We just came back from a three day trip to Jakarta. As always there were some fascinating takeaways.

The country seems to be on a relatively even keel, though multiple problems still remain. The windfall for Indonesia is a dropping inflation and interest rate environment. For countries with large nominal interest rates (like India and Indonesia), this is a large windfall. This combines with a drop in trade deficits which feeds through into better government financials, lower energy subsidies, etc. But all these are only medium term windfalls and they have to be taken advantage of through structural changes.

There are two points we wanted to high light about Indonesia which are unique and one could be game-changing.

The Tax Amnesty Scheme

This is a scheme to induce some of the Indonesian wealth which is held offshore to return back to Indonesia. Now, such schemes have been tried by many countries (and some multiple times), but the results have been mediocre at best. In the current Indonesian scheme there are two points which might create results that are significant.

- The first is the fact that the fine is only between 1-6%, with no retrospective taxes to be paid. This is extremely generous and could induce some to get back their money

- The second point is a fall out from the global information sharing agreement between all participating countries which comes into effect in 2018 (the Common Reporting Standard (CRS) is an information standard for the automatic exchange of information between signatory jurisdictions, developed in the context of the Organisation for Economic Co-operation and Development OECD). This would make it much easier for countries to find out about assets belonging to its tax residents which are held abroad.

The net impact of these two points could be the repatriation of a decent chunk of funds to Indonesia. Rough estimates talk of USD 250 bln. of Indonesian private wealth being held abroad, with a large chunk in Singapore. Even if a third of this finds its way back over a few years, it could have significant impact on exchange rates, domestic liquidity, future tax collection, funding of its ambitious infrastructure projects, etc. We will keep a watch out for further details on this front.

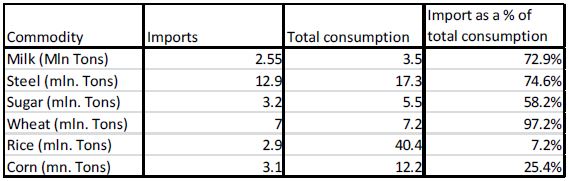

Surprising Import Dependency

Indonesia is rarely identified as a large importing country. With its trade surplus at about USD 7 bln p.a. we would think Indonesia is relatively self-sufficient. Also with its large domestic market and

relatively fertile land mass we would expect Indonesia to have a well-developed industrial and agricultural base.

This is not necessarily true. For its net exports, Indonesia has a large dependence on some soft

commodities like palm oil and hard commodities like coal. On the other hand it is strangely overdependent

on imports for some basic commodities.

Commodities like steel, milk, sugar and wheat are largely imported. This is on top of very low per capita consumption levels. This shows a very rudimentary agricultural and industrial base.

For instance the management of Ace Hardware (a home improvement retailer) said, “Indonesia even imports its hammers”. This kind of a situation is excusable in small sub-scale economies but not in a

USD 2 trl. economy with the fourth largest population in the world.

This situation is frustrating for an investor but also a huge opportunity for the future in terms of unfulfilled demand for very basic products.

Hence Indonesia has the ability to keep us, as investors, perpetually interested.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.