We live in a world of paradoxes, claimed a friend over a beer the other day. I agreed with him, but went further to add, that seldom do we in the stock markets not had paradoxes around us, just that they tended to vary in degree. He persisted that what we have today are extremes and he even used the word ‘distortions’ to make his point. I could not disagree much with that.

Back at my desk the next day I pondered over that conversation, musing about the distortions and how in a convoluted manner everything about our financial markets was connected and that ‘Main Street’ and Wall Street were joined at the hip. That the actions in financial markets touched the lives of millions who have no connection with it and yet are impacted in one way or another by its actions and gyrations.

Central Banks are today’s soft targets to explain away the ills that plague financial markets. With good reasons (and we will not get into those here), but we must admit that in a fundamental way, their actions are a starting point to several paradoxes and distortions we see abounding around us today.

Post the GFC, Central Banks in the key developed economies mostly and importantly, have adopted accommodative and aberrant monetary policies, employing quantitative easing and other means, to the point that we now have negative real rates in large parts of the developed economies.

The first and most direct outcome of such policies has been reflected in the massive rallies in bond markets and the corresponding decimation of sovereign bond yields, as liquidity flows out of central banks and into these markets. Things have come to head now where there is no yield left for investors in bonds.

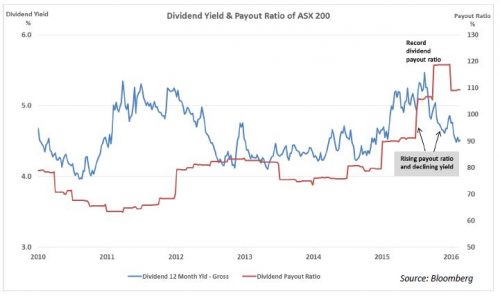

Where have investors turned to then? Equities, quite naturally. Income-repressed investors have shifted their attention first to those sectors/geographies where the corporate sector has traditionally sustained high dividend pay-outs to shareholders. Australia is a good example of this. Result: such countries’ equity markets/companies’ stock prices have been bid up, in many instances regardless of their medium term earnings outlook. Companies on their part have been raising distributions, cutting back on capex and keeping shareholders and markets happy.

What has that lead to? Lower capex, leading to lower demand for capital goods and services, which in turn drives growth lower. This forces employment cuts and lowers or stifles wage growth. Industrial companies are not building new factories so they do not need to employ more people to work in them. While not apparent in the short run, over longer periods, there has been a clear connection between investment and employment.

This in turn keeps a lid on inflation, which comes back full circle to Central Banks, who indulge in continuing with their ‘lower for longer’ interest rate policies in the hope of ‘inflating’ their economies.

This is where easy monetary policy has stopped working. All that Central Banks have succeeded doing thus far is achieving asset price inflation, but not creation of enough jobs. Meanwhile, companies are doing all they can to keep their shareholders happy and succeeding for the large part, but not policy makers.

It is a vicious circle that the world is caught up in from which there has been no escaping, thus far. Through this period, equity valuations have continued to rise. The recent re-rating has been counter-intuitive for many investors. It has not occurred against a backdrop of accelerating profits growth. It has in fact occurred in its absence, as investors search for yield.

The accompanying chart shows that in Australia, while dividend pay-outs have risen continuously since 2011, the yield has declined, quite sharply since the beginning of the current year.

We also recognize that dividends and share buybacks can be ‘engineered’ or held aloft higher and longer than is in the company’s own good in the long term. Companies can sustain high dividends in spite of their cash-flows not ‘covering’ them fully or being adequate, by dipping into cash reserves or borrowing. Eventually when this becomes apparent to the markets, the stock prices retreats taking back all those ill-gotten returns in one fell swoop.

For the past few months, we have therefore put every stock and bond we look at, including those in the portfolio, under the scanner to test for their cash flows and the sustainability of dividends. We also run three tests on companies before we even consider doing more work on them.

- Resist paying up for premium valuations. Post a prolonged re-rating of P/E ratios, some of the biggest outperformers today are now trading at their multi-year highs in terms of valuations. We would not chase these high-flyers. These are the cocktails for potential debacles once markets begin the journey towards normalisation. Difficult to time. But we are believers that history repeats.

- Buy companies whose cash-flows are growing or even flat-lining, but certainly not declining. It does not matter for now where this increase is coming from – even capex cuts will do. What is important is that it is being distributed back to shareholders.

- Buy growth stocks very selectively. In a world where growth is sparse and uneven anyway, companies where embedded growth expectations are high and which have low dividend yield support are prone to de-rating risk, when earnings fail to meet lofty expectations. No matter if it happens to be the bluest of blue-chips.

The current state of affairs may yet extend further in magnitude and time. But like all such excesses, we keep the faith in the mechanism of markets to correct the situation. So while we live through this period of distorted financial markets and asset classes, we remind ourselves that it ain’t over till the fat lady sings!

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.