It does not matter which part of the world you are in. We are in the thick of the earnings reporting season for the March quarter of the year. And it has been a source of much debate lately. We have been having a few thoughts ourselves on how we should look at these earnings in different markets, what the markets have been doing and if at all there are any investment opportunities being created in the process owing to the short-sightedness of markets. There is also the matter of viewing these in the context of slowing GDP growth in some parts of the world and feeble recovery in others.

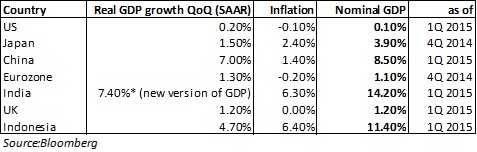

Nominal GDP Growth is Poor

Given the slowing economic wherever you look in the world, it is not surprising that revenue and earnings growth estimates for benchmark indices have been coming off – quite alarmingly in some cases. One would have expected the weak commodity environment to have offered some respite. However the weakening revenue growth has indeed continued to have a dampening effect on earnings growth as well, as we can see across markets.

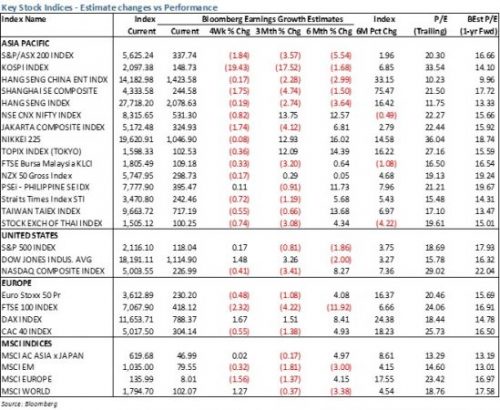

Earnings Growth is Struggling

Globally earnings growth is weak or artificially boosted by currency moves. The US dollar rally over the past two quarters or more has increased the complexity. It has turned things on the head for a few markets where the impact has been swift and magnified such as Europe, Japan, Korea and the US itself. US corporates have been smarting from a strong dollar hit on their reported earnings while their European brethren have been benefitting from the weak Euro. Japan has gained while Korea is bruised. These cross-currents of currencies have led to large differences in reported and underlying earnings. Companies have been taking pains to explain these and analysts’ tearing their hair in despair. But through this the underlying trend remains weak.

In China, the A-share companies’ revenue and earnings growth continue to be weak. For 2014, market earnings grew 6.4% while non-financial revenues grew only 0.4%. In Q1CY15, the non-financial revenue fell 4.5%, the first decline since the global financial crises.

Take a look at India and Indonesia. Both countries are huge beneficiaries of weak crude oil prices. It allows them elbow room to restructure their fiscal balances. While this is being done in both places with varying degrees of successes, the headline GDP growth numbers continue to disappoint.

Earnings growth estimates and reported figures remain tepid and continue to be revised downwards even as stock prices have remained elevated.India has seen earnings being revised downwards almost continually for the past three years now. However the stock market has been rallying in the hope of an imminent reversal of this trend.

Markets Need Earnings Growth to Further Rally

Look at the table below to see the performance of the indices versus the decline in earnings estimates. Investors who have been bidding up the Indian and Indonesian markets for the past few quarters are now realising that the path to earnings recovery is tortuously slow and ridden with pitfalls and that this could take longer than previously imagined. Result, both markets sold off through April.

Remember, that globally stock markets have been rallying largely on the backs of the easy monetary policies of the Central Banks. However PE re-rating can take them only so far and before long earnings must manifest themselves for markets to hold up, consolidate and/or rally onward. This has now become the central debate and in a way the biggest challenge for many global markets to sustain their rallies.

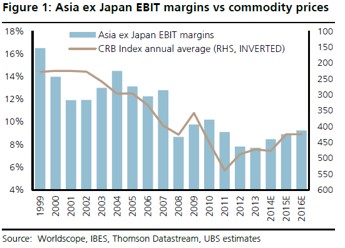

The Silver Lining is in Potentially Bottoming Margins

The hope in Asia ex-Japan (and also the world) is that weak commodity prices will give way to higher margins in the quarters ahead, lifting earnings and estimates of investors. With sales growth constrained by poor nominal GDP growth and PE above long term averages, the load of earnings growth has to be carried by margins. The bulls’ case is that this is a typical early cycle phenomenon. Low utilisation and falling costs (commodities primarily) would be the support for margin improvement. Asian margins have had a strong correlation with dropping commodity prices.

This could lead to markets growing into the upcoming earnings uptick. We are looking closely for evidence of this and keeping our fingers crossed. All our endeavours are to look for such beneficiaries.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.