India and Indonesia both experienced positive tectonic political change in their respective national elections in 2014. Actual delivery by Prime Minister Modi in India and President Joko Widodo in Indonesia has been positive, but less than the initial hyped-up investor expectations. The two countries have some critical similarities and differences, and are both scheduled to have elections in 2019. An important topical differentiation between the two since 2014 is inflation: it eased in both countries, but Indonesia is the clear winner. Looking ahead, growth is poised to improve in both economies, but the risk of inflation appears to be greater in India. This would prompt further monetary tightening. Indonesia’s inflation is better behaved but it has tightened more than India. More tightening is likely but mainly for defending the currency.

Selected Key Similarities and Differences

With a nominal GDP of USD2.6tn, India is a significantly bigger economy than Indonesia (USD1.01tn). It is also more populated than Indonesia and was a late bloomer on economic reforms among Asian countries. Consequently, its nominal per-capita GDP (USD1,983 in 2017) is significantly lower than Indonesia’s (USD3,876). Both economies are domestically driven with independent investment cycles and unsatiated aspirational consumption demand. However, India is better endowed than Indonesia with human capital, especially in information technology, managerial jobs and entrepreneurship. On the other hand, Indonesia has a slight edge over India in low-end manufacturing, ease of doing business, and social and health indicators. Infrastructure development and poverty eradication have been important goals for successive governments in both countries, and each suffers from delays and lopsided implementation.

In recent years India has benefitted significantly from the decline in commodity prices while Indonesia, being a commodity exporter, was hit by the negative terms of trade shock. The tide however has turned and India is at a disadvantage from higher commodity prices while Indonesia will be a beneficiary. Indonesia has an open capital account whereas India has been more cautious, proceeding in incremental steps. This makes Indonesia more sensitive to swings in global risk appetite and capital flows. However, Indonesia scores better than India on fiscal matters. According to the IMF, Indonesia’s general government debt stands at 29.6% of GDP, while India’s is significantly higher at nearly 69% of GDP in 2018. India also has a much higher general government fiscal deficit. The IMF estimates it at 6.5% of GDP for India compared with around 2.5% of GDP for Indonesia.

Economic Recovery in the Works

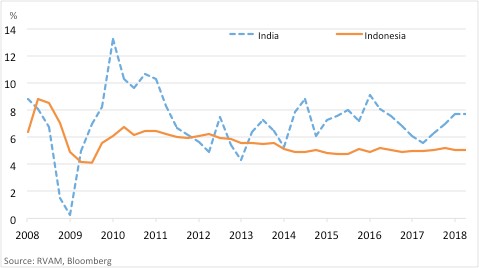

Economic growth in recent years has been more volatile in India than Indonesia (see chart below). GDP growth unexpectedly moderated in India in the first four years of the Modi government. This was in sharp contrast to the widespread expectations of swift acceleration under the new government. In truth the slowdown was palpable even before the disruptive and poorly implemented demonetization and the implementation of a major reform like the Goods and Services Tax (GST). In contrast, Indonesia’s economic growth under Jokowi has been relatively steady at its realizable potential.

Real GDP growth

The IMF estimates India’s real GDP growth at 7.4% and 7.8% in 2018 and 2019, respectively, following 6.7% in 2017. This growth profile is better than Indonesia’s (2017: 5.1%, 2018: 5.3%, 2019: 5.5%). The Indian economy has been growing faster than Indonesia’s – and will continue to do so – partly because it is starting from a smaller base. Both India and Indonesia have appealing structural tailwinds, but these require economic reforms to unlock the respective growth potentials.

Growth in gross fixed capital formation is improving in both economies, driven partly by higher spending on infrastructure, with more convincing signs of a pickup in capex on machinery and equipment in Indonesia. The sustainability of the capex recovery in India will be constrained by the pace of progress in resolving the banking sector’s NPAs. Hence credit growth will take longer to accelerate in India. In contrast, Indonesian policymakers do not have the severe twin-balance-sheet challenges facing their Indian counterparts.

Petroleum-related subsidy has been cut in both economies. This, in turn, adversely affected consumer spending due to higher retail fuel prices. The impact appears more pronounced in Indonesia than India, partly because of offsets in the latter from rapid growth in consumer credit. As a matter of fact, facing subdued investment spending, Indian banks have been aggressively tapping consumer demand for credit growth. Non-food bank credit increased by 11.1% YoY in June 2018, with personal loans (including credit for consumer durables, housing and vehicles) growing at a faster clip of 17.9%. Looking ahead, private consumption would likely get a boost in both countries as the two governments are likely to step up spending, especially in rural areas, in the run-up to next year’s elections.

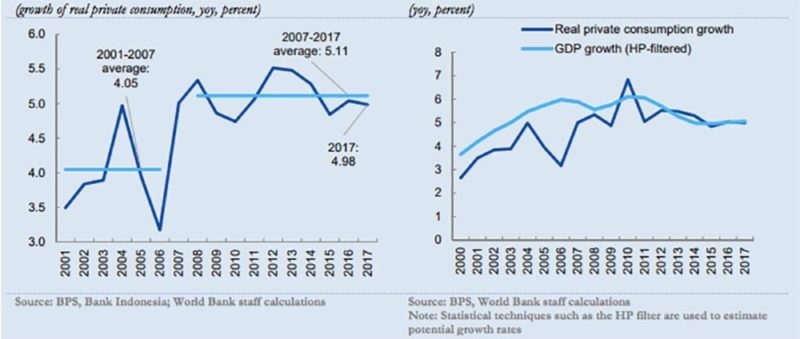

Indonesia offers an interesting dichotomy: in the last couple of years, there has been a decoupling of retail sales growth from the growth of real private consumption (see chart below). However, the World Bank counters the general view of weakness in consumer spending as indicated by the softness in retail sales. It suggests that private consumption has not decelerated since it has grown at a steady pace of 5% for the past eleven quarters and remains close to its long-run average while also tracking GDP growth (see chart below).

Apart from data quality issues, the World Bank’s analysis reveals that the retail sales index only captures the consumption of some goods and does not include services. On the other hand, the household survey provides a more comprehensive measure of household consumption.

Indonesia: Private consumption and GDP

With the Indonesian economy already growing at its long-run average, sustained acceleration in private consumption without creating imbalances warrants the government to step up supply-side reforms that raise the economy’s potential growth rate. This in turn will pull up the growth in private consumption.

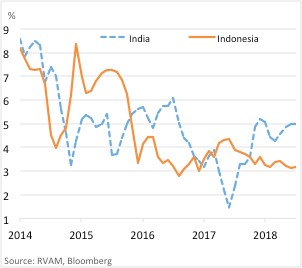

Inflation Risk is Greater in India

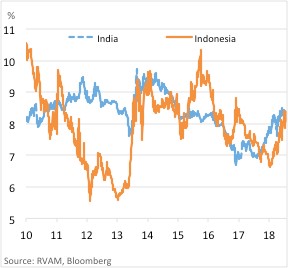

Headline CPI inflation was high in both countries in 2014 when the new governments took office, but declined significantly after (see chart below). Inflation in Indonesia has been broadly stable in the last one year and within the Bank Indonesia’s (BI) target range of 2.5-4.5%. In contrast, inflation has been rising in India even after adjusting for the statistical impact of the increase last year in the house rent allowance (HRA). To be sure, India’s CPI inflation is well above the official target of 4% (broad range: 2-6%). Core inflation has been moving up in India while it is broadly stable in Indonesia following a meaningful downshift (see chart below).

Headline CPI inflation

CPI-core inflation

Both governments cut fuel subsidies early in their tenure, prompted by the collapse in international crude oil prices. While India has continued with retail fuel price adjustments, higher food-related subsidy and cuts in GST rates could adversely affect the fiscal deficit outcome. The Modi government had already given itself more leeway in the 2018-19 Union Budget announced earlier this year by adopting a wider fiscal deficit target of 3.3% of GDP compared with the previously stated goal of 3%. Disappointingly, the Indonesian government said in March that it would cap domestic coal prices and keep fuel and electricity prices unchanged until the end of 2019. The decision appears to be motivated by political considerations ahead of the presidential election next year.

India has better managed food inflation than Indonesia. Food inflation declined in India this year to 3.2% YoY in June while it increased in Indonesia to 5.4% in July. The Modi government deserves credit for ensuring lower food inflation. However, it has not implemented any new institutional framework to inspire confidence that stability in food inflation will be sustained and is not just a propitious outcome of good luck and ad-hoc policy steps. A key concern is that with core inflation already firming in the early stages of recovery, any increase in food inflation from a supply shock will further complicate inflation management for the infant monetary policy committee (MPC) that was constituted in 2016.

Monetary Policy and Currency Risk

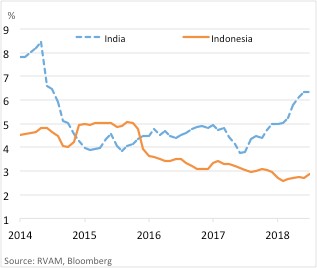

BI has been more aggressive in monetary tightening, hiking its policy rate by a cumulative 100bp in three steps to 5.25% (two rate hikes in May and one in June). The Reserve Bank of India’s (RBI) MPC raised interest rates 50bp to 6.5% in two consecutive hikes in June and August. Despite the different quantum of tightening, the benchmark 10-year government bond yields are now at similar levels (see charts below).

10-year government bond yields

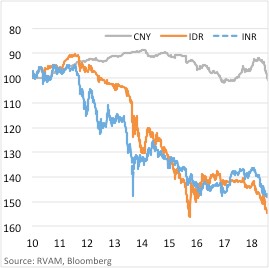

Exchange rate vs USD (Index, Rise=appreciation)

Importantly, the explicit motivation for monetary tightening was different in the two economies, which have significantly improved their macroeconomic landscape compared to the “taper tantrums” in 2013 when they were included in the Fragile-5 economies. In Indonesia’s case, higher rates were necessary mainly to defend the IDR from excessive and destabilizing depreciation. Indeed, BI justified the first rate hike in May on the need to “maintain economic stability amid the escalating risks in the global financial market and global liquidity downturn.”

India’s MPC on the other hand stressed inflation concerns rather than currency defence as its main goal when it unexpectedly raised the repo rate in June. It hiked again in August and announced (for the first time) its inflation forecast for early 2019-20 at an elevated 5% compared with its target of 4%. While the MPC justified maintaining the neutral stance on multiple uncertainties, the new one-year forward inflation forecast hints that more rate hikes are in store by the still-new MPC working to establish its credibility.

Effective policies of the government in some areas notwithstanding, India’s macro has been, in large part, a warrant on international crude oil prices. Delivering the mandated 4% CPI inflation on a sustained basis as economic growth and corporate pricing power strengthen remains an ambitious goal, in our view. In fact, even if international crude oil prices remain broadly stable, local inflationary impulses are likely to strengthen as domestic demand improves, economic growth becomes more broadly based and corporate pricing power strengthens.

What about the use of interest rates to defend the currency? This remains a marginally bigger risk for Indonesia than India. External pressures such as US interest rates, movements in international crude oil prices and the fallout from the threat of trade-related economic friction are common to both economies. However, India has a significantly more comfortable foreign reserves position than Indonesia. On the IMF’s assessing reserve adequacy (ARA) metric, the ratio of foreign reserves/ARA metric for India stands at 1.51 versus Indonesia’s 1.38 (a ratio of 1-1.5% is considered adequate). Despite that advantage, INR’s price action in recent years has been similar to IDR’s (see chart below). Indeed, year-to-date, both INR and IDR have depreciated 6-7% against the USD.

In conclusion, India and Indonesia both experienced lower inflation under the present governments that came to power in 2014 following a positive election outcome that pleased investors. The fall in inflation was due to a combination of factors: decline in the price of international crude oil, tough fiscal decisions by the respective new governments and sound macroeconomic management. Growth is poised to improve in both economies, but the inflation risk appears to be underappreciated in India. Indonesia has tightened more than India (100bp vs. 50bp), but due mainly to currency-related jitters trigged by external factors. In India the unexpected rise in inflation has been the more important reason than currency defence. Further monetary tightening will be warranted in both economies. Inflation concerns will be the key reason for India to raise policy rates while currency defence will be the main motivation for Indonesia, if external drivers force BI’s hand.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.