It is not only China that is slowing

Over the last few weeks we have had a flood of China bashing and Fed rate hike speculation from the newswires. Hence we decided we will not subject you to any more from our side. Also, those who have been reading these pieces know pretty much where we stand.

Last week in one of my private email groups one of us invited a new member, a Brazilian fund manager working out of Europe. Post her welcoming remarks she was quickly asked for her view on Brazil. Now most of us sitting in the antipodal East follow little of what goes on in that part of the world below the equator. She began trotting out in earnest all that was woefully wrong with the economy of her country of birth. She began by narrating the following:

- Industrial production was in free fall since 2014, last number ~-8% yoy.

- Unemployment rate doubled from 4.5% in Dec 2014 to 9.5% in July 2015

- Inflation is now just shy of 10%

- Interest rates of 14%+ ; highest real rates in EM

- Fiscal deficit of 9% of GDP

- Currency devaluation of 40% YTD

- Popularity of the President is reportedly below 10%

- GDP is expected to contract between 2.5-3.5%

- Gross government debt is 65% but if you count public sector, households and provinces it is north of 200%

Now stack those figures up against China or any other Emerging Market of some size. You will be hard pressed to beat that set, I guarantee. And yet, barring the usual suspects like the Economist and a few others of its ilk, there is little hand-wringing or bad press about what is going on there or how the Government has failed its people miserably. Yes, Brazil is not comparable to China’s size or importance to the world economy perhaps, but it us no midget either. It is after-all one quarter of that old now-defunct acronym – BRIC. And now it has been downgraded by S&P to “junk”!

So before you think that China is the world’s biggest problem child, look around to make sure. Much of Emerging Markets is today in the doldrums on many fronts. Today, the world’s economies are interconnected ever more in myriad ways where economic contagion is inevitable. The U.S., Europe and Japan – the growth engines of yesteryears – are all sputtering and cannot get their economies to achieve the ‘escape velocity’ to grow out of their woes. They have been transmitting this around the globe so that now the Emerging Markets too have the contagion. Asia, that bastion of growth, has at least temporarily lost the right to call itself a ‘growing’ market anymore. What we are saying simply is that economic growth of the “strong and robust” kind is becoming a distant memory in most places. And the best we can do is to allow the world to smoothen out this period of adjustment to a lower equilibrium.

EMs offer bargain basement valuation and very negative sentiment

Blaming China for every stock market decline is therefore missing the wood for the trees. What the present ex-growth situation has created is a graveyard of beaten-down stocks in Emerging Markets. Strategists and quant guys are having a field day pointing how such and such stock is -1SD or -2SD from its five-year average or how close it is to the GFC crises low valuations now.

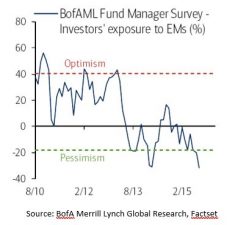

What the current situation of China-phobia and Fed Rate hike guessing game has achieved is that it has put almost all Emerging Markets stock markets on one of the largest bargain sales of the past twelve years. Emerging markets have been turned into pariahs and the dichotomy of stock positioning, capital flows, valuations on absolute and relative basis versus Developed Markets has reached extreme readings on any data point you look at.

We have learnt from history that such irrationality can persist longer than we can remain solvent and we are reminded by many of this adage, lest we forget. Yet, it is equally true to remember that the greatest buying opportunities are most often sighted on hindsight. That it is darkest before dawn – pardon our use of another cliché.

EM is still in a multi-year adjustment phase, a process that began about three years ago. The structural challenges are crystallising as:

- weak productivity growth

- excess capacity especially in Asia

- elevated debt levels

- adverse demographics and

- negative terms-of-trade shock for the commodity exporters.

But, as we have often seen, in financial markets change at the margin is what matters and not the absolute position. And all these factors, at the margin are bottoming out in the next twelve months.

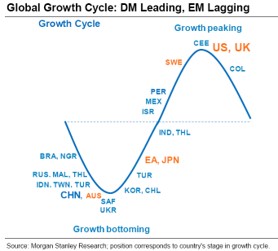

In EM, the slowdown is still in full motion and it probably will not be before 2016 that we are going to see a notable bottoming out in annual GDP growth. A generally slow response of policy support to boost aggregate demand has meant that EM growth is likely to remain weak in the near term. But responses have started to come in – both on the monetary and fiscal front. Hence eventually we believe that EM growth will pick up from a cycle low and begin moving up sometime in 2016. The general pattern across the BRICs – except possibly Brazil – is that the last two quarters of 2015 are likely to be the worst.

We must be aware that if EM growth were to indeed bottom in 2H15, then this current bargain sale might not last for a long time as many seem to think. Markets could be giving up on this asset class exactly at the wrong time. Yes, we are deeply in the capitulation phase. Through this, we ought to get cracking on those stock screens!

A few valuation and sentiment indicator charts

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.