Nearly half way into the year equity markets have charted a bullish course but the chatter in the marketplace is not as gung-ho as one would expect after such a strong rally. We have been attending a few conferences over the last few months and investors on average still sound cautious, worrying about the unknown risks. As we analyse the root cause of this disconnect, what strikes us is the narrowness of the current rally.

Equity markets are up nearly 20%

We started the year with trepidation on what the tectonic shifts emanating from the U.S. would mean for the Asia-Pacific region and for its growth outlook and what the impact of a de-globalizing world would be on export-oriented Asian economies. Five months into the year, Asian markets are up over 20% and economists are playing the game of upgrading numbers to catch up, while strategists worry about the risks that they could be missing out on. The rally in markets this year has been broad based with most markets (across emerging and developed) delivering similar US dollar returns.

Returns have been narrow

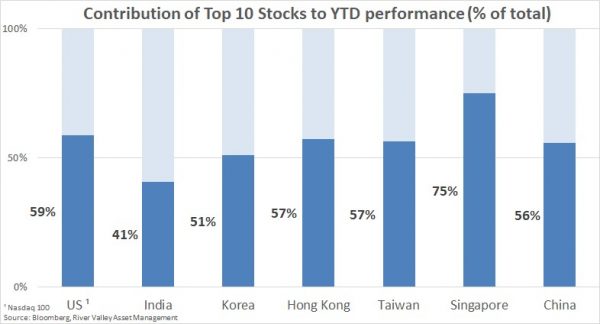

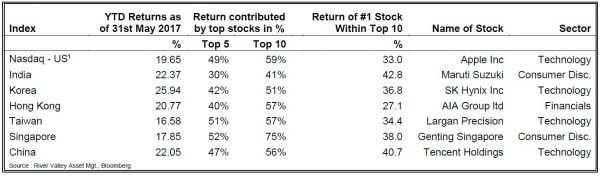

As we dig deeper into performance what strikes us is the concentration of returns across every major market and index. The chart below shows the contribution by the top ten stocks to the overall market performance across various markets. More than half the performance in every market is explained by a narrow set of companies.

The table below shows the year-to-date US dollar performance across markets. Returns in the 20% range are hallmarks of bull markets. However the returns delivered so far have been concentrated in a few sectors and stocks. Large cap indices have delivered a disproportionate part of the returns – a reflection of investors buying ETF’s to get market exposure. Secondly, most of the performance has been concentrated in a few sectors like technology and consumer discretionary. While some of these names have a strong story behind them, not all of them are delivering earnings and cashflow growth that could justify the moves and current valuation.

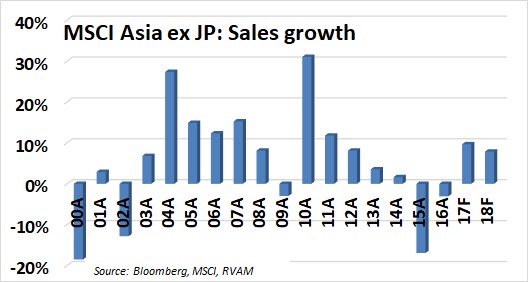

In Asia ex-Japan, after two years of declining sales growth, we are likely to see this recover in 2017 and sustain in 2018. But this growth will not be anywhere near as strong as we have been used to seeing in the past ten years as the region matures and reflects the anaemic economic growth we are experiencing globally.

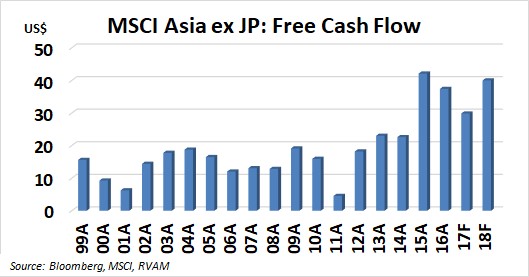

The market is increasingly focusing on cash flows

Free cash-flow generation continues to be strong. Our thesis of slower growth for longer seems to be playing out yet. Slower growth has led to strong free cash-flow generation for a few years now. We believe this is unlikely to change significantly unless we get rip-roaring growth back.

Markets have been paying attention to this intermittently over the last two years, with ‘dividend yield’ as a style outperforming for varying periods of time before surrendering to some other style.

More recently, we were pleasantly surprised at a Korean strategy presentation we attended to find that the focus was on reforms being enacted by the newly elected President, Moon Jae-in and on how the historically shareholder-unfriendly Korean chaebols are being pressured to return cash back to shareholders by raising dividends or buying back shares. While much has been written and said on this subject for a long time, little has transpired. We are seeing more urgings from the investment community to the Koreans to change their ways. Some of the optimism in the rally in Korea is driven by such a reckoning. Clearly, a change in their way of thinking could provide further large upside to the market.

The opportunities going forward

As we look into the future new themes are developing in Asia. The need to use surplus savings and utilize the excess industrial capacity is forcing the government in China to become aggressive with its OBOR (One Belt, One Road) overseas infrastructure investment program. At the same time, in ASEAN and South Asia economies are embarking on a new phase of development with infrastructure investment as its centrepiece. Thailand, Malaysia, Indonesia and the Philippines are all in various stages of developing their infrastructure. The scale of work required is humongous both individually and collectively. Stock picking opportunities could abound should these governments get the frameworks for implementation and the capital required in place.

To conclude, we see the region’s stock markets having rallied in strong double-digit terms this year and it does put us on alert that a correction could occur much as the night follows the day. However, given the narrowness of this performance we are mindful that there are plenty of investible opportunities that the markets have not sighted or fully priced yet. It seems we have got plenty of work to do yet!

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.