Falling in and out of love is a staple human trait that brings with it extremes in joy and pain, as we all know well. Humans take that trait to the stock markets, and they create extended periods of euphoria and depression for themselves, but in a different setting. The last five to ten years have seen this sharp mood swing in favour of and against several sectors of the global economy and in particular here in Asia.

This month, we turn our attention to one such sector that has been spurned by investors for five or more years. This sector has generally under-performed the broad regional indices and global ones as well. There are many reasons for us to be gently wooing this sector again. This falling in love again stems from not just this protracted period of the sector playing the fool but, in all seriousness, we are beginning to believe that its true strengths of being handsome (great cash-flows and ROEs) and dependable (stable margins and sales growth) are being ignored, in a crowd of made-up visages and made-up personas dressed to look beautiful but where their beauty is proverbially just skin deep. That Mr Good-looking and Dependable is the Consumer Staples sector.

Let us get this straight: this sector has looked just as good for the better part of the past decade. It is just as well that prettier, younger faces have come around distracting the new retail crowd of investors which has made its way into the markets in this period.

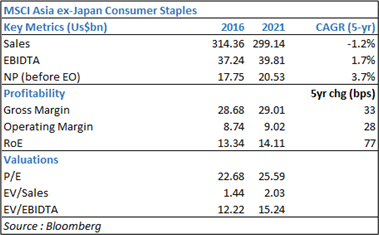

These sectors on their part have, in all fairness, fared much better, and those which could execute well have had asymmetric growth prospects. These are chiefly technology, e-commerce, and emerging thematics like renewables, electric vehicles, and even commodities and semi-conductors, which have stolen the limelight by simply out-pacing Mr. Good-looking and Dependable. Look at the snapshot of performance from the table alongside of the consumer sector in Asia.

Valuations themselves have not de-rated in this period despite the sector’s sluggish performance as it came at a time when interest rates globally were declining sharply, when the pandemic actually benefitted some companies in the sector and when costs generally were being benign.

However, lower interest rates, easy monetary policies and abundant liquidity meant that investors moved to other pastures. These factors also led to a change in the mind-sets of investors who wanted to justify owning expensive profitless companies over those in the consumer sector whose virtues rested on time-tested attributes of cash-flow generation, dividends, RoEs, capital allocation discipline, etc. A new breed of young retail investors – lacking in experience and who had never witnessed a business cycle – entered the markets. Their combined heft in terms of moving stocks has been felt palpably in the last few years and it all happened to mostly favour the tech-enabled sectors.

The chart alongside shows the MSCI Asia ex-Japan Consumer Staples Index v/s the MSCI Asia ex-Japan broader market index benchmark. Clearly, the consumer sector has under-performed consistently in the past five years.

There have been other idiosyncratic factors too that impacted this sector. Factors such as the declining weights of consumer stocks in benchmark indices owing to big tech names elbowing them out with expanding weights (as their stock prices ran higher and faster) and new tech IPOs coming into the indices pushing such sectors down even further. And then, consumer companies did themselves few favours by not doing much by way of M&A activity or new large entities going public and entering the indices like several tech/ e-commerce companies did. So, what is changing now that we should pay closer attention to this sector?

One of the fundamental changes and key reason to be turning towards this sector is the fact that the interest rate regime has turned for good and that we are now firmly in a high inflation environment.

As liquidity gradually tightens like a noose around the neck, it will throttle the excess cash out of the system first. It will also lead to (in fact, has already begun the process of) investors questioning the spiffy yardsticks and valuation metrics of profitless companies. The fundamental change in the discount rate assumptions alone has already wreaked huge erosion in values everywhere in those kinds of companies and generally in most stocks whose P/E multiples expanded more as a consequence of loose liquidity conditions than real earnings expansion.

Now investors are more likely to turn back to the old-fashioned tenets of investing and towards companies and sectors that have durable sales and profit growth, generate cash and pay good dividends in addition to buying back shares and enhancing EPS growth. One of the most important criteria that are being screened today is for sectors and companies that enjoy pricing power to ride out the inflationary environment.

It is here that companies in several consumer sub-sectors such as food & beverages, liquor, childcare, personal products, cosmetics, etc. come into play. While all of them have some linkage to commodities, directly or in the form of packaging, it is a lot less at the gross margins level, allowing them plenty of space to manoeuvre costs. Further, most of them enjoy market leading brand positions which enables them to pass on costs, even if it is gradual, and recoup any short-term hits to their margins. Hence, over a period of two to four quarters, such companies have been seen to restore their operating margins and continue to grow their revenues despite demand slowing down.

We acknowledge that it is not painless for them as well. Growth rates will decline in many cases, yet the quantum of growth delivered over the next three to five years is unlikely to be hit. We believe that such companies could potentially thrive once cost increases have been passed on and costs pared and could in fact be in a period of expanding margins a year out as they seldom ever rollback price increases once they are made.

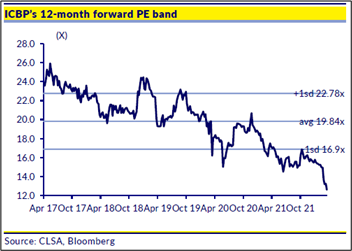

As we write this, the market is extremely worried about raw material cost inflation hurting margins and profits in the coming one or two quarters. Earnings estimates for the current year have been cut back in many cases. However, stock prices have suffered even sharper declines leading to a de-rating that has rendered many of these strong robust businesses at 5- to 10-year low multiples in terms of P/E ratios. This is a classic mispricing of businesses where troughed earnings are being priced with trough valuations.

Our work across the sector and in Asia in particular is throwing up several long-term opportunities of this kind. Some investors are clearly taking a short-term view of the current situation. However, stock prices seem to be holding their ground after the decline in the initial part of the year, when inflationary factors came to the fore arising from the Ukraine situation and other supply-side factors in play even prior.

To illustrate this, we chose a stock that was once the most favoured staple stock in Asia, much loved by all types of investors and with a strong steady performance record; the stock now finds itself at decadal low valuations. The company is Indofood CBP Sukses Makmur (ICBP.IJ) listed in Jakarta.

Indofood CBP – The Noodle King

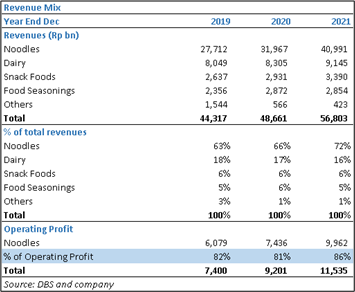

As one of the leading FMCG companies in Indonesia, ICBP is majority owned by the Salim Group (CEO Anthoni Salim) through Indofood Sukses Makmur (INDF IJ) which owns an 81% stake in Indofood CBP (ICBP IJ). ICBP is Indonesia’s largest instant noodle producer known for the ‘Indomie’ brand. Noodles account for over 80% of the operating profit, with the balance coming from dairy, snack foods and food seasoning.

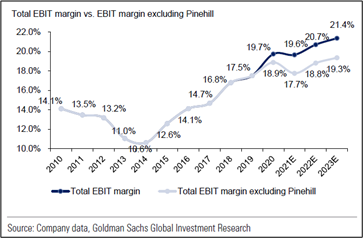

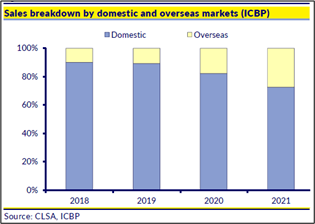

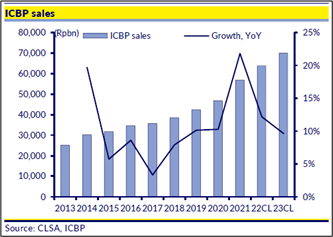

In May 2020, ICBP acquired Pinehill Corporate Limited, an affiliated party transaction (owing to its links with ultimate parent First Pacific). The total deal size was US$ 3bn. Pinehill Corporate is engaged in the manufacturing and distribution of Indomie instant noodles in eight countries with twelve factories and 10bn packs production capacity. In order of importance, Pinehill’s key markets are Saudi Arabia, Nigeria, Egypt, Turkey, Serbia, Ghana, Morocco and Kenya. This acquisition did not go down well initially with investors for various reasons that we will not elaborate here now. Suffice to say that the acquisition has played out operationally and that the new geographies have grown solidly in the last two years. So, what is the ICBP story really, now that Pinehill is fully in the bag post 2021?

Rules the roost in Indonesia: ICBP has a 70% market share of the noodle market in Indonesia: a high market share in a category which is consumed by Indonesians all day – from breakfast to meals to snacks and even late-night supper. While the market is mature, it is yet growing in volumes in low to mid-single digits and, coupled with the regular dose of price increases, ICBP has sustained revenue growth of roughly high mid-single digits over time. This is not about to change anytime soon as the next competitor is several times smaller, and no foreign player is likely to enter and wage a battle with a 70% share owning behemoth. The share of noodles in its sales is so large that other categories, while being strong in their own right, are less consequential to the overall growth case for the company.

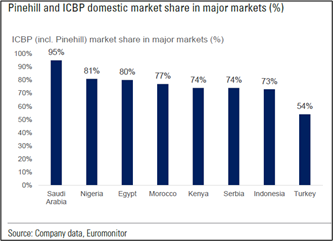

Hot streak in the Middle East and Africa too: Moving to the Middle East, disclosures post the acquisition have been less than gratifying, but they have been improving. We learn now that Pinehill has market shares north of 70% in almost all the geographies it operates in and operates almost like a replica of ICBP in Indonesia. Its local partners are strong and well-established local business groups. The gross margins are north of 35% on average. Such market dominance is indeed rare to find in staples categories.

The key distinction in this geography is that noodles are NOT a staple diet for the masses. Noodles have yet to broaden their appeal. As it is the market leader, the onus is on Pinehill to grow the market, deepen penetration and drive consumption growth.

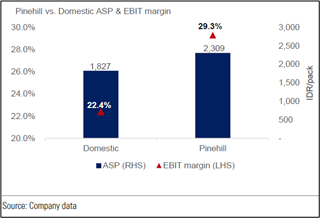

The price of noodles here is higher than in Indonesia and, since the product is mostly the same, the gross and EBIT margins tend to be higher. The pricing power in these countries is also higher, given the fragmented nature of the competition, none of whom have the wherewithal to combat Indomie.

Finally, ICBP’s financial structure has seen deterioration since it acquired Pinehill using mostly US$ debt and some cash. This has converted the company from a net cash one to an indebted company (Net Debt: Equity 0.33). Not much to be raising a sweat about, yet it is obvious that the stock has de-rated meaningfully owing to the debt coming into the overall EV calculations since 2020.

However, given the strong earnings visibility and cash generation, the indebtedness will become small enough to cease to be an issue or a talking point in a year or two. Meanwhile, the dividend pay-outs could potentially rise from here, providing the stock with a good dividend yield (~ 4%), something investors have not been used to in the past, given the lofty stock valuations back then (~ 25-35x).

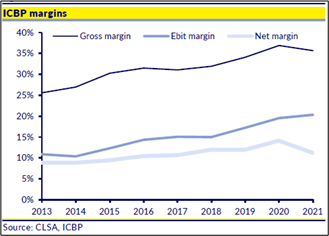

Taming the Inflation Monster: In recent times, the price of wheat and palm oil have shot up much more than ever before, which is a challenge to ICBP’s ability to pass on the entire cost increase in one go. Hence, this is being done in measured form so as not to upset its core consuming franchise as also to avoid being accused of profiteering while the masses suffer under inflationary costs of living. Think how sensitive pork is to the Chinese.

Over the next few quarters, the company’s management is confident that it will get the measure of the problem and hence has been bold enough to guide for growth even at the end of what will be the most challenging year in a decade for it and for consumer companies.

Looking back, ICBP managed to pass on high input costs during the period 2007-8 with five price hikes (>40%) and another four price hikes (25%) made during 2012-2013. ICBP’s sales saw little impact post these periods. ICBP is in perhaps the best position to tackle today’s cost pressures than most FMCG peers in Indonesia or the rest of Asia.

To conclude, ICBP is a typical example of a consumer staple that lords over the terrains it operates in owing to its vice-like grip over the distribution channels, its household brand strengths, under-penetrated geographies in the Middle East and Africa, prodigious cash flows and a healthy dividend yield. All this, available at decadal trough valuation of 12-13x P/E.

We could throw into the mix a dozen more consumer staples names from Asia that have similar attributes – market leaderships (# 1 or #2 positions), stable GMs and OPMs, solid structurally high RoEs, net cash balance sheets in many cases, and dividend yields > 3%, going as high as 7-8% in some cases.

It bears remembering that none of these companies has a growth challenge from a competitive or technological standpoint and that the issues that suppress their profits today are cost related or, in some cases, supply constrained, but not demand constrained or threatened by a technological disruption or competitors with products that provide greater cost-benefits to customers to warrant them to switch.

So, what are the things we need to look out for that will serve as catalysts to investors turning to this sector in Asia? Even as we write, the U.S. consumer staples sector is already among the top performing sectors versus the S&P500 along with the other defensive sector, Pharmaceuticals & Healthcare. It will not be long before the rest of the world/ Asia follows and changes its indifferent attitude towards it thus far.

These are some features we would advise investors to monitor:

- Look for companies which have already taken corrective price actions; these will bear fruit the earliest.

- Watch out for growth to sustain regardless of price hikes; this suggests strong brand franchise and/or resilient demand trends.

- Track gross and EBIT margin progressions in the March and June quarters and management commentary for potential turns and/or confidence in cost cutting actions bearing fruit.

- Track stock price action at each such turn of events to see how the market reacts to positive and not-so-positive data points.

- Follow corporate actions and insider buying actions. Company insiders are among the biggest and earliest buyers in deep downturns and often signal better tidings ahead or a potential bottom being close at hand.

Over time, as the liquidity paradigm shifts to a tighter regime, appreciation for companies with real sustainable long term growth track records will begin to find favour with investors. It is highly probable that consumer staples will be high up in that list as their virtues begin to be appreciated better in the changing economic climate. A secular re-rating of the sector may eventually follow, but this will take some time to happen. But when it does, it would provide huge upsides to investors who are patient enough to get in sometime this year.

Alicia Keys kept “fallin’ in and out of love” in 2001 and sung her way to a clutch of Grammies for her soulful efforts. If she were a financial analyst, she would be telling us, “’Tis the year for falling in love again” with consumer staples.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.