If share buybacks were an animal species, they would be found only in certain geographies. The U.S. would have the largest population, followed by a few other countries. The truth is that share buybacks as a financial tool to enhance total shareholder returns have been embraced whole-heartedly by only a few countries on the planet. In some countries, they are shrugged off as a capitalist financial engineering tool to prop share prices by the rich, in others they are met with scorn and derision by managements who believe that cash should not be squandered in buying pieces of paper but be used to build hard assets for the future, never mind that they do not pay off in the short term. In other countries, we think they do not have a strong view on the subject; so they pile up large amounts of cash on their balance sheets and then one day blow it up on an unrelated acquisition and/or pay crazy sums for it which could be a related party transaction, leaving shareholders tearing their hair out in despair and their share prices hurtling downwards.

While the U.S. has taken share buybacks to an extreme, in these times of ultra-low (or even negative) interest rates, there are other countries where share buybacks have not found much traction over the years although a few companies have made a go and accomplished some. India is one such country.

Local investors in India hardly ever care about dividends. What’s more, most would not even know the dividend yield of the stock that they own. In a country where the risk free rate has seldom dropped below 7%, peak tax rate is over 33% and dividends are taxed at 20% of profit, it is no wonder that dividend as a means to return cash has been inefficient.

More crucially, Indian managements, hung up as they are on growing their businesses, believe that cash is better in their hands rather than the hands of shareholders and hence not to be squandered away on western capital market notions, useless as they deem them to be.

However, now that the Government of India has decided to use share buybacks some months ago, investors have sat up and taken note. We did too, taken aback as we were, inured over years of semi-successful attempts at disinvestments of public sector shares on the stock market as a means of raising cash to balance the budget deficit.

Now, the Modi Government has been calling upon public sector companies that have been hoarding cash for years on their balance sheets, to buy back their own shares. The Government of India is an overwhelmingly majority shareholder (north of 65%) and also the biggest beneficiary of such an action. Simply put, these Public Sector Companies will buy back shares through the tender route at a fixed price from the market based on existing listing rules by the regulator SEBI.

This achieves several objectives, some obvious, in one swift stroke:

- Reduces share count and increases reported EPS (in most cases attributable to the buyback

alone) - Improves reported RoE as cash earns below par returns thus dragging down shareholder return

ratios - Reduces the risk of such companies misallocating cash to less profitable and low return

generative ventures through wrongly-timed, expensive expansions, making low return

acquisitions. Historic bad boys guilty of such acts were ONGC, OIL, SAIL, SCI, MTNL, BSNL - The Government of India can raise the cash directly from such companies without having to take

price risk while disinvesting its stock on the market and often pressuring the prices perversely

through its own action - Tax efficient for individuals and the company. Individuals will have to pay a 10% dividend

distribution tax when receiving dividends in excess of Rs. 1 mn each year. Companies themselves

pay 20% dividend distribution tax on their net profits while distributing dividends. Buybacks

would obviate both these. - Helps achieve the Government’s fiscal objectives without raising heckles.

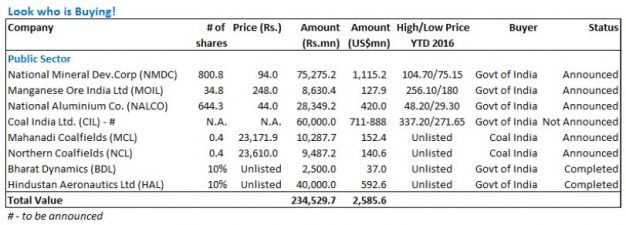

From the table below you will see that the Government of India will have succeeded in raising nearly Rs.235bn (~US$2.6bn). The Government aims to collect Rs.565bn (~ US$8.37bn) through disinvestment in PSUs in the next fiscal as per the Budget for 2016-17. Of the total budgeted proceeds, Rs.360bn (US$5.33bn) was estimated to come from minority stake sale in PSUs, and the remaining Rs.205bn (US$3.04bn) is projected to come from strategic sale in both profit and loss-making companies. Now with almost 40% of the target being achieved in a ‘painless’ fashion and rather swiftly and efficiently, this mode could be used more often and with great effect in future. Note that the market has taken this extremely well, noting the obvious benefits. The market is also cognizant that the Government has been generous about the price of the buyback, it being at the top end of the high/ low range of the stock price on an YTD basis.

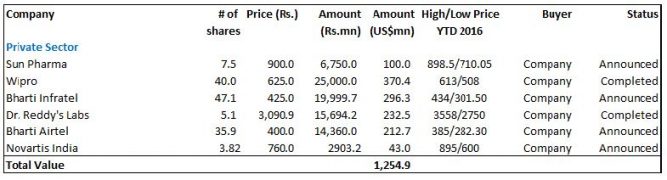

While the Government has emerged as the biggest purveyor of share buybacks this year, the private sector too has been making bold moves. Five of the largest companies in India have announced or completed share buybacks during the calendar year 2016 thus far totalling US$1.25bn. This may seem like small change by international standards but, when compared to the Indian capital market’s own history, these are very big numbers indeed. They are a great advertisement for other corporates to use this route in future as an effective tool to enhance shareholder returns, especially considering the punitive tax treatment that is meted out to companies in India.

It is easy to be cynical about the Government dipping its hands into the corporates cookie jars and the risk that it might even empty them leaving little to finance their future growth. It is therefore hoped that this Government, which has acted innovatively and smartly yet again, will not be overindulgent in this regard. It must be said here that post these buybacks, these companies will have enough cash left on their balance sheets to fund future growth.

The bigger takeaway for us is that hopefully, more listed private sector companies will take a leaf out of the Government’s book this time (sounds odd, doesn’t it?) and follow its example and that of their own brethren who have shown the way thus far, to conduct ever more share buybacks when warranted and return cash rightfully to shareholders and enhance their returns. Surely this can only be an added good for the BUY case for Indian equities.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.