For the US it has been an earnings-less market recovery. We expect anaemic US earnings growth in 2014, hence market returns could be muted. Opportunities lie elsewhere.

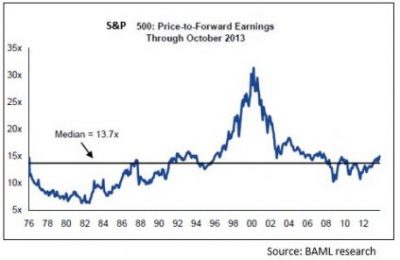

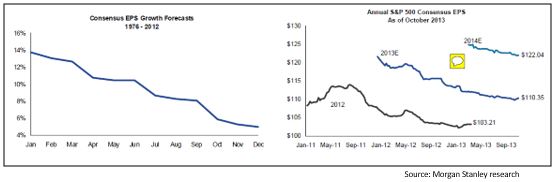

A bulk of the returns from the US market over the past two years has been from PE re-rating. The S&P 500 is up 41% since the beginning of 2012, but the EPS growth over the period 2011-2013 is only expected to be 9-10%. Thus the bulk of the price return has been through a re-rating process.

The same is true for the world index. The MSCI All Country World Index (ACWI) is up 31% from the beginning of 2012. But earnings growth in 2011-2013 is only 4%. Hence there has been a strong re-rating here too.

US valuations do not have much upside

In retrospect, this re-rating is probably justified on two fronts:

- A perceived bankruptcy risk in large parts of the world has been priced out. Risk premiums shrank and hence a re-rating occurred.

This factor has mostly been played out in most developed markets and hence will not be a source of re-rating except in some pockets of emerging markets where bankruptcy risk is still priced in. Here re-rating can still occur.

- The second and more important point is that the risk free rates fell from early 2010 to the middle of 2013. 10 year US treasury rates fell from 3.8% to 1.6% over this time frame. This was another strong reason for the re-rating.

This trend is reversing now with the same rates up to 2.8% in the last six months. Though the yield increase could slow down in the near term, this reversal is a long term secular trend. Hence the tail wind on valuation from a drop in risk free rates is now reversing.

In the US the valuation numbers are near historic highs not including the late 1990s to 2000 dotcom phase, as shown in the chart below. Therefore re-rating in the US will struggle to remain a driver of market returns.

In conclusion: The US re-rating is in its final leg and cannot remain the primary driver of stock market returns going forward. In the rest of the world the re-rating still has some way to go.

US earnings growth could surprise on the down side

Earnings growth is driven by two things – revenue growth and margin expansion.

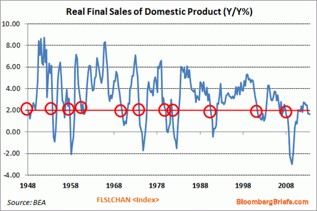

For revenue growth, one large driver is GDP growth. In the US, the numbers YTD are sub-2%. The spike of the last quarter is largely driven by a strong inventory rebuild which will unwind in Q4. The 2014 numbers are expected to be between 3 and 3.8%. This is where the potential for disappointment is the highest.

GDP growth and hence revenue growth could surprise on the downside

The chart below shows the US quarterly y-o-y GDP growth.

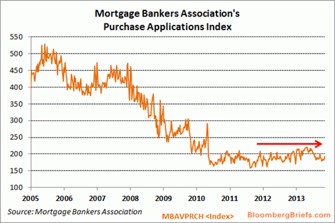

The underlying drivers of growth remain weak – housing sales are still bouncing at the bottom (see chart below) and long term rates which support this are going up.

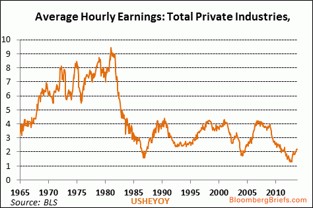

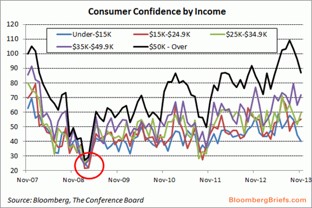

Labour participation is on a secular down trend (though unemployment seems to be coming down). This has resulted in poor wage growth (see chart below left) and consumer confidence is showing signs of weakening (see chart below right).

Hence consumption is continuing to struggle (as shown in the chart below). Service sector growth is poor and this accounts for 75% of the economy.

Government leverage has gone up dramatically in spite of expenses being cut. The one saving grace is that corporate balance sheets are strong and can be used. But there is no sign of the beginning of this corporate spend and, in fact, the incremental spend could possibly happen outside the US.

The net conclusion is that the GDP growth bulls for 2014 could have some negative surprises.

This would mean that US corporate revenue growth in 2014 could also surprise on the downside.

Not much upside for US corporate margins

Corporate margins are at historic peaks and are expected to hit uncharted territories according to forecast numbers. 84% of the top 1,500 US companies are expected to have a margin improvement next year – this is much higher than the previous peak (as shown in the chart on the left below). Also, margins are expected to be the highest since 1972 (when data started to be collected). Both factors tell us that the best case is a limited upside on margins and most likely a drop.

Hence earnings growth in the US can surprise on the downside. The expected growth number is about 11% for 2014. It could be lower. Also, historically, earnings growth expectations in the US have come down by about 10% from January to December of the same year, as shown in the chart on the left below. In the past two years also, earning expectations have been pared down through the year. 2014 could be a typical year.

Conclusion

We are worried that the US market medium term returns will be anaemic. Though there remain structural and cyclical positive reasons, these are already built into the high valuation and the high earnings expectations.

Therefore our hunt for returns is focused more towards Asia and Europe.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.