Seldom does a day pass when you don’t read about that miserable word that’s meant to cause harm and inflict wounds on our financial well-being. The word that Central Bankers abhor, statesmen detest and economists are befuddled with.

Yes it is the ‘D’ word and it is no longer spoken in hushed tones these days. Deflation has been with the world for some time now. In more salubrious times, we even called it ‘disinflation’. What matters is how countries, industries and individual companies are dealing with it and learning to live with it. The manner in which they are doing so is indeed varied. And it is this aspect that we have chosen to highlight this month.

One of the chief drivers of declining prices has been the crash in the price of crude oil and hard commodities. Their deflationary effect has spread to engulf adjacent sectors that manufacture products such as consumer goods, capital goods, petrochemicals, packaging material, etc. Even the banking and financial services sector, which lends money to these primary industries as well as secondary ones, has now begun to feel the full blast of the deflationary wind, albeit with a lag. Hence, to illustrate our insight into “deflation” we are using the example of two companies – Deutsche Bank (representing the banking sector) and Fortescue Metals (representing the resources sector).

The “deflation survivors” and the “deflation deniers”

The Banks: Deutsche Bank

As we pore through scores of company reports and research on a regular basis, we came across two striking examples of companies and sectors which are dealing with the Deflation Monster in diametrically opposite manners.

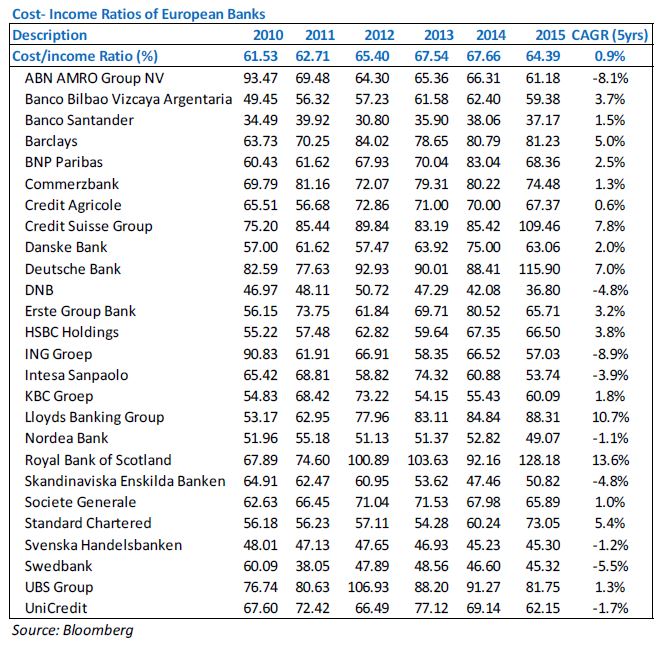

A month ago, European banks and their balance sheets came under the scanner leading up to a massive sell-off in their stock prices. Questions arose about their solvency and whether there was a ‘big bank’ going bust somewhere soon, bringing the spectre of another GFC upon us. So we decided to take a look at one of the banks on the European Block that has done precious little to set its house in order, in terms of defending its profitability in the face of rising costs of doing business and declining revenue streams.

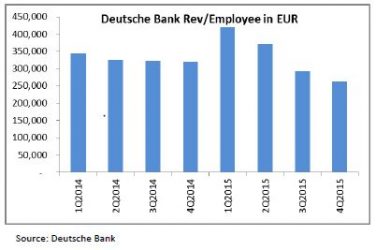

Deutsche Bank has been a shining example of a monolithic institution in denial of the changing environment and the world. Since the end of the Global Financial Crises, the bank has barely grown its revenues.

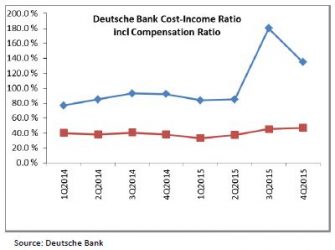

It has been waiting for an ephemeral revenue recovery for the past six years while its total costs have risen to over 100% of revenue. Even if so called “one off” costs are excluded, this banks runs at a cost/income ratio of over 80% – for good banks this should be about 50%.

The reason is simple: while total costs have gone up because of non-controllable factors like regulation, compliance, higher capital requirement, fines for past misdemeanours, etc., the controllable costs (i.e. employee costs) have also kept inching up. Deutsche Bank’s employee cost itself is about 50% of revenue. This is where the crux of the problem is.

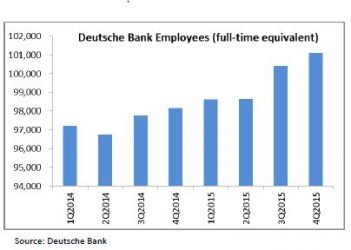

There has been practically zero reduction in the unit cost of their largest cost item, employee cost. As will be shown later, this is in stark contrast to the unit cost reduction in the material sector and that too at a much faster pace. Consequently, Deutsche Bank’s net profit has collapsed from Eur3.38bn at the end of 2013 to Eur1.5bn in 2015.

As these numbers bear out, one of the chief items of cost that banks have control over is the employee cost. It can either slash headcount or cut absolute pay. Deutsche has done neither if the numbers are to be believed.

Run an eye over the list of European Banks in the Appendix and you will find the story of Deutsche repeating itself more or less. Which leads us to believe that Banks have done precious little to lower their cost base in response to the dramatic change in the lending environment and a world of negative interest rates. Banks have limited their cost cutting primarily to closing down businesses or selling them. But this leads to a loss in revenue too. True cost cutting happens only when costs are cut without much of a cut in revenue. And banks can do this only if there is a genuine reduction in per head employee cost. There is a totally different discussion required to understand why banks do not do that.

The Commodity Complex: Fortescue Metals

Now let us fly over to the other side of the globe and into the other hemisphere to reach Down Under in Australia. You will find there a company as belligerent as you can find anywhere on the planet. Fortescue Metals Group (FMG) has shown how a company that operates in the iron ore mining sector can overcome, and indeed thrive, against all odds of collapsing prices and falling demand.

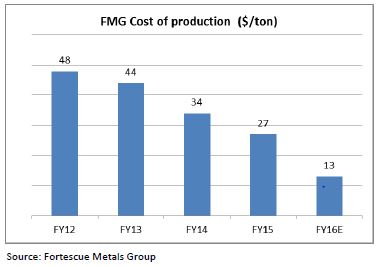

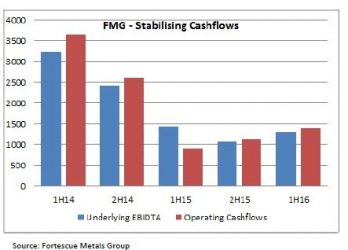

FMG has demonstrated that by cutting costs in pace with ASP drops, it is possible to not just stay profitable but to generate free cash flows. Yes, in absolute terms profits have declined, as one would expect.

However, what is truly commendable is the alacrity with which it has cut its cost base in response to the decline in the price of its key product, iron ore.

While iron ore prices have dropped by more than 70% from the peak, direct cost of production for FMG has also dropped by nearly 70%. Even including fixed cost, the drop in unit costs is a very commendable 50%. Consequently FMG continues to make a respectable cash profit even after the gut wrenching drop in ASPs. How many companies in the world can maintain profitability after a drop of more than 70% in ASPs and that too over a period of less than four years?

We find this dynamic also in the other commodity big boys such as BHP and Rio, in some coal miners in Indonesia, etc. Despite the collapse in prices, these companies have managed to remain profitable and deliver free cash flows and pay dividends to shareholders.

The commodity world is under maximum duress currently and it is refreshing to encounter a few companies which have succeeded in weathering this period through sheer effort and tenacity rather than just wait for the environment to bail them out.

Conclusion

As investors, it is these kinds of companies that grab our attention these days. They know how to deal with a deflationary environment. And have the management strength and balance sheet to weather a tougher environment. We know that the survivors who come out of these times are going to be very profitable and built-to-last companies.

Appendix

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.