As we work our way through another earnings reporting season, it is hard not to notice a couple of things. One, that more companies are missing consensus estimates than beating them in Asia ex-Japan. Japan itself sticks out like a sore thumb as being the only large market where companies are beating estimates. Two, the large number of companies blaming the poorer reported numbers to cross-currency effects. They are not simply hurting due to translational effect of their operating currency (often the US dollar) strengthening but also because gradually the sharp devaluation of certain currencies like the Yen is beginning to have a telling effect on the terms of trade and global competitiveness of their businesses. It has now been a year since the greenback began its inexorable climb chiefly against the Yen, Euro and GBP (we won’t go into the reasons here) and now it has begun to impact global businesses meaningfully.

The questions on everyone’s minds are: how long can this last and, once the dollar rally reaches its anniversary, what does it mean for earnings the following year? If it is only a translational problem, then how do we view the current P/Es being assigned to stocks, because then the belief should be that this dollar rally must mean-revert/normalise and lead to earnings recovering too? Will P/Es normalise too or will they remain elevated leading stocks to re-rate even further?

Just to put into perspective the extent of the poor performance of companies that have reported thus far, we looked at a compilation done at the start of August by Credit Suisse. While it is early days with just 32% of companies having reported so far, the downgrade to 2015E consensus EPS of 2.7% is the worst start to the reporting season since late 2012. The report mentions that within the MSCI Asia ex-Japan index, of the 205 companies that have reported earnings for the June 2015 quarter or half year, 56 have been associated with upgrades, while 119 have been associated with downgrades. The biggest downgrades so far at the country level have been Korea (-6.9%), Taiwan (-2.9%), Indonesia (-2.8%), Thailand (-2.1%), Singapore (-1.7%), Australia (-1.4%) and India (-0.9%). Compare this to Japan, where 73% of companies have reported and consensus EPS has been upgraded by 0.8%.

If early trends are assumed to be reflective of what the earnings season will likely end up looking like, then it is not clear how much of this weak performance can be attributed to the strong dollar. Note that the US Dollar has appreciated by 40% on a trade-weighted basis, akin to the previous bull markets, only this time it has been a lot faster.

However, we should juxtapose this with the other observation that today’s most crowded trade in global financial markets is the long U.S. Dollar one. Most surveys will tell you that investors of all ilks expect this rally to continue even if the U.S. Fed were to ‘lift-off’ interest rates tomorrow. Once again some work from Credit Suisse strategists comes handy.

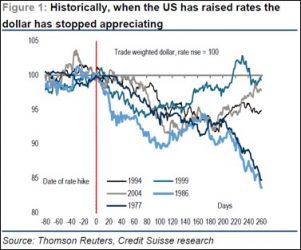

The chart above on the right shows that the dollar has historically fallen after the first Fed rate hike. In fact, the first rate hike on the last five tightening cycles was associated with a dollar weakening by around 10% in the following three month period. We concede that monetary policy this time is significantly more de-synchronous. It appears that the euro is already pricing in considerable US tightening.

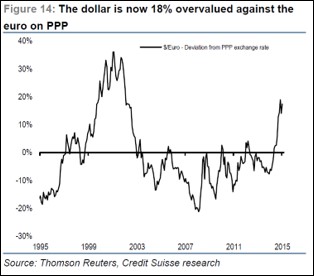

Credit Suisse also points out that the dollar is now overvalued against the JPY and Euro (see charts below).

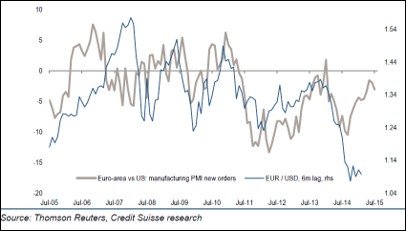

PMI differentials between the U.S. and Europe suggest that it is the euro which ought to be a lot stronger. But it is not and we would blame this on the diverging monetary policy between Europe and the US.

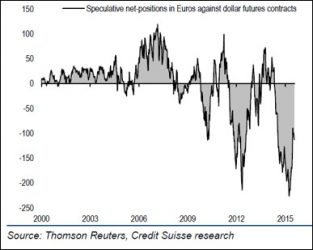

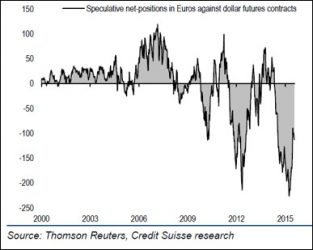

Europe is generating a current account surplus of 2.2% of GDP and has seen equity portfolio inflows of 2.3% of GDP this year so far. It would require a very low Bund yield to direct capital away from Europe. Finally, speculators are significantly short the Euro yet.

Here’s the thing. Given the crescendo in the dollar trade consensus, the market thinks it is highly likely that we will see the U.S. Fed hike rates in September. If the above arguments are to be considered and history repeats itself, then we are at a possible reversal point in the current Dollar rally.

If the Fed does oblige the ‘crowd’ and deliver the first rate hike come September, then we are likely to see increased volatility and possible reversals in the trends of several asset classes and markets, all inextricably linked to this massive consensus trade which could unwind potentially in a disorderly fashion.

The dollar’s rally could perpetuate itself further if the Fed were to back away in September pushing their ‘lift-off’ date further out, most likely into 2016 then.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.