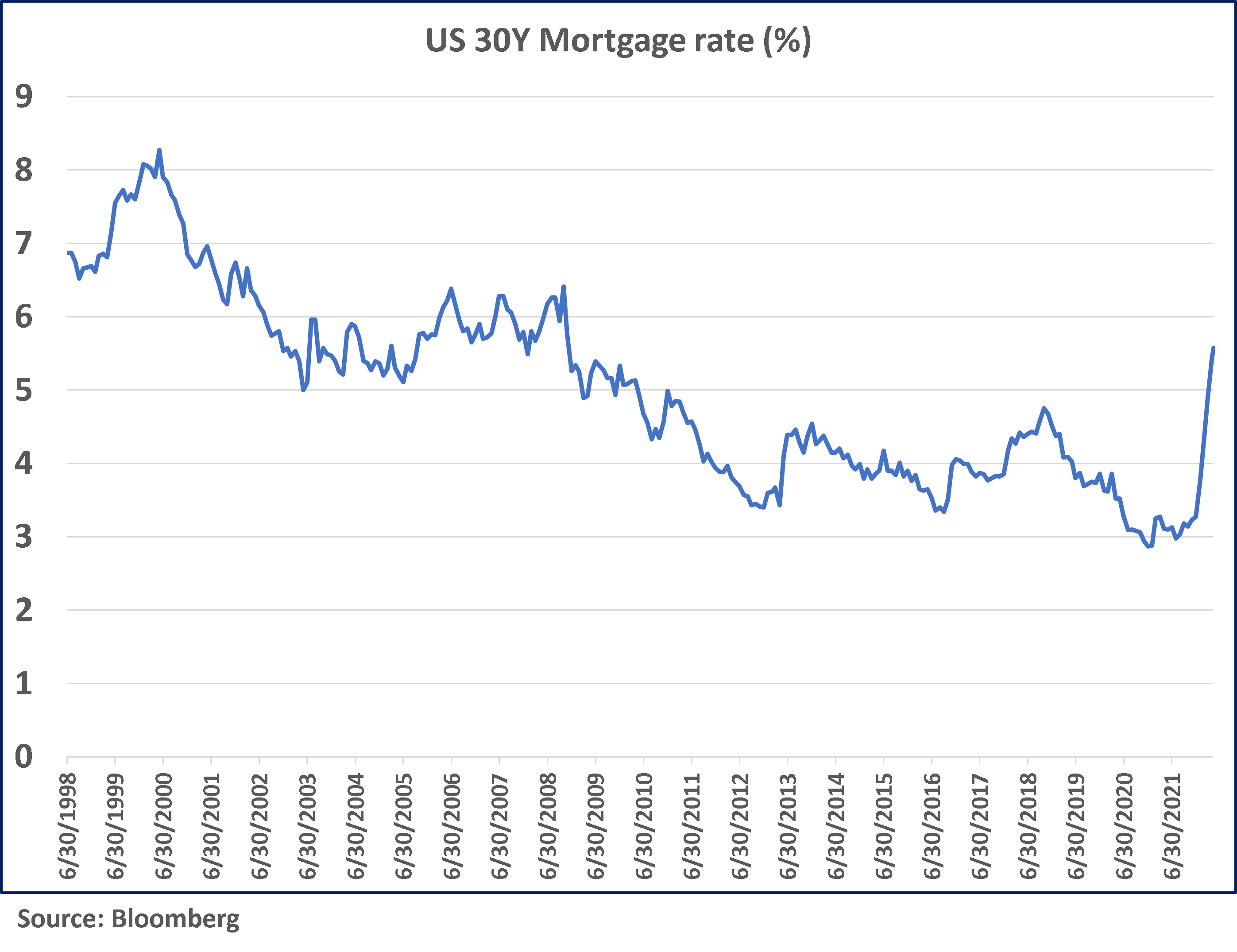

3. US Housing looking frothy:

This is the less talked about bubble but probably the most harmful if it bursts. The excesses are building up sharply and the drivers of these excesses are fast reversing. Because of the sharp drop off in mortgage rates and the increased cash from Covid government cheques, housing affordability had dramatically improved in 2020. A median salaried household of two had seen a dramatic increase in its ability to buy a house from a budget of USD 450,000 pre-Covid to over USD 600,000 by the end of 2021 – a whopping 33% increase. With the sharp rise in mortgage rates, that number has dropped sharply back to USD 469,000. But the mean new home price has jumped from about USD 380,000 to about UD 529,000 now. Thus, mean affordability has gone below mean price for the first time since 2005.

The mortgage rates are the real culprit and have gone up sharply by over 2.5% since November. The rates are back to where they were in 2008 before the crash. This is the primary cause of the sharp drop in affordability.

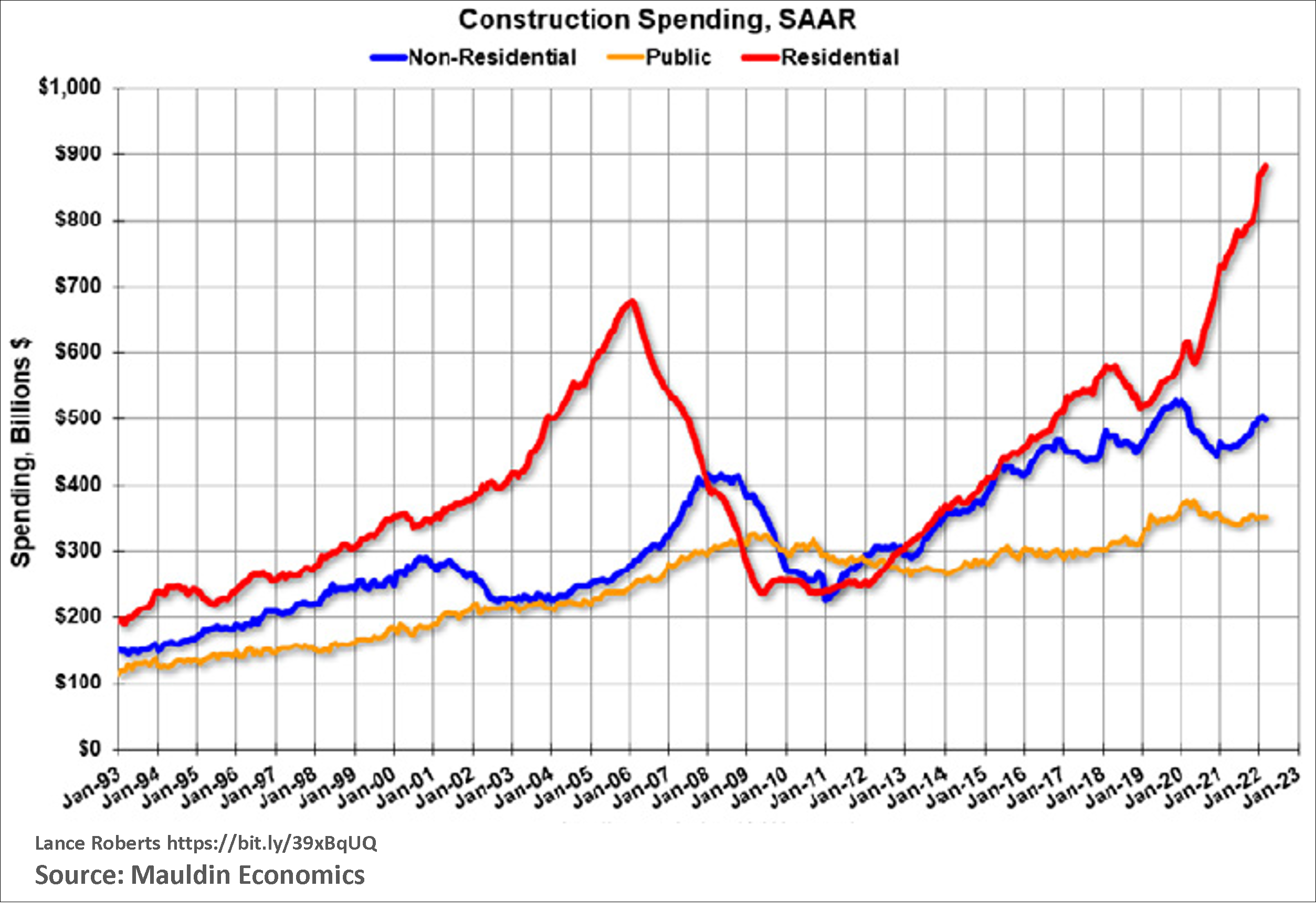

Add to this a sharp increase in future supply as average residential housing construction spend has jumped from less than USD 600 bln. per annum pre-Covid to about USD 900 bln. at the current run rate. Part of this is a pass through of cost increases but even the volume of future supply is going up.

Consequently, this is another asset class which looks very vulnerable to a sharp correction.

Rates And Liquidity Are Both Tightening – The Punch Bowl Is Being Taken Away

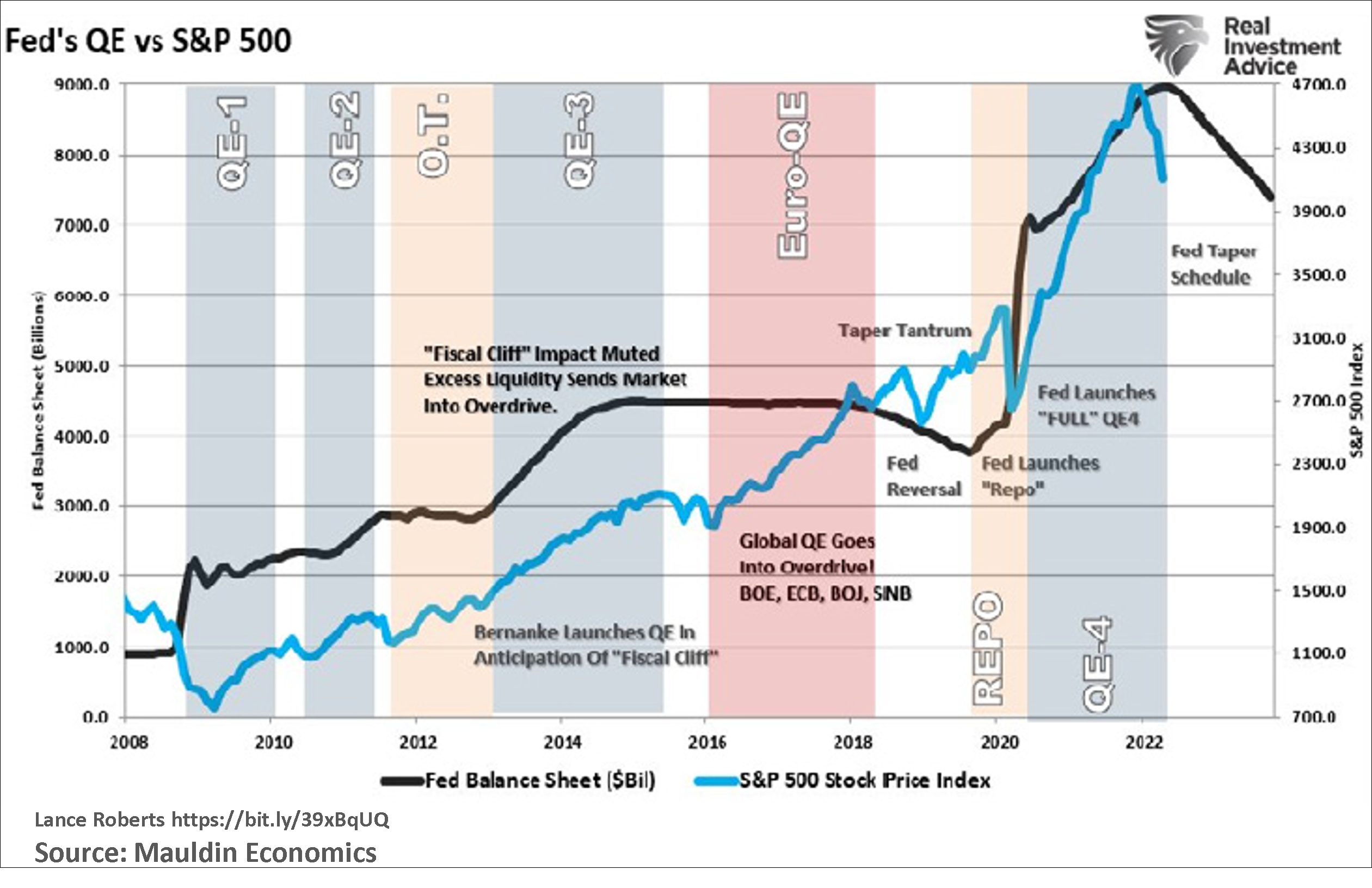

The primary source of the strong return across developed markets over the past ten years has been the strong infusion of liquidity by central banks in general and the U.S. FED in particular. This increase in availability of money has been accompanied by a rock bottom interest rate i.e. the cost of money. Both these are reversing. The cost of pumping in lots of near-free liquidity into the system usually is inflation. But the world avoided paying this cost due to factors like globalisation, sharply improving demographics in large countries like China and India, technology-led productivity improvement, etc. The first two factors are surely reversing now. Hence, inflation i.e. the cost of easy money is now truly entrenching itself. Hence, the liquidity cycle is leading to the selloff and re-pricing of assets.

The chart alongside shows how the FED’s balance sheet exploded from USD 4 trln. before Covid to USD 9 trln. now. This is QE 4. The FED has given a forward prediction of bringing it back to USD 7 trln. by end 2023 (still 75% higher than pre-Covid numbers) and that is what is scaring markets. This balance sheet unwind has an impact not only on asset prices but also on economic activity and corporate profits.

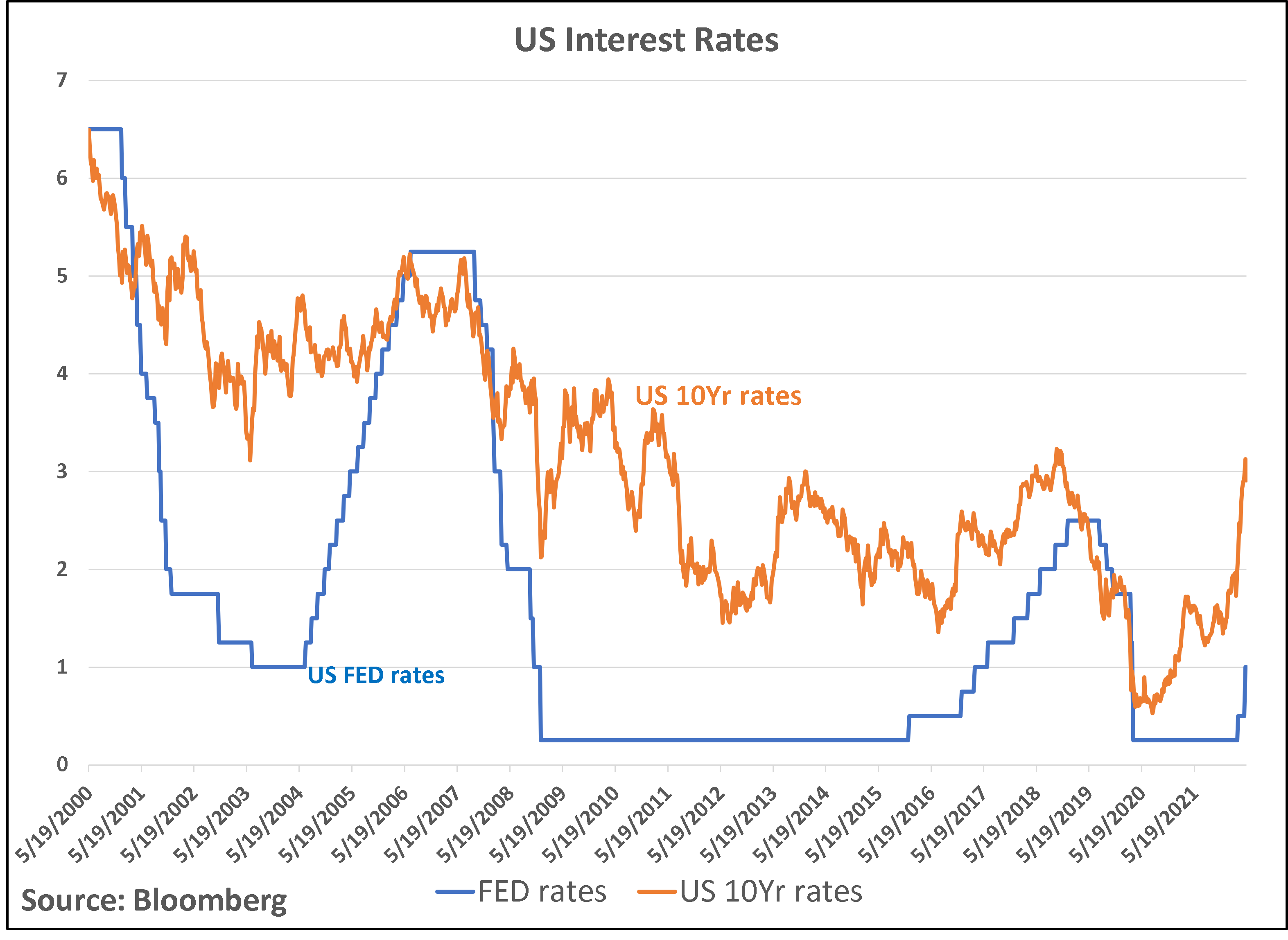

The chart alongside shows the current interest rates. The FED has indicated a target of over 2.5% for the FED rates in the next 6-12 months, which could further push up 10-year rates too. In short, if inflation persists, we are probably going to see interest rates we have not seen in over a decade.

Conclusion

The air is being let out of a lot of inflated asset prices and the fizzing sound is omnipresent and loud. As this happens, a large group of investors who have only seen up markets is going to add to uncertainty and systemic risks. The usual sources of vulnerabilities (like the banking system and corporates) are probably better prepared, but the weakest links could be from unexpected corners. Hence, get ready for a bumpy ride as we reset. Real value will be created, and new leadership will form. We are looking out for that and positioning ourselves for it.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.