The world remains transfixed on happenings in Ukraine and on what the next move by the U.S. Federal Reserve would be. Weighty issues surely. Yet we thought that rather than weighing in on these and contributing to the noise, we could talk instead about an interesting stock that few domestic investors in India can invest in and which global investors can buy, but which has largely escaped their attention thus far.

The Set-Up Today- Apathetic And Disbelieving Yet

Until a year ago, there were barely three brokers who actively covered the stock, such was the apathy even on the sell-side. Many buy-side investors to whom we have bounced the name off have, well, just politely changed the topic of discussion or vehemently rubbished it as a ‘lost cause.’ We thought this was a great time to be delving deeper into the company and to figure out why sentiment has come to such a pass. We also wanted to test our growing conviction that the travel business in India has reached an inflection point and that the pandemic has catalysed the process of change and altered consumer behaviour permanently. We were looking for a way to play this theme but in a way where the payoff could be asymmetric if we were proved right and yet where we could walk away with no more than a bruise rather than a body blow if the thesis came unstuck for any reason. This company seemed to fit the bill and the stock’s technical set-up vis-a-vis investor awareness, ownership, coverage by analysts, etc. all seemed to tell us that there was a big gap between perception and reality here to profit from.

A Gorilla In the Making In Plain Sight

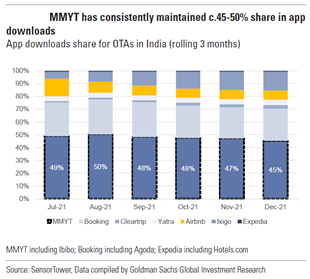

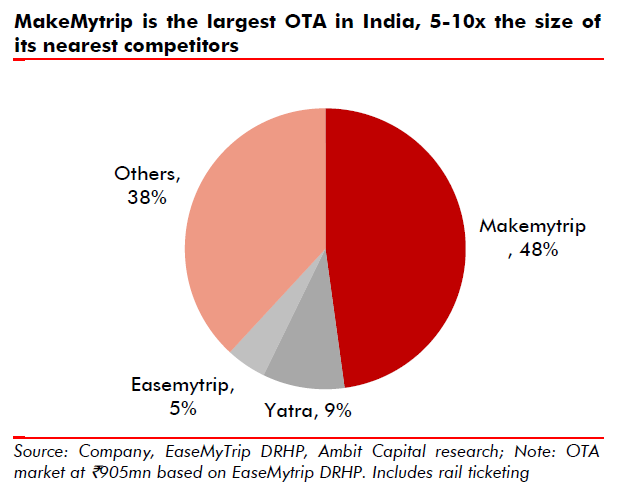

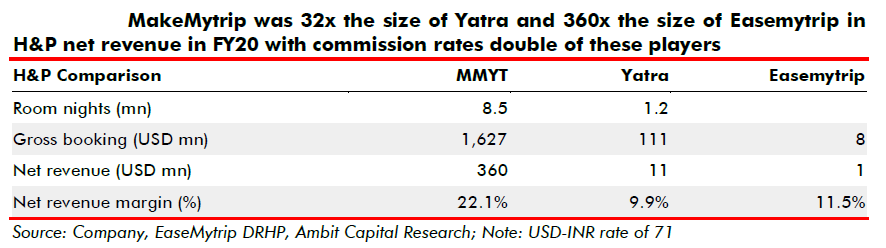

The company in question is MakeMyTrip. MakeMyTrip (MMYT) is the largest OTA (online travel agent) in India. The online travel market in India has a number of players, including Indian online travel agents (OTAs – MakeMyTrip, Yatra, etc.), foreign OTAs (Booking Holdings, Expedia, etc.), budget/ alternative accommodation providers (Oyo, Airbnb, etc.), and horizontal e-commerce players (Paytm, Amazon, etc.). However, despite the presence of multiple players, MMYT continues to be the dominant platform – it is the highest downloaded OTA platform with a share of 45-50% of new downloads.

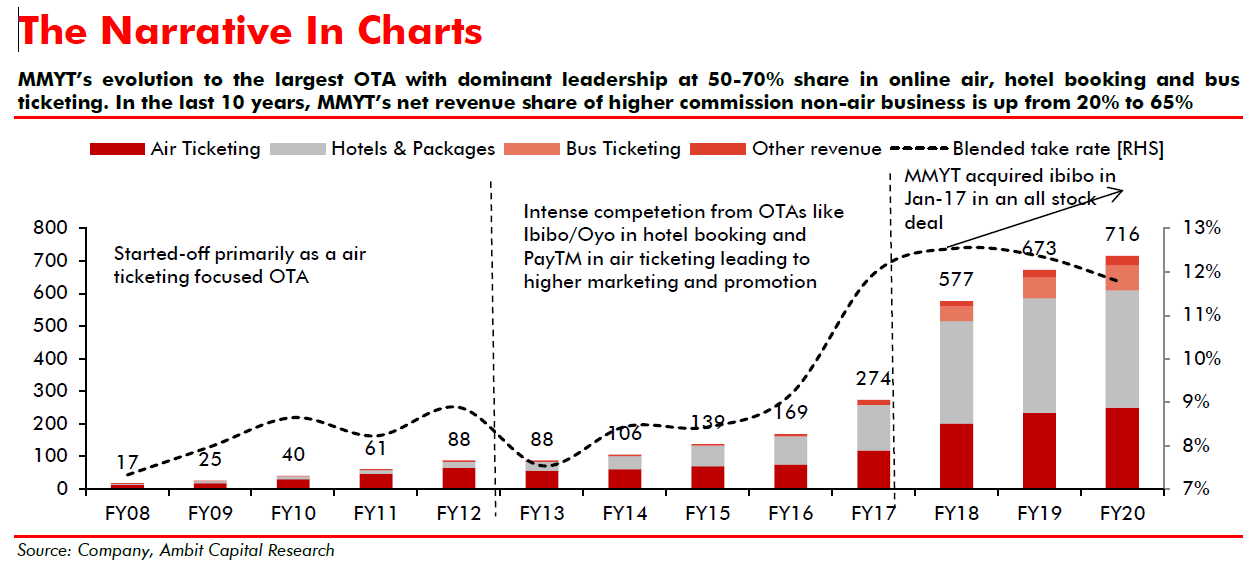

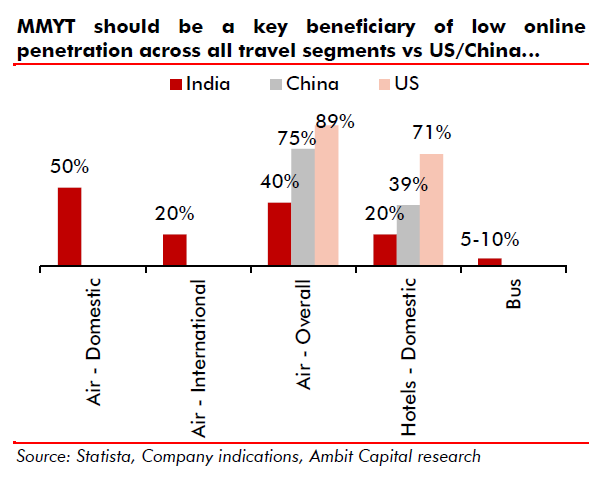

It commands market shares of ~50% in online air ticketing, ~ 60% of online hotel bookings and 65-70% of online bus bookings in India. In addition to these, it also provides alternative accommodation such as homestays, experiential holidays, tourist cab bookings, visa support and train bookings as well. This leadership position has taken a decade to build. Its early mover advantage vis-a-vis competitors, its scale and the network effects built over this period of toil, are now beginning to reap rewards.

Why It Has Taken MMYT More Than A Decade To Bloom

To understand why it is likely to win and potentially win big from here, we must understand why it has taken the company over ten years to get to where it is today. This is because the factors for its success in future lie embedded in the factors that led it to struggle and almost come a cropper in the early years.

A bit of history is a good place to start. MakeMyTrip was founded by Deep Kalra, an alum of IIM-Ahmedabad. It was first launched in the U.S. market in the year 2000 to cater to the overseas Indian community for their U.S.-to-India travel needs. It started its Indian operations in September 2005, offering online flight tickets to Indian travellers. The company also started to focus on non-air businesses like holiday packages and hotel bookings. On 17 August 2010, MakeMyTrip Limited was listed on the NASDAQ after its initial public offering. Let us also reflect on the decades of 2000 and 2010, in India specifically, and the state of the travel industry back then.

The Renaissance Of India’s Travel Industry

Around that period, the Indian travel industry was sluggish, with no new innovations happening, and ripe for disruption. A few big offline players like Thomas Cook, Cox & Kings and Mercury Travels ruled the roost. Travel for leisure as an activity, especially international travel, was still far down the list of priorities for most middle-class households. However, there were some important changes on the horizon that were reshaping the industry at warp speed.

The Internet was beginning to move into more and more homes, even though broadband quality was often unreliable and speeds available were slow. The spread of PC ownership, not to mention that of laptops, was shamefully low for a country of India’s working population. With internet/ broadband connections gathering momentum, PC ownership too began to grow exponentially.

Finally, the arrival of companies like Samsung, LG and, later, Apple accelerated India’s embrace of smartphones. This catalysed the migration of tasks like making travel bookings to mobile phones and online platforms, especially with younger folks.

Remember too that Apple’s iPhone1 was first unveiled only in January 2007, two years after MMYT began its India operations! Thus, the history of online travel is still very young. It could safely be said that MMYT was clearly ahead of its times and that listing the company on the stock exchanges came too early, given the hard yards that the company had yet to run.

It was also a time when physical travel infrastructure was under-developed. Travel bookings were still the preserve of the street-corner travel agents who preferred to accept cash as a mode of payment. Often travel was an avenue for the super-rich to get rid of excess cash by buying themselves expensive holidays. Credit cards were in the domain of the well-to-do and rich for the most part, although they were beginning to proliferate quickly down the income curve of Indians.

It was also a time when hotel infrastructure in terms of availability of good quality, affordable hotels in key tourist sites, was poor and inadequate. The hotel industry’s own development path runs quite in parallel to that of OTAs.

Airports were old and with inadequate ground handling capabilities to make them suitable for larger modern aircraft to land. Hence, several destinations that we take for granted today, were not on the flight maps of airlines even ten years ago.

Like hotels, the growth of Low-Cost Carriers, was a critical cog in the wheel of the birth and development of OTAs, not just in India but worldwide. Their growth and tribulations too would track those of hotels and OTAs in this period.

India’s Travel Prism Begins To Crystallise

Against this backdrop, MMYT was not alone in fantasizing that it could make it work and build a profitable business. A slew of OTAs were born, including some familiar names like Travelocity, Cleartrip and Yatra. More would emerge from their embryonic stage with large venture capital and private equity funds entering India around the same time, looking to bet on the next ‘big idea.’

The decades of 2000s and 2010s have been ones where these fledging companies (of which MMYT was an early bird), fed by PE/ VC funds, slugged it out for the mindshare and wallet shares of the emerging middle-classes who were beginning to now want to venture out of India for their holidays. It soon became a period of massive ‘land-grabbing.’ Customer acquisition costs did not matter, so long as they were and could be funded by the PE funds and VCs. Those that managed to find the funds survived, and still do in some shape or form today. The rest perished. These funds had an important role to play through this period and, without their financial support, it is doubtful that India’s travel industry would be where it is today.

So, while two sides of the triangular prism – 1) travel infrastructure, and 2) internet/ smartphones, which both formed the supply side – were developing at their own rapid pace, the third side – the Indian middle-class from where the demand would emerge – was coming of age equally fast alongside. As this prism was crystallising, the final success factor was the strategies and management quality of the OTAs themselves, which would finally throw up the winners. OTAs, on their part, experimented with different strategies, hoping to disrupt the traditional travel agents and prise out customers to go online by sustained promotional activity, offering freebies, etc.

When we put these myriad challenges of those decades into perspective, for a start-up like MMYT to survive, leave alone succeed, now seems like an achievement in itself. It did not succeed in turning a profit for many years, but survive it did!

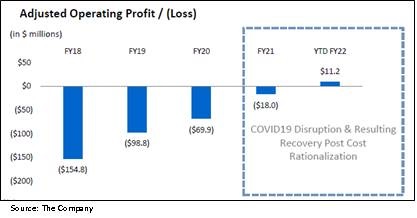

For the naysayers, it should come as no surprise as to why it has taken MakeMyTrip such a long time to deliver its first positive EBIDTA quarter as late as FY21, eleven years after it was listed!

Hindi-Chini Bhai Bhai Is Not A Pipedream Here

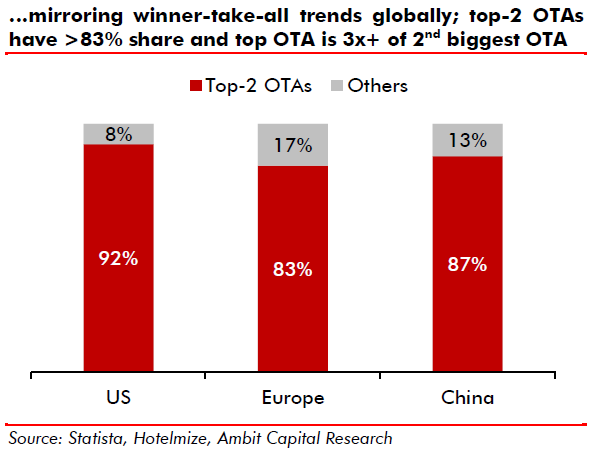

In 2019, Trip.com, the global Chinese OTA (previously Ctrip), became a majority shareholder of MMYT by raising its stake in the company from 26% to 49%. Trip.com ownership brought huge financial backing, global sourcing of travel properties and access to a hosting base of hotels and flights that can possibly be matched only by the likes of Booking.com and Expedia. MMYT hence received vital funding during the pandemic that enabled it to hold out, even as its competitors were dealt a debilitating blow. In fact, MMYT has emerged even stronger from the pandemic relative to competitors, with an unmatched product suite and market shares which are 5-10x larger than those of the nearest competitor. MMYT’s dominance in India, in many ways, mirrors global trends, where the top two OTAs command > 80% market share between them.

Headwinds Turning Into Tailwinds

The factors that led to MMYT struggling and fighting for survival are precisely those which have now become enablers of its current and future success. Let us enumerate them quickly.

- Demographics are a huge tailwind for India and the travel business. It is estimated that 85% of internet users today are below the age of forty.

- Smartphone adoption in India is now virtually universal. India is one of the world’s largest Internet markets, with over 400mn smartphone users. This technological leap alone is possibly the single biggest catalyst for the growth of India’s Internet-linked companies, whether they be travel, ecommerce or online payments companies.

- The growing penetration of low-cost carriers in India and globally is leading to more Indians flying today and in the future. India’s domestic passenger traffic grew to 141mn with 13% CAGR over FY11-19. This is expected to touch 400mn between FY20-40 at a CAGR of 10%.

- The number of operational airports in India for domestic and international travel is expected to more than double between now and 2040 and the size of the fleets of commercial aircraft is expected to rise by 3.5x, as per estimates by Ambit Capital and FICCI-KPMG research.

- Flying is now becoming the preferred mode of inter-city travel for leisure and business in India, as opposed to train travel in the previous decades. The addressable market for MMYT, which is the middle/ upper middle-class and affluent, is expected to double by 2030 given the increase in airport connectivity, number of flights and aircraft capacity growth projected. These are all powerful demand drivers for MMYT in the future.

- The rapid growth of hotel rooms in 2-, 3-, 4- and 5-star hotels and into non-metro cities and holiday destinations has given a huge fillip to domestic holidaying. As a result, businesses that handle hotel reservations, bus bookings and tourist cab bookings are rapidly going online, consolidating and becoming organised. These bookings are expected to grow even faster than air-ticketing, which has already achieved 80% penetration in terms of online bookings today.

As we have seen in other markets like China, the U.S. and Europe, the online travel business is a winner-takes-all one. Looking at the competitive landscape today, MMYT is poised to be that winner in India.

The Path To Profits

Other than the rapid adoption of mobile/ online as the preferred mode of booking tickets and holidays, a recurring theme across India internet has been the improvement in unit economics due to COVID-19, driven by a decline in selling and marketing spend. This is no different for MMYT.

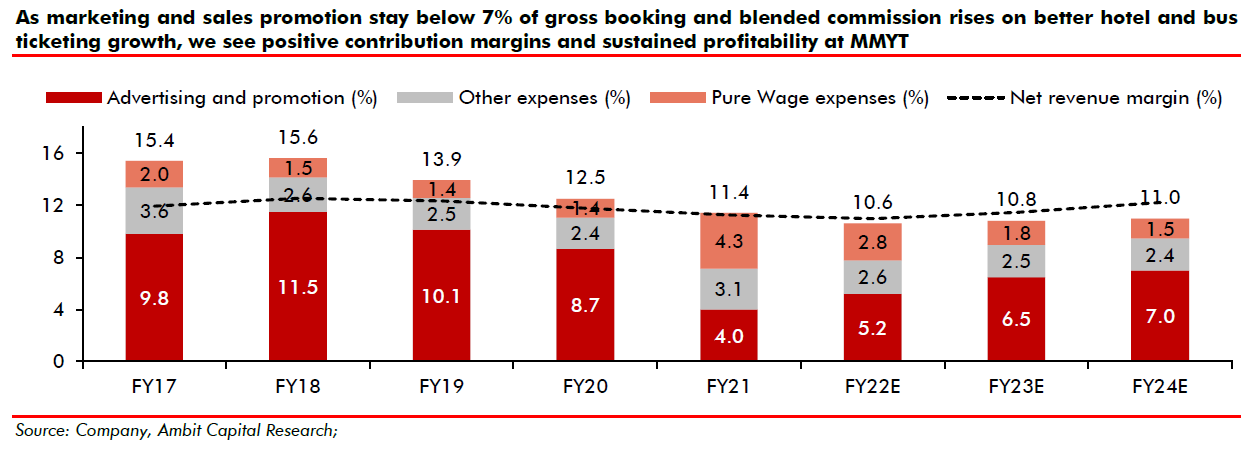

Over the last three years, MMYT’s true strength has been captured in its ability to pare its cost base significantly without impacting its top line growth in any way. This SG&A leverage is becoming apparent consistently through the pandemic period.

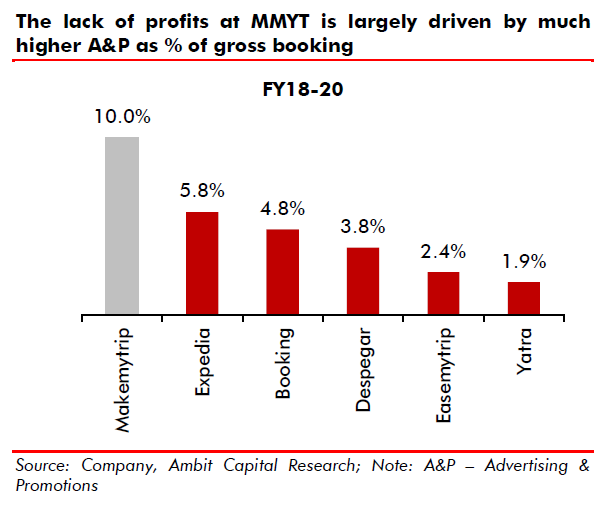

As sales and promotion expenses are capped below 7% of gross bookings and blended commission rates rise on stronger hotel and bus ticketing growth, we have already seen positive contribution margins and the arrival of its first positive EBIDTA. Historically, sales and promotion expenses were running at 10% or more, making it virtually impossible to make a profit. Globally, this ratio in mature market players ranges between 4-6%.

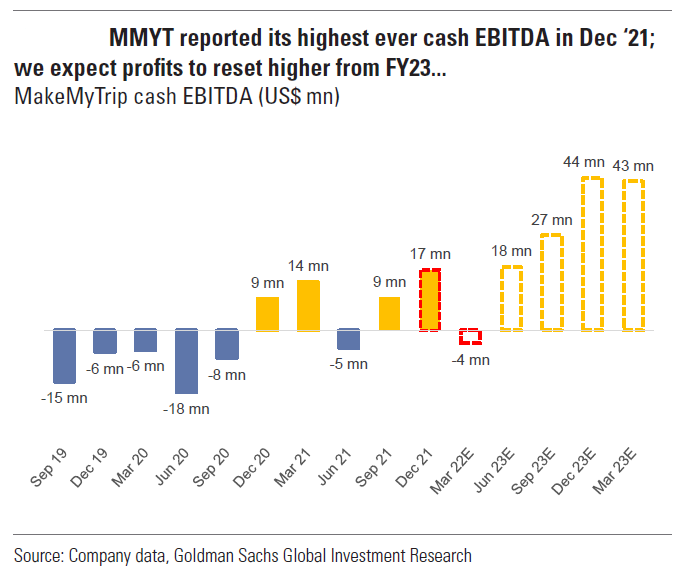

These tailwinds, as well as the success of MMYT’s management in reining in costs, are beginning to be captured in its financial performance in the last two years. The COVID-19 pandemic has imparted volatility to the quarterly performance, which is natural as the economy has opened in fits and starts. What has become clear is that through this period, MMYT has continued to execute its strategy strongly.

What Is The Market Thinking About MMYT?

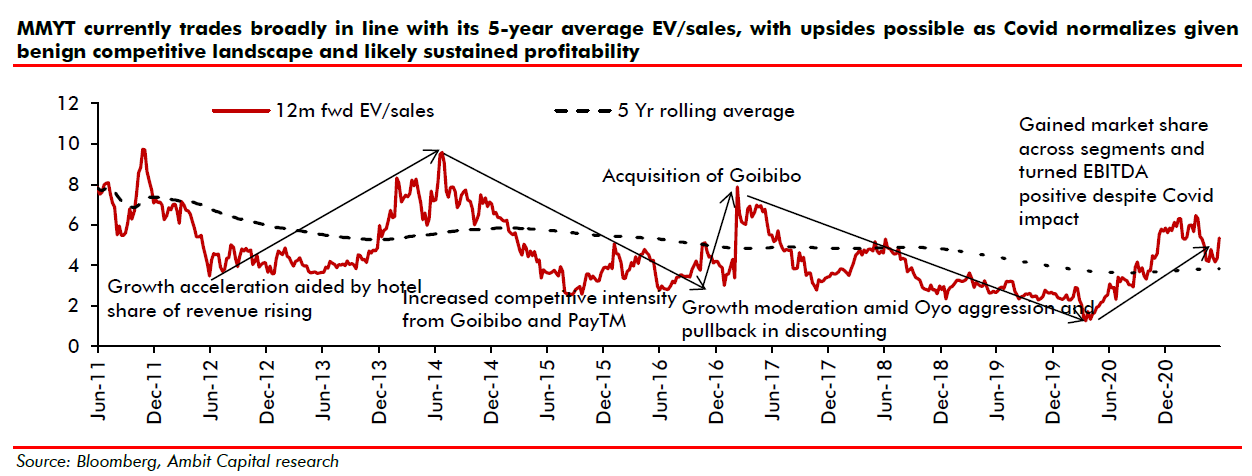

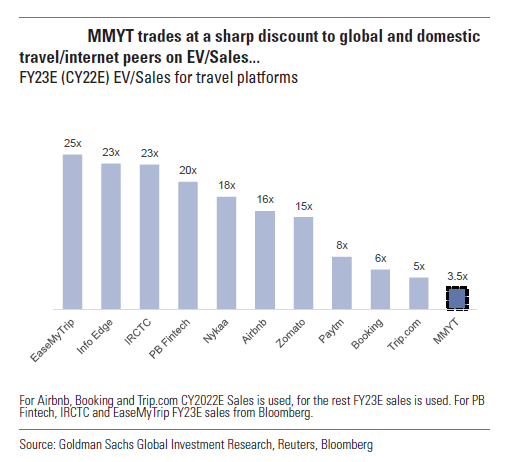

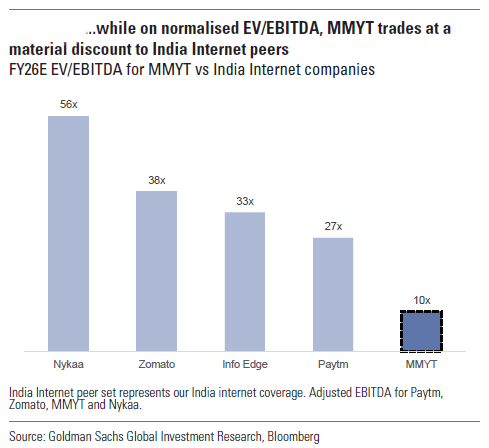

MMYT is a rare Internet company that will not just be EBIDTA positive in FY22 but will turn in its first net profit in FY23, barring any hiccups from the pandemic again. Historically, given the absence of profits, MMYT has been traded on an EV/ Sales valuation metric.

However, as the company turns profitable, the valuation metrics could also move to a combination of EV/Sales and EV/EBIDTA multiples. It is also an opportune moment in time when the stock markets are beginning to question the wisdom of valuing profitless companies on ritzy sales multiples alone, particularly where profits are not even on the horizon. MMYT is a refreshing change where profits have arrived, which could trace an asymmetric path in future. MMYT remains a mispriced investment opportunity.

As an investor, one would not be too ambitious if one remarked about the MakeMyTrip stock as “Dirty” Harry Callahan did in the movie Sudden Impact: “Go Ahead, Make My Day!”

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.