We have been increasingly intrigued by a collection of companies across the world which we classify as growth monopolies. They are mostly in different verticals in the online services space and have disproportionately large market shares in their verticals (normally over 50%). These verticals include travel (Booking, MakeMyTrip, Ctrip, etc.), accommodation (AirBnB), ride share (Uber, Didi, Grab, Ola), delivery (Uber, DoorDash, Grab, Meituan, Zomato, etc). Most of these companies are still growing as the verticals continue to grow, have large user bases that can be monetized in other ways and most are increasingly a lot more focused on profitability compared to even three years ago. This is an exciting space for us. Hence, this write-up on Grab, which we feel will be one of these fast-growing profitable monopolies with deep moats.

Overview

Grab is a leading super-app in Southeast Asia (SEA), providing a comprehensive suite of services that is primarily focused on deliveries and mobility and also has a small but fast-growing digital finance business. Operating in over 500 cities across eight countries — Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam — Grab connects users with a wide range of essential services. These include on-demand and scheduled deliveries of food and groceries, ride-hailing through private cars, taxis, and motorcycles, as well as digital payment solutions, lending, insurance and wealth management.

Investment Summary

We remain positive on Grab as a leading play in the ride hailing and food delivery markets in SEA for the following reasons:

- SEA’s market opportunity due to its under penetration and fast growth;

- Grab’s very strong position at 55% market share. Consolidation among players in SEA’s Mobility/ Delivery market (few dominant players left);

- Grab’s increasing focus on profitability and margins;

- Potential value of Grab’s financial services business in the future;

- Grab’s competitive valuation compared to global peers and strong free cash growth going forward.

Investment Thesis

- Market Opportunity and Competitive Positioning in SEA

In terms of market opportunity, the potential total addressable market (TAM) for Grab’s Mobility and Delivery services can be valued at $375 bn. Of this, about 8% is online and Grab holds about 55% of this online market, i.e. 4.4% of the TAM. In terms of users, Grab is serving 6% of SEA’s population, in contrast to Uber’s 17% penetration in the U.S. However, with SEA’s economy expected to maintain solid growth at mid-single digits through 2030, we anticipate acceleration of the adoption of Grab, supported by the region’s economic expansion.

Grab has an even revenue spread across the five large markets in SEA, a unique position not replicated by any other player. This gives it a huge scale advantage. Also, its large presence in both Mobility and Delivery gives it cross selling benefits not available to any other player. Even globally, only Uber (Grab’s largest shareholder) has this advantage.

2. Consolidation in SEA Mobility/ Delivery Market will lead to better profitability

As the market leader with a commanding 55% market share across Mobility and Delivery, Grab benefits from strong network effects and economies of scale. It is also the only player with a region-wide presence (all six large economies in ASEAN) compared to other players which are focused primarily in one or two markets.

Grab operates in a highly competitive market that was initially characterized by aggressive consumer and merchant subsidies. The early players competed heavily on discounts to drive volumes and market share, but the landscape has since consolidated to a few dominant players.

If market consolidation continues, Grab’s dominance is likely to strengthen further. Given that Grab is 3x to 4x larger by GMV than its nearest competitor, it is well-positioned to gain additional market share and improve margins simultaneously, benefiting from network effects and scale advantages. GMV is the gross merchandise value, representing the sum of the total dollar value of transactions from Grab’s products and services, including any applicable taxes, tips, tolls, surcharges and fees, over the period of measurement.

We expect improvements in unit economics, driven by the introduction of higher-margin services and lower customer acquisition costs. In addition, we believe the lower operating cost from the prevalence of 2-wheelers in SEA will continue to support higher-than-peer margins (8.6% for GRAB Mobility vs 7.2% for UBER Mobility in FY23). We expect the bulk of the industry profit in 2025-26 to be made by Grab.

History of Grab’s growth, fund raise and, now, industry consolidation:

- DiDi and SoftBank Investment (2017): Grab secured a $2 bn investment from DiDi Chuxing (5% current holding) and SoftBank (10.7% current holding). This indicated that DiDi will not enter the SEA market to compete with Grab.

- Uber Acquisition (2018): Grab acquired Uber’s SEA operations in exchange for a 27.5% stake, removing a major competitor from the region. The current holding is 13.6% post dilution and listing.

- Trans-Cab Attempt (2023): Grab was set to acquire Singapore taxi operator Trans-Cab but the deal was blocked by the Competition and Consumer Commission of Singapore (CCCS), citing anti-competitive concerns.

- Gojek’s Market Exits and GoTo Merger: Gojek (only in Mobility) merged with Tokopedia (a top five e-commerce platform in SEA) in 2021 to form GoTo Group. However, Gojek exited Vietnam in 2023 and Thailand in 2021, focusing mostly on Indonesia and Singapore.

- FoodPanda trying to exit since 2023: Delivery Hero announced plans to sell its FoodPanda operations in SEA, with Grab rumoured as a potential buyer. By February 2024, Delivery Hero ended negotiations with a ‘particular buyer’. Hence, the SEA business of FoodPanda is now in a state of limbo.

- Market Share Gains: In 2023, Grab’s GMV grew 12% YoY, while competitors FoodPanda and Gojek saw declines of 12.9% and 10% YoY, respectively. Grab’s delivery business posted 19% GMV growth in 1Q24, taking market share from FoodPanda, which experienced a 5% decline in its Asia segment. In Mobility, Grab’s 27% YoY GMV growth in 1Q24 suggests it is capturing share from Gojek, which reported flat overall Gross Transaction Value (GTV).

- Other smaller ride-hailing companies in markets like Malaysia and Vietnam have exited or scaled back due to the dominance of Grab and Gojek.

3. Grab’s focus on Profitability

As competition eases, Grab aims to improve unit economics through higher-margin products and lower customer/ supplier acquisition costs. As mentioned above, Grab benefits from lower operating costs, especially with the prevalence of 2-wheelers in SEA, which supports higher margins. This advantage is not fully appreciated by the market.

- Incentive Management: Incentives as a percentage of GMV have steadily declined from 20% in 2019 to 7.6% in 2023. Consumer incentives are now focused on new users and product launches. While Mobility incentives have stabilized around 8%, Delivery still has room for improvement, with incentives at 10% of GMV in 2Q24.

- 2Q24 Margin Erosion: Grab’s push for affordable services, like saver rides, led to lower-than-expected Mobility EBITDA/GMV in 2Q24 (8.2% vis-à-vis 8.9% expected). However, this expansion broadens its total addressable market and is expected to drive long-term growth.

- Profitability Outlook: Grab’s group adjusted EBITDA for 2024 is expected to reach the top end of the $250-270 mn range, marking its first year of positive EBITDA. As per our estimates, it can even exceed this number. Adjusted free cash flow turned positive in 2Q24 ($36 mn) and management expects 2024 to be the first year of positive adjusted free cash flow. Additionally, management expects long-term delivery margins (EBITDA/GMV) to reach 4%+ by 2027. Mobility margins are expected to rise from 8.6% in FY23 to 9.3% by FY26.

- Advertising and Upside: As of 1Q24, the advertising business currently contributes 1.4% of GMV. There is ample room for improvement in advertiser penetration, as only 3% of merchants currently buy ads.

- Cost Management: Grab has outlined plans to decrease costs over time. It expects cost as a percentage of revenue to decline as the platform becomes more efficient in supporting users. S&M and G&A expenses are also expected to decrease as a percentage of revenue as Grab achieves scale.

- Financial Services: Grab’s financial services segment is on track to reach profitability by 2026. The company continues to expand its product offerings, including for its partner banks, and is working to improve overall profitability in this business line.

In summary, Grab’s strategic shift to profitability is driven by rationalized incentives, higher-margin products and its cost advantage in SEA. However, continued competitive pressure could force higher incentives and slower margin expansion, impacting valuation.

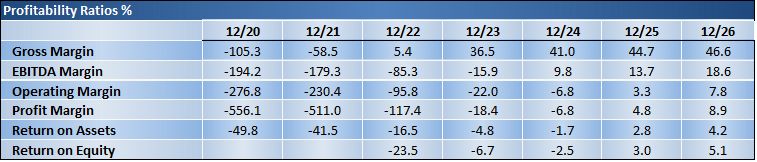

Consolidated company EBITDA margin (EBITDA/Sales) is expected to move from -16% in 2023 to +13.7% in 2025. The 2024 Q2, this was already -3.9%.

A comparison of margins with some of its peers show that in 2025 Uber and DoorDash will have much higher margins than Grab. We believe, given Grab’s high market share and weak competition, it could have margins near its best peers.

The company guides on EBITDA margin as defined by EBITDA/GMV. It is targeting a medium-term margin of 9-10% for Mobility and 4% for Delivery as defined above. We use these as our terminal assumptions.

Despite a reduction in incentives as a percentage of GMV, Grab’s Monthly Transacting Users (MTUs) have continued to grow steadily, increasing from 26.3 mn in 2018 to 35.5 mn in 2023, to 41 mn in Q2 204 with projections to reach 46 mn by 2026. Because of this fast growth and the COVID-related demand hum, GMV/MTU dropped in 2024 but will start inching up again from here.

4. Potential Value of Financial Services Business

We see banking services as synergistic to Grab’s on-demand offerings, helping lower payment processing fees and enhancing partner loyalty, which solidifies Grab’s competitive advantage. Its financial services business includes payment processing for its partners and lending to some of its mobility and delivery partners. Its complete insight into its cash flow gives Grab a deeper control over the risk it takes on its lending book. In addition, it has launched digital banks in Malayasia, Singapore (with Singtel) and Indonesia. In 2023, this segment contributed 8% of total revenue but was loss making, leaving some investors puzzled about Grab’s investment in the highly regulated banking sector. We assume this business to break even by 2026. These are the reasons we believe these investments make sense:

- Cost Synergies: Operating as a bank allows Grab to achieve cost synergies and grow cash flow without draining capital. Over 80% of GXS (Grab’s digibank) customers with active loans are linked to Grab’s ecosystem. Within two weeks of launching GX Bank in Malaysia, ~80% of depositors were existing Grab users.

- Enhanced Engagement: As seen in Uber’s case, multi-category services lead to higher user loyalty and spending. Grab’s multi-category users demonstrate increased retention and engagement, strengthening the supply side of its Mobility and Deliveries businesses.

- Larger Opportunity: The current demand for digital lending in SEA is estimated at $90 bn, surpassing the combined online Mobility and Deliveries markets, and is projected to grow to $300 bn by 2030 (CAGR >25%). Approximately 70% of Southeast Asians are unbanked or under-banked, with figures reaching nearly 80% in less developed countries like Vietnam and the Philippines.

While this business segment is currently modest, its future potential is significant, indicating a promising upside ahead.

5. Attractive Valuation

The company is going to be EBITDA positive in 2024. With flat capex and low capex intensity, the company will be sitting on increasing free cash flow from 2024. Revenue growth will be over 18% p.a. over the next three years (2024-27) and earnings growth much higher. With the company sitting on net cash of over 35% of market cap, this is a cash-rich, cash-generative growth stock.

Headline multiples on earnings look high but this is expected at a turn-around point for businesses like this. On EV/Revenue, it is again cheaper than the best peers like Uber or DoorDash, but growing much faster.

Summary

Grab’s strong market leadership, coupled with ongoing consolidation in SEA, positions it well to capture further market share and improve profitability in a fast-growing market. The company’s focus on reducing costs, optimizing incentives and expanding high-margin services supports its path toward sustainable earnings growth. Additionally, its growing financial services business adds long-term potential, enhancing its overall value proposition. With improving margins, solid growth prospects and an attractive valuation, Grab offers an interesting investment opportunity.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.