Inflation has been front and centre of news headlines and investment debates for much of the year. And not without good reason as we all know. One of the consequences of this inflationary period for the global economy has been its direct impact on certain industries that have been caught squarely in its wake. These industries have had little time or warning to react to this surge in inflation. One such industry has been the consumer staples sector. We restrict our focus to companies predominantly in Asia in this newsletter.

This sector produces day-to-day items of food and beverage consumption, from biscuits and cookies, to snack food, noodles, cooking oil, ready-mix teas/ coffees and soft drinks, among many others. Companies engaged in manufacturing such products have been hit by the nearly vertical rise in a short period of time of a variety of raw materials, from commodities like wheat flour, palm oil, milk, sugar to packaging materials like PET, PVC, LLDPE, etc. Companies in this sector that possess strong brands with market leading positions generally grow through sheer volumes and a modicum of price growth which is correlated to inflation in those economies.

As prices of their raw materials rose, these companies’ cost structures were disrupted overnight and in ways they had never experienced or prepared for in decades. Clearly, the weaker ones floundered while the stronger ones took the most obvious route of raising prices in huge doses to protect their profit margins as much as they could without hurting demand or losing competitiveness. Clearly, also, there has been consumer pushback and dismay during this period. However, this has not been an easy fix for these companies. Many of them carry inventories of raw materials and finished goods of anywhere between a few weeks to a few months. As it typically happens, there are mismatches in the time between making price increases across a portfolio and hundreds of SKUs and the raw material costs which come first.

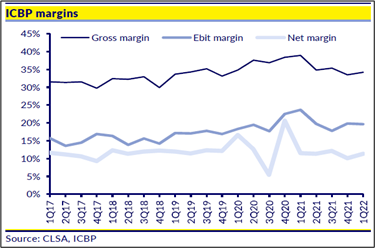

The consequence of this tug-of war is the immediate impact on gross margins of such consumer staples companies. The first hit began to be felt somewhere at the turn of 2021-22 and, in many cases, worsened as 2022 progressed. Companies in Asia began seeing their quarterly gross and operating margins tank, often by as much as 500bps or more from their normalised levels. Even after exercising acute cost cuts on promotions and other fixed costs, the bottom lines of such companies have taken a severe beating. Investors have been quick to dump these stocks in the first half of the year as analysts began to chop their estimates hard and fast.

We have now come to a point where several of these commodities, mostly the agricultural variety and even some petrochemical based, have already registered sharp declines off their first half peaks. Some of the supply side issues that caused them to spike have abated and are likely to remain stable from here. The global economic slowdown taking hold is also likely to ease demand pressures as also the shipping-related freight prices and bottlenecks at ports. All these changes are net incrementally positive for such raw materials and hence for consumer staples companies in the future.

Stock prices of companies in the sector across Asia appear to have hit their troughs and are beginning to recover some of their lost poise. Amidst this carnage are some bluest of blue-chip companies, which have among the strongest and best-known brand portfolios that consumers swear by today and have done so for decades. These are the typical FMCG companies with brands as moats. What is more, their balance sheets are generally fortress-like, generating copious free cash flows and which have continued paying steady dividends.

One such company we thought is worth a mention is Indofood CBP in Indonesia. Indofood CBP, or ICBP as it is often called, is among Indonesia’s and Asia’s pre-eminent consumer staples companies.

Indofood CBP (ICBP)

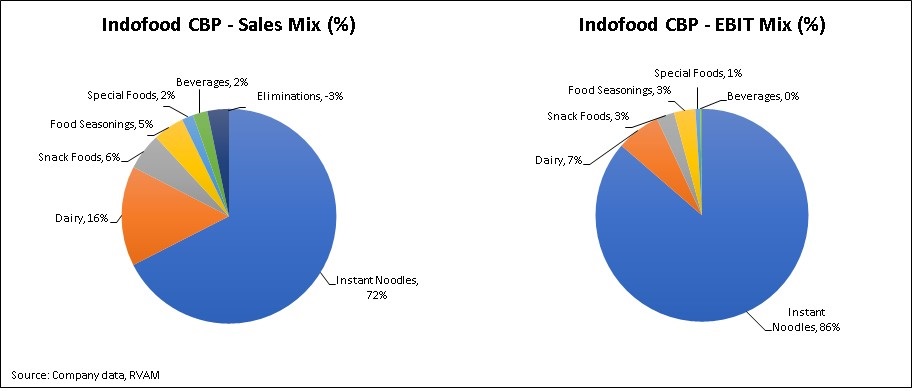

Indofood CBP (ICBP) is one of the leading FMCG companies in Indonesia. In 2009, it was established as a separate entity from its parent company, Indofood Sukses Makmur (INDF). ICBP’s main business divisions are instant noodles, dairy, snack foods, food seasonings, nutrition & special foods, and beverages.

The company is owned by the Salim Group, one of Indonesia’s largest business groups. The Indofood group is well integrated and operates in food categories that lend well to their large and efficient distribution. For e.g., Bogasari Ltd., owned by parent INDF, is Indonesia’s largest flour mill and supplies flour to ICBP for its noodles.

Market Dominance In Instant Noodles In Indonesia And Africa

ICBP rules the roost in instant noodles in Indonesia, enjoying a 70% market share. It has gained market share continuously over the last ten years. Its Indomie brand of instant noodles is a household name. Indonesia is the second largest consumer of noodles in the world after China, yet has per capita consumption lower than that of other Asian countries like Malaysia and Vietnam. The market itself has fewer than twenty organized players and several small players in the unorganized sector who are mostly regional.

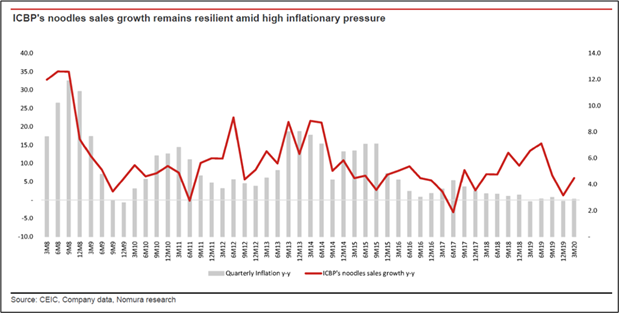

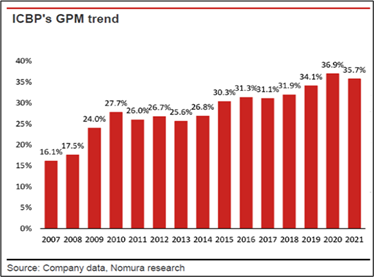

ICBP enjoys huge pricing power which the company has exercised responsibly over the past decade, growing the business mostly in volume terms and some price increases to grow at or around mid to high single digits. This is captured in not just the stability of the sales and its growth through inflationary periods but also the gross profit margins that ICBP is able to crank out, rain or shine.

Its low cost of operations, arising from scale efficiencies and integration with the group for key raw materials like flour and palm oil, and dominant market share give it ample room to contain S&P costs unlike other consumer staples companies operating in highly competitive fragmented categories.

ICBP also enjoys one of the top three positions in other categories it operates in but, owing to its smaller scale, its profitability remains lower than instant noodles but healthy versus competition. These categories provide huge potential to grow in the future as they are still in their growth phase. The noodle business accounts for 85% of operating profits today.

Acquisition Of Pinehill

ICBP acquired Pinehill Company, which was 51%-controlled by Salim Group in a related party transaction in 2020. The deal gave ICBP c.56.5% operating interest in Pinehill’s four subsidiaries, which are involved in manufacturing and distribution of Indomie brand instant noodles in Saudi Arabia, Nigeria, Turkey, Egypt, Kenya, Morocco and Serbia. Pinehill owns 59% in three of the companies and 49% in Dufil (Nigeria). The acquisition cost was US$3bn, of which ~ 70% was paid upfront and the balance in April 2022.

Saudi Arabia and Egypt accounted for ~ 85% of the revenues of Pinehill. At the time of acquisition, Pinehill had twelve instant noodles manufacturing facilities in eight countries, with a total production capacity of 10 billion packs and distribution networks in thirty three countries/ territories (including Dufil). Pinehill taps into a total population of more than 550mn people and has access to growth in instant noodles in a region with a population larger than that of Indonesia. These countries in Africa are significantly under-penetrated and developed as far as consumption of noodles is concerned and where often pasta or breads are the staple. However, noodles are fast gaining popularity and the group itself, given its dominant market shares, holds the mantle to develop this market further and partake in its growth in future.

ICBP estimated Indonesia’s instant noodles consumption per capita (CPC) at approximately 78 packs per person per year in 2019. The CPC for Egypt and Saudi Arabia stood at only 10.8 and 8.5 packs per person per year. For the other countries, the figure is still below 5 packs per person per year, e.g. Turkey 2.6 packs per person per year. The expectation is that the Middle Eastern and African markets will follow a similar growth trajectory as seen in Indonesia over the next ten years. Once again, given the dominant market shares (75-95%) in these countries, Pinehill enjoys a huge moat-like position with high profitability, pricing power and partners who have been operating in these geographies for many decades. These markets are also under-developed in terms of product innovations such as cup noodles, wider range of flavourings, etc., all of which will likely be replicated by ICBP over time.

Pinehill contributed to 27% of total ICBP noodles sales in CY21, the first full year of operations since it was acquired. Pinehill’s margins are higher than ICBP’s Indonesia noodles margins, but these are not provided separately today. Pinehill’s pricing power can be gauged from the fact that it has passed on double-digit price increases, grown solidly through the pandemic and demonstrated how dominating that business has proved to be.

The acquisition of Pinehill has, in one fell swoop, added a big long-term growth pillar to the company. Pinehill is currently growing faster than the Indonesia business, and its profitability is superior as well. Hence, in future, not only revenue growth but also profit growth will be faster than prior to the acquisition.

Raw Material Cost Inflation Issues

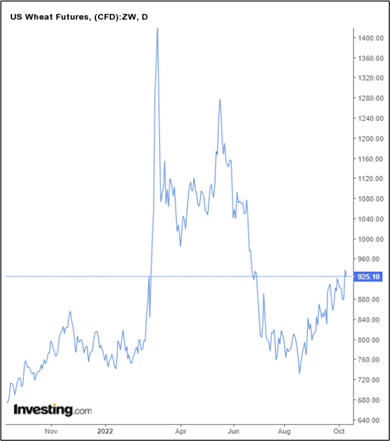

Over the last one year, global commodity price inflation has impacted ICBP as well, mainly in the form of wheat and palm oil prices. Both these account for roughly 35% of COGS. The weak profitability in Q2CY22 is in stark contrast to the strong sales growth of 17.5% yoy driven by domestic (+12% yoy) and Pinehill (+32% yoy). The GPM contracted 540bps yoy and 480bps qoq, driven by (1) higher wheat and CPO prices, and (2) seasonally lower volumes, which further accentuated the decline. Much of the price corrections that have happened will likely reflect into numbers with a three-to-six-month lag as we have seen both commodities’ prices declining in the last few months.

We expect the lower CPO price to directly benefit margins in 3Q22, while wheat could take some time as Bogasari needs to run down its existing inventories before reflecting lower wheat prices. The supply chain is much shorter for CPO as ICBP does not import the product, while wheat is at least a 3-4 months’ supply chain. As such, margins are expected to improve sequentially in 3Q22, and further in 4Q22 and revert to reach close to normalised earnings in CY23, barring any further unexpected supply disruption driven RM price spikes.

While the market is aware of the same and the stock bounced off its lows, we believe that the true earnings power and heft of the group are yet under-appreciated by the market. We also note that over the last two years, the stock has been penalised through a de-rating of its PE ratio, for the large debt it carries today post the Pinehill acquisition. ICBP’s Net Debt/Equity will likely rise to ~72% in CY22 since it made the final payment for Pinehill this year. This is likely to be the peak debt for the company. ICBP is likely to generate FCF of ~IDR7.5trn over the next two years i.e., a FCF yield of c.7.2%. After maintaining an average pay-out ratio of ~40%, the Net Debt/Equity will likely decline rapidly to ~35% in the next two years. We believe that this alone could be a significant value driver for the stock.

Accounting Issues Impart Volatility To Reported Earnings

One thing to bear in mind while reading ICBPs accounts is that since the Pinehill acquisition was funded by US$ debt, the MTM value of this debt is passed through the P&L and the forex gains/losses impact the reported numbers. Hence, it is important to strip these out before arriving at the adjusted net profits of the company.

What Is The Growth Algorithm For ICBP?

- ICBP will exit the hyper-inflationary environment in 2HCY22 partially, but CY23 ought to reflect the full year benefit of all the price increases taken during CY21-22 and the benefit of declining wheat and palm oil prices. Even assuming these commodities have a price reversionary increase later in 2023, ICBP ought to see EBIT margins expanding higher from the 19-20% it sustains today as the sales mix enriches with higher share from Pinehill too.

- On a longer-term basis, we would model for the Indonesian sales to grow in mid to high single digits, driven higher more by non-noodles growth. We would expect Pinehill to continue to grow revenues in mid-teens over the next few years owing to under-penetration of the category, greater potential for innovation and price increases in those markets. Upside surprises are possible here.

- On a blended basis, given the increasing share of Pinehill profits in the business, a steady increase in EBIT margins (~30-50bps) per annum is very likely. This ought to drive a 15-20% growth in net profits sustainably for ICBP in this period.

What Does It Mean For Shareholder Returns?

ICBP now trades on a CY23E of ~13x. The Price/Sales ratio of 1.5x, an RoE of 20% and a dividend yield of ~4% do no justice to the true strength and value of this gorilla-like consumer company. We reckon that the market seeks some more evidence of a recovery in sales growth after the string of price hikes forced on the market. Arguably, the market may take some time to absorb these and consumption may have tapered at the margin. However, from experience with staples like noodles, consumer demand tends to adjust quicker. Hence ICBP’s return to normalised growth in sales and profits ought to be faster and smoother. While we also do not make a case for the stock going back to trade in the high 20s in P/E terms, a reversion back to 18-20x could see the stock rise by between 40-50% in the next 12-18 month period.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.