As regular investors would know, we usually spend the early part of the year travelling, kicking the tyres, sniffing out opportunities, getting comfortable with our investment views and watching out for lurking risks. January 2019 took us to Indonesia where we attended a conference, met up with companies, heard the local take on politics and got a feel for the investment landscape in this emerging and dynamic economy at the heart of ASEAN. The time was well spent but we came back wondering how long it is going to take Indonesia to deliver on its full potential.

Jakarta at this time of the year is nice and pleasant and traffic was not too onerous. We had two full days of back-to-back company meetings in addition to listening to political pundits pontificating on the implication of the impending elections. While there were diverging views, nobody expected a significant change in direction after the elections. Consensus was veering round to the view that the economy should start looking up in the second half of the year, once the dust settles. There were a few cautionary risks mentioned, for instance an unexpected upset or a slip towards populism, though they were dismissed as quickly as they were raised. The economy seems to be chugging along at a steady pace and the improving global environment is providing reasons for optimism to corporates who are all directly impacted by exchange rate fluctuations of the currency.

Politics to the Forefront

With elections a couple of months down the road (April 17th), it was not a surprise that all the discussions centred on a pre-/post-election outlook. There were companies geared towards consumption which were trying to gauge how much they would benefit from a pre-election spending spree while others were trying to estimate the post-election recovery and the changes if any to the policy environment.

To us there were two big takeaways: a) the fact that Indonesia has matured significantly as a democracy; and b) the view that the elections results seem to be a foregone conclusion (with incumbent president Jokowi consistently in the lead), unless a last-minute surprise springs up. Despite the factional trade-offs and societal divides which come to the fore in any country going into elections (and Indonesia is no different), what struck us was that electoral debates were focussed around economic issues like jobs, income and growth, and not around social fault lines. The opposition (Prabowo) is using economic shortcomings and the government’s inability to deliver on sky high expectations from the last elections, while the incumbent has cobbled together a formidable social coalition which encompasses extreme diversity to ensure broad-based support for his reformist agenda and his re-election.

From an investors’ perspective the question that is foremost on everybody’s mind is whether Jokowi (if he returns) will use the mandate of his second (and last) term, with an eye on legacy, to accelerate and deliver on some of the reforms which could not be taken up in the first term or would his multi-interest coalition bog him down. Having delivered on economic stabilization and infrastructure boost in the first term, an acceleration of economic activity in Indonesia over the next five years may depend on decisive steps to provide comfort to both domestic and foreign investors on safety and transparency, with a firm turn-away from nationalistic policies that dominated the last five years of decision making.

Fundamentals Look Well-Anchored

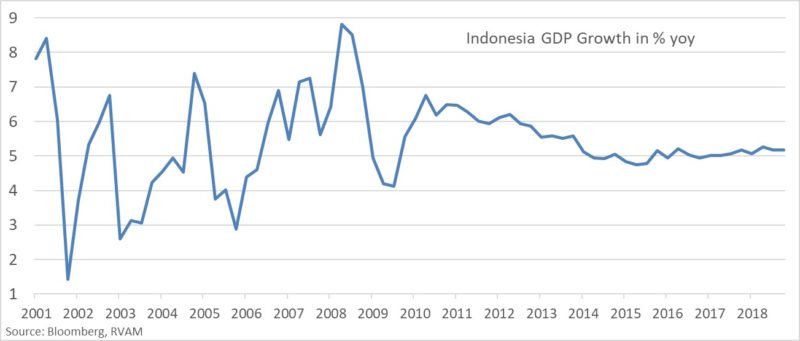

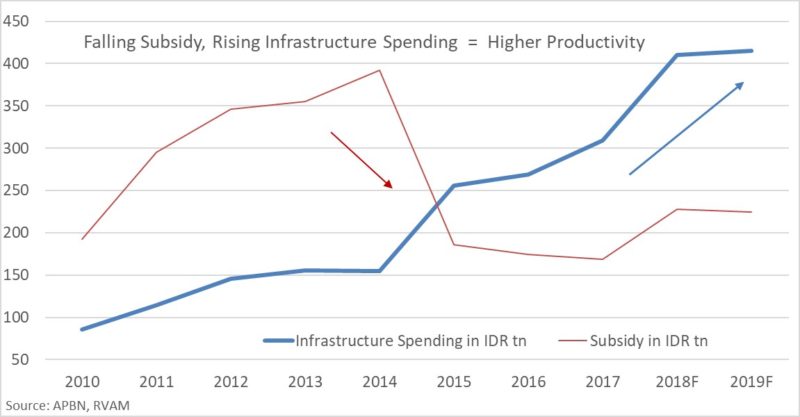

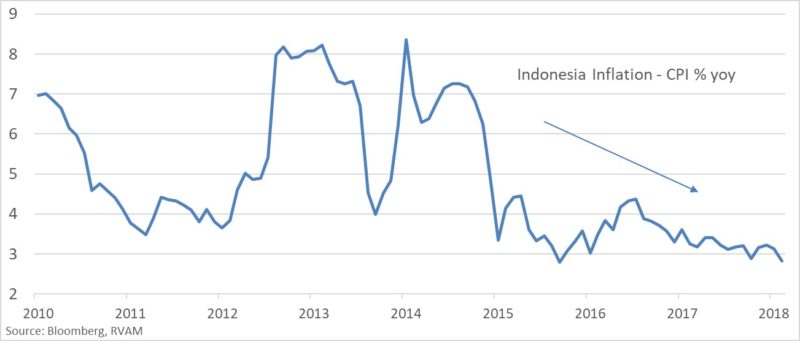

Election season gave us a good reason to look at how the economy has performed over the last five years. For an economy that has historically seen volatility in economic activity, GDP growth has been remarkably steady at around 5% while inflation has come down structurally as the government has delivered on subsidy cutbacks. This has negatively impacted domestic consumption (resulting in weak top line growth for many corporates) and corporate investments, offset by rising infrastructure investments. The government seems to have delivered on infrastructure which has helped keep growth on an even keel and should structurally underpin the upgrade of Indonesian growth potential in the long run.

For as long as we can remember, most regular visitors to Indonesia come back with stories of infrastructure deficit and how difficult it has been to get projects moving off the ground. Given its history, the government seems to have performed remarkably well in getting many of its 223 national strategic projects off the ground with the first set of projects getting delivered in 2019. We saw many examples of works on the ground, starting from the airport terminal to metro rail pillars and toll road works to get confidence that the second round of projects due for completion by 2022 would most likely be delivered. The message was reinforced when we heard corporates across sectors discussing how they were incorporating the impact of new infrastructure on their future business plans.

From a macroeconomic perspective, with low inflation, low aggregate levels of debt and steady improvement in infrastructure, Indonesia seems well poised to accelerate its growth trajectory in the coming year. We wrote about these dynamics in our August 2018 monthly. Our on-the-ground visit reinforced the thesis.

The External Situation is Key to Confidence

While the domestic outlook seems stable, not surprisingly every corporate that we met highlighted global uncertainty as the biggest risk. The specific worries varied from outlook for US interest rates to the impact of the China slowdown to volatility of the Indonesian exchange rate. 2018 witnessed significant uncertainty on the external front in Indonesia as capital outflows driven by rising US interest rates increased currency volatility (and depreciation), reminding market participants of the “Fragile Five” days of 2013-14. The swift response of the central bank – raising interest rates pre-emptively (by +175bp) in the second half of 2018 -seems to have helped stabilize the situation as is reflected in the strengthening of the Indonesian Rupiah in January 2019.

Given that Exchange rate was a factor which has deeply impacted economic fortunes in Indonesia historically, we were surprised by how easily corporates had dealt with the exchange rate volatility observed in the second half of 2018. Retailers and consumer companies seemed to have passed the cost impact onto consumers without impacting margins, while volumes have been steady. The rise in interest rates on the other hand has dampened activity in sectors like property. A benign global rate regime going forward could provide the Indonesian central bank the ability to moderate its tightening stance, especially as consumer prices are well behaved (chart on the right) and real rates continue to be high in Indonesia.

China and its Role

Indonesia, despite its robust domestic economy, is impacted by what happens in China through various channels. The first and direct impact is through China being the biggest market for commodity exports out of the country. The second (and hotly debated) impact is through benefits flowing from investments under the Belt and Road initiative promoted by China. The third impact, one of the surprise findings of our trip, is the role played by the Chinese private sector in driving investments and participating in business ventures in Indonesia.

The slowdown seen in activity in China in the second half of 2018 is being directly felt through lower commodity pricing and, in some cases, weaker demand for exports out of Indonesia. Lower commodity income directly impacts the weaker sections of the economy, especially in the outlying islands of Indonesia and is reflected in tapering demand for discretionary purchases like motorcycles. In the near term, this seems to have been partly mitigated by government spending ahead of elections, but if demand from China does not recover going into the latter part of 2019, we could see further dampening of discretionary consumption in rural areas.

Indonesia as an emerging middle-income economy needs a significant amount of FDI to boost economic activity and historically has been open to investments from all parts of the world. The nationalistic turn in politics over the last five years has dampened foreign investment activity, especially in the resources sector (in which Indonesia is particularly endowed) where forced domestic ownership requirements have frozen western investments as global MNCs have tried to work in the changed landscape. While it has been a headwind, we got the feeling, as we met up with some of the companies in the sector, that the government has approached it pragmatically and given sufficient lead time for compliance with the two key factors (domestic ownership and value addition norms) so that players would over time focus back on growth. Surprisingly, however, one of the global resource players we met, after having sat on a resource for decades, was now making a long-term ten-year plan to aggressively make use of the endowment by bringing in new downstream investments. So much for worries of global players packing up and leaving Indonesia.

As Indonesia started looking for sources to finance its ambitious infrastructure plan, initially there were high expectations that it neatly dovetailed with China’s Belt and Road initiative. Cheap capital and rapid delivery expertise from China could help Indonesia quickly move up the infrastructure curve. The fanfare over the announcement of the Jakarta-Bandung High Speed Rail followed that narrative, but the inexperience of state-owned players from China in dealing with democratic land issues and local contractors has delayed the promise of Belt and Road in Indonesia, though in our opinion it has not deferred it.

On the other hand, we were pleasantly surprised by inroads made by the Chinese private sector enterprises in Indonesia. Across multiple industries – cement, property, automobile, mining, heavy industry, etc. – we came across examples of entities from China setting up large scale capacities in Indonesia. They seem to be replicating their home market business models of scale, low price and high volume turnover which left quite a few Indonesian companies perplexed as they are used to high profitability with steady growth. Their impact on the marketplace has been minimal till now as the Chinese enterprises have struggled in marketing and connecting with consumers. While local corporates dismissed their impact, we would not be surprised if in a few years’ time they become disruptors of the cosy oligopolistic structure that Indonesian family-owned corporates are used to operating in.

Where are the New Emerging Companies?

Our experience of investing in emerging markets over two decades has been one of discovering new and interesting companies on each visit to one of these countries. As economies evolve and grow, new dynamic entrepreneurs emerge to grab opportunities and build businesses around them. Unfortunately, this is something which we found lacking in Indonesia on this trip. While there are anecdotal stories of fintech start-ups, with successful examples like Go-Jek (the ride hailing company), these were the exceptions. Indonesia continues to be dominated by traditional family-owned oligopolies, the same companies that we came across a decade ago.

Discussing advertising trends with one of the largest media groups in Indonesia highlighted the above conundrum starkly. Their top five customers account for 25% of their revenue and the top fifteen made up over 50% of ad spent in Indonesia. These were the same FMCG companies that used to have similar market presence a decade ago. Unlike in other Asian countries, whole industry segments like financial services, automobiles and retail do not advertise extensively in Indonesia. These are all sectors where dominant players rule the market with oligopolistic power. Can this change? Potentially it could, if some of the trends we see in terms of online nimble internet players entering the retail and fintech space start making inroads. These players are funded by the deep pockets of Chinese online giants who have seen successful transformation in their home market.

Other than emergence of new players, there is another risk to oligopolistic profits that existing players are currently milking “Online”. Two retailers we met separately, operating in different segments (fashion and hardware), each seemed to dismiss the impact of online and did not have a cogent plan as it was only 1% of their sales. One was happy to let the family-run holding company execute a group online strategy while the other did not seem concerned with any strategy. We were left wondering whether these entities would be able to react as and when buying habits change in Indonesia, similar to what has been observed in other markets.

The thought became entrenched in our mind when at the end of a shared meeting with one of the largest corporates in Indonesia, an investor from China asked the management with a puzzled look, “Where is the animal spirit in Indonesia?” As we left behind a flummoxed management, to us the biggest risk in Indonesia became apparent: disruption to existing business models run by staid family-owned conglomerates.

Consumption and Property

The biggest conundrum of investing in Indonesia over the last five years has been the lack of consumption growth. For any underpenetrated emerging market growing GDP at 5% p.a., one would naturally expect consumer companies to be the biggest beneficiaries. Part of the explanation for the lack of consumption growth comes from the fact that the government cut subsidies, thus negatively impacting disposable income in the hands of the consumer (see chart on page 2 of the newsletter) and redirecting the capital towards infrastructure spending. The multiplier from this productivity shift should start emerging over the next couple of years as these projects are delivered. This is apparent in the property sector where for a long period of time developers used to focus on low-rise, far-flung integrated developments providing all the amenities in one location. Laying of new infrastructure like rail lines (MRT/LRT) is creating demand for apartment-style developments close to stations (called transit-oriented development-TOD). New players who helped develop these infrastructure assets are emerging as property players offering TOD products, leaving behind the large, well-entrenched developers with idling land banks located in suburbs.

The second reason why existing property players have struggled is the complete drying up of investment demand, partly due to tightening of lending conditions but more importantly due to the wait and watch attitude among the dominant economic class in Indonesia which is an ethnic minority and feels uncomfortable with rising nationalistic jingoism over the last few years. We were informed that one of the reasons why the tax amnesty of 2017 did not deliver the expected growth and demand boost (despite successful tax collection) was because of low confidence in repatriating capital back to Indonesia in the face of hostile nationalistic rhetoric.

In conclusion, we came back reassured about the long-term dynamics and growth potential of the Indonesian economy. Corporates have gone through a mixed experience over the last five years, as drivers in the economy changed. But going forward, as the fruits of the hard-won economic stability become apparent, we would be surprised if revenue growth for the market does not accelerate. The key risk in our mind is to watch out for margin compression as there is complacency that companies can continue doing business like in the past. For the economy to accelerate to a higher growth rate (which Indonesia can definitely achieve), there needs to be a rollback of nationalistic rhetoric, which hopefully a new rejuvenated president (depending on the election outcome) can deliver, as the political system becomes more mature and the rising middle class ever more demanding.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.