Over the last few years, the investment management industry as well as other participants, ranging from CEOs and portfolio managers to housewives and part-time dabblers, have all taken wholeheartedly to social media. Twitter is a cacophony, YouTube is flooded with noisy predictions and pedantic voices and WhatsApp, now anointed as ‘WhatsApp University’, has become the fountainhead of knowledge for social media junkies.

When you have a vortex of a zillion views and debates churned out in this cauldron every single day, it is natural to expect that the creative streak of Indian investors and their homespun sense of humour (which others might not necessarily find amusing) find an expression on one or more of these platforms, which is then regurgitated and passed around ad nauseum.

Humour has no boundaries. Humour is our second language. Even more so when we are nervous or under pressure. We humans are defined by our emotions and programmed to seek out happiness in order to preserve our psychological well-being. In the hurly burly of trading and investing in the stock market every day, we encounter periods of high stress. At such times, humour can indeed be the most effective stressbuster.

As Leonardo DiCaprio’s character in Inception said, “Once an idea has taken hold of the brain, it’s almost impossible to eradicate. An idea that is fully formed – fully understood – that sticks, right in there somewhere”.

Which brings us to memes. People on the internet today are obsessed with memes. They are funny, witty and, most of all, relatable. Memes have infiltrated our lives in many ways. In India, memes are mostly inspired by politicians, cricketers and movie stars who have the knack of saying and doing the oddest things and who provide a steady flow of fodder to the meme factories. The stock market and its denizens, on the other hand, are known to be among the most humourless and stoic, preferring to talk in geeky numerical terms most of the time.

So, when social media is all agog with memes on one particular stock in India, almost to the exclusion of any other stock worthy of being memed, it conveys many things to us about the stock in question, which then begs closer scrutiny. It is fascinating to see how investors relate to that stock and embrace every meme based on it. It is promptly passed on to their stock market brethren in the hope of eliciting a smile amidst their busy lives.

No single stock has captured the imagination of a mass of investors in the age of social media in India as ITC Ltd. ITC Ltd has hands down earned the title of the “Meme Stock of India”. Memes in the U.S. and elsewhere generally target unpopular, non-mainstream stocks, where meme creators go beyond just satirizing them.

In India, the ITC stock has been considered a Blue-Chip, a solid long-term core portfolio holding among domestic investors for decades. Its core business is cigarettes where it has over three-quarters of the market share in India. Nearly 90% of its profits are generated by cigarettes while the rest of the revenues and profits are derived from businesses as disparate as branded consumer goods, hotels, paper and paperboards and agri-trading.

This piece is not about the merits or demerits of ITC Ltd as an investment idea. It is about what has led to ITC becoming the Meme Stock of India. The meme storm brings into focus issues surrounding the ownership of ITC today and shows why things have come to such a pass, where the stock is being lampooned the way it is. Additionally, we see a connection with behavioural finance and why investors would do well to pay heed to the softer, more abstract aspects of investing and fit them as best as they can somewhere in the investment process. ITC’s memes reflect and echo what is in the minds and hearts of thousands of investors who are owners or non-owners, their frustrations and tribulations with the stocks and its management over the years. This welter of emotions is surely being translated into their investment and trading actions, which in turn influence how the stock has been trading now for close to a year.

Formation of the Storm

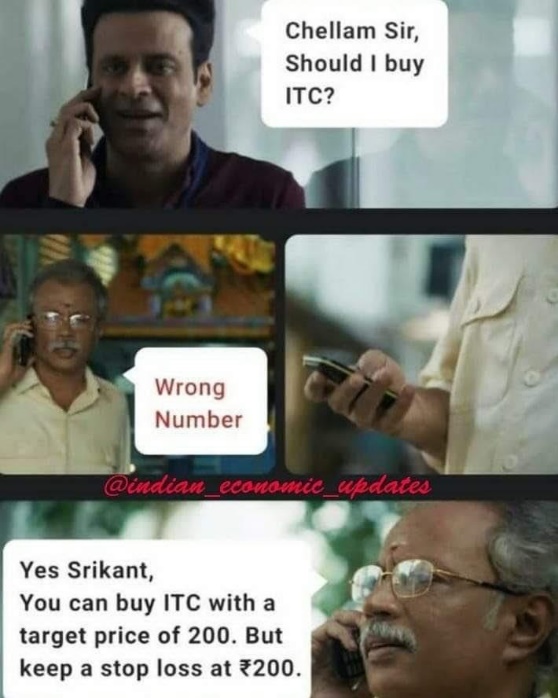

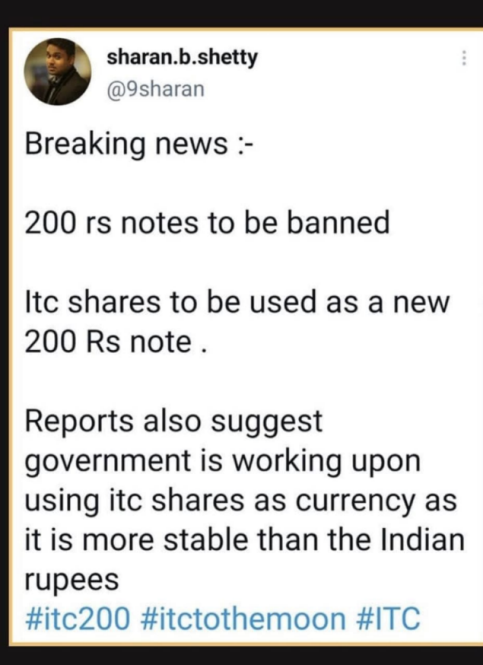

Let us begin by relating to those who have missed the fun and fury of the ITC meme storm, why it began without much provocation and what is keeping it going.

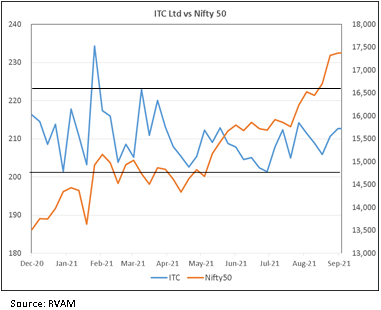

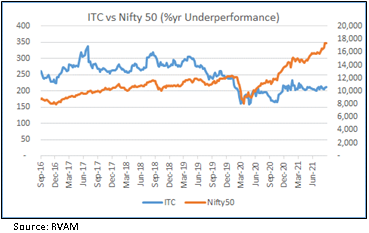

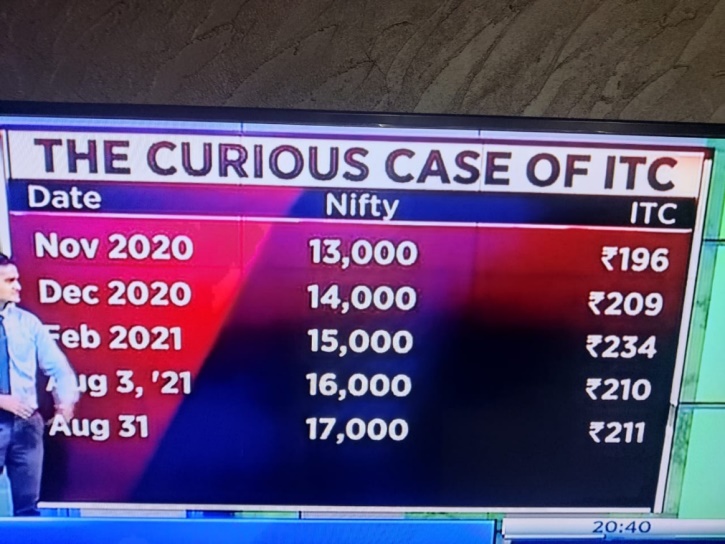

The ITC stock has traded in a tight band between Rs.200 and Rs.225 since December 2020, barring a brief thrust higher in early February 2021 to Rs.239 for a few days, only to fall back and settle into the band again. For accuracy, we take the point where ITC reclaims the Rs.200 level for the first time since the double-dip post-COVID 19 correction, on Dec 7, 2020 till today and compare its performance versus the Nifty 50 Index. The results leave little more to be said (see chart alongside).

If one goes back a further five years, the stock’s returns are deeply in the red, even as the broader market represented by the Nifty 50 index doubled in this period. These deeply painful negative returns for the most part have not been lost on millions of investors, old and young, new and not so new who have come into the markets since.

ITC has now become the butt of jokes on social media for its lack of participation not just in the current rally but for declining in absolute terms now for the better part of five years. In the past one year, it has been pinned within this trading range despite the several favourable stimuli that the broader market has benefitted from through 2021, and despite the post-pandemic recovery seen in the economy. This has baffled, confused and frustrated investors.

Through this period, several bloggers and investors have weighed in on the ills that beset the company and some of its obvious strengths and what management ought to do to unlock value. Management itself has been quizzed about this and has responded with the stoic poise Virginia House has been known for for decades.

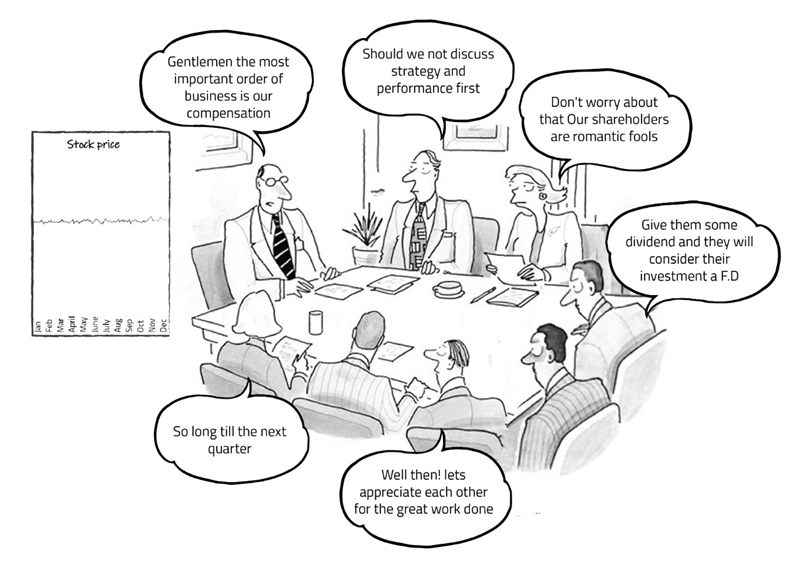

Each quarterly result period passes with ITC’s performance being what has now become, well, ‘ITCesque’. Investors discuss the bit of growth here, a decline there, a dose of consumer business optimism dribbles in, and analysts tweak their estimates, often in their decimal places, and put out the perfunctory ‘BUY’ reports. And the world moves on. Each year’s AGM passes with management making polite assurances of doing their best to ‘unlock shareholder value’. Clearly investors are incredulous and unimpressed. A blogger recently used this cartoon to illustrate his critique of ITC (see alongside).

The state of inertia from lack of affirmative management action, insipid operational performance and a stock price that is as active as a wallowing hippopotamus in a pool of water, has created a negative feedback loop which is well and truly closed. This is now providing inspiration to the meme producers, their creative juices flowing, the longer the stock remains somnambulant. Their humour conveys the pathos and infinite patience of ITC shareholders. We have provided a selection of a few of them in the Appendix for your mirthful consumption.

It would be instructive for those less familiar with the ITC stock to know what has made ITC the proverbial ‘dog’ in the market today.

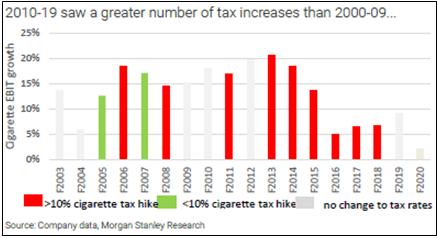

Operational performance: While we will not delve into the details of each business, the following two charts show that ITC’s operational performance has slowed down measurably in the past five years relative to its own historic performance tracking back to 2000. Surprising as it may seem, this has come at a time when the incidence of taxation has never been more benign for the industry in India. Ironically, ITC’s best performance came at a time of heightened taxes inflicted by the Government of India on tobacco products between FY11-FY15.

While it can be granted that investors have increasingly become wary of owning ‘sin’ stocks and the new-fangled ESG Funds have played their part, it is the company’s poor track record of diversifications and asset allocation decisions made in the past which are now coming to haunt it and its shareholders.

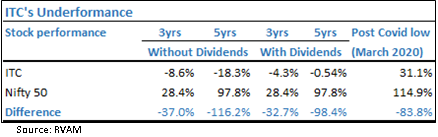

Stock performance: We know that it is incorrect to judge managements and company performances over short periods of time. Hence to be fairer, to assess if the derision and scorn heaped on ITC has any merit, we checked the performance of the stock against the Nifty 50 Index in which it was a key constituent (but no longer so). We compared the stock’s performance including and excluding the generous dividends it has paid over this period, but not doing the same for the Nifty 50, i.e. in a way penalising the broader index. We also measured how it has fared since the fateful bottom of March 2020 when the global and Indian stock markets registered cataclysmic lows.

The results are stark (see accompanying table and chart). The price chart since 2016 shows that the stock’s underperformance has become acute since the cataclysmic COVID-19 bottom of the markets in March 2020. The market has de-rated the stock severely even as the broader market and its peers enjoyed a huge positive re-rating in this period. One could list a litany of reasons for things to have come to such a pass and all of them would be equally right or mostly right. But we digress.

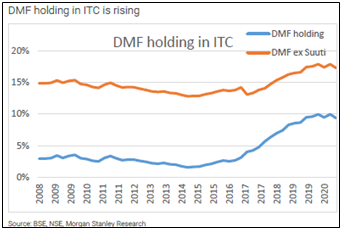

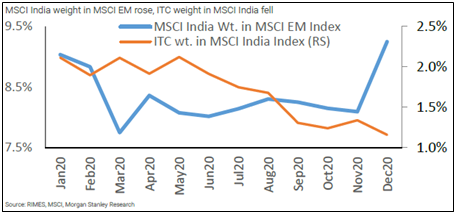

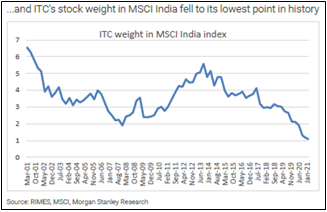

Stock positioning: This litany of factors that has conspired against the company has not gone unnoticed by institutional investors. Their actions speak louder than words. Foreign investors (FPIs) have been voting with their proverbial feet, stomping out in steady procession over the last few years, even as the domestic mutual funds (DMFs) have been holding on and even increasing their ownership in the same period. The FPI selling surely has something to do with the rising activism against tobacco companies worldwide and ESG issues. But it would be incorrect to pinpoint ESG as the sole reason for FPIs to be selling out. Note that even today a sizeable FPI holding of 20.3% continues in ITC, which suggests that not all FPIs think and act alike.

As the complexion of indices themselves have morphed over time, ITC’s relative importance within them has shrunk to record lows as well, where it is no longer among the ‘must own’ stocks for any institutional investor whether they use the Nifty 50 index or any other benchmark for Asia ex-Japan or Emerging Market asset-classes.

As a wag remarked to us the other day, ITC’s biggest contribution to investors so far this year has been providing the humour through the memes it has inspired and not much else by way of creating any shareholder value.

When we connect the starkly poor operational and stock performance of ITC with social reaction this has elicited through the memes, it bring us to the more important takeaway from this episode – that it has become the subject of a great case study for advocates of behavioural finance.

ITC and Behavioural Finance: A Match Made in Heaven

Put in simple terms, Behavioural Finance is the study of the influence of psychology on the behaviour of investors of all types. It also includes the subsequent effects of such actions on the markets. It focuses on the fact that investors are not always rational, have limits to their self-control and are influenced by their own biases.

We have had several conversations with investors who remain wedded to the ITC stock, firm in their convictions that the days of deliverance are close at hand or just over the horizon. Our conversations with them indicate some important learnings for us as investors and echo the importance of analysing behavioural aspects as a key tenet of investing beyond the cold quantitative tools we are most comfortable with. Some of these biases which we have encountered are:

Loss Aversion Bias: Investors have a stronger desire to avoid losses than to make gains. This causes investors to over-focus on avoiding risk. Often investors who suffer from loss aversion bias have “get even-itis,” where they want to hold a losing investment position until they get back to even, regardless of the poor future prospects for the security. A vast number of today’s holders of ITC are likely to own the stock at a price well above Rs.200 and are ‘under-water’ as they see it, making them prone to this form of bias.

Endowment Bias: Endowment Bias is an emotional bias where investors value an asset more when they own it whether due to purchase or inheritance. It can be seen as the underweighting of opportunity cost. The mere fact that they own it creates this form of bias to justify continued ownership.

Outcome Bias: This is a cognitive and information processing bias, where investors make a decision based upon the outcome and not based upon the process that led to that result. While ITC’s performance can be termed steady and stable, it is poorer than its peers. How ITC has ended up under-performing and if it could have fared vastly better, is something its shareholders seem to be less concerned about. An example of outcome bias would be when investors focus only on the recent 3-5 year track record of returns when selecting an investment manager, rather than analysing the investment process of the manager that led to that return.

Anchoring and Adjustment Bias: This is a cognitive and information processing bias, where investors use a default number or ‘anchor’ and do not adjust adequately, and end up using statistically arbitrary, psychologically-determined anchor points. Usually associated with the absolute value of the stock price level, in ITC’s case, the bias is illustrated by the many investors who own the stock who are anchored to the stock’s historic P/E multiples and believe that the stock is hugely under-valued relative to its history and relative to its peers and continue to hang on waiting for the rating to revert.

Recency Bias: It is a cognitive bias and information processing bias, where investors overemphasize more recent events relative to those in the near or distant past. This bias ties in with anchoring bias where investors’ recent memory of ITC trading at P/Es of 20x or more impedes a more balanced view on the stock.

Episodes like ITC, when seen through the prism of behavioural finance and its tenets, give us valuable insights into our own behaviour as investors and, we hope, nudge us out of our relative comfort zones to introspect on our processes further and more truthfully than we may have in the past. The recent flood of memes on ITC reflects the growing frustration and fatigue of investors, small and large. One could use the ITC episode as an opportunity to examine other stocks in the portfolio where such biases may have seeped in, and cull them.

That it has taken social media and memes to focus our attention on a large, hallowed Goliath-like company like ITC to get us to rethink, reflect and show a mirror to us, to take a hard look at ourselves as investors and how we can better ourselves in future, says a lot about how strong an impact social media is making to the arcane world of investing. The next time you receive a meme on a stock, it would be worthwhile to pause and reflect about the hidden message within and if there was a deeper meaning beyond the smile it brought with it.

What is a Meme?

A meme, as described by Encyclopaedia Britannica, is a unit of cultural information spread by imitation. The term meme (from the Greek mimema, meaning “imitated”) was introduced in 1976 by British evolutionary biologist Richard Dawkins in his work The Selfish Gene.

Dawkins conceived of memes as the cultural parallel to biological genes and considered them similar to ‘selfish’ genes, as being in control of their own reproduction and thus serving their own ends. Understood in those terms, memes carry information, are replicated and are transmitted from one person to another. They have the ability to evolve, mutate randomly and undergo natural selection, with or without impact on human fitness (reproduction and survival). The concept of the meme, however, remains largely theoretical.

Within a culture, memes can take a variety of forms, such as an idea, a skill, a behaviour, a phrase, or a particular fashion. The replication and transmission of a meme occurs when one person copies a unit of cultural information comprising a meme from another person. The process of transmission is carried out primarily by means of verbal, visual or electronic communication, ranging from books and conversation to television, e-mail or the Internet. Those memes that are most successful in being copied and transmitted become the most prevalent within a culture.

APPENDIX: The Nicotinic Highs of the ITC Meme Storm

“ITC…has it gone up?”

After the ITC stock rallied by more than 1% in a day

“That’s it! My heart is filled with joy today!”

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.