The year 2021 turned out to be a year of two distinct halves. In the first half, our focus markets tracked the world as re-opening accelerated and vaccines became a reality. The second half saw a sharp reversal with the restructuring in China (described in detail in our last newsletter) and the re-closure of Asean. The MSCI China index was down 22% for the year and the Asean index was broadly flat for the year. Though disappointing, this sets up a base for good returns over the medium term from here onwards.

As we mentioned in the previous month’s write-up, we are seeing a lot of factors come into alignment for a good set of market returns from China and Asean in 2022, especially post the Q1 temporary slowdown because of the Omicron variant. After dwelling in some detail last month on China, we would like to talk about Indonesia this month. This is a very exciting opportunity but requires some patience. The country macro environment has not look this good since the early 2000s which was the beginning of a strong 10-year growth cycle. We elaborate on this further below.

Indonesia is one of the larger economies in the world. In GDP terms it is the fifteenth largest economy in the world and in terms of PPP the seventh. With real GDP growth expected to average about 5% p.a., it will be a top ten country in GDP terms within this decade. Also, in per capita terms it is already a middle-income economy with a per capita GDP of USD 4,000, which is nearly double that of India. Hence, the country is ripe in terms of demand take off for multiple categories of those products for which demand tends to kick in at this level of wealth.

History: A Story Of Two Disparate Decades

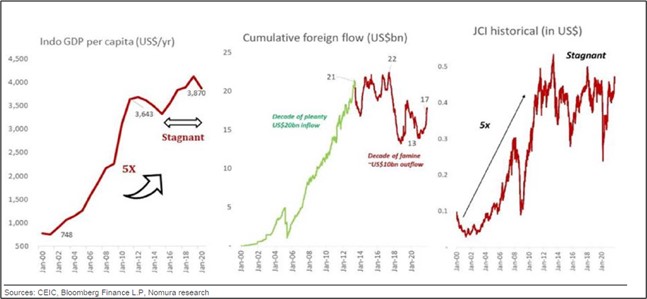

Indonesian economic growth had a very disparate experience in the 2000-2010 period compared to that in the 2010-2020 period. In the first decade, the economy grew a whopping 4.5x from USD 177 bln. to USD 744 bln. But in the second ten years it just grew 40%, reaching USD 1.06 trln. by 2020. This second decade was the decade of cleaning up the excesses of the boom years, deleveraging, building institutions, etc. And it has set up the base for the coming years.

In spite of this slower second decade, the GDP compounding in USD over the 20-year period is over 9% per annum. During this period, Indonesia pulled itself out of the category of poor countries (per capita GDP of about USD 900) to a middle-income country of per capita GDP of USD 4,000. This is what we believe Indonesia is capable of.

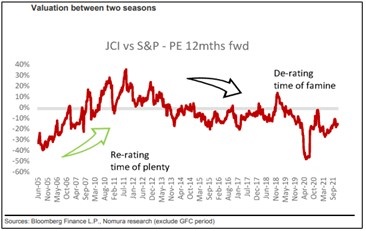

The stock market returns also follow a similar pattern. During the first 10 years the JCI was up 5x in USD terms but gave negligible returns in the second decade. This is also reflected in cumulative foreign flows into this market with over USD 20 bln. coming into this market in the first decade and nothing in the second.

Strong Improvement in Macro Fundamentals

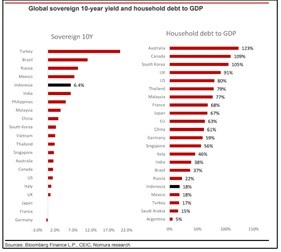

While the economy and markets have lost momentum over the past 10 years, the macro fundamentals have been improving. Indonesia has one of the strongest macro numbers amongst most large markets. This is based on two factors: (1) one of the lowest leverage figures, and (2) strongly improving current account surplus. This is like an under-levered individual with fast growing monthly salary. Combine this with a structural downward move in inflation and interest rates, and such an entity has a huge potential to lever up and grow.

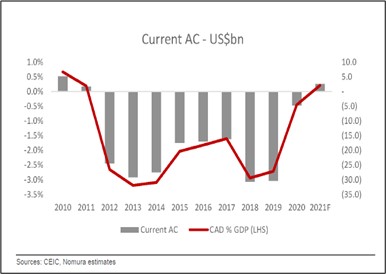

External surplus for the first time in 12 years: With a huge turn around in the external deficit, the IDR has remained quite steady through the turmoil of the past two years. Also, the FX reserve continues to accumulate. Indonesia is arguably the biggest beneficiary of the commodity price boom in the last two years – palm oil, coal, nickel, other non-ferrous metals, etc. are large export commodities for Indonesia and they have seen over 100% price increases. This is a huge windfall. Combining this with lower imports on a slower local economy has resulted in a current account surplus for the first time in 12 years. Also, the forex earnings from tourism recovery are yet to come and will show up as the sector recovers through 2022. Finally, Indonesia is strongly pushing for further value addition to its commodity exports to help capture more of the value chain. This is a structural positive for the investment cycle and more wealth retention in the country.

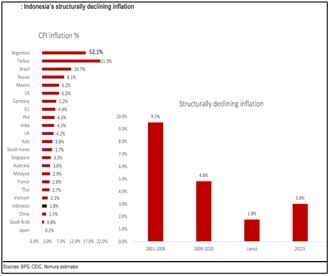

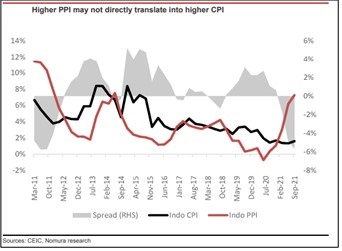

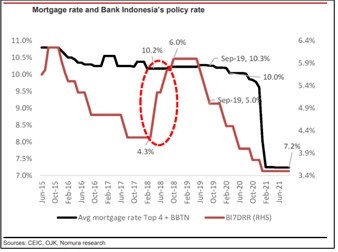

Structural drops in interest rates and inflation form a potent combination with low initial leverage: The other structural positive is Indonesia moving out of the high inflation, high interest rates zone. Interest rates in Indonesia have structurally moved down, but still have a huge scope for further reduction. Currently, Indonesia has very high real rates given that it is a stable economy, and these will continue to move down as more global capital gets attracted to the country. Combine this with a low initial level of household debt and there is a lot of potential demand which can be tapped. Indonesia’s current household debt to GDP at 18% is very low (as seen in the chart below). This is half of India’s level and less than a third of China’s. The expected drop in rates is already showing up, as seen in mortgage rates dropping from 10.3% in September 2019 to 7.2% now. This is a huge drop. Similar drops are being seen in rates for auto and other consumer finance too.

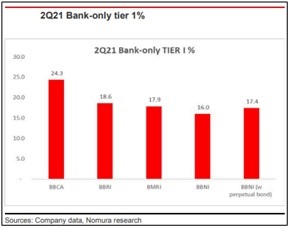

The Indonesian banking system is flush with loan/ deposit ratios of about 60%, and most banks highly over-capitalised with tier 1 capital between 16-24% for the larger banks. To put this in context, well-capitalised western banks have tier 1 ratios in the 12-14% range. Clearly, the Indonesian banking system has a lot of surplus capital to support lending if required.

The Market

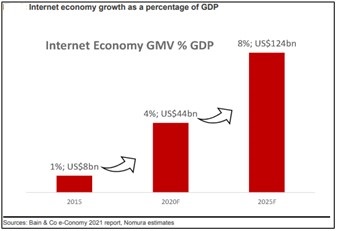

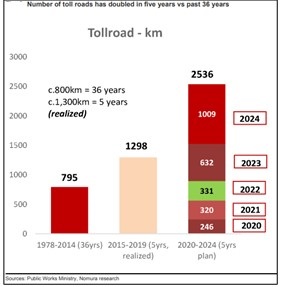

The market is seeing some structural changes. There is a robust and fast-growing e-commerce space. Also, the government is increasingly pushing infrastructural spending (though this did slow down during COVID-19).

This and other structural changes are broadening the investment options in the market and improving the earnings outlook. On the valuation front, the Indonesian market has continuously de-rated over the past 8 years and currently has very low allocation from global investors. Its forward multiples have moved from a 25% premium to S&P in 2012 to a 15% discount now. Hence, we feel that many positives are aligned for the Indonesian market, justifying our large exposure to this market.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.